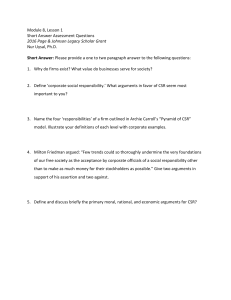

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/0967-5426.htm Does green innovation mediate corporate social responsibility and environmental performance? Empirical evidence from emerging markets Mandella Osei-Assibey Bonsu, Yongsheng Guo and Xiaoxian Zhu Green innovation Received 17 October 2022 Revised 4 April 2023 Accepted 9 June 2023 International Business School, Teesside University, Middlesbrough, UK Abstract Purpose – This paper examines the mediation role of green innovation in the relationship between corporate social responsibility and environmental performance of manufacturing firms in Ghana. Design/methodology/approach – The paper chose African emerging markets and surveyed managers from manufacturing firms. With 301 questionnaires qualified for this study’s final analyses, the authors adopt the multiple regression with mediation models to estimates the nexus among study variables. Findings – Results evidence that both corporate social responsibility and green innovation has a positive and significant impact on environmental performance. Interestingly, the authors find that corporate social responsibility significantly improves environmental performance through green innovation indicating that firms could essentially build their dynamic resource and innovation capabilities in sustainability leading to enhanced environmental performance. Research limitations/implications – This paper develops a dynamic resource-based view of firm environmental performance illustrating how firms use resources to build strategic capabilities for competitive advantage, which leads to improved environmental performance. The paper highlights the mediation role of green innovation on corporate social responsibility and environmental performance relationships. Practical implications – This study’s results provide significant insights to owners and managers of manufacturing companies to integrate corporate social responsibility and green innovation to ensure environmental performance and sustainability. Furthermore, policy makers should encourage green innovation when design sustainable development systems in the manufacturing industry. Originality/value – The paper provides a valuable model showing how green innovation mediates corporate social responsibility to improve environmental performance and build competitive advantages considering both small, medium, and large manufacturing enterprises in emerging countries. Keywords Green innovation, Corporate social responsibility, Environmental performance, Ghana Paper type Research paper 1. Introduction For decades, firms globally have engaged in activities that worsen the environment (Vardhan et al., 2019), which governments and policy makers have debated the severity of this degradation and the necessity of acting (Yang et al., 2018; Zhang et al., 2020). Firms should make significant changes to combat and lessen environmental degradation and environmental impact. Researchers working on environmental protection have been discerning on ways to incorporate novel strategies and approaches, including green marketing and green innovation to lessen the effects of environmental degradation (Groening et al., 2018). Policy makers and the general populace growing concern about environmental deterioration is causing a significant move in the conduct of businesses and organisations. Authors would like to thank the Editor in Chief and annonymous reviewers for their constructive feedbacks to improved the quality of the paper. Conflict of interest declaration: There is no conflict of interest. Journal of Applied Accounting Research © Emerald Publishing Limited 0967-5426 DOI 10.1108/JAAR-10-2022-0271 JAAR Firms are now looking for innovative solutions to lessen their environmental impact while still achieving their financial goals (Fernando et al., 2019). The manufacturing sector has the greatest environmental impact of any economic sector (Rivera and Clement, 2019; Dahlmann and Bullock, 2020) because of its large role in air pollution, deforestation, climate change, and waste generation. More people than ever are becoming aware of how businesses, and manufacturing industries particularly, affect the environment. The general public expects organisations to act responsibly towards the environment (Gaganis et al., 2019). Therefore, entrepreneurs are being forced to embrace the corporate social responsibility business model (Han et al., 2019). Numerous scholars have examined various aspects of corporate social responsibility including its influence on firms’ profitability and predicted the significance of CSR for reducing the environmental impact of economic operations (Lin et al., 2021). A new business model based on CSR that combines profitability and social responsibility is gradually replacing the previous one, which is primarily focused on profitability (Chao and Hong, 2019). In this regard, CSR and financial performance relationship has been researched for a while (Barauskaite and Streimikiene, 2021; Maqbool and Zameer, 2018), and recent research suggests that, in the context of the manufacturing industry, environmental investments have a positive impact on firm profitability. According to Shabbir and Wisdom (2020), environmentally conscious firms outperform less ecologically aware firms in terms of profitability. Considerable efforts has been expended in researching the CSR segment of environmental benefits (Kraus et al., 2017; Hussain et al., 2022). Literature has revealed inconclusive results between CSR and firm performance (Galbreath and Shum, 2012; Orazalin and Baydauletov, 2020). Scholars suggested essential elements of mediation or moderation to explain the inconclusive results (Galbreath and Shum, 2012). Therefore, we propose green innovation as a mediator between CSR and environmental performance. According to NRBV theory, green innovation (GI) contributes significantly to the definition of sustainable performance (Hart, 1995), suggesting that sustainable performance is a key indication when assessing firms’ performance (Qiu et al., 2020; Chen, 2008). Green innovation aims to improve existing products and processes more ecologically sustainable (Albort-Morant et al., 2016). Green innovation can be engineered by selecting environmentally friendly raw materials, avoiding waste, designing products according to eco-design principles, lowering carbon footprints and consuming less water, electricity, and other raw materials (Singh et al., 2020; Gunasekaran and Spalanzani, 2012). Notwithstanding this, scarce research has been conducted to examine the environmental performance in African emerging markets. Moreover, less research on CSR has paid attention to measuring environmental performance (EP) considering both SMEs and large manufacturing firms with the mediating role of green innovation in Africa, particularly Ghana. Therefore, we are driven to close this important gap and ask the following research questions: RQ1. What are the impacts of CSR and green innovation on Environmental performance? RQ2. What are the impacts of CSR on green innovation? RQ3. To what extent does green innovation mediate CSR and environmental performance? Manufacturing sector has grown significantly over the years in Africa. Particularly, Ghana’s manufacturing sector has developed enormously, contributing around 6.8 billion to GDP in the first quarter of 2021, in line with the country’s continued output growth (roughly 1.1 billion US dollars). However, Ghana is struggling to reinstate a balance between economic growth and environmental problems. For example, Ghana was ranked 170th of countries with 27.70 score for environmental sustainability [1]. This index indicates that Ghana is lagging behind other countries in environmental sustainability with manufacturing operations contributing for the most problems (Bandehnezhad et al., 2012). Therefore, how Ghana could decrease environmental problems and figure out manufacturing firms’ application of technological innovations provide excellent support to policy makers. Adopting questionnaires to managers of Ghanaian manufacturing firms, we received 310 responses and developed a theoretical framework tested using regression with mediation models. Results evidence that CSR has a significant impact on green innovation and environmental performance; and green innovation has a positive and significant effect on environmental performance. We further found that, CSR significantly improves environmental performance through green innovations indicating that firms could essentially build their dynamic resource and innovation capabilities in sustainability leading to environmental performance. Additional tests were performed with results provided robustness checks and confirmed the preliminary findings. We incorporated the Natural RBV theory to theoretically validate the findings and explain the role of green innovation on CSR and environment performance. We provide contributions to current literature in four folds. First, literature has extensively focused on large manufacturing firms (Kraus et al., 2020; Rehman et al., 2021b), with limited research on SMEs (Boiral et al., 2019). SMEs represents most firms globally and collectively contribute to productivity growth, but often exhibit less resources to address sustainability issues. Therefore, we fill in the gap and contribute to the literature considering both SMEs and large manufacturing enterprises. Second, we explain the mixed results of CSR and environmental performance by validating the mediation role of green innovation. To our best knowledge, this is the first empirical study from African emerging market, particularly Ghana. Ghana is recognised as one of Sub-Sahara Africa’s fastest-growing economies, with an annually average growth of more than 5% during the last three decades. Third, we build on single framework to integrate CSR, GI and EP based on natural RBV theory, which proposes that firms take advantage of resources to build strategic capabilities to garner competitive advantage leading to ensure environmental performance. Finally, we produce results critical for current policy makers to challenge the progress towards environmental performance goals by applying GI and CSR as criterion factors to define countries heterogeneity effects of the variables. Section 2 reviews literature, theoretical background and hypotheses development. Section 3 provides research methodology. Section 4 presents findings followed by discussions with the final section providing theoretical and practical implications. 2. Literature review 2.1 CSR policy and practices in Ghana CSR is a concept that promotes companies to voluntarily incorporate social and environmental issues into their operations and relationships with stakeholders. CSR describes business practices considering firms economic, legal, ethical and philanthropic concerns to multiple stakeholders (Carroll and Shabana, 2010). Currently, the conception of voluntary CSR is challenged given the several similarities between CSR and the law, including new significant legislations, particularly in developing countries (Blowfield and Frynas, 2005). Unsurprisingly, Ghanaian companies are not required by law to carry out CSR initiatives. The initiatives are undertaken responding to moral principles than the law requirements. Despite the absence of comprehensive or easily accessible CSR documentation in Ghana, the country has an extensive range of CSR-related policies, legislation, and practises including Ghana Land policy documents, constitution provisions and environmental impact assessments as stated in parliamentary act (Atuguba and Dowuona-Hammond, 2006). Additionally, the government provides tax incentives to firms engaging CSR initiatives to promote CSR practices. Hence, most Ghanaian businesses understand the value of CSR practises. Firms’ practices CSR to Green innovation JAAR enhance their reputation and promote socioeconomic development for their key stakeholders. However, their CSR concepts consists around health, philanthropic, education, environment and capacity building. Some of the factors motivating companies CSR selection and implementation in Ghana includes beneficiary community’s needs, interests and expectations and CSR frameworks and guidelines (Clement and Tackie, 2017). However, some firms CSR practices are mainly impeded by insufficient funds and human resources. The needs of various stakeholders and the unclear connections between a firm’s CSR and beneficiary demands discomfort businesses’ ability to meet beneficiary demands. 2.2 Theoretical background and hypothesis We use the Natural Resource Based View (Hart, 1995) to theorise the relationships between CSR and environment performance with the mediation role of green innovation. According to the theory, firms can get a competitive advantage by using various environmental approaches including environmental protection, sustainable product development, and environmental conservation (Hart, 1995; Hart and Dowell, 2011). To support the theory, we suggest that green innovation can be viewed as both an organisational resource and a dynamic capability that is always advancing. From this angle, firms may gain an advantage over rivals by enhancing the impact of CSR on green innovation and their environmental performance (Rehman et al., 2021b). By incorporating the information gained through green innovation into their CSR and using corporate social responsibility to further green innovation, manufacturing companies may also continuously improve their competitive advantage. Exploratory green innovation is concerned with developing new products and technologies that have the potential to restore environmental damage as well as exploitative green innovation, which focuses on enhancing currently available products and technologies to lessen their detrimental effects on the environment. Hence, we consider natural RBV theory on economic, social, and environmental responsibility dimensions, green innovation, and environmental performance of manufacturing firms in Africa emerging market such as Ghana. 2.2.1 Corporate social responsibility and environmental performance. The contact of the environment with firms influences the economy. Firms are challenged to implement pollution controls and other environmentally friendly initiatives. If these issues are unresolved, it forms risk depleting resources and harming society by concentrating only on their economic interests (Tilaye, 2019). Recently, researches on CSR and business achievement confirmed that, CSR significantly increase economic performance (Hernandez et al., 2020). However, CSR initiatives to measure environmental performance have received less attention (Orazalin, 2020). CSR refers to firms’ commitment to pursuing strategies, making decisions and undertaking actions that advantage larger community. According to Huang and Watson (2015), firms integrating environmental considerations into their management systems improves its environmental results. Some previous research revealed that, CSR enables firms to develop environmental competency generating sustainable development (Wong, 2013). Using the NRBV theory, CSR is a resource for firms to improve their environmental performance (Hart, 1995). Notably, studies on CSR and environmental performance nexus are inconsistent and require further study. Kraus et al. (2020) and (Rehman et al. (2022) found no direct impact of CSR on environmental performance of manufacturing firms. However, other studies discovered direct and significant impact of CSR on environmental performance (Zhou et al., 2023; Hussain et al., 2022). Hence, studies are required to comprehend the inconsistencies of CSR and environmental performance nexus leading to our first hypothesis. H1. CSR has a significant effect on environmental performance. 2.2.2 Corporate social responsibility and green innovation. Green innovation is the creation of new or enhanced goods, procedures, or technology that both help the economy and the environment (Li et al., 2020). GI is more unpredictable and disruptive than traditional innovation since it depends on a wider range of knowledge and the integration of more technology components (Wicki and Hansen, 2019). The evolution of applied technology within the workplace in accordance with community requirements and the company’s sustainability and strategy is the interaction between CSR and green innovation. CSR and green innovation have a positive reciprocal relationship that is highly dynamic (Handayani et al., 2017; Shahzad et al., 2020). The realisation of green innovation that makes the company competitive in the market is influenced by the continuity of CSR implementation (Rehfeld et al., 2007). Studies have shown that there exists a connection between CSR and innovation (McWilliams and Siegel, 2000). CSR is considered as networks of acquiring information, knowledge, and financial resources from environments that can be used for internal investment in various stages of innovation (Surroca et al., 2010). According to the Natural RBV theory, firms using their resources and capabilities can link CSR with green innovation (Broadstock et al., 2019). Kraus et al. (2020) discovered significant effect of CSR on green innovation. Similarly (Hao and He, 2022), revealed that CSR is significantly related to green innovation promotion among Chinese firms. According to Shahzad et al. (2020), firm’s CSR implementation will lead to an increase in green innovation and environmental sustainability. Moreover, Novitasari and Tarigan (2022) showed that, firms concerned with the environment can improve green innovation. Therefore, we argue that CSR has significant effect on firms’ green innovation leading to our second hypothesis: H2. CSR significantly influences green innovation. 2.2.3 Green innovation and environmental performance. Green innovation refers to technological advancements that are used to reduce waste, global warming, water use, air pollution, and energy consumption. Climate change is considered a severe problem faced by the world (Li et al., 2021), and green innovation is indispensable to reducing its harmful impacts. Green innovation considerably encourages environmental performance and connected to organisational environmental management agenda (Adegbile et al., 2017). Moreover, GI reduces the negative environmental impact of company while simultaneously enhancing organisational social and financial performance through reduction of waste and expense (Weng et al., 2015). Kraus et al. (2020) discovered that, green innovation significantly impacted environmental performance. Similarly, Edeh et al. (2020) shown that, technological innovation significantly enhances export performance. However, technological innovation transfers can negatively influence the environment (Ferreira et al., 2020). Researchers also observed CSR as having an impact on the EP of manufacturing enterprises, with GI acting as a mediator (Seman et al., 2019; Kraus et al., 2020). However, the above-mentioned studies are unable to determine how well GI predicts environmental performance. The uniqueness of GI significantly affects the environmental performance. However, Chiou et al. (2011) contended that green innovation has significant influence whiles green managerial innovation has no impact. This evidence is that the effects of GI on environmental performance is inconclusive and needs further investigation. Using Natural RBV theory, we propose that GI becomes an important firm resource that the firm employs to enhance its environmental performance and gain the trust stakeholders. Hence, we propose that: H3. Green innovation significantly influences environmental performance. 2.2.4 The mediating role of green innovation. The previous discussions on the relationships between CSR, GI and EP highlight that CSR influence green innovation resulting to improve firms’ environmental performance. Literature has confirmed that green innovation positively impacts environmental performance (Kraus et al., 2020; Wang et al., 2021; Ahmed et al., 2021). Moreover, studies have demonstrated that CSR significantly improves both sustainable financial and organisational performance (Orazalin and Baydauletov, 2020; Long et al., 2020; Green innovation JAAR Feng et al., 2022). Notably, Hussain et al. (2022) discovered that, green innovation, green capability and environmental strategy significantly mediates the relationships between CSR and EP of big industrial firms in Pakistan. Similarly, Kraus et al. (2020, b) found that GI significantly mediate the CSR impact on EP of large manufacturing firms in Malaysia. The study also claimed the connection between CSR and firm performance is ambiguous and needs further research considering the inclusion of a mediating variable. According to the Natural RBV, green innovation and environmental practices describe the relationship between environmental resources and competitive advantage (Kraus et al., 2020; Hart, 1995). Hence, we used GI as mediating factor to examine the relationships between CSR and EP leading to our fourth hypothesis: H4. Green innovation significantly mediates between CSR and environmental performance. 3. Methodology We focus Ghanaian manufacturing firms regulated under the Ghana Enterprises Agency. Ghana economy is diverse, resource rich and industrial including digital technology, automatic production and exporting of several and valuable resource including hydrocarbons and industrial raw materials. Moreover, Ghana has free market economy with few barriers to market entry activities, so there is massive growth of manufacturing firms. We purposively surveyed 250 manufacturing firms of which 140 were from small and medium manufacturing and 110 from large manufacturing firms and were contacted through email. We ensured that, these firms understand green innovation. Our research was limited to businesses in the Greater Accra Region, considered as Ghana’s most important site for manufacturing operations (Rankin et al., 2002). In Ghana, the Greater Accra region is home to over 80% of all manufacturing companies. We developed questionnaires on 7 Likert scale ranging from (1 strongly disagree to 7 strongly agree), which were in three sections: First section examined the respondents demographic profiles including age, gender, education, and experience. The second section measured respondents firm background information including firm age, size, and industry competitiveness, and firm categories respectively. The final section measured variable constructs: CSR dimensions (economic, social, and environmental), green innovation, and environmental performance. We sent questionnaires to owners of the small and large manufacturing firms from October to December 2021 through email and LinkedIn. To ensure high response rate, assurance of respondent’s confidentiality and their firm were given. We randomly selected the respondents which allowed us to obtain sample of 310 respondents representing managers of sampled firms. These respondents were engaged because they have global vision for green product, and processes and hence assess the intervening role of green innovation on CSR and environmental performance relationship. 3.1 Measures We measured CSR with twenty-one items on economic, social and environmental dimensions from (Alvarado Herrera, 2008). Specifically, each dimension recorded seven items. Green innovation was measured using five items taken from the extant literature (Chang, 2011; Tang et al., 2018). Environmental performance comprises five items adopted from (Laosirihongthong et al., 2013). Moreover, we reported firm age, firm size, and industry competition as control variables. Existing literature indicates that, the firm’s characteristics effect firm environmental practices (Aguilera-Caracuel and Ortiz-de-Mandojana, 2013; Shu et al., 2016). Hence, we operationalised firm age and size as the natural logarithms of years of operations and the number of employees respectively. For industry competition, we followed Shu et al. (2016) wherever respondents were asked to specify the most suitable account of their industry on the following: “not competitive, to extremely competitive”. Therefore, we develop novel model for relationships between CSR, green innovation, and environmental performance, taking control variables into account (See Figure 1). Green innovation 3.2 Data analysis In testing the hypothesis on the mediation role of GI on CSR and environmental performance of Ghanaian manufacturing firms, we applied the multiple regression with mediation tests due to the number of data sets (Eckstein et al., 2015). We constructed the following models to test the hypothesises controlling variables including firm age, firm size and industry competitiveness which effects environmental practices. Env Perfit ¼ β0 þ β1 ðCorporatesocial responsbilityÞit þ β2 ðgreen InnovationÞit þ εit Green Innovationit ¼ β0 þ β1 ðCorporate Social ResponsibilityÞit þ εit Env perfit ¼ β0 þ β1 ðCSR*Green innovationÞit þ β2 ðFirmageÞit þ β3 ðfirmSizeÞit þ β4 ðComp:IndÞit þ εit “Model 1 estimates the impact of CSR and green innovation on environmental performance, Model 2 estimate the impact of CSR on green innovation and model 3 tested the mediation role of green” Out of distributed questionnaires, we received 350 completed responses. 40 responses were not integrated in the final analysis since they were incomplete. Therefore, we obtained a final sample of 310 representing a response rate of 62%. Table 1 presents respondent’s profiles. 3.3 Non-response and common method bias We lessen non-response bias by applying the t-test method to estimate response differences between the early wave (220) and late wave (90) groups (Tsou and Hsu, 2015). Results indicate significant value of (p 5 0.31), which proved the absence of non-responses bias. However, the total responses found to be fit were 310. Since we collected data from a single source and survey questionnaires, there is a chance of common method bias that can taint the results Corporate Socia; Responsibility (CSR) H1 Environmental Performance (EP) H4 H2 H3 Green Innovation (GI) indirect effects direct effect Source(s): Figure created by authors Figure 1. Research model JAAR Profile Characteristics No. of respondents Percentage Gender Male Female 210 100 67.74 32.26 Small and Medium Large 1–15 16–50 51–100 101- above 120 190 90 74 64 82 38.71 61.29 29.03 23.87 20.64 26.46 108 114 88 34.83 37.77 27.4 Firm Nature Employees Firm age Table 1. Respondents profile 1–10 years 11–15 years 16- above years Source(s): Table created by the authors (Rehman et al., 2021a; Kraus et al., 2020). Hence, we performed common method bias using post hoc Harman single factor method which yielded 34.16% less than 50% benchmark (Fuller et al., 2016; Podsakoff et al., 2003) indicating that research data used had no common method bias that could impact the relationship between variables. 3.4 Measurement models We run convergent and discriminant validity tests before estimating values using the multiple regression to ensure measurement model is appropriate. Table 2 shows the summary of convergent and reliability validity results of study constructs. Factor loadings of each constructs exceed 0.6 which confirmed the attainments of indicator validity with the minimum benchmark of 0.5. Composite reliability and Cronbach’s alpha coefficients for each constructs exceeded the approval 0.70 threshold recommended in the extant literature. However, the average variance estimates (AVE) values for each constructs was above 0.5 recommended benchmark, implying that the variations recorded by the questionnaire items were substantially greater than the changes caused by measurement error (Raykov, 2012).Therefore, we confirmed the convergent and internal consistency of the research variables. Correlations among each set of variables remained in the range between 0.33 and 0.54. We used the Fornell and Larker AVE metric to examine discriminant validity. The average variance estimates (AVE) square root of the latent variable should be greater than the correlations across dimensions in the model to meet the discriminant validity criteria. The AVE square root for environmental and economic CSR, for example, was 0.85 and 0.86 (Table 3), respectively, which is higher than their correlations of 0.41 in Table 3. Hence, discriminant validity was found between the two conceptions. However, all average variance estimates square roots were larger than correlations among all variables. Hence, the research accepts discriminant validity. 4. Empirical results and discussions After confirming that the indicators of all variables were reliable and valid, we test the research hypothesis using the multiple regression with mediation controlling firm age, firm size and industry competitiveness which effects environmental practices. Table 5 reports estimations highlights and empirical evidence from models employed. First, we estimate the R2 model for environmental performance and green innovation. The models were found to explain an appropriate level of variability in the constructs (R2 for Main Variables Indicators loadings CA CR AVE EC-1 0.878 EC-2 0.877 0.912 0.953 0.744 EC-3 0.878 EC-4 0.769 EC-5 0.883 EC-6 0.869 EC-7 0.878 Social CSR SC-1 0.748 SC-2 0.881 0.915 0.918 0.557 SC-3 0.882 SC-4 0.883 SC-5 0.878 SC-6 0.772 SC-7 0.874 Environmental CSR ENV-1 0.817 ENV-2 0.888 ENV-3 0.818 ENV-4 0.808 0.804 0.946 0.718 ENV-5 0.827 ENV-6 0.868 ENV-7 0.828 Green Innovation GI-1 0.883 GI-2 0.878 0.881 0.926 0.715 GI-3 0.772 GI-4 0.874 GI-5 0.817 Environmental Performance EP-1 0.751 0.812 0.895 0.682 EP-2 0.851 EP-3 0.868 EP-4 0.829 Note(s): The table presents the reliability and validity results. EC, SC, ENV, GI, and EP represents economics, social, environmental, green innovation, and environmental performance respectively. CA is Cronbach Alpha, CR Composite Reliability, and AVE is Average Variance Estimates, respectively Source(s): Table created by the authors Green innovation Economic CSR CA AVE EC SC ENV GI Table 2. Results of convergent and discriminant validity EP Economics CSR 0.91 0.744 0.86 Social CSR 0.91 0.557 0.39 0.75 Environmental CSR 0.80 0.718 0.41 0.29 0.85 Green Innovation 0.88 0.715 0.51 0.33 0.54 0.84 Environmental Performance 0.81 0.682 0.45 0.30 0.366 0.45 0.82 Note(s): Table presents the descriptive and discriminant for sampled firms. EC, CSR, SC, ENV, GI, EP represent average variance estimates, environmental performance, corporate social responsibility, green innovation, social, economics, and environmental respectively. CA is Cronbach Alpha and AVE is Average Variance Estimate which is shown on the diagonal Source(s): Table created by the authors EP 5 0.70, R2 for GI 5 0.612, and R2 for EP 5 0.717). These results were consistent with (Chin, 1998) criteria; hence the model’s empirical validity was determined to be adequate. Table 3. Descriptive and discriminant validity JAAR Table 4. Full sample Results From model 1 (See Table 4), CSR is positive and significant on environmental performance which supports H1. The positive effects suggest that 1% increase in CSR dimensions will significantly improve the environmental performance of manufacturing companies in Ghana by about 37.4%, which supports the NRBV theory affirming that, natural resources increase sustainable effectiveness (Hart, 1995). The results confirm the results of (Orazalin and Baydauletov, 2020; Hernandez et al., 2020; Zhou et al., 2023). Regarding green innovation, there is evidence of positive and significant effect at 1% on environmental performance suggesting that green innovation increase the environmental performance of all firms as they technologically innovate (see Table 4). However, the result support H2 and confirms with (ElKassar and Singh, 2019; Kraus et al., 2020) indicating that, green innovation is positively related with firm competitive advantage. The result further validates the NRBV (Hart, 1995) in that innovation fosters sustainable performance. From model 2, CSR has positive effect on green innovation at 1% significance level. The positive effect of CSR shows that rising dimensions of CSR leads 34.92% increase in green innovation of firms. The results accept H3 (Table 5) affirming that CSR leads to ecoinnovations of firms in conserving the economic, social, and cultural elements of operating environment in Ghana (Abbas, 2020). However, environmental CSR and green innovation relationship is limited in the extant literature (Zhou et al., 2019), particularly in Africa. Thus, we cover that in Africa perspective contributing to the extant literature. To address the indirect effect, we discovered that CSR has indirect effect on environmental performance with the existence of green innovation as a mediator (See Table 4). The result supports Natural RBV theory and H4 suggesting that the rising dimension of CSR would Green Innovation Environmental Performance Model 1 Test/p-value 0.374(0.00) *** 0.3715(0.00) *** Model 2 Test/p- value 0.3492(0.000) *** Model 3 Test/p-value CSR GI Mediation effect CSR*GI 0.1512 (0.000) *** Control Variables LnInD 0.265(0.000) **** LnSize 0.365(0.000) *** LnAge 0.313(0.00) *** 0.70 0.612 0.717 Adj. R2 Obs 310 310 310 Note(s): Table presents the empirical results of sampled firms. CSR represents corporate social responsibility, GI, green innovation, ***, **, * indicate significance at 1%, 5 and 10% level, p-value is provided in the parenthesis Source(s): Table created by the authors Hypothesis Table 5. Hypothesis testing Environmental performance Relationships Estimates P-value Prove H1 CSR→EP 0.374 0.000*** Confirmed H2 CSR→GI 0.349 0.000*** Confirmed H3 GI→EP 0.371 0.000*** Confirmed H4 CSR→GI→EP 0.1512 0.000*** Confirmed Note(s): Table presents the hypothesis for firms. CSR represents corporate social responsibility, GI, green innovation, and EP, environmental performance with ***, **, * indicate significance at 1%, 5 and 10% level Source(s): Table created by the authors leads to improve environmental performance through green innovation at coefficient of 15.12%. Therefore, along with direct effect, green innovation also has indirect effect to improve environmental performance in Ghana. We confirm the findings with (Hussain et al., 2022; Kraus et al., 2020). However, the result is novel in the extant literature from the standpoint of Africa emerging country. For control variables impact on environmental practices, we found competition intensity significant and positive on environmental performance at 1% suggesting that intense industry competition across firms increases environmental performance of firms by 26.5% of the coefficient (see Table 4). Similarly, we find that EP and firm size has positive relationships at 1% significance level suggesting that 36.5% surge in Ghanaian manufacturing leads to improve environmental performance. Finally, results found positive and 1% significant effect of firm age to achieving EP suggesting that, firm age increase will lead to upsurge environmental performance at 31.3% of the coefficient. Long existing firms are having enough resources for green innovation and implementing CSR dimensions including environmental responsibility, and this positively and significantly improve firm environmental performance outcomes. Green innovation 4.1 Additional tests and robustness checks We performed additional tests to ensure robustness of our results. We believed that SMEs have cash flow and short-term debt, whereas larger firms have a proportion and total debt, which could influence their CSR engagements and use of technological innovation for environmental performance. Therefore, we conduct robustness checks by finding regressions for large and small manufacturing firms. 4.1.1 Results for large firms. As evidence in Table 6, there are large effects of CSR on environmental performance by 1% significant level. The coefficient confirms the existence of positive relations amid CSR and environmental performance. Similarly, green innovation is positive and significant on environmental performance of large manufacturing firms in Ghana. The positive coefficient suggests that rise in green innovation activities will improve environmental performance through 38% confirming the results of Kraus et al. (2020). In model 2, the large and positive impact of CSR on green innovation reveals that 1% increase in CSR dimensions leads to 18.57% increase in green innovation. Model 3 support positive and significant mediation role of GI on CSR and environment performance at 1% significance level, suggesting that large manufacturing firms practicing levels of CSR enhance their environmental performance through green innovations at12.6% coefficient. Interestingly, Environmental performance Green Innovation Environmental Performance Model 1 Test/p-value 0.471(0.00) *** 0.380(0.00) *** Model 2 Test/p-value 0.1857(0.000) *** Model 3 Test/p-value CSR GI CSR*GI 0.126(0.000) *** LnInD 0.396(0.000) **** LnSize 0.106(0.000) *** LnAge 0.075(0.000) *** 0.617 0.721 0.751 Adj. R2 Obs 190 190 190 Note(s): Table presents the regression results for large firms. CSR represents corporate social responsibility, GI, green innovation, ***, **, * indicate significance at 1%, 5 and 10% level, p-value is provided in the parenthesis Table 6. Source(s): Table created by the authors Results for large firms JAAR our results support industry competitiveness and firm size positively and significantly related to EP for large manufacturing in Ghana at 1% significant level. This suggests that intense industry competition and the size of firm determines the environmental performance of large manufacturing firms. 4.1.2 Results for small firms. From model 1, CSR exerts positive and significant impact on environmental performance. Firm CSR dimensions increase at 1% leads to an upsurge in small and medium environmental performance by 27.16% of resistance of CSR (see Table 7). Likewise, GI is positive and significant on EP at 1% significance level suggesting that 1% increase in green innovation leads to improve environmental performance of small and medium firms in Ghana by 0.2153%. From model 2, CSR is found to be positive and significant on green innovation at 1% significance level. CSR dimensions increase fallouts to upsurge green products and process innovations at coefficient of CSR resistance (0.263%). Moreover, the results found positive and significant mediation role of green innovation on CSR and environment performance at 1% significance level (see Table 7). This suggests that small and medium firms increasing extents of CSR improves their environmental performance through green innovations at coefficient of 1.1134%. Our results for large firms demonstrated large positive and significant effect of size on environmental performance but found fewer positive and significant on environment performance. Interestingly, age has positive and significant influence on environment performance suggesting that age of SMEs 1% longer existence leads to improve EP at about 0.0218%. Finally, we found positive and significant effect of industry competitiveness on EP of Ghanaian SMEs at 0.0251%. Comparing both results (large-smaller firms), both CSR and green innovation has positive and significant impact on environmental performance. Imperatively, green innovation is positive and significant for both firms, but the significance will last longer for firms. The indirect effect of GI is still positive and significantly related to CSR and environmental performance at 1% significance level signifying that by estimating both firms on the nexus between GI, CSR and environmental performance, the regressions evidence unchanged which confirms that, GI mediates CSR and environmental performance for both large and SMEs manufacturing firms. Therefore, our findings presented above are robust based on the consistent results of study models. 5. Conclusions and policy implications We highlighted and bridged the gap to examine the mediation effects of GI on CSR and environmental performance grounded on Natural RBV theory. We found that both CSR and Table 7. Results for small and medium firms Environmental performance Green Innovation Environmental Performance Model 1 Test/p- value 0.2716(0.000) *** 0.2153(0.000) *** Model 2 Test/p- value 0.2635(0.000) *** Model 3 Test/p-value CSR GI CSR*GI 0.1134(0.000) *** LnInD 0.0251(0.000) **** LnSize 0.0566(0.000) *** LnAge 0.0218(0.00) *** 0.514 0.621 0.641 Adj. R2 Obs 120 120 120 Note(s): Table presents the regression results for large firms. CSR represents corporate social responsibility, GI, green innovation, ***, **, * indicate significance at 1%, 5 and 10% level, p-value is provided in the parenthesis Source(s): Table created by the authors GI have positive and significant effect on environmental performance supporting the NRBV theory. Additionally, we discovered positive and significant effect of CSR on GI, suggesting that green innovation through CSR would demonstrate firms’ legitimacy and support to achieve sustainable advantage leading to improve environmental performance. Finally, we discovered that CSR positively achieving environmental performance through the role of GI. Hence, CSR should be a top priority for managers and owners because of its significant impact on firm environmental performance. Additionally, managers of firms should embrace green innovation to achieve sustainable development and plays essential role in developing green products and services that can enhance environmental performance and sustainability. Excluding few scholarships of theoretical existence within CSR-EP and innovation studies, our paper is the first academic effort based on Natural RBV RBV theory to highlight the role of green innovation on CSR and EP from Africa. Therefore, we conclude that, manufacturing firms use green innovations along with CSR activities to achieve sustainable performance leading to improve environmental performance. Finally, we performed robustness tests by finding regressions for large and small manufacturing firms. Our results were robust consistent with results of the study models. In conclusion, we highlight the significance of GI and CSR in achieving firm EP, which supports the Natural RBV theory. The NRBV theory provides framework for understanding the strategic value of these resources and their potential for improving environmental performance of manufacturing firms. 5.1 Theoretical implications Our results have four main implications to advance theory. First, we contribute to advance the NRBV theory to validate CSR, GI and EP relationship in Africa emerging markets. Second, we tested a model considering the unique qualities of both SMEs and large manufacturing enterprises based on Natural RBV theory as no research has link the theory to CSR and environmental performance with the intervening role of green innovation in Africa, particularly, Ghana. Thirdly, we provide a significant theoretical contribution through adopted measurements scale of CSR, GI, and EP. To summarise, this is the first empirical evidence to estimate the relations in novel single framework of managers from Ghanaian markets. However, their measures have been validated statistically for reliability, convergent and discriminants validity. Hence, academics could apply them for similar studies from other emerging and developed countries. Finally, we propose resource-based view of firm environmental performance (Figure 2) to illustrate the process. Firms take advantage of resources including natural resources, labour, physical and financial capitals, information and technology, social network, and reputation to build competitive advantages. This model recognises the interaction between natural environment and the firm as a way of building competitive advantages apart from the traditional sources. Furthermore, this model identifies six strategic capacities including CSR strategy, green innovation, efficient utilising, organising, and managing resources, and marketing capabilities that firms established to improve environmental performance. Likewise, green innovation enhances environmental performance by reducing CO2 emission, decreasing waste, lowering resource use, preserving water, and using renewable energy. Finally, improved environmental performance will create further competitive advantages by enhance firm image and reputation. 5.2 Policy implications We provide significant practical implications based our findings. First, we confirmed that CSR has positive significant impact on environmental performance, and indirect impact Green innovation JAAR Figure 2. A resource-based view of firm environmental performance Resources Strategic capability Environmental Performance Natural resources Labour Capital Information and technology Network and reputation CRS Strategy Green Innovation Efficient utility Organisation Management Marketing Reduce emission Decrease wastes Lower resource use Preserve water Use renewable energy Source(s): Figure created by authors through green innovation implementations of manufacturing firms. Hence, green innovation and CSR should be developed and executed as an integral part of the firm strategies. Managers should recognise and implement green innovation and CSR to improving environmental performance, which is tedious to achieve without GI and CSR. Second, we encourage managers, owners and policy makers to use our research context of environmental performance to decrease wastes, noise, pollutants, preserve water, and invest in renewable energy to ensure environmental performance. Imperatively, management should look beyond profitability when implementing CSR and green innovation engagements in their operations, as CSR-GI is observed as a mechanism to achieve environmental performance leading to SDGs. Finally, developing countries particularly, Africa, should seek to design sustainable development systems to encourage manufacturing firms to invest in green innovation. Therefore, activities for the implementation of green environmental initiatives should be highlighted; thus, encouraging green product funding is critical to achieving environmental performance. Despite these contributions, we encountered some limitations. First, we used manufacturing firms in Africa emerging markets adopted cross-sectional method. Therefore, further studies could adopt longitudinal approach for better firm conclusion on causal relationships and even compare both developed and emerging markets. Finally, other mediating factors such as green transformational leadership and green financing can be observed on CSR and environmental performance nexus from COVID-19 perspective. Note 1. Environmental performance Index. Accessed at https://epi.yale.edu/epi-results/2022/component/epi References Abbas, J. (2020), “Impact of total quality management on corporate green performance through the mediating role of corporate social responsibility”, Journal of Cleaner Production, Vol. 242, 118458. Adegbile, A., Sarpong, D. and Meissner, D. (2017), “Strategic foresight for innovation management: a review and research agenda”, International Journal of Innovation And Technology Management, Vol. 14, 1750019. Aguilera-Caracuel, J. and Ortiz-De-Mandojana, N. (2013), “Green innovation and financial performance: an institutional approach”, Organization and Environment, Vol. 26, pp. 365-385. Ahmed, M., Guo, Q., Qureshi, M.A., Raza, S.A., Khan, K.A. and Salam, J. (2021), “Do green hr practices enhance green motivation and proactive environmental management maturity in hotel industry?”, International Journal of Hospitality Management, Vol. 94, 102852. Albort-Morant, G., Leal-Millan, A. and Cepeda-Carrion, G. (2016), “The antecedents of green innovation performance: a model of learning and capabilities”, Journal of Business Research, Vol. 69, pp. 4912-4917. Alvarado Herrera, A. (2008), Corporate Social Responsibility Perceived from A Sustainability Perspective, and its Influence on the Reputation of the Company and on the Behavior of the Tourist, Univeristy of Valencia. Atuguba, R. and Dowuona-Hammond, C. (2006), Corporate Social Responsibility in Ghana, A Report to (Fes-Foundation), Ghana. Bandehnezhad, M., Zailani, S. and Fernando, Y. (2012), “An empirical study on the contribution of lean practices to environmental performance of the manufacturing firms in northern region of Malaysia”, International Journal of Value Chain Management, Vol. 6, pp. 144-168. Barauskaite, G. and Streimikiene, D. (2021), “Corporate social responsibility and financial performance of companies: the puzzle of concepts, definitions and assessment methods”, Corporate Social Responsibility And Environmental Management, Vol. 28, pp. 278-287. Blowfield, M. and Frynas, J.G. (2005), “Editorial setting new agendas: critical perspectives on corporate social responsibility in the developing world”, International Affairs, Vol. 81, pp. 499-513. Boiral, O., Ebrahimi, M., Kuyken, K. and Talbot, D. (2019), “Greening remote smes: the case of small regional airports”, Journal of Business Ethics, Vol. 154, pp. 813-827. Broadstock, D.C., Managi, S., Matousek, R. and Tzeremes, N.G. (2019), “Does doing ‘good’ always translate into doing ‘well‘? An eco-efficiency perspective”, Business Strategy And The Environment, Vol. 28, pp. 1199-1217. Carroll, A.B. and Shabana, K.M. (2010), “The business case for corporate social responsibility: a review of concepts, research and practice”, International Journal of Management Reviews, Vol. 12, pp. 85-105. Chang, C.-H. (2011), “The influence of corporate environmental ethics on competitive advantage: the mediation role of green innovation”, Journal of Business Ethics, Vol. 104, pp. 361-370. Chao, A.C. and Hong, L. (2019), “Corporate social responsibility strategy, environment and energy policy”, Structural Change And Economic Dynamics, Vol. 51, pp. 311-317. Chen, W.-R. (2008), “Determinants of firms’ backward-and forward-looking R&D search behavior”, Organization Science, Vol. 19, pp. 609-622. Chin, W.W. (1998), “The partial least squares approach to structural equation modeling”, Modern Methods For Business Research, Vol. 295, pp. 295-336. Chiou, T.-Y., Chan, H.K., Lettice, F. and Chung, S.H. (2011), “The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in taiwan”, Transportation Research Part E: Logistics And Transportation Review, Vol. 47, pp. 822-836. Clement, A. and Tackie, G. (2017), “Corporate social responsibility and performance: a case study of mining companies in Ghana”, Journal of Economics And Sustainable Development, Vol. 8 No. 20, pp. 48-57. Dahlmann, F. and Bullock, G. (2020), “Nexus thinking in business: analysing corporate responses to interconnected global sustainability challenges”, Environmental Science and Policy, Vol. 107, pp. 90-98. Eckstein, D., Goellner, M., Blome, C. and Henke, M. (2015), “The performance impact of supply chain agility and supply chain adaptability: the moderating effect of product complexity”, International Journal of Production Research, Vol. 53, pp. 3028-3046. Green innovation JAAR Edeh, J.N., Obodoechi, D.N. and Ramos-Hidalgo, E. (2020), “Effects of innovation strategies on export performance: new empirical evidence from developing market firms”, Technological Forecasting And Social Change, Vol. 158, 120167. El-Kassar, A.N. and Singh, S.K. (2019), “Green innovation and organizational performance: the influence of big data and the moderating role of management commitment and HR practices”, Technological Forecasting and Social Change, Vol. 144, pp. 483-498. Feng, Y., Akram, R., Hieu, V.M. and Tien, N.H. (2022), “The impact of corporate social responsibility on the sustainable financial performance of Italian firms: mediating role of firm reputation”, Economic Research-Ekonomska Istrazivanja, Vol. 35, pp. 4740-4758. Fernando, Y., Jabbour, C.J.C. and Wah, W.-X. (2019), “Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: does service capability matter?”, Resources, Conservation And Recycling, Vol. 141, pp. 8-20. Ferreira, J.J., Fernandes, C.I. and Ferreira, F.A. (2020), “Technology transfer, climate change mitigation, and environmental patent impact on sustainability and economic growth: a comparison of European countries”, Technological Forecasting And Social Change, Vol. 150, 119770. Fuller, C.M., Simmering, M.J., Atinc, G., Atinc, Y. and Babin, B.J. (2016), “Common methods variance detection in business research”, Journal of Business Research, Vol. 69, pp. 3192-3198. Gaganis, C., Pasiouras, F. and Voulgari, F. (2019), “Culture, business environment and smes’ profitability: evidence from European countries”, Economic Modelling, Vol. 78, pp. 275-292. Galbreath, J. and Shum, P. (2012), “Do customer satisfaction and reputation mediate the csr–fp link? Evidence from Australia”, Australian Journal of Management, Vol. 37, pp. 211-229. Groening, C., Sarkis, J. and Zhu, Q. (2018), “Green marketing consumer-level theory review: a compendium of applied theories and further research directions”, Journal of Cleaner Production, Vol. 172, pp. 1848-1866. Gunasekaran, A. and Spalanzani, A. (2012), “Sustainability of manufacturing and services: investigations for research and applications”, International Journal of Production Economics, Vol. 140, pp. 35-47. Han, H., Yu, J. and Kim, W. (2019), “Environmental corporate social responsibility and the strategy to boost the airline’s image and customer loyalty intentions”, Journal of Travel and Tourism Marketing, Vol. 36, pp. 371-383. Handayani, R., Wahyudi, S. and Suharnomo, S. (2017), “The effects of corporate social responsibility on manufacturing industry performance: the mediating role of social collaboration and green innovation”, Business: Theory And Practice, Vol. 18, pp. 152-159. Hao, J. and He, F. (2022), “Corporate social responsibility (csr) performance and green innovation: evidence from China”, Finance Research Letters, Vol. 48, 102889. Hart, S.L. (1995), “A natural-resource-based view of the firm”, Academy of Management Review, Vol. 20, pp. 986-1014. Hart, S.L. and Dowell, G. (2011), “Invited editorial: a natural-resource-based view of the firm: fifteen years after”, Journal of Management, Vol. 37, pp. 1464-1479. Hernandez, J.P.S.-I., Ya~ nez-Araque, B. and Moreno-Garcıa, J. (2020), “Moderating effect of firm size on the influence of corporate social responsibility in the economic performance of micro-, small-and medium-sized enterprises”, Technological Forecasting And Social Change, Vol. 151, 119774. Huang, X.B. and Watson, L. (2015), “Corporate social responsibility research in accounting”, Journal of Accounting Literature, Vol. 34, pp. 1-16. Hussain, Y., Abbass, K., Usman, M., Rehan, M. and Asif, M. (2022), “Exploring the mediating role of environmental strategy, green innovations, and transformational leadership: the impact of corporate social responsibility on environmental performance”, Environmental Science And Pollution Research, Vol. 29 No. 51, pp. 76864-76880. Kraus, S., Burtscher, J., Niemand, T., Roig-Tierno, N. and Syrj€a, P. (2017), “Configurational paths to social performance in smes: the interplay of innovation, sustainability, resources and achievement motivation”, Sustainability, Vol. 9, p. 1828. Kraus, S., Rehman, S.U. and Garcıa, F.J.S. (2020), “Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation”, Technological Forecasting And Social Change, Vol. 160, 120262. Laosirihongthong, T., Adebanjo, D. and Choon Tan, K. (2013), “Green supply chain management practices and performance”, Industrial Management and Data Systems, Vol. 113 No. 8, pp. 1088-1109. Li, H., Hameed, J., Khuhro, R.A., Albasher, G., Alqahtani, W., Sadiq, M.W. and Wu, T. (2021), “The impact of the economic corridor on economic stability: a double mediating role of environmental sustainability and sustainable development under the exceptional circumstances of COVID-19”, Frontiers in Psychology, Vol. 11, 634375. Li, Z., Deng, X. and Peng, L. (2020), “Uncovering trajectories and impact factors of Co2 emissions: a sectoral and spatially disaggregated revisit in beijing”, Technological Forecasting and Social Change, Vol. 158, 120124. Lin, Y.-E., Li, Y.-W., Cheng, T.Y. and Lam, K. (2021), “Corporate social responsibility and investment efficiency: does business strategy matter?”, International Review of Financial Analysis, Vol. 73, 101585. Long, W., Li, S., Wu, H. and Song, X. (2020), “Corporate social responsibility and financial performance: the roles of government intervention and market competition”, Corporate Social Responsibility And Environmental Management, Vol. 27, pp. 525-541. Maqbool, S. and Zameer, M.N. (2018), “Corporate social responsibility and financial performance: an empirical analysis of Indian banks”, Future Business Journal, Vol. 4, pp. 84-93. Mcwilliams, A. and Siegel, D. (2000), “Corporate social responsibility and financial performance: correlation or misspecification?”, Strategic Management Journal, Vol. 21, pp. 603-609. Novitasari, M. and Tarigan, Z.J.H. (2022), “The role of green innovation in the effect of corporate social responsibility on firm performance”, Economies, Vol. 10, p. 117. Orazalin, N. (2020), “Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy”, Business Strategy And The Environment, Vol. 29, pp. 140-153. Orazalin, N. and Baydauletov, M. (2020), “Corporate social responsibility strategy and corporate environmental and social performance: the moderating role of board gender diversity”, Corporate Social Responsibility And Environmental Management, Vol. 27, pp. 1664-1676. Podsakoff, P.M., Mackenzie, S.B., Lee, J.-Y. and Podsakoff, N.P. (2003), “Common method biases in behavioral research: a critical review of the literature and recommended remedies”, Journal of Applied Psychology, Vol. 88, p. 879. Qiu, L., Hu, D. and Wang, Y. (2020), “How do firms achieve sustainability through green innovation under external pressures of environmental regulation and market turbulence?”, Business Strategy And The Environment, Vol. 29, pp. 2695-2714. Rankin, N., S€oderbom, M. and Teal, F. (2002), The Ghanaian Manufacturing Enterprise Survey, Centre for the Study of African Economies (CSAE), University of Oxford. Raykov, T. (2012), “Scale construction and development using structural equation modeling”, in Hoyle, R.H. (Ed.), Handbook of Structural Equation Modeling, pp. 472–492, The Guilford Press. Rehfeld, K.-M., Rennings, K. and Ziegler, A. (2007), “Integrated product policy and environmental product innovations: an empirical analysis”, Ecological Economics, Vol. 61, pp. 91-100. Rehman, A., Ullah, I., Afridi, F.-E.-A., Ullah, Z., Zeeshan, M., Hussain, A. and Rahman, H.U. (2021a), “Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modelling”, Environment, Development and Sustainability, Vol. 23, pp. 13200-13220. Green innovation JAAR Rehman, S.U., Kraus, S., Shah, S.A., Khanin, D. and Mahto, R.V. (2021b), “Analyzing the relationship between green innovation and environmental performance in large manufacturing firms”, Technological Forecasting and Social Change, Vol. 163, 120481. Rehman, S.U., Bresciani, S., Yahiaoui, D. and Giacosa, E. (2022), “Environmental sustainability orientation and corporate social responsibility influence on environmental performance of small and medium enterprises: the mediating effect of green capability”, Corporate Social Responsibility and Environmental Management, Vol. 29 No. 6, pp. 1954-1967. Rivera, J. and Clement, V. (2019), “Business adaptation to climate change: american ski resorts and warmer temperatures”, Business Strategy and The Environment, Vol. 28, pp. 1285-1301. Seman, N.A.A., Govindan, K., Mardani, A., Zakuan, N., Saman, M.Z.M., Hooker, R.E. and Ozkul, S. (2019), “The mediating effect of green innovation on the relationship between green supply chain management and environmental performance”, Journal of Cleaner Production, Vol. 229, pp. 115-127. Shabbir, M.S. and Wisdom, O. (2020), “The relationship between corporate social responsibility, environmental investments and financial performance: evidence from manufacturing companies”, Environmental Science and Pollution Research, Vol. 27, pp. 39946-39957. Shahzad, M., Qu, Y., Javed, S.A., Zafar, A.U. and Rehman, S.U. (2020), “Relation of environment sustainability to csr and green innovation: a case of Pakistani manufacturing industry”, Journal of Cleaner Production, Vol. 253, 119938. Shu, C., Zhou, K.Z., Xiao, Y. and Gao, S. (2016), “How green management influences product innovation in China: the role of institutional benefits”, Journal of Business Ethics, Vol. 133, pp. 471-485. Singh, S.K., Del Giudice, M., Chierici, R. and Graziano, D. (2020), “Green innovation and environmental performance: the role of green transformational leadership and green human resource management”, Technological Forecasting And Social Change, Vol. 150, 119762. Surroca, J., Tribo, J.A. and Waddock, S. (2010), “Corporate responsibility and financial performance: the role of intangible resources”, Strategic Management Journal, Vol. 31, pp. 463-490. Tang, Y., Mack, D.Z. and Chen, G. (2018), “The differential effects of ceo narcissism and hubris on corporate social responsibility”, Strategic Management Journal, Vol. 39, pp. 1370-1387. Tilaye, S. (2019), “The current practice of corporate social responsibility in Ethiopia”, International Journal of Social Work, Vol. 6, p. 45. Tsou, H.-T. and Hsu, S.H.-Y. (2015), “Performance effects of technology–organization–environment openness, service Co-production, and digital-resource readiness: the case of the it industry”, International Journal of Information Management, Vol. 35, pp. 1-14. Vardhan, K.H., Kumar, P.S. and Panda, R.C. (2019), “A review on heavy metal pollution, toxicity and remedial measures: current trends and future perspectives”, Journal of Molecular Liquids, Vol. 290, 111197. Wang, M., Li, Y., Li, J. and Wang, Z. (2021), “Green process innovation, green product innovation and its economic performance improvement paths: a survey and structural model”, Journal of Environmental Management, Vol. 297, 113282. Weng, H.-H., Chen, J.-S. and Chen, P.-C. (2015), “Effects of green innovation on environmental and corporate performance: a stakeholder perspective”, Sustainability, Vol. 7, pp. 4997-5026. Wicki, S. and Hansen, E.G. (2019), “Green technology innovation: anatomy of exploration processes from A learning perspective”, Business Strategy and The Environment, Vol. 28, pp. 970-988. Wong, S.K.S. (2013), “Environmental requirements, knowledge sharing and green innovation: empirical evidence from the electronics industry in China”, Business Strategy and The Environment, Vol. 22, pp. 321-338. Yang, J., Guo, H., Liu, B., Shi, R., Zhang, B. and Ye, W. (2018), “Environmental regulation and the pollution haven hypothesis: do environmental regulation measures matter?”, Journal of Cleaner Production, Vol. 202, pp. 993-1000. Zhang, Y., Song, Y. and Zou, H. (2020), “Transformation of pollution control and green development: evidence from China’s chemical industry”, Journal of Environmental Management, Vol. 275, 111246. Zhou, Y., Shu, C., Jiang, W. and Gao, S. (2019), “Green management, firm innovations, and environmental turbulence”, Business Strategy and The Environment, Vol. 28, pp. 567-581. Zhou, S., Tiruneh, W.A. and Legese, M.A. (2023), “The effect of corporate social responsibility on environmental performance: the mediating role of green innovation and green human resource management”, International Journal of Emerging Markets, Vol. ahead-of-print No. ahead-ofprint, doi: 10.1108/IJOEM-02-2022-0211. Corresponding author Mandella Osei-Assibey Bonsu can be contacted at: m.osei-assibeybonsu@tees.ac.uk For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com Green innovation