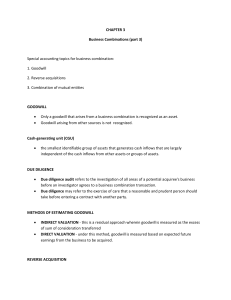

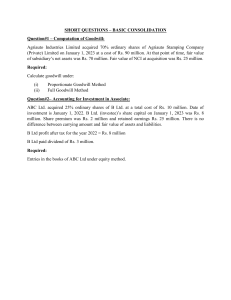

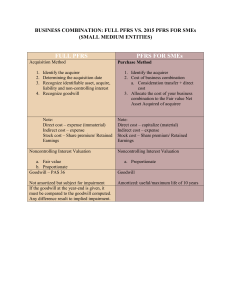

lOMoARcPSD|18211635 APR4 Unit -I (Midterm) Bachelor of Science in Accountancy (Catanduanes State University) Studocu is not sponsored or endorsed by any college or university Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 UNIT I – BUSINESS COMBINATIONS Business Combination – PFRS 3 definition– is a transaction or other event which an acquirer obtains control of one or more businesses. Occurs when one company (acquirer) acquires another company (acquired) or when two or more companies merge into one. After the combination, one company gains control over the other. PFRS # 3 - objective is to improve the relevance, reliability and comparability of financial reporting of an entity in relation to a business combination by establishing the recognition and measurement principles and disclosure requirements for the acquirer. Essential elements in the definition of a business combination: 1. Control 2. Business Control an investor controls an investee when the investor is exposed or has rights and the ability to affect those returns through its power over the investee . Normally presumed to exist when the ownership interest acquired in the voting rights of the acquire is more than 50% or 51% or more. May still be obtained without necessarily acquiring more than 50% of the acquiree’s voting rights in the following instances: 1. The acquirer has the power to appoint or remove the majority of the board of directors of the acquire; or 2. The acquirer has the power to cast the majority votes at board meetings or equivalent bodies within the acquire; or 3. The acquirer has the power over more than half of the voting rights of the acquire because of an agreement with other investor; or 4. The acquirer has the power to control the financial and operating policies of the acquire because of law or an agreement. Acquisition Method of Accounting for Business Combinations Four steps are to be used as follows: 1. Identify the acquirer 2. Determine the acquisition date 3. Determine the consideration given (price paid) by the acquirer 4. Recognize and measure the identifiable assets acquired, the liabilities assumed, noncontrolling interest and previously held equity interest in the acquire. Any resulting goodwill or gain from bargain purchase should be recognized. Identify the acquirer Acquirer is the entity that obtains control of the acquire. a. In asset acquisition, the acquirer is the company transferring cash or other assets and/or assuming liabilities. b. In stock acquisition, the acquirer is the company transferring cash and/or other assets for a controlling interest in the voting common stock of the acquire. “Reverse acquisition” may occur when a publicly traded company is acquired by privately traded company where the issuing company is the acquire. Determine the acquisition date Acquisition date – date on which the acquirer’s obtain control of the acquire – the date which the acquirer legally transfers the consideration, acquires the assets and assumes the liabilities of the acquire – generally the closing date. Acquisition date is usually the date the fair values are established for the accounts of the acquired company Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 Determine the consideration given Consideration given is assumed to be the fair value of the acquire as an entity which is calculated as the sum of: a. The cash or noncash assets transferred by the acquirer b. The shares of stocks or bonds issued by the acquirer. c. Contingent consideration Contingent consideration – is an agreement to issue additional consideration (asset or stock) at a later date if specified events occur - measured at its acquisition date fair value. Changes resulting from events after the acquisition date but within the measurement period ( which maybe a maximum period of 1 year from the acquisition date) are recognized as an adjustment as an adjustments against the original accounting for the acquisition (may affect goodwill or gain from acquisition) Changes resulting from events after the acquisition date but after the measurement period ( which maybe a maximum period of 1 year from the acquisition date) are not measurement period adjustment. The additional consideration given is to be accounted for as follows: a. If it is equity – the original amount is not measured b. If additional consideration is cash or other assets, the changed amount is recognized in profit or loss. Acquisition-related costs – costs incurred to effect business combination- broker’s fees, accounting, legal and other professional fees, general and administrative costs are expensed. Stock issuance costs – when shares are issued for the net assets acquired, stock issuance costs – Sec registration fees, documentary stamp tax, newspaper publication fees are treated as a deduction from Share Premium(APIC) from previous share issuances. In case Share Premium or APIC is reduced to zero, the remaining stock issuance costs is treated deduction from retained earnings. Cost to issue debt securities – accounted for as bond issue costs which are deducted from the bonds payable when determining the carrying amount of the bonds. Record and Measure Acquirer’s Assets and Liabilities that are assumed. Fair values of all identifiable assets and liabilities are recorded Total fair value of all identifiable assets less liabilities is equal to fair value of the net assets. The total identifiable assets should never include goodwill that may exist on the acquiree’s books. The goodwill to be recorded is the “new goodwill” which is the result of the combination or based on the price paid by the acquirer. a. If Price paid by the acquirer exceeds the fair value of net assets – the excess is recorded as “Goodwill”. Goodwill (an asset) is not amortized but its impairment is tested in future accounting periods. b. If Price paid is less than the fair value of net assets (bargain purchase) – the difference is record as “ Gain on bargain purchase” and shown as gain in profit or loss statement. However, before recognizing gain on bargain purchase, the acquirer shall reassess if it has correctly identified all the assets and liabilities and shall recognize any additional assets or liabilities that are identified in that review. Acquirer is not permitted to recognize valuation allowance as of acquisition date for assets acquired in a business combination that are measured at acquisition-date fair values- no valuation allowance for acquired accounts receivables, loans and property, plant and equipment. Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 Classified into: 1. Asset acquisition - acquirer purchases the assets and assume the liabilities of acquiree in exchange for cash or non cash assets or bonds or shares of stock of acquirer. Acquired company is dissolved. a. Merger - two or more companies merge into single company and the acquirer is one the combining companies. Example: D Co + E Co,+ F Co. = E Co., b. Consolidation - two or more companies merge into single company and the acquirer is a new company. Example: D Co + E Co,+ F Co. = G Co., c. Goodwill/Gain on acquisition Consideration transferred Less: Fair value of net assets of acquiree Goodwill (Gain on acquisition) xxx xxx xxx Note: If consideration transferred exceeds the fair value of net assets acquired, the excess is Goodwill, but if consideration is less than the fair value of net assets acquired the differences is a Gain or income from acquisition. 2. Stock acquisition – The acquirer obtains control by acquiring a majority ownership in the voting rights of the acquiree. Acquirer is the parent, the acquiree is the subsidiary. Both companies retain their legal existence but for financial reporting purposes they are viewed as a single reporting entity. May described as: 1. Horizontal combination – combination of similar businesses, example a bank acquires another bank. 2. Vertical combination - combination of entities operating a different levels in a marketing chain. A manufactures acquires a supplier of raw materials. 3. Conglomerate – combination of entities with dissimilar business, example a real estate acquires a bank.. Asset acquisition: To illustrate: A Company and B Company Balance Sheets June 1, 2021 A Company B Company Book values P 1,650,000 350,000 P 250,000 200,000 120,000 800,000 550,000 250,000 180,000 ____________ ____20,000 P 3,250,000 P 1,120,000 Assets Cash Accounts Receivable Inventories Building Equipment Goodwill Liabilities and Equity Accounts Payable Bonds Payable Ordinary Shares (P 100 par) Share Premium Retained Earnings P P 150,000 400,000 1,500,000 400,000 800,000 3,250,000 A Company incurred the following expenses: Direct acquisition costs Indirect acquisition costs P P 50,000 100,000 400,000 200,000 370,000 1,120,000 P 45,000 15,000 Downloaded by Sweet Potatok (potatoksweet@gmail.com) FMV P 150,000 300,000 200,000 P 50,000 100,000 lOMoARcPSD|18211635 REQUIRED: 1. Journal entries on the books of A Company to record the purchase of the net assets of B company in a business combination assuming the following purchase price: a) P 945,000 b) 620,000 2. Assuming A Company issued 8,000 shares of its ordinary shares for the net assets of B company. The market value of A Company’s share on June 1, 2021 was P 120 per share. Costs of SEC registration and issuance of the equity securities amounted to P 40,000. Solution: Req. 1 (a) Price paid P 945,000 GENERAL JOURNAL Date 2021 June Particulars 1 PR Accounts receivable Inventories Building Equipment Goodwill Accounts Payable Bonds Payable Cash Acquisition of B Company. Debit Credit 250,000 150,000 300,000 200,000 195,000 50,000 100,000 945,000 Acquisition Expense Cash To record acquisition related costs 60,000 60,000 To compute for Goodwill: Total price paid: Cash Fair value of net asset acquired: Total assets Less: Total liabilities Goodwill 945,000 900,000 150,000 750,000 195,000 Req. 1 (b) Price paid P 620,000 GENERAL JOURNAL Date 2021 June Particulars 1 PR Accounts receivable Inventories Building Equipment Accounts Payable Bonds payable Cash Gain on acquisition Acquisition of B Company. Debit Credit 250,000 150,000 300,000 200,000 Acquisition Expense Cash To record acquisition related costs Downloaded by Sweet Potatok (potatoksweet@gmail.com) 50,000 100,000 620,000 130,000 60,000 60,000 lOMoARcPSD|18211635 To compute for Gain on acquisition: Total price paid: Cash Fair value of net asset acquired: Total assets Less: Total liabilities Gain on acquisition 620,000 900,000 150,000 750,000 (130,000) The Statement of Financial Position of A Company after the combination: A Company Balance Sheet June 1, 2021 P 970,000 Accounts Payable 600,000 Bond Payable 350,000 Total Liabilities 1,100,000 450,000 Ordinary shares, P 100 par Share Premium Retained Earnings (800 + 130 ___________ Total Equity P 3,470,000 Total Liabilities & Equity Cash (1,650 – 620 – 60) Accounts receivable Inventory Building Equipment Total Assets P 200,000 500,000 P 700,000 60) P 1,500,000 400,000 870,000 P 2,770,000 P 3,470,000 Req. 2: Assuming A Company issued 8,000 shares of its ordinary shares for the net assets of B company. The market value of A Company’s share on June 1, 2021 was P 120 per share. Costs of SEC registration and issuance of the equity securities amounted to P 40,000. GENERAL JOURNAL Date 2021 June Particulars 1 PR Accounts receivable Inventories Building Equipment Goodwill Accounts Payable Bonds Payable Ordinary Share (8,000 x 100) Share Premium ( 8,000 x 20) Acquisition of B Company. Debit Credit 250,000 150,000 300,000 200,000 210,000 50,000 100,000 800,000 160,000 Acquisition Expense Share Premium Cash To record acquisition related costs 60,000 40,000 100,000 To compute for Goodwill: Total price paid: Stocks issued ( 8,000 shares x P 120(mv.)) Fair value of net asset acquired: Total assets Less: Total liabilities Goodwill 960,000 900,000 150,000 Downloaded by Sweet Potatok (potatoksweet@gmail.com) 750,000 210,000 lOMoARcPSD|18211635 The Statement of Financial Position of A Company after the combination: A Company Balance Sheet June 1, 2021 Cash Accounts receivable Inventory Building Equipment Goodwill P 1,550,000 600,000 350,000 1,100,000 450,000 210,000 Total Assets __________ P 4,260,000 Accounts Payable Bond Payable Total Liabilities P 200,000 500,000 P 700,000 Ordinary shares, P 100 par Share Premium (560,000 – 40,000) Retained Earnings (800,000 -60,000) Total Equity Total Liabilities & Equity P 2,300,000 520,000 740,000 P 3,560,000 P 4,260,000 Note: The Statement of Financial Position of the acquirer after the combination includes book value of all assets and liabilities of the acquirer plus the fair value of assets and liabilities of the B Company – the acquire. In the books of the B Company (acquiree) GENERAL JOURNAL Date 2021 June Particulars 1 PR Debit Investment in A Company Accounts Payable Bonds Payable Loss on sale of business Accounts receivable Inventories Building Equipment Goodwill To record sale of net assets 960,000 50,000 100,000 10,000 Ordinary Shares Share Premium Retained Earnings Investment in A Comp Loss on sale of business Distribution of A’s share to stockholders and liquidation of B Company 400,000 200,000 370,000 Credit 250,000 120,000 550,000 180,000 20,000 Downloaded by Sweet Potatok (potatoksweet@gmail.com) 960,000 10,000 lOMoARcPSD|18211635 Problem 2: The company to be acquired by MMC, Inc. has the following balance sheet on December 31, 2020: JYR Company Balance Sheet December 31, 2020 Cash Marketable Securities Inventory Land Building ( net) Equipment P 40,000 60,000 100,000 30,000 150,000 80,000 _________ P 460,000 Total Assets Current Liabilities 5%, 5-year Bond Payable Total Liabilities P 25,000 100,000 P 125,000 Ordinary shares, P 1 par Share Premium Retained Earnings Total Equity P 10,000 140,000 185,000 P 335,000 P 460,000 Note 1: A customer list with a significant value exists. Note 2: There is an unrecorded warranty liability on prior product sales. Fair values of all accounts have been established as of December 31, 2020, in conformity with the fair value measurement as follows: Account Cash Marketable Securities Inventory Land Building Equipment Customer list Current liabilities Bonds Payable Premium on Bonds Payable Warranty liability Method of Estimation Book value Market value Market value Adjusted market value Adjusted market value Market value Other estimate, discounted cash flow based on estimated future cash flows Book value Fair value(adjusted with premium/discount) Adjusted market value using market based interest rate applied to contractual cash flows Other estimate, discounted cash flow based on estimated future cash flows Fair value P 40,000 66,000 110,000 72,000 288,000 145,000 125,000 ( 25,000) 100,000 (4,000) (12,000) On December 31, 2020, MMC, Inc. issued 40,000 shares of its P1 par value ordinary shares with a market value of P 20 each for JYR Company. MMC, Inc. also incurred the following costs of P 47,000 as a result of this transaction: P 16,000 for consultant’s fee and brokerage fee, P 5,000 for accountant’s fee and P 4,000 for attorney’s fee. Internal secretarial and administrative costs of P 10,000 are indirectly attributable to combination. Costs to register (SEC) such as accountant’s and legal fees and issue (printing stock certificates) stock certificates amounts P12,000. REQUIRED; Record the acquisition of the net assets of JYR Company and related transactions on MMC’s books. Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 Solution: Problem 2: GENERAL JOURNAL Date 2020 Dec. Particulars 31 PR Debit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Ordinary Shares (40,000 x P 1) Share Premium Acquisition of net assets of JYR Co. 40,000 66,000 110,000 72,000 288,000 145,000 125,000 95,000 Acquisition expenses Share Premium Cash Direct and indirect acquisition expenses and cost to issue & register stocks. 35,000 12,000 Credit 25,000 100,000 4,000 12,000 40,000 760,000 47,000 Problem 3 –Using Problem 2: Prepare the necessary journal entries in the books of MMC, under the following independent cases: 1. (Cash contingency): Using the same information in Problem 2, assuming that MMC Inc. , issued 33,500 shares and the acquirer agreed to pay an additional P 100,000 on January 1, 2023 , if the average income during the 2-year period of 2021-2022 exceeds P 5,000,000 per year. The expected value is P 40,000 calculated based on the 40% probability of achieving the target income. Solution: GENERAL JOURNAL Date 2020 Dec. Particulars 31 PR Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Contingent consideration payable Ordinary Shares (33,500 x P 1) Share Premium Acquisition of net assets of JYR Company. Debit Credit 40,000 66,000 110,000 72,000 288,000 145,000 125,000 5,000 Downloaded by Sweet Potatok (potatoksweet@gmail.com) 25,000 100,000 4,000 12,000 40,000 33,500 636,500 lOMoARcPSD|18211635 2. (Cash contingency) Using the same information in Problem 2, assuming that in addition to the stock issue, the acquirer agreed to pay an additional P 100,000 on January 1, 2023 , if the average income during the 2-year period of 2021-2022 exceeds P 5,000,000 per year. The expected value is P 40,000 calculated based on the 40% probability of achieving the target income. On February 1, 2021, the expected value of the contingent consideration was revised to P 65,000, due to facts and circumstances existing on the acquisition date. On March 1, 2021, the estimate was again revised to P 62,000 due to events that affect the contingency. On January 1, 2023, the average income for 2021 amounted to P 5,500,000 and P 2022 amounted to P 5,700,000. Solution: GENERAL JOURNAL Date 2020 Dec. 2021 Feb. Mar 2023 Jan. Particulars 31 1 1 1 PR Debit Credit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Contingent consideration payable Ordinary Shares (40,000 x P 1) Share Premium Acquisition of net assets of JYR Co. 40,000 66,000 110,000 72,000 288,000 145,000 125,000 135,000 Goodwill Contingent consideration payable Revised within the measurement period. 25,000 Contingent consideration payable Gain on contingent consideration One time measurement is allowed, charge to operations (subsequent measurement) 3,000 Contingent consideration payable Loss on contingent consideration Cash Payment, contingent event happens. Downloaded by Sweet Potatok (potatoksweet@gmail.com) 25,000 100,000 4,000 12,000 40,000 40,000 760,000 25,000 3,000 62,000 38,000 100,000 lOMoARcPSD|18211635 3 Stock contingency with Market value given) Using the same information in Problem 2, assuming that in addition to the stock issue, MMC also agreed to issue additional stock to the former stockholders of JYR Company if the average post-combination earnings over the next two years equaled or exceeded P 700,000 per year. The additional 10,000 shares expected to be issued are valued at P 15,000. On January 1, 2023, the earnings for 2021 and 2022 amounted to P 700,000 and P 760,000, respectively. Solution: GENERAL JOURNAL Date 2020 Dec. 2023 Jan. Particulars 31 1 PR Debit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Contingent consideration payable Ordinary Shares (40,000 x P 1) Share Premium Paid in capital for contingent consideration. Acquisition of net assets of JYR Co. . Paid in Capital for contingent consideration Ordinary share Share Premium Payment. Contingent event happens. Credit 40,000 66,000 110,000 72,000 288,000 145,000 125,000 110,000 25,000 100,000 4,000 12,000 15,000 40,000 760,000 15,000 15,000 10,000 5,000 4. Stock contingency Using the same information in Problem 2, assuming that in addition to the stock issue, MMC Inc. also agreed to issue 5,000 additional shares if the average income during the 2 year period of 2021 – 2022 exceeded P 80,000 per year. . On January 1, 2023, the average income amounted to P 110,000. (the contigent event happens) Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 Solution: GENERAL JOURNAL Date 2020 Dec. 2023 Jan. Particulars 31 1 PR Debit Credit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Ordinary Shares (40,000 x P 1) Share Premium Acquisition of net assets of JYR Co. 40,000 66,000 110,000 72,000 288,000 145,000 125,000 95,000 Share Premium Ordinary share Issuance, contingent event happens. 5,000 25,000 100,000 4,000 12,000 40,000 760,000 5,000 Note: If contingent event did not occur, NO ENTRY ( No issuance of additional shares. ) 5. Stock contingency Using the same information in Problem 2, assuming that in addition to the stock issue, MMC Inc. also agreed to issue 5,000 additional shares two years later if the fair value of acquirer’s common stock fell below P 20 per share. On January 1, 2023, the contingent event happens and the common stock of MMC had a fair value below P 20. Solution: Date 2020 Dec. 31 2023 Jan. 1 GENERAL JOURNAL Particulars PR Debit Credit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Ordinary Shares (40,000 x P 1) Share Premium Acquisition of net assets of JYR Co. 40,000 66,000 110,000 72,000 288,000 145,000 125,000 95,000 Share Premium Ordinary share Issuance, contingent event haapens. 5,000 25,000 100,000 4,000 12,000 40,000 760,000 Note: If contingent event did not occur, NO ENTRY ( No issance of additional shares. Downloaded by Sweet Potatok (potatoksweet@gmail.com) 5,000 lOMoARcPSD|18211635 6. On December 31, 2020, MMC issued 40,000 shares of its P 1 par value common stock with a market value of P 800,000. In addition to the stock issue, MMC also agreed that added shares would be issued on January 1, 2023, to compensate for any fall in the market of MMC common stock below P 20 per share. The settlement would be to cure the deficiency by issuing added shares based on their fair value on January 1, 2023. On January 1, 2023, the contingent event happens and the stock had fair value of P 16. Solution: Date 2020 Dec. 2023 Jan. GENERAL JOURNAL Particulars 31 1 PR Debit Credit Cash Marketable Securities Inventory Land Building Equipment Customer List Goodwill Current liabilities Bonds Payable Premium on bonds payable Warranty Liability Ordinary Shares (40,000 x P 1) Share Premium Acquisition of net assets of JYR Co. 40,000 66,000 110,000 72,000 288,000 145,000 125,000 95,000 Share Premium Ordinary share ( 10,000 x 1) Issuance, contingent event haapens. 10,000 25,000 100,000 4,000 12,000 40,000 760,000 10,000 Note: If contingent event did not occur, NO ENTRY ( No issuance of additional shares. Stock Acquisition a. Non-controlling interest (NCI) Equity in the subsidiary not attributable directly or indirectly to parent, also called minority interest. Measured by the acquirer either at: 1. Fair value, or 2. The NCI’s proportionate share of the acquiree’s identifiable net assets. Fair value of NCI in net assets of subsidiary computation: a. If problem is silent – 1. = if there is an assessment , higher between Fair value of Assessed and Proportionate share, or 2. = If there is no assessment , higher between Fair value Implied and Proportionate share to compute: Fair value Implied = Consideration transferred /acquirer’s interest x NCI’s interest Note: the Fair value of NCI can never be less than the NCI percentage of the fair value of the net assets of the subsidiary. Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 b. If problem is not silent: a. Problem selected Full Goodwill Method, use 1. Fair value assessed, if given, 2. If not given, then implied fair value ( based on acquirer’s consideration given) b. Problem selected Partial Goodwill Method, use Proportionate share basis b. Statement of Determination and allocation of Excess: Consideration transferred Fair value of Non-controlling interest in net assets of subsidiary Total value of subsidiary Less: Book value of net assets of subsidiary Allocated Excess Allocation of excess: Add: Decrease in asset or Increase in liabilities Deduct: Increase in asset or Decrease in liabilities Goodwill or (Gain or Income from acquisition) xxx xxx xxx xxx xxx (xxx) xxx KEY DIFFERENCES BETWEEN FULL PFRS AND PFRS FOR SME Item Full PFRS Acquisition method – PFRS3 PFRS for SMEs Purchase method – under Sec. 19 par. 6 2. As to non-controlling interest Measurement At the option of the entities: 1. at Fair value 2. at Proportionate share In the Net identifiable Asset of the acquiree at Proportionate share in the Net Asset of the acquiree 2. Contingent Consideration Initially recognized as part of the consideration transferred - non occurrence of a future event(e.g. not meeting earnings target) is not considered to be a measurement period adjustment – therefore not adjusted against goodwill -Initially recognized in the cost of the combination only if it meets probability and reliably easurable” criteria - if future event does not occur, then only the adjustments to the cost of business combination are made against goodwill. 1. As to method 3. Cost incurred in a business combination Direct costs Indirect costs Cost to issue register stocks Costs to issue debts and Expensed Capitalized – added to consideration transferred Expensed Debited to APIC/Share Premium Debited to APIC/Share Premium Debited to Bond issue costs Debited to Bond issue costs Expensed Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 4. Recognizing and measuring assets acquired and liabilities assumed on initial recognition. - identifiable intangible assets 5. Exceptions to recognition or measurement principles or both, on initial recognition. - Contingent liabilities 6. Accounting Method Term used Measuring goodwill/bargain purchase gain Valuation of goodwill Recognized separately from goodwill if it is either contractual or separable Requires recognition if their fair value can be measure reliably Recognized only where there is a present obligation that arises from past events and its fair value be measured reliably. Requires recognition of possible obligations if their fair value can measured reliably. Acquisition method Options: 1. Full Fair value/Full goodwill 2. Proportionate share of identifiable net assets (Partial Goodwill) Cost less impairment loss Purchase Method Proportionate share of identifiable net assets (Partial Goodwill) Cost less impairment losses and amortization (life should be presumed to be 10 years) Cost less impairment amortization accumulated loss less Problem: (Adapted) On January 1, 2020, AA Co. acquired 80% of the outstanding voting stocks of ABC Company for P 600,000. On the same date, the book value of net assets of ABC Company was P 550,000 and the land is understated by 100,000. The direct costs and indirect costs incurred and paid amounted to P 10,000 and P 5,000, respectively. Q1: How much is the amount of consideration transferred under Full PFRS and PFRS for SMEs? Solution: Full PFRS Consideration transferred = P 600,000 PFRS for SMEs Consideration transferred = P 600,000 Add: Direct transaction cost 10,000 Total consideration given P 610,000 Q2: Under Full PRS, how much is the amount of full goodwill to be recognized? Consideration transferred Add: NCI at fair value (implied) (600,000 ÷ 80%) × 20% Total value of Acquiree Less: Fair value of net assets of Acquiree ( 550,000 + 100,000) Goodwill - full Downloaded by Sweet Potatok (potatoksweet@gmail.com) 600,000 150,000 750,000 650,000 100,000 lOMoARcPSD|18211635 Q3: Under Full PRS, how much is the amount of partial goodwill to be recognized? Consideration transferred Add: NCI at proportionate share (650,000 × 20%) Total value of Acquiree Less: Fair value of net assets of Acquiree ( 550,000 + 100,000) Goodwill - partial 600,000 130,000 730,000 650,000 80,000 Q4: Under PFRS for SMEs, how much is the amount of partial goodwill to be recognized? Consideration transferred Add: Direct costs Total consideration given Add: NCI at proportionate share (650,000 × 20%) Total value of Acquiree Less: Fair value of net assets of Acquiree ( 550,000 + 100,000) Goodwill 600,000 10,000 610,000 130,000 740,000 650,000 90,000 Reverse Acquisition (source: Accounting for Business Combination by Zeus Vernon B. Milan) The entity that issued the securities (legal acquirer) is identified as the acquiree for accounting purposes and the entity whose equity interests are acquired (the legal acquiree) is the acquirer for accounting purposes. Example: ABC Co. a private entity wants to become a public entity but does not want to register its shares. To accomplish this, ABC will arrange for a public entity, DBC Co., to acquire its equity interests in exchange for public entity’s equity interest. In substance, the accounting entity acquirer, DBC Co. issues no consideration to the acquire. Instead the accounting acquire, ABC Co., issues its equity shares to the owners of the accounting acquirer, DBC Co., to enable the accounting acquirer to obtain control over the accounting acquire, ABC Co. The acquisition date fair value of the consideration transferred by the accounting acquirer shall be measured as an amount based on the number of equity interests the legal subsidiary (accounting acquirer) would have to issue to give the owners of the legal parent (accounting acquire) the same percentage of equity interest in the combined entity that results from the reverse acquisition. KEY DIFFERENCES BETWEEN CONVENTIONAL ACQUISITION AND REVERSE ACQUISITION Item Issuer of shares as consideration transferred Conventional Acquisition The issuer of shares is the accounting acquirer Reverse Acquisition The issuer of shares is the accounting acquire Reference to combining constituents - accounting acquirer – Legal Parent - accounting acquire – Legal Subsidiary - accounting acquirer – Legal Subsidiary - accounting acquire – Legal Parent Measurement of consideration Fair value of consideration transferred by the accounting acquirer Illustrative Problem: Fair value of the notional number of equity that the accounting acquirer would have to issue to the accounting acquiree to give the owners of the accounting acquire the same percentage of ownership in the combine entity. Please refer to Accounting for Business Combination by Milan. Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 UNIT I – BUSINESS COMBINATION Activity 1 – Problems 1. On June 1, 2020, BIG Company acquired all of the assets and liabilities and assumed all the liabilities of SMALL Company. As of this date, the carrying amounts and fair values of the assets and liabilities of SMALL Company are shown below: Carrying amounts Fair values Cash in bank 15,000 15,000 Receivables 195,000 115,000 Allowance for bad debts (25,000) Inventory 420,000 300,000 Furniture and Equipment , net 100,000 50,000 Land 200,000 250,000 Building, net 1,000,000 1,200,000 Goodwill 100,000 Total assets 2,005,000 Liabilities Payables Equity: Ordinary shares, P 10 Share Premium Retained Earnings Total liabilities & Equity 650,000 650,000 700,000 350,000 305,000 2,005,000 BIG Company incurred transactions costs amounting to P 125,000 for legal, accounting and consultancy services. . REQUIRED: 1. Journal entries on the books of BIG Company to record the purchase of the net assets SMALL company in a business combination assuming BIG Company paid cash of: a) P 1,500,000 b) P 1,000,000 2. Journal entries on the books of SMALL Company to record the combination and the liquidation of the company under requirement 1-a and b. 2. Pool Company issued 120,000 shares of P10 par common stock with the fair value of P2,550,000 for the net assets of Spot Company. In addition, Pool incurred the following acquisition-related costs: Legal fees to arranged the business combination Cost of SEC registration, including accounting and legal fees Cost of issuing stock certificates General administrative costs P25,000 12,000 3,000 20,000 Immediately before the business combination in which Spot Company was dissolved, Spot’s assets and equities were as follows (in thousands): Book Value Fair Value Current assets P2,000 P1,100 Plant assets 1,500 2,200 Liabilities 300 300 Ordinary Shares 2,000 Retained earnings 200 Q1: What is the amount of goodwill (income from acquisition) and Share Premium to be recognized by Pool Company? Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 Q2. Prepare the necessary journal entries in the books of Pool Company. Date Particulars PR Debit Credit 3. FEER Corporation acquired all the assets and liabilities of CARE Corporation by issuing shares of its common stock on January 1, 2021. Partial balance sheet data for the companies prior to the business combination and immediately following the combination is provided: FEER CARE Combination Corporation Corporation Book value Book value Cash P 65,000 P 25,000 P 90,000 Accounts receivable 72,000 20,000 94,000 Inventory 33,000 45,000 88,000 Building and Equipment (net) 400,000 150,000 650,000 Goodwill _________ _________ ? Total Assets P 570,000 P 240,000 ? Accounts Payable Bonds Payable Ordinary shares, P 2 par Share Premium Retained Earnings Total Liabilities and stockholders’ equity P 50,000 250,000 100,000 65,000 105,000 P 570,000 P 25,000 100,000 25,000 20,000 70,000 P 240,000 P 75,000 350,000 160,000 245,000 ? P ? Determine: Q1. The number of shares issued by FEER for this acquisition _______________. Q2. The market value per share of the stock issued by the acquiring corporation on January 1, 2021: Q3. The fair value of the net assets of CARE Corporation on the date of combination _______________ Q4. The amount of Goodwill to be reported immediately following the combination________________ Q5. The Retained Earnings balance immediately following the combination ___ Q6. Prepare journal entries in the books of FEER. Books of FEER Corp. Date Particulars PR Debit Downloaded by Sweet Potatok (potatoksweet@gmail.com) Credit lOMoARcPSD|18211635 UNIT I – BUSINESS COMBINATION Activity 2 – Short Problems The balance sheet of Green Company as of December 31, 2019 is as follows: Assets Cash Accounts receivable Inventories Property, Plant and Equipment Total assets P 175,000 250,000 725,000 950,000 ________ P 2,100,000 Liabilities and Stockholders’ Equity Current liabilities P 250,000 Mortgage payable 450,000 Common Stock 200,000 Additional paid-in capital 400,000 Retained Earnings 800,000 P 2,100,000 On January 1, 2020, Red Company bought all the outstanding stock of Green Company for P 1,800,000 for cash. On the date of purchase, the fair value of Green’s inventories was P 675,000 while the fair value of Green’s property, plant and equipment was P 1,100,000. The fair values of all other assets and liabilities of Green Company were equal to their book values. 1. The goodwill to be recorded in the books of Green Company is ________________ 2. The journal entry in the books of Red Company to record the business combination: Date Particulars PR Debit Credit For items 3 - 5: On July 1, 2019 A Company acquired the net assets of Company B by issuing 10,000 ordinary shares with par value of P 20 and bonds payable with face amount of P 1,000,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P 40 per share. On the other hand, the bonds payable are trading at 110. Company A paid P 20,000 share issuance costs and P 40,000 bond issue costs. Company A also paid P80,000 acquisition related costs and P 40,000 indirect costs of business combination. On the same date, the current liabilities of Company B have fair value of P 1,200,000 while the noncurrent liabilities of Company A have fair value of P 1,000,000 Before the date of acquisition, Company A and Company B reported the following data: Company A Current assets Noncurrent assets Current liabilities Noncurrent liabilities Ordinary shares Share premium Retained Earnings 2,000,000 4,000,000 400,000 600,000 1,000,000 2,400,000 1,600,000 Company B 1,000,000 2,000,000 800,000 1,000,000 400,000 600,000 200,000 At the time of acquisition, the current assets of Company A have fair value of P 2,400,000 while the noncurrent assets of Company B have fair value of 2,600,000 on the same date. Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 3. What is the goodwill or (gain on bargain purchase) arising from business combination? ________ 4 – 5: The journal entries in the books of Company A to record the business combination: Date Particulars PR Debit Credit 6. On October 1, 2019, the Great Company acquired the net assets of the Lite Company when the fair value of Lite Company’s net assets was P 116 million and their carrying amount was P 120 million. The consideration transferred comprised P 200 million in cash transferred at the acquisition date, plus another P 60 million in cash to be transferred 11 months after the acquisition date if a specified profit target was met by Lite . At the acquisition date there was only a low probability at the profit target being met, so the fair value of the additional consideration liability was P 10 million. In the event the profit target was met, the P 60 million cash will be transferred. What amount should Great Company present for Goodwill in its statement of consolidated financial position on December 31, 2019? _________________ 7. On January 1, 2019, ART Company and DRAW Company entered into a contract of merger wherein ART will issue 100,000 ordinary shares with par value with a par value of P 10 and a quoted price of P 21 to the existing shareholders of DRAW in exchange for the net assets of Draw. Art paid acquisition related costs of business combination amounting to P 100,000 and stock issuance cost amounting to P 200,000. AS of December 31, 2018 ART company has total assets with book value of P 50,000,000 and fair market value of P 60,000,000 while DRAW has total assets with book value of P 5,000,000 and fair market value of P 4,000,000. The net assets of Draw on December 31, 2018 is P 2,600,000. Q1. What is the total assets of ART Company on January 1, 2019 after the merger? ____________ Q2. What is the goodwill (gain on bargain purchase) arising from business combination? __________ 8. ABC Corporation paid P 800,000 to acquire all the net assets of PRT Company. PRT Company reported assets with a book value of P 980,000 but with a fair value of P 1,080,000 and liabilities with a book value and fair value of P 230,000 on the date of combination. ABC Corp. also paid P 30,000 for finder’s fees related to the acquisition. The goodwill/(Gain on acquisition) is: __________________ Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 9. On September 30, 2020, ABC Company acquired all the TUV Company’s P 2,150,000 identifiable assets and P 530,000 liabilities. book values of the TUV’s assets and liabilities equal to their fair values except for the overvalued furniture and fixtures. As a consideration, ABC issued its own shares of stock with a market value of P 1,715,000 and cash amounting P 375,000. Contingent consideration is determined to be P 148,000 on the date of acquisition. The merger resulted into P 647,000 goodwill. Assuming ABC had P 4,890,000 total assets and P 2,731,000 total liabilities prior to the combination and no additional cash payments were made, but expenses were incurred for related cost amounting to P 28,000. After the merger, how much is the combined total assets in the books of the acquirer? __________ 10. ABC Company acquired all of DOM Company’s assets and liabilities on July 1, 2018, in a business combination at that date. DOM reported assets with a book value of P 2,496,000 and liabilities of P 1,424,000. ABC noted that DOM had P 160,000 of research and development costs at the acquisition date that did not appear of any value. ABC also determined that patents developed by DOM had a fair value of P 480,000, but had not been recorded by DOM. xcept for building and equipment. ABC determined the fair value of all other assets and liabilities reported by DOM approximated the recorded amounts. In recording the transfer of assets and liabilities in its books, ABC recorded goodwill of P 372,000. ABC paid P 2,068,000 to acquire DOM’s assets and liabilities. If the book value of DOM’s building and equipment was P 1,364,000, what as their fair value? ______________ 11. D Company, acquirer, made the following entry to report the acquisition: Tangible assets 400,000 Customer lists 60,000 Goodwill 100,000 Liabilities Cash 200,000 360,000 Six months after the acquisition , the customer lists is determined to be worthless. How is this new information reported if (1) the new information relates to the value of the customer lists as of the date of acquisition and (2) the new information relates to change in value since acquisition. Customer lists are written off, and: (1) (2) a) A gain on acquisition of P 60,000 is recorded Goodwill decreases P 60,0000 b) Goodwill increases P 60,000 A loss of P 60,000 is recorded c) A loss of P 60,000 is recorded Goodwill increases P 60,000 d) Cash is reduced by P 60,000 A loss of P 60,000 is recorded. 12. Sweet Company purchased Sour Company in 2016. At that time the existing patent was not recorded as separately identified intangible asset. At the end of fiscal year 2017, the patent is valued at P 15,000 and goodwill has a book value of P 100,000. How should these assets be reported at the beginning of year 2018? a) Goodwill, P 100,000; Patent P 0 b) Goodwill, P 115,000; Patent P 0 c) Goodwill, P 100,000; Patent P 15,000 d) Goodwill, P 85,000 : Patent P 15,000 13. POP Corporation acquires all of SISY Company at an acquisition cost of P 75,000,000 in cash. Assets and liabilities of the acquired company are as follows: Book value Fair value Current assetss P 500,000 P 700,000 Land, buildings and equipment (net) 6,000,000 8,000,000 Brand names 0 2,000,000 Potential profitable future contracts 0 10,000,000 Liabilities 2,000,000 1,750,000 POP records goodwill of: __________________ Downloaded by Sweet Potatok (potatoksweet@gmail.com) lOMoARcPSD|18211635 14. AD Corp. acquired the net assets of CE Company on July 1, 2017. In exchange for net assets at fair market value of CE Company amounting to P 835,740. AD issued 81,600 shares at a market price of P 12 per share (P 9 par value). Out of pocket costs of the combination were as follows: Legal fees for the contract of business combination Audit fees for SEC registration of share issue Cost of shares of stock certificates Broker’s fee Other direct cost of acquisition General and allocated expenses P 10,000 13,000 7,000 8,000 22,000 25,000 AD will pay an additional cash consideration of P 546,000 in the event that CE’s net income will be equal or greater than P 1,140,000 for the period ended December 31, 20178. At acquisition, there is a high probability of reaching the target net income and the fair value of the additional consideration was determined to be P 234,000. Actual net income for the period ended December 31, 2017 amounted to P 1,500,000. The additional consideration was paid. Q1. Goodwill to be recognized as of December 31, 2017 is ____________________ Q2. The amount chargeable to operations (loss/expense) for the year ended December 31,2017 is ____________________. 15. DREAM Company is acquiring the net assets of BANN Company for an agreed-upon price of P 900,000 on July 1, 2020. The value was tentatively assigned as follows: Current assets Land Equipment - ( 5-year life) Building ( 20- year life) Current liabilities Goodwill P 100,000 50,000 200,000 500,000 (150,000) 200,000 Values were subject to change during the measurement period. Depreciation is taken to the nearest month. The measurement period expired on July 1, 2021, at which time the fair values of the equipment and building as of the acquisition data was revised to P 180,000 and P 550,000, respectively. REQUIRED: At the end of 2021 what adjustments are needed for the financial statements for the period ending December 31, 2020 and 2021? Downloaded by Sweet Potatok (potatoksweet@gmail.com)