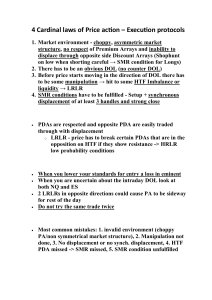

MMXM (Market Maker Models) One of the MOST overcomplicated and misunderstood ICT trade models I'm going to simplify it as best I can in this thread Occurs as price trades into a HTF liquidity pool Valuable as a narrative tool Bias is important Market maker models depict the process of order pairing There are 2 entries found in market maker models: Low Risk and High Probability Now let's take a look at some charts 1. Breakdown/Breakout of initial consolidation Breakout traders enter the market & place stops at the opposing end of the initial consolidation 2. A 2nd range forms an accumulation of orders before the run to the liquidity pool (support/resistance) More traders are entering in this range, placing stops at either the bottom of this range or the initial consolidation 3. Price trades into HTF liquidity pool and shows signs of SMR where institutions enter (Low Risk Entry) 4. Price consolidates for a short amount of time before a second displacement occurs (High Probability Trade) 5. Expansion to original consolidation and/or HTF targets beyond Execution #1 - Low risk entry inside the SMR range Once price exhibits a displaced reversal (MSS), there are a multitude of methods to enter (OB, FVG, breaker, entry on displacement, SMT) Stops should be above the high of the raid on liquidity (high/low of the SMR range) Execution #2 - High Probability Entry After the SMR look for a second range to be formed Use your entry model inside this range after a run on stops OR Wait for the 2nd displacement > look to from POIs in premium/discount of the impulse swing Conclusion Market maker models visualize the process of institutional order pairing Not all models will be picture perfect, the understanding of each components purpose is what’s important Share this if it was helpful to you!