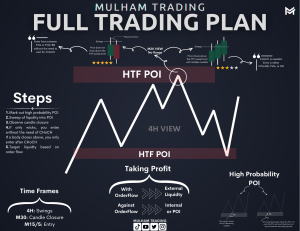

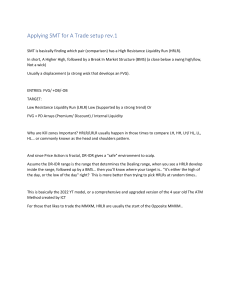

The Full Guide On How To Create Your Own ICT TRADING SETUP Mulham Trading TABLE OF CONTENT 1 INTRODUCTION 2 BASIC SETUP 3 SETUP CRITERIA 4 ADDITIONAL CONFLUENCES 6 TIME FRAMES 7 KILLZONES 8 MACROS 9 PUTTING ALL TOGETHER 10 MODELS/SETUPS INTRODUCTION This book is for people who finished learning all ICT concepts, but still lost. They do not know what do to now, and they cannot figure out their own setup. This book will be your guide to inspire you to create your own setup. I also included 4 models that you can backtest and use, while the last one being my favorite. Remember, this book will only be useful for people who are already familiar with ICT concepts. Disclaimer: This is only a humble try to simplify and help beginners. All credit is to the man himself, ICT, who invented the concepts and I learned from. -Mulham Trading 1 BASIC SETUP The main components of the 2022 ICT mentorship setup are: 1. Sweep of Liquidity or Price reaching POI (Point of interest) 2. Price reacts aggressively with a displacement to the other side 3. The move in "2" causes a Change of Character (CHoCH), AKA Market Structure Shift (MSS) On the left is a blueprint of the basic mode, while on the left is trade example on ES1! We will try to learn how to make variants with higher win rates, and more precise entries with more reward to risk ratio. 2 SETUP CRITERIA One criteria is choosen from each category to create the setup that fits you. 1 Liquidity Sweep | POI | Both Liquidity: Swing highs/lows | Previous day's high/low | Previous week's high/low | Equal highs/lows POI: Order Block (OB) | Fair Value Gap (FVG) | Breaker Block (BB) 2 FVG | OB For entry, either FVG or OB is used 3 TYPE OF ENTRY (CONFIRMATION) a. After the CHoCH, you enter on the FVG/OB1 b. After the CHoCH, you wait for price to trade through the FVG, you switch to a lower time frame, and you look for a CHoCH/BOS with a LTF FVG where you entered from there Entry a Entry b 3 ADDITIONAL CONFLUENCES More conflunces can be implemented to the setup to improve the setup 1 Premuim/Discount | Daily Bias Long trades are allowed on discount, and short trades on premuim. Gann Box can be used to to identify premuim and discount zones. Daily Bias is taken into account too 2 Inducement | Liquidity When there is an inducement/liquidity above the FVG for example, it is a higher probability to go long. On ther other hand, it is a higher probability go short when there is an inducement/liquidity below the FVG 4 ADDITIONAL CONFLUENCES (cont.) 3 Optimal Trade Entry (OTE) Only take the trade when the FVG is on the OTE zone which is 0.618-0.79 using Fib Retracement tool. 4 SMT Divergence SMT Divergence occurs when there is a divergence . between the lows/highs of the correlated pairs. US30 US100 US30 5 US100 TIME FRAMES Your time frames used in the setup should be related. You cannot use a 4H sweep or POI and then use the M1 for CHoCH. It is not logical. When using entry type a, you can use HTF and MTF. On the other hand, for entry type b, you can use HTF, MTF, and LTF, or MTF, MTF and LTF. For example, M15/M5 sweep, M5 FVG, M1 FVG. My suggestions for the time frames are as following: Type/TF HTF MTF LTF Type 1 4H 1H M15 Type 2 1H M15 M5 Type 3 M15/M5 M5 M1 6 KILL ZONES KZ are are the specific time periods when we will look for our setup as there is more volume in the market Forex LONDON OPEN 2:00-5:00 NEW YORK OPEN 7:00-10:00 LONDON CLOSE 10:00-12:00 Indicies LONDON OPEN 2:00-5:00 NEW YORK AM 8:30-11:00 NEW YORK LAUNCH 12:00-13:00 NEW YORK PM 13:30-16:00 7 MACROS Taking setups within these macro time slots will increase your trade probability as a setup will most likely occur in one of thosr time slots. LONDON 2:33-3:00 4:03-4:30 NEW YORK AM 8:50-9:10 9:50-10:10 10:50-11:10 NEW YORK LUNCH & PM 11:50-12:10 13:10-13:40 15:15-15:45 8 PUTTING ALL TOGETHER Now, you will need to pick one option from each criteria (1-3) and add conflunces to that. In general, the more conflunces you add, the higher the win rate, but the less trades you will find as it is harder to find a trade with lots of confluences. Pick on type of the time frames types. It depends if you like to hold trades for longer time, or just scalping very quick. The next pages will be different setup variants, just from the criteria and conflunces explained above. It shows how easy it will be to create your own successful setup just by following those steps. Tip: After skimming over the models, only pick or create one setup, backtest it, master it, start on demo with risk management, and see the results. Don't over complicate it. 9 MODELS/SETUPS MODEL 1 LONG SHORT Checklist HTF Liquidity Sweep/POI (OB/FVG) LTF Liquidity Sweep CHoCH with Displacement & FVG 10 MODELS/SETUPS (CONT.) MODEL 1 EXAMPLES 11 MODELS/SETUPS (CONT.) MODEL 2 LONG SHORT Checklist HTF Liquidity Sweep/POI (OB/FVG) LTF Liquidity Sweep CHoCH with Displacement & FVG FVG In OTE (0.618-0.79) 12 MODELS/SETUPS (CONT.) MODEL 3 LONG SHORT Checklist HTF Liquidity Sweep/POI (OB/FVG) LTF Liquidity Sweep CHoCH with Displacement & FVG Inducement (IDM) or internal liquidity is formed FVG In OTE (0.618-0.79) 13 MODELS/SETUPS (CONT.) MODEL 3 EXAMPLES 14 MODELS/SETUPS (CONT.) MODEL 4 (effective, yet difficult to find) LONG SHORT Checklist HTF Liquidity Sweep/POI (OB/FVG) LTF Liquidity Sweep CHoCH With Displacement & FVG Price Trades Through The FVG LTF CHoCH With Displacement & FVG Enter On LTF FVG 15 MODELS/SETUPS (CONT.) MODEL 4 EXAMPLE HTF LTF 16