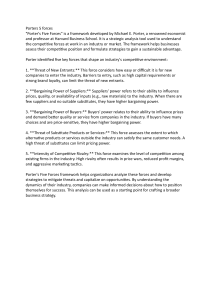

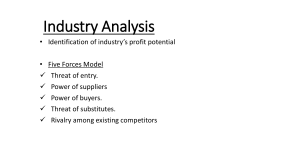

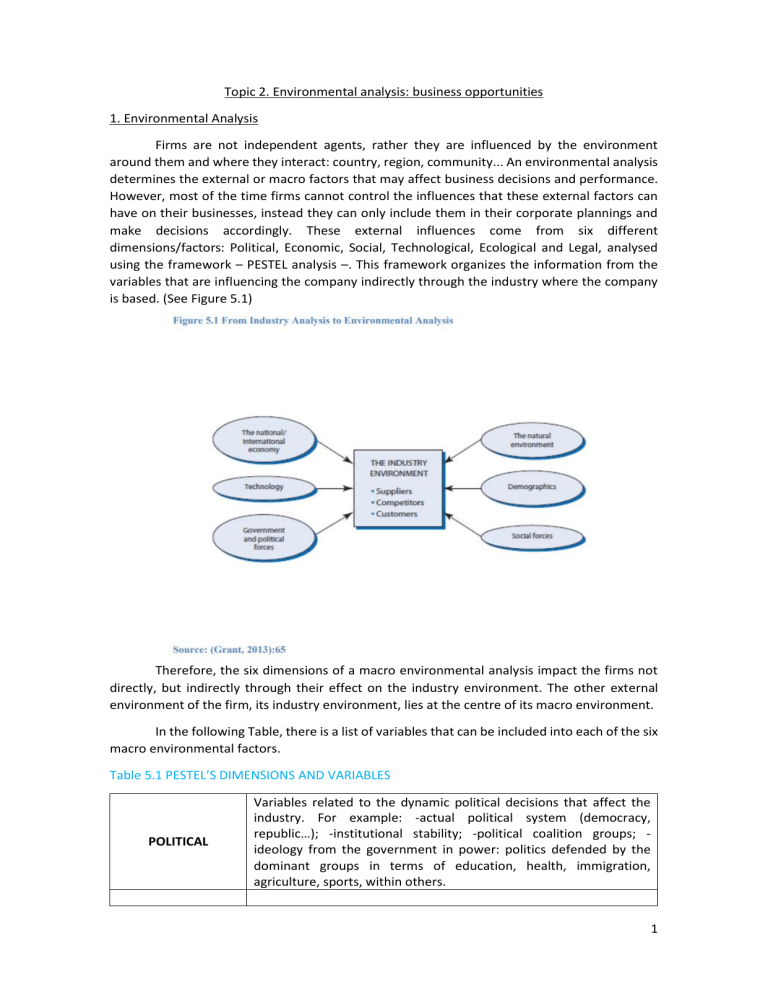

Topic 2. Environmental analysis: business opportunities 1. Environmental Analysis Firms are not independent agents, rather they are influenced by the environment around them and where they interact: country, region, community... An environmental analysis determines the external or macro factors that may affect business decisions and performance. However, most of the time firms cannot control the influences that these external factors can have on their businesses, instead they can only include them in their corporate plannings and make decisions accordingly. These external influences come from six different dimensions/factors: Political, Economic, Social, Technological, Ecological and Legal, analysed using the framework – PESTEL analysis –. This framework organizes the information from the variables that are influencing the company indirectly through the industry where the company is based. (See Figure 5.1) Therefore, the six dimensions of a macro environmental analysis impact the firms not directly, but indirectly through their effect on the industry environment. The other external environment of the firm, its industry environment, lies at the centre of its macro environment. In the following Table, there is a list of variables that can be included into each of the six macro environmental factors. Table 5.1 PESTEL’S DIMENSIONS AND VARIABLES POLITICAL Variables related to the dynamic political decisions that affect the industry. For example: -actual political system (democracy, republic…); -institutional stability; -political coalition groups; ideology from the government in power: politics defended by the dominant groups in terms of education, health, immigration, agriculture, sports, within others. 1 ECONOMIC SOCIO-CULTURAL TECHNOLOGICAL ECOLOGICAL LEGAL Variables related to the main macroeconomic indicators that describe the economic situation of a region (country, community,…) For example: - GDP; - inflation; - interest rates; - currency exchange rate; - per capita income; - unemployment rate; - private consumption levels, etc. Variables that shape the social and cultural reality of a territory. For example: - population density; -birth, death and sickness rate; evolution of the population (age, sex...); - lifestyle habits (use of Internet, social networks…); - consumption levels; - education levels; and others. Variables related to technology, transport and telecommunications infrastructure. For example: -public and private budget for R&D projects; - patents and copyrights registered; - transport infrastructure (roads, railways, airports, ports); - telecommunication infrastructure (digital and mobile telephone connections, broadband); - other potential technological advances (renewable energy, autonomous cars, …) Variables associated with the environmental aspects linked to the nature a territory. For example: -climate; - geographic location; pollution levels (air, sea, …); - recycling levels; - environment sensibilisation levels, … Variables related to the current regulations in terms of: health, education, labour, finance, trade, social action, environment, immigration, technology, science, sports, agriculture … There are a few business problems when using just a PESTEL analysis to study the effect of the external macro environment in the performance of a company. First, it is very difficult to find all the information related to the variables to include in the analysis, which creates uncertainty. Second, it is very costly for a firm in terms of use of time and resources to do this type of analysis. Third, the results could trigger an information overload, very difficult to manage. And fourth, this analysis offers a picture of the environment in a moment in time, it is a static analysis, with a vague utility for a firm that make decisions and undergo changes every day. 2. Scenario Planning Scenario planning was developed by Royal Dutch Shell at the late of 1960s and beginning of 1970s, which helped the company to prepare for the oil crisis of the 1970s1 and early 1980s2 and to take better management decisions. In his book “The Art of the Long View” of Peter Schwartz (1998), he defines scenarios as stories that help companies to adapt to those changing aspects of the present environment. Scenario Planning acts as a tool to overcome the staticity of a general PESTEL analysis and the unpredictability, dynamism and complexity of a firm’s macro environment. The latest American or Asian tsunamis show the dynamism levels a territory can have. For example, when disrupted global chains led to factories to stop their production on other continents. 2 (Thomson Strickland, 2012) In this sense, scenario planning appears as an important tool that allows managers to move beyond a single forecast, and create different coherent stories of the future, to aid with the decision making in the short and long run. For example, to help farmers forecast their future sales and investments, scenario planning can aid to predict whether the harvest will be good or bad. 2.1 Building Scenarios The process of scenario planning usually begins with a brainstorming on how managers and other leading employees think how those big shifts in economics, society, politics or technology of its macro environment might affect a particular problem or issue in the company. From these meetings, a list of priorities is drawn up, including things that will have the most impact on the particular problem and those variables whose outcome is the most uncertain. The chosen priorities will give managers a rough picture of the future, which will help them take strategic decisions on resource employment or investment choices. (Wack, 1985) “The more control the actors can have over a trend, the quicker it may vanish. A company cannot change the demographic trend of an aging population, but an industry can change price competition” (Shoemaker, 1995). Hence, even though the company cannot influence its macro environment most of the time, it can take decisions within its industry that can help to shape a new macro environment. Figure 5.2 consists of five steps you need to follow to build scenarios. Initially, it is necessary to identify the drivers of change from the different factors of the macro environment: economic, political, socio-cultural… 3 Then from these drivers of change two lists of variables must be selected. On one hand, those variables that represent basic trends. For example, if unemployment rate increases, most probably consumption declines. On the other hand, identify key uncertainties variables or dimensions from the macro environment. That is, those factors or variable from which the company does not have enough information about their possible change. Then managers need to rank the information obtained and make rules of interactions. If we use the example above, if unemployment increases, consumption levels decline and consequently prices will decline too. And lastly, multiple scenarios should be drawn up. The following Illustration shows an example of how an organization develop scenarios. Illustration 5.1 Scenario Planning at Visitscotland VisitScotland is the Scotland national tourism board that directly supports the Scottish Government’s Economic Strategy. Since 2001 the company has been engaged in developing scenario planning, economic modelling and scenario construction in a systematic fashion... It also supports organizations in the Scottish tourism industry by providing advice, statistics, and reports, with the aim to encourage the provision and improvement of tourist facilities in Scotland. In the aftermath of the 9/113 and 7/7 terrorist bombs and the severe acute respiratory syndrome (SARS) outbreak that caught out many tourism organizations, the methodology of scenario planning was seen as a way to improve strategic management in organizations and tourism in general. Originally, the scenarios had a time frame to 2025 and included product offers and markets with the Scottish industry and broader consumers’ needs and wants, plus supply-side and other structural issues. All the organization’s stakeholders were connected through its board. VisitScotland worked closely with the Moffat Centre at Glasgow Caledonian University in 2003 and again in 2008 to identify key drivers for the Scottish tourism industry. The information gathered was then used to make forecasts and quantify, economic, demographic and technological trends that may have some impact on the Scottish tourism industry. To find the uncertainties, VisitScotland used McTAFE, a system-based approach developed by Strathclyde University and an independent group referred to as the Remarkable People network. The collaboration of this group provided new ideas from outside the industry and the organization, and external experts to add rigour to the scenario process and planning. Initially, it became clear to the research group that there was a high probability of a war in Iraq. This gave VisitScotland the opportunity to put their process into action. Having already identified a range of key driving forces for Scottish tourism, including oil prices, GDP, consumer confidence, media stories and levels of disruption, they were combined to produce two different underline themes – economic behaviour and the nature of disruption. The best 4 and worst outcomes for each theme then formed the basis for developing four scenarios. For example, economic behaviour ranged from a ‘setback’ in the world economy to ‘merchants of doom’, a global recession. The scenarios developed were then reduced to three as the into the valley of death scenario was believed too extreme. New advent predicted a new world order following a major war in Iraq with impacts in tourism by travel disruption, and a brief economic downturn followed by recovery. The most positive outcomes for the industry was how the west won, with a very limited and a short period of disruption caused by war and terrorism and a minor economic blip, but consumer confidence remained relatively sustainable. Global Northern Ireland on the other hand, had predicted limited disruption but a full blown recession that would have a dramatic effect on domestic tourism. The events proved the validity of scenario planning and even if the events most closely resembled how the west was won, there were positive feedback of elements included in the other two scenarios, particularly the level of disruption caused by ongoing terrorism. Source: Adapted from (Thomson Strickland, 2012): 62 Question: Identify the steps of the scenario planning process that VisitScotland followed. How did scenario planning help the tourism industry in Scotland? 3. Industry Analysis The industry analysis is a valuable alternative of the macro environmental analysis as it focuses companies directly to the influences the industry has on their performance. The industry analysis represents the study of the external micro environment of a firm in order to learn about the possibilities of being successful and overcome the companies’ competitors in terms of profits. As it happens with the macro environment, the industry environment, being an external contextual setting, influences the firm but there is no much possibilities to be influenced by the company. And if the macro environment affects companies indirectly through the industry where they are located, the micro environment affects directly to those companies that integrate the industry. The question is, if all firms in the industry are influenced in the same way by the industry environment factors. The answer is no, the diversity of companies within an industry in terms of wealth, size… make these influences differ from firm to firm. For some companies, these influences may be positive and help them obtain opportunities to exploit in the market. For others, these micro environmental influences may sound negative and imply threats to avoid. For example, in January 2018, 1,044 new companies from the real state agencies, finance and insurance have been incorporated into the real state agency sector. Their creation was the result of two macro environment influences – house price and demand increase – and two micro environment influences – the exit of many real state agencies in the past due to the housing bubble in Spain (2001-2007), and the increase in the number of buying-selling houses. (Alonso, 2018). 5 The new real state agencies of the industry are damaging the image of the old real state agencies, hence for the latter, the environment influences have a negative impact on them, while for the former, the new real state agencies is a very positive impact as customers value the new companies as being more professionals. As Thomson Strickland et al (2012) explain, in order to obtain a deep understanding of how the industry influences the companies’ competitiveness levels, managers can use well known analytical tools, and well defined concepts (explained in the next section), that can help to answer the following seven questions: ✓ Are there attractive opportunities for companies in the industry? ✓ What are the competitive forces that companies in the industry are facing, and how strong are they? ✓ Which are the factors that are driving changes in the industry, and what impacts these changes have on the industry profitability and the competition intensity between firms? ✓ Where is the market positioned within the industry – who is in a strong position and who is in a weak one? ✓ Is it possible to predict the competitive moves rivals are going to make next? ✓ What are the key success factors to have success in the industry? ✓ Does the industry provide opportunities to obtain and have a sustainable level of profits? 4. Competitive Forces The American Journal, Harvard Business Review (HBR), published an article from Michael E. Porter titled “How Competitive Forces Shape Strategy” in 1979. This was the first article proposing a methodological framework to analyse the forces influencing the companies from the micro environment – the industry –. That article was a revolution in the strategy field, and since then Porter have published many other articles, books and has given conferences worldwide about the subject. He has also used his framework to analyse not only industries, but also corporations, regions, nations, and recently industries like health care. It can be argued that the model he proposed “Five forces model” have shaped academic research and business practice. From its publication, there has been a huge amount of research articles using the model as the basis of their research or analysing its methodology. Also, many companies worldwide have been using the five forces model to analyse the influences of the industry competitive forces on their performance. And there is no strategic management course at any University worldwide where Porter’s model is not explained. In an article in the HBR in 2008 Porter, 29 years after his first publication on the theme, reaffirms himself on the methodology used, updates and extends the classical work. Hence we will use this 2008 publication to explain the theoretical model. According to Porter, there are five forces that shape industry competition: Rivalry Among Existing Competitors; Bargaining Power of Suppliers; Bargaining Power of Buyers; Threat of New Entrants; Threat of Substitute Products or Services (See Figure 5.3) Porter explains in his article: “If the forces are intense, as they are in such industries as airlines, textiles, and hotels, almost no company earns attractive returns on investment. If the forces are benign, as they are in industries such as software, soft drinks, and toiletries, many companies are profitable.” 6 Hence the shape of competition in an industry and the attractive opportunities it offers to companies, depends on the intensity of those five competitive forces. Moreover, the industry structure drives profitability and competition in all sort of industries: mature or emergent, product or service, low tech or high tech, regulated or unregulated… This powerful industry conceptual model reveals the roots of an industry’s present profitability, and teaches firms how to influence competition and profitability over time and how to anticipate to other competitors. Following, we present the five forces model by analysing the most important aspects of each of the five drivers of competition. 4.1 Threat of entry New entrants in an industry put pressure on established companies, like it has happened in the real estate agents sector we commented earlier, and bring new capacities, fresh ideas and new desire to win. But they also put pressure on costs, prices and the rate of necessary investment to compete. In particular, when these new entrants come from other markets, as they bring cash flow and existing capabilities, it is very difficult to compete with them. For example, Apple into music, smartphones, coming from the personal computer market or Disney into fun parks, cruise ships and children’s retailing, coming from the film industry. The threat of entry in an industry depends on the entry barriers the industry present and the reaction new entrants can expect from existing companies. So which are these barriers to entry? → Supply-side economies of scale. It is well known between economists that when companies enjoy from economies of scale means they are able to produce large volumes and have lower costs per unit, as they can spread their fixed costs over more units, have better terms with their suppliers, or employ more efficient technology. 7 This entry barrier forces new entrants to accept a cost disadvantage or to enter an industry on a large scale that is very difficult to maintain in the short term, as it consists of a new company in the market and unknown from the possible customers. The Figure 5.4 shows how average cost decreases as the output increases until point Q2 where the company exploits all the economies of scales. From that point on, an increase in output would mean diseconomies of scales and an increase in average costs. Therefore, the industries that enjoy economies of scale will have a limit in the company’s production levels and this threat of entry will not be permanent in time. When the companies in the industry use economies of scale, this will be a barrier to entry, so there will be no threat of entry and the industry will be attractive. → Demand - side benefits of scale. It happens when buyers want to pay for a company product because other known buyers are also doing the same. Buyers may like to buy from wellknown big companies because of the variety of products and the more reasonable price. Buyers may also like being part of a network of customers, it represents an insurance for them, if many people buy the product, and it must be good. We can see this type of interpretation in Internet, as future buyers find out how many people bought the product before choosing whether to buy it or not. This network effect makes demand – side benefits of scale a barrier to entry of newcomers, as they need to create trust in customers, reduce price and build up a large base of customers before being competitive in the industry. Therefore, many firms will be discouraged to entry. If there is demand-side benefits of scale in an industry, this means a barrier to entry, so there will be no threat of entry and the industry will be attractive. → Customer switching costs. Switching costs are fixed costs that customers assume when changing traders. These costs may arise if the buyer in order to change the supplier needs to alter product specifications, modify information systems and processes, restrain employees from using a new product ... The larger these switching costs, the harder will be for the buyer to buy products from a new entrant in the industry. For example, the software used by the air traffic controllers have huge switching costs, as they work many years with the same software company, who is responsible for explaining the software, installing it, updating it, managing its maintenance, etc. Besides, new candidates to air traffic controllers are taught the software before starting to work at the airport. 8 When switching costs are high, it becomes a barrier to entry, therefore there will be no threat of entry and the industry will be attractive. → Capital requirements. New entrants will decide not to enter an industry if it requires large capital investments. This capital may be necessary to extend customer credit, to acquire fixed facilities, fund start-up losses or build inventories. This entry barrier becomes more important if the capital requirements is not recovered initially because it may be an up-front advertising campaign or used for research and development. Even though large companies will not see capital requirements a barrier to entry, it is true that the pool of likely entrants will be significantly reduced. If capital requirements are important to enter an industry, it will be a barrier to entry, so threat of entry will not be important and the industry will be attractive. → Incumbency advantages independent of size. No matter the size of the company, just because they are already in the industry, incumbents may have cost or quality advantages that new rivals find unavailable. It refers for example to most favourably geographic locations, best raw material sources, cumulative experience that have provided incumbents to be more efficient in their production, established brand identities, etc. However, sometimes new entrants bypass these disadvantages by locating their stores not in regional shopping centres where the incumbents are placed, by in freestanding sites, like Wall-Mart or Target. When there are incumbency advantages, this will be a barrier of entry, hence no threat of entry and the industry will be attractive. → Unequal access to distribution channels. A new entrant will want to secure distribution of its product and place it in attractive shops’ shelfs, displacing other products of established firms with the use of price breaks, promotions, etc. If the established companies tie up very well the retail channels or wholesales so as not to leave available spaces for new entrants, then the latter will deter to come into the industry. Nevertheless, sometimes new entrants bypass this barrier by not using distribution channels. For example, Ryanair entered the airline industry selling their tickets online through their websites. When there is unequal access to distribution channels in the industry, this will be a barrier to entry, thus no threat of entry and the industry will be attractive. → Restrictive government policy. Government can protect an industry through limiting or foreclosing new entry, through for example, licencing or restrictions on foreign investments. Regulated industries such as: taxi services, airlines or liquor retailing are examples of this barrier of entry. Government policy can also increase the level of other entry barriers, for example, imposing safety regulations that raise scale economies newcomers face. When there are restrictive government policies in an industry, this will be a barrier of entry, therefore no threat of entry and the industry will be attractive. Expected retaliation The expected retaliation of the existing companies can defer the decision of entering an industry. Incumbents may use messages or public statements vigorous enough to keep potential entrants out of the industry. For example, newcomers may know the experience of incumbents in this type of retaliation; or that the incumbents have substantial resources to fight back, to cut 9 prices to retain market share at all costs. Maybe the problem is that the industry growth decreases and newcomer only seek to take volume from the incumbents to stay in the industry. When there are expected retaliations in an industry, this will be a barrier of entry, hence no threat of entry and the industry will be attractive. Table 5.2 is a summary of the competitive force – threat of entry. The entry barriers in an industry and the expected retaliation need to be assessed in relation to the capabilities of new entrants. Established companies need to be aware of the creative capabilities newcomers find to overcome apparent entry barriers, like it happens with foreign firms, companies in related industries or start-ups. 4.2. The bargaining power of suppliers Powerful suppliers are able to increase price, lower the quality of their products/services or shift the costs to established companies in the industry. Those companies in the industry that are unable to pass on cost increases in the price of their products/services, may be obliged to leave the industry if they stop being competitive. Famous examples of powerful suppliers may include the raise in price of Microsoft operating systems for personal computers, and the small reaction of PC makers in an industry where they have limited freedom to raise prices accordingly. A supplier group will be powerful if: - It is represented by a small and very concentrated industry in relation with that of the incumbents. For example, PC makers were very fragmented and the company Microsoft was a near monopoly in operating systems. - The supplier does not depend on the buying industry for its revenues, hence they see a way to extract maximum profits from their sales. Instead, if the buying industry is an important market for the supplier, the latter will want to protect and care for the former, assisting in teaching how to use the software program for example, or contributing to the buyer’s R&D. 10 - Its clients (companies of the industry) have to face switching costs when changing suppliers. If a company has invested heavily in a specific raw material then it would be difficult and costly to change suppliers. Also, if they had to learn the suppliers’ program, software or how to use its equipment, then the company will assume costs if changing suppliers. Sometimes it happens that the company locates itself near the supplier, hence changing to another supplier will impose transaction costs. On the other hand, suppliers can also have switching costs and they will have to remain with the same company (customer), which it will limit their power. - The suppliers are offering differentiated products, in terms of quality (product/ service) or in terms of brand. Printer suppliers such as Canon have their customers tied up because of brand, services, maintenance… - There is no substitute for what the supplier is offering. For example, medical surgeons are a supplier group impossible to substitute, hospitals need them and cannot avoid them. - The group of suppliers threaten to integrate forward and become another company in the industry. If the industry is becoming very attractive and its companies are gaining profits, it will tempt suppliers to enter the industry. For example, an airline starts its own tour operator company, like American Airlines and its American Airline Vacations. When the suppliers in an industry are powerful, they will have supplier power and the industry will not be attractive. Table 5.3 presents a summary of the competitive force – power of suppliers. 4.3. The bargaining power of buyers Powerful buyers, the other side of the coin from the suppliers, can force companies to lower prices, demand better services and quality, hence taking value from the firms and imposing them higher costs. Also, buyers can make companies in the industry compete more fiercely with each other when moving around freely, when buying products, or demanding services. 11 Some group of buyers have bargaining power over the industry either because they will be price sensitive or because of their negotiating power. The group of buyers will be price sensitive if: - The product they buy suppose a high cost relative to its budget or its cost structure. In this sense, buyers will find companies that supply them products/service with lower costs for them. On the other hand, if the buyer buys products that will not suppose increase in their costs, then they will not be price sensitive. - The buyers are earning low profits and have less money to spend, hence they will be price sensitive to the products/services they buy. For example, the cell phone industry is highly competitive, hence they cannot assume high costs when buying products such as technology. Therefore, they will be sensitive to price. - The quality of the product/service they buy is not important for their products. For example, companies that sell low cost products and offer no service to customers, they will be no interested in the quality of the products they buy to the industry. In this case, these companies will be sensitive to price. - The product of the industry does not have much effect on the other buyers’ costs. For example, if the buyer’s product sell by itself and does not depend so much on the industry product, then the buyers will be more sensitive to price. However, if it happens the other way round and like with cell phones, the technology plays an important role in the phone sales, then buyers will not be sensitive to price. The group of buyers will have negotiating power if: - The buyer is big in size and buys large volumes of products from the industry. In this case, they will have negotiating power. - The product they buy from the industry is standardized and they can buy it anywhere. Then they will have negotiating power, as they will choose the seller that sells their products at the lowest price, which will put pressure on the sellers. - The buyer does not face high switching costs if they change and go to another seller. - Buyers are able to backwards integrate, when they feel tempted at seen that the industry is very profitable. This ability to integrate backwards give buyers negotiating power. The book retailer Amazon.com Inc for example, has integrated backwards and has become a book publisher. When buyers are either price sensitive or have negotiating power, they have buyers’ powers and the industry will not be attractive. 12 In Table 5.4 there is a summary of the competitive force – power of buyers. “Most sources of buyer power apply equally to consumers and business-to-business customers. Like industrial customers, consumers tend to be more price sensitive if they are purchasing products that are undifferentiated, expensive relative to their incomes, and of a sort where product performance has limited consequences. The major difference with consumers is that their needs can be more intangible and harder to quantify.” (Porter, 2008) There can be other buyers between the company in the industry and the end consumer: these are intermediates/assemblers/distribution channels. They can have important negotiating power by influencing end consumer’s consumption decisions. For example, a supermarket acts as an intermediate selling the product of the industry (i.e. Kellogg’s breakfast cereals). The supermarket can decide to occupy their shelves mainly with their own brands, exerting negotiation power over the industry and conducting consumers to buy mainly their products. Hence, what can the industry do to avoid this type of pressure? The companies in the industry can make exclusive contracts with channel distributions or can sell the product directly to the end user like Apple does. 4.4. The threat of substitutes The substitutes represent other products different from the industry that can also satisfy similar needs to the consumer and can be replaced by one another. For example, Netflix substitute cinemas; email substitute letter posting; vegetable (plant or cereals) milk substitute cow’s milk. When consumers tend to buy substitute products/services, then these substitutes threatens the industry and this happens when: 13 - The substitutes has a lower price or a higher performance, reducing the profit potential of the industry’s product. For example, Skype offer consumers free telephone and videoconference services against costly conventional providers of international phone calls. - The buyer’s switching costs are low at substituting the product of the industry for that of a lower price. - Substitutes products threat the industry by placing a ceiling in the price of the industry products and consequently in the companies’ ability to earn profits. Hence, the industry needs to be aware that innovation projects in other companies may result in substitute products/services for the industry that threat their present and future benefits. When the threat of substitute products is high, then there is threat of substitute and the industry is not attractive. Table 5.5 represents the variables and solutions of the competitive force – threat of substitutes. 4.5. Rivalry among existing competitors This force analyses how competitive are the companies within an industry. This competitiveness can take the form of new products in the market, service improvement, price discounting, and advertising campaign. When in an industry there is high competitiveness then companies have less potential to earn profits. The intensity level of competitiveness depends on: - Number of competitors and size. If there are many competitors in the market, then the rivalry among them increases. However if there are leader companies, big in size then the level of rivalry decreases. - The level of industry growth is low. If the industry growth is slow because demand is low, then companies will strive to gain market share. - Barriers to exit the industry are high. When companies in the industry use specialized equipment or assets, or need to have specialized knowledge to operate in the industry, then these become a barrier to exit the industry even if companies are earning low or no profits. This creates excess capacity in the industry where demand is lower than supply (D<S) and all companies in the industry, including the healthy ones will be affected. - Competitors are committed to the business other than just for profits. In some industries the rivals are state-owned companies that may be committed to create employment or to have their own prestige. Other times, rivals are more engaged into offering a full line of products or for image reasons. In industries such as high technology or media it is very common. - Rivals do not know much about each other, they may have different goals, other forms of competing. Hence they don’t see each other’s market signals. 14 “Rivalry is especially destructive to profitability if it gravitates solely to price, because price competition transfers profits directly from an industry to its customers.” (Porter, 2008). Price competition occurs when: - The products or services of the competitors are very similar, lowering the switching costs of buyers. This situation make competitors to lower prices and gain new customers. The airline industry in the last decade has been an example of price competition. - Fixed costs in the industry are higher than marginal costs. This situation encourages rivals to cut prices below their average costs, which create pressure for the other competitors to do the same, in order not to lose customers. For example, delivery companies are forced to do their service regardless of volume, suffering consequently from high fixed costs. - Efficiency demands for an increase in capacity, like it has happened with the polyvinyl chloride (PVC) business. From 1950s, more and more companies started to increase the volume of PVC supply, as they found new uses and methods to increase their durability. This increase in supply resulted in overcapacity in the industry and in a consequent cut in prices and high competition. - The product in the industry is perishable. As the durability of some products is limited, to keep obtaining value from it, companies feel tempted to cut prices and increase sales before it is too late. Fresh vegetables and fruits are perishable and farmers usually lower their prices to obtain the most of it. Computers are an example of perishability as new models make the formers obsolete. And the same happens with information, it becomes outdated or not necessary any more. In the case of services in tourism, in a restaurant empty tables one day make the service unprofitable as it cannot be stored for the next day. When competition in an industry is high, rivalry among competitors is high and the industry will not be attractive. Table 5.6 presents a summary of the competitive force – rivalry among existing competitors. 15 “Rivalry can be positive sum, or actually increase the average profitability of an industry, when each competitor aims to serve the needs of different customer segments, with different mixes of price, products, services, features, or brand identities. Such competition can not only support higher average profitability but also expand the industry, as the needs of more customer groups are better met. The opportunity for positive-sum competition will be greater in industries serving diverse customer groups.” (Porter, 2008) Learning Activities ✓ Find three examples of companies that use scenario planning in their strategic management. ✓ Find out which are the competitive forces that drive profits down from the food distribution industry. 16