Corporate Finance Project Report: Working Capital & Firm Performance

advertisement

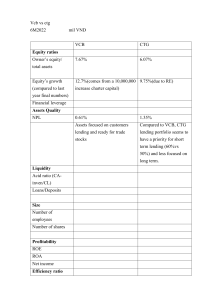

1 “Final Project Report” Topic : Group Members : Haiqa Malik (2019-BBA-027) Javeria Asif (2019-BBA-033) Muqadas Qayyum (2019-BBA-054) Dua E Zahra (2019-BBA-) Subject : Corporate Finance Department : Business Administration Semester : Date of Submission : VIII 21/06/2023 2 Abstract This study aims to investigate the impact of working capital policy on firm performance in the context of the cement industry in Pakistan, moderated by firm size and controlled for liquidity and sales growth. We collected the required data of a total of 20 Pakistani cement firms for running multiple software tests which helped us identify the framework relationship. The regression analysis suggests that the selected independent variables have a significant impact on the firm performance as measured by ROA and ROE. The findings of this study will offer insight to organizations regarding the importance of designing and implementing effective working policies that would impact their financial performance in the long run, ultimately leading to success and growth. Based on our findings it is recommend that firms should develop industry specificguidelines to determine the best way to manage their working capital. 3 Table of Contents 1. Chapter 1. Introduction ....................................................................................................4 1.1 1.2 1.3 1.4 Background of study ………………………………………………………………..4 Problem Statement …………………………………………………………...……..5 Objectives of study ………………………………………………...……………….5 Significance Of study ……………………………………….……………………...5 2. Chapter 2. Literature Review ………………………………………………..…………6 3. Chapter 3. Methodology ..................................................................................................7 3.1 3.2 3.3 3.4 3.5 3.6 3.7 Research Design …………………………………………………………………….9 Sample Size …………………………………………………………………………9 Research Instrument …………………………………………………………….….9 Software Used ……………………………………………………………………...9 Theoretical Framework …………………………………………………………….9 Hypothesis………………………………………………………………………….10 Variable Measurement ……………………………………………………………10 4. Chapter 4. Results ……………………………………………………………………10 5. Chapter 5. Conclusion ……………………………………………………………....11 6. Chapter 6. Future Implications …………………………………………………….12 7. Chapter 7. Limitations ………………………………………………………………13 8. References 4 Chapter No.1: Introduction Efficient management of an organization’s resources is essential for the success of any organizations. In today’s business world, organizations face an immense amount of pressure regarding WCM. Working capital means “the investment used to meet the firm’s day to day operations”. The way in which organizations design and implement their policies for working capital has a major impact on the firm’s profit and liquidity. Effective and efficient WCM deals with the management of CA and CL of a firm in a way that would help them to eliminate the risk of any sort of incapacity to meet short term liabilities along with avoiding excessive investment. WCP consists of two parts, first one is WCI policy which focuses more investment on the level of CA and second is WC. Financial Policy which involves financing of firms assets through short term liabilities. A firm should create balance between its profitability and its day to day operations, while insufficient amount of WC lessen a firm’s liquidity and holding of excess WC results in the depletion of profitability of a firm (Ghosh & Maji, 2003). Size is observed as a major determinant of firm’s performance, this has even been explained theoretically by the economies of scale. There are a few studies on this, in one study it was found that there is a negative relationship between firm size and firm FP (Kouser et al. 2012). Baumol (1959) also coincide that large firm size can lead to inefficiencies and lower profits. With WC being one of the most crucial functions of corporate management, in this research we have also linked the concept to liquidity and sales growth, having them act as controlling variables. (Smith, 1980) The management of these short term assets and liabilities demands careful allegiance as Management of WC plays a important role in the calculation of a firm’s profitability, liquidity , risk and also helps in achievement of goal of avalue. As well as the objective of achieving value. (Jeng-Ren et al. 2006) .Due to influence on firm’s profitability and liquidity WCM is considered important for corporate finance, proper management can lead to success whereas poor management can lead to bankruptcy (Padachi et al.2008). Background of Study: There have been various studies conducted to find and know about relationship between WCM and profitability ratio of firm. (Filbeck and Krueger, 2005) conducted a study to find the significance of the management of WC. Liquidity and profitability being a major competent in WCM was studied by Kargar and Blumenthal in 1994. The cement industry as a significant segment of the industrial sector plays a important role in the economic development of Pakistan.There are a total of 20 other industries that are interconnected with cement and construction sector. The cement sector is vibrant and is growing, having the production capacity of 20 million tons, and about 11 million tons cement exported from Pakistan which contributes to the economy. Pakistan is ranked 5th in cement exports. In this research we 5 collected the required data of a total of 20 Pakistani cement firms for running multiple software tests which would help us identify the framework relationship. Problem Statement: Despite WC policy playing a significant role in shaping the firm’s performance, there has been limited research conducted on this relationship being moderated by the moderator if firm size. “Does WCM Policy being moderated by firm size, affect the profitability of the cement industry in Pakistan?” Objectives of study: Main objectives of our study are following: To identify the impact of WC policy on firm FP , in the cement sector of Pakistan. To see identify the effect of WCM on firm performance of cement sector with the moderating role of firm size. To see the controlling impact of liquidity and sales growth on the WC policy and firm performance, in the cement industry of Pakistan. Significance of Study: In this research, we investigate the impact of WC policy on a firm’s financial performance, moderated by firm size in a Pakistani context. Previous studies have either showed a positive or negative relationship between the independent and dependent variable, the moderating effect of firm size has not been well understood. For this purpose, this study will provide empirical evidence on this relationship along with filling the gap of how firm size can act as a moderator between WCM and firm performance. From a practical standpoint, the findings and results of this study will offer insights for organizations regarding the importance of designing and implementing effective working policies which would positively impact the financial performance. 6 Chapter No. 2: Literature Review Underlying Theory; The Underlying theory of our research is ‘WCM Theory”. The theory aims is efficient use of by monitoring and optimizing the use of its Current Assets and Current Liabilities. The Second Theory which we considered in our Research is “A Resource base view of a firm” which means anything which could be consideration of a strength or weakness of a given time. Resource at a given time could be defined as these assets which are semi permanently to the firm (e.g. brand name, in house knowledge of technology, employment of skilled personnel, trade contract, capital, machinery, and efficient product). Working Capital Policy (WCP): Firm’s WC Policy means their level of investment in their current assets to achieve their goals.A lot of Research Specialists have studied the working Capital policy has been studied by a lot of research specialists who have given different views. For instance, in a study Aktas et al., (2015); Deloof, (2005); Yazdanfar & Ohman (2014). It is said that proper WCM has a major effect on the financial performance of a firm. WC is internal fund resource which is used to meets the firm’s current liabilities as it provides liquidity to firms. Another study (Panda & Nanda, 2018) has shown that if a firm were to hold more working capital then it could cause a high cost of liquidity and vice versa. The appropriate management of working capital is essential to ensure that a firm maintains adequate liquidity while maximizing profitability (Huang, Lu, & Zhang, 2019). Hill and Hsin (2013) stated the importance of a company’s working capital being in line with the industry and growth rates of the company, where an aggressive working capital management policy positively impacts profitability. Duc et al. (2019) found that efficient management of inventory and accounts receivable increases profitability and lower financial risk, Singh and Kumar (2017) on the other hand argue that effective WCM can improve the profitability and liquidity ratio of a firm. (Lazaridis & Tryfonidis, 2006) investigated the WCM effect on the profitability ratio of Greek firms.This study shows that there is a negative effect of aggressive WC policy on firm’s profitability. Financial Performance: A study by (Morara & Sibindi, 2021) states that an appropriate use of a firm’s assets along with keeping a firm’s rivals and completion in mind is what shows how well the firm is performing. (Kaushik & Chauhan, 2019) conducted a study to examine the WC policy relationship with firm 7 financial performance for which they selected 211 firms in India and firm’s data from 2008 to 2016 was taken for study. (Mabandla, 2018) documented a solid association between firm financial performance and aggressive WCP., a study by Pestonji and Wichitsathian (2019) found highly significant relationship of Working Capital Investment Policy on Firm Financial Performance. A study by (Benrquia and Jabbouri, 2021), shows that the monitoring of WC is crucial to assure the abundant liquidity level and to ensure accurate daily operations while also enhancing the performance and value of the firm. Akoto et al. (2013) also studied this by collecting data of different Ghanaian companies, and the results proved that WCM positively effects firm’s financial performance. Rehman et al. (2010)’s analysis of 204 Pakistani manufacturing firms revealed the net sales, conversion cycle of cash and the firm’s inventory turnover having a notable impact on performance of the firm. Firm Size: “Size-Performance” theory (Demsetz & Lehn, 1985) suggests that there is a positive relationship between the firm size and its FP , with larger firms tending to generate more revenue, profit and higher market value compared to smaller firms .A study by Vakilifard and Taslimi (2021) found that larger firms tend to have better FP than smaller ones due to the economies of scale they enjoy. Similarly, Karabag and Kilincarsan (2021) discovered that larger firms have a higher ROA and equity as compared to small firms. However, the “Resource-Based” theory (Barney, 1991) offers a different perspective and argues that the effect of firm size on profitability is not always positive because profitability also depends on resources firm have. A study by Ljubownikow and Servali (2020) suggests that larger firms tend to have lower return on assets than smaller ones because of their difficulty in adapting to changing market conditions. There are some scholars who have found that there is no impact of firm size on firm financial performance. For instance, Study by Arora and Sharma (2019) revealed that in different sector industries there is no consistent link of firm size on firm financial performance. Relationship of WCM and FP: Many studies have proved that WCM and FP have positive relationship with each other.Several studies have shown that companies which uses efficient WCM have better FP.For instance, Deloof (2003) found that Belgian firms with efficient WCM had higher profitability than their peers. Similarly, Lazaridis and Tryfonidis (2014) through his study proved that there is positive impact of effective WCM on FP of firm of Greek companies. Kim and Sorensen (1986) highlighted the negative impact of excessive WC on profitability in a sample of small Korean firms. Similarly, Eljelly (2004) found that WCM have a negative relationship with firm FP in Saudi Arabia firms. Overall, these studies indicate that WCM plays a crucial role in determining the FP of companies. Therefore, companies should focus on efficient management of their WC to enhance their profitability and financial stability. 8 Liquidity relationship with Firm Financial Performance: Scholars have different views on the liquidity effect on firm financial performance. For example, Dichev and Piotroski (2001) found a positive impact of liquidity on firm financial performance in US companies. Whereas, some scholars argue that high liquidity might not necessarily lead to better financial performance. For instance, Abor (2005) found no significant relationship between liquidity and profitability for firms in Ghana. Moreover, some scholars suggest that the relationship between liquidity and FP might be nonlinear or context-dependent. For example, Ng and Smith (2019) found that low liquidity was associated with lower FP in the short-term, while high liquidity had a negative impact in the long-term for Australian firms. Overall, liquidity effect on FP is not straightforward and can vary depending on various factors, such as the industry, firm size, and economic conditions. Sales Growth and Financial Performance: Many Scholars have studied the relationship of sales growth with Financial Performance of Firm. Some researchers suggest that high sales growth leads to higher profitability and shareholder wealth. For example, Li and Faff (2011) found that sales growth positively affect firm financial performance. However, other studies suggest that high sales growth can lead to lower profitability due to increased costs associated with growth. For instance, Scherreiks and Steensma (2018) found that there is a negative relationship between sales growth and profitability for Dutch retail firms. Moreover, some scholars suggest that the relationship between sales growth and FP is not linear and can vary depending on the industry and firm size. For example, Kavalec and Charoenwong (2018) found a curvilinear relationship of sales growth on profitability for firms in the healthcare industry in Thailand. There are also studies that suggest no significant relationship between sales growth and financial performance. For instance, Kim and Heo (2018) found no positive effect of sales growth on firm performance for Korean firms. 9 Chapter No 3: RESERCH METHODOLOGY: Research Design: Our research was based on longitudinal data as all the data information was publically available and is categorized as time series data of five years (2018 to 2022). The data was extracted from the annual financial reports of the companies which we have selected and the ratios are calculated in order to gain comparability among the companies. We have taken the data of the companies of cement industry of Pakistan. The study is conduct in order to draw a conclusion of relationship between Working Capital Policy (Independent Variable) and firm profitability (Dependent Variable). Sample Size: We have taken total 20 cross section companies from the cement industry of Pakistan to collect data and the total number of observations are 100. Research Instrument: The instrument that we have used to collect data for our research is the annual report of the companies. . The annual financial reports contains all the data which we needed for the calculation of the ratios which we needed in our study. Software Used: The software used in our research is first of all Microsoft Excel. We have entered all the data extracted from annual financial reports into Microsoft excel and we have calculated ratios needed. Secondly we used E-view to get the results of our plan Analysis. Theoretical Framework: 10 Hypothesis: H1: There is positive relationship between IV and DV. H2: Moderating Variable moderates the relationship of IV with DV. VARIABLE MEASURMENT: Working Capital Policy Decision: The Independent Variable in our study consist of IP and FP. In the Article “Impact of WCP on Firm’s Profitability: A Case of Pakistan Cement Industry” the measures of WCP is IP and FP. Independent Variable: Variable Measures Abbreviation Investment Policy Total Current Assets/Total IP Assets Financing Policy Total Current Liabilities/Total FP Assets Financial Performance of Firm: In Article “Impact of Financing decisions ratios on firm accounting-based performance: evidence from Jordan listed companies” following measures are used to measure the Independent Variable. Dependent Variable: Variable Measures Source Return on Assets (ROA) Net profit / Total assets Aphagia and Gavoury (2011) Return on Equity (ROE) Net Income / Average Total Odusanya et al. (2018) Equity Net Operating Profit (Earnings before Interest and Nill Tax + Depreciation) / Total Assets Firm Size: We have taken a firm size as a moderator in our study to check the impact of firm size on the working capital policy and firm performance. 11 Moderating Variables: Variable Measures Source Firm Size Natural logarithm of turnover Ghayas and Akhter (2018) Liquidity and Sales Growth: In the line with previous studies, in addition to our IV, Liquidity and Sales Growth are included as control variables in our study to control a set of firm specific observable characteristics that are likely to be correlated with firm performance. Controlling Variables: Variables Liquidity Sales Growth Measure Source Current Ratio = Current Liabilities Current Great Lakes Herald Assets (2010) Natural Log Sales of current year / Sales of Previous Year 12 Chapter No. 4: Results SUMMARY STATISIC: Table 4.1: Descriptive Statistics: Variables N Mean Std. Dev. Min Max FP 100 0.478900 0.813409 0.010000 6.420000 FS 100 6.931400 0.659260 5.390000 8.520000 IP 100 0.348400 0.262385 0.070000 1.070000 LIQ 100 2.158700 4.757987 0.160000 30.81000 NOP 100 0.112000 0.170217 -0.55 1.020000 ROA 100 2.216200 4.693427 -15.56 13.70000 ROE 100 3.700400 8.301506 -37.48 20.42000 N=No. of Observations Std. Dev. = Standard Deviation, Min= Minimum, Max= Maximum Sources= the data is collected from the annual statements of the companies. The abbreviations used for FP: Financing Policy, FS: Firm Size, IP: Investment Policy, LIQ: Liquidity, NOP: Net Operating Profit, ROA: Return on Assets, ROE: Return on Equity. Table 4.1 of this report is depicting the results of descriptive statistics for Mean, SD, min and max values of the table. The Financing Policy the companies we have taken ranges from 0.010 to 6.420 with a mean of 0.478900 and a standard deviation of 0.813409 which shows Table 4.2: Correlation Analysis: Variables FP FS IP LQ NOP ROA ROE FP 1.000000 FS -0.107664 1.000000 IP -0.171037 -0.195438 1.000000 LQ -0.159122 -0.434643 0.514003 1.000000 NOP -0.118404 0.293084 -0.029894 -0.113599 1.000000 ROA -0.169387 0.327785 -0.057108 -0.038156 0.218443 1.000000 ROE -0.156542 0.368117 -0.077106 -0.047785 0.192739 0.960605 1.000000 SG 0.499686 0.046269 -0.233463 -0.007781 -0.185007 0.040090 0.049253 SG Table 4.2 shows a correlation analysis of all the variables. When the value of correlation is 1, it exhibits a very perfect strong and positive correlation on the other hand, if the correlation is -1, 1.000000 13 shows a perfect negative correlation. However, the 0 correlation indicates there is no relationship exist between the variables. In the case of FP (Independent Variable) , it has a perfect correlation with itself, It has a positive correlation with SG indicating that increase in Sales Growth will have positive impacts on its Working Capital Policy. FS, IP, LQ, NOP, ROA AND ROE are negatively correlated with FS. There is a negative Correlation between FS (Moderator) and FP, IP and LQ depicts that increase in firms Sizes will have negative impact on its Liquidity and Investing Policy. NOP, ROA,ROE AND SG are positively correlated with FS. IP (Independent Variable) is positively and significantly correlated with liquidity of firm, which indicates that increase in Liquidity will have positive impact on investing policy of firm. Whereas NOP,ROA,ROE and SG have negative correlation with IP. LQ is negatively correlated with all the variables except IP. NOP is positively correlated with FS, ROA and ROE indicates that increase in NOP will have positive impact on Firm Performance. NOP is negatively correlated with rest of the variables. ROA is positively correlated with FS, NOP, ROE and SG shows that Increase in ROA will leads firms towards the better Financial Performance. The variable is negatively correlated with FS, IP and LQ. ROE is negatively correlated with FP, IP and LQ shows that Working Capital policy and Liquidity policy of the firm with negatively impacts the Firms performance. Rest of the variables are positively correlated SG is negatively Correlated with IP, LQ and HAUSMAN TEST SPECIFICATION: The results of the Housman test depict that the regression estimates derived from fixed effects models are more appropriate for the analysis because they are more consistent and efficient. The test failed to meet the assumption of the random effect model in which prob > 0.05. REGRESSION ANALYSIS: Dependent Variable: ROA Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Panel Regression Analysis (ROA) 14 Coefficient Standard Prob. (B) Error 0.428612 4.232665 0.9197 C 0.160086 10.4813 0.9879 IP 1.215296 3.704917 0.7441 FP 0.06129 0.146266 0.6768 LQ 3.1809 0.939332 0.0013 SG -0.011083 0.126631 0.9306 ROA (-1) 0.533016 R-squared Adjusted R-squared 0.329241 Durbin-Watson stat 2.783046 2.61571 F-static 0.001662 prob. (F-statics) In our Paper regression Analysis is used to measure the firm performance during the period 2018 to 2023, to measure the firm performance we have used ROA,ROE and NOP as dependent variable, IP, FP, LQ and SG of the firms as Independent and Controlling Variables Respectively. Variables In the evaluation of Table 4.3, where the results of regression analysis regarding the impact of IV on DV are demonstrated. R-Square also known as the coefficient of determination shows that how much change and variation in dependent variable is caused by independent variables. The value of R-square 0.533016, which indicates that the independent variable are responsible for 53.30% variation in the dependent variable which is ROA. It also means that the variables we have taken to find out the relationship are highly effected and the remaining 46.70% constitute those variables or factors that we have not taken. The value of R-square is strong and Fit in our model. The adjusted R-square is a modified version of R-square which tells whether adding or removing additional Variables improves a regression modal or not. The value of Adjusted R-square in the table is 0.329241 in the table. In order to find the autocorrelation in the regression analysis Durbin Watson’s value was computed. The value of Durbin Watson Stat is 2.783046 which is greater than 2 which shows that there exist no autocorrelation but a negative correlation between ROA and independent variables. The F test explains of the relationship between a dependent variable and all independent variables. The F-statistics is used to test the significance of R, from the results of our table F-statics is 2.61571which is insignificant. The overall significance of the table can be interpreted by the value of the Probability of F-statics. If the probability value of F-static is less than 0.05 the model will be significant. The p-value of F-statics is 0.001662 in our modal which is less than 0.05 which shows that p-value of the F-static is significant. 15 Dependent Variable: ROE Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Panel Regression Analysis (ROA) Variables Coefficient (B) Standard Error Prob PC 2.539385 7.986575 0.7517 IP -6.435287 19.82258 0.7467 FP 3.56572 7.040917 0.6146 LQ 0.089101 0.278388 0.7501 SG 6.263719 1.785066 0.0009 ROE (-1) -0.069435 0.150712 0.6468 0.518957 R-squared Adjusted R0.309047 squared Durbin-Watson 2.495777 stat 2.472282 F-static 0.002873 prob. (F-statics) Table 4.3 depicts the results of the regression analysis of Dependent Variable ROE (Return of Equity) along with independent Variables. The Value of R-Square in the table is 0.518957, which shows that the independent variables of the study are responsible for 51.89% of variation out of 100% in the dependent Variable which is ROE. Which means that remaining 48.11% consist of those Independent variables which are not taken in study. The value of Adjusted R-square is 0.309047 which is 30.90 in the table which is less than R-square. The value of Durbin-Watson test is 2,495777 which is greater than 2 which shows that there is a negative correlation exist. The value of Prob of F-statistic in a table is 0.002873 which seems to be less than 0.5 so it is significant. Dependent Variable: NOP Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Panel Regression Analysis (NOP) 16 Variables C IP FP LQ SG NOP (-1) R-squared Adjusted R-squared Durbin-Watson stat F-static prob. (F-statics) Coefficient (B) 0.345118 0.10228 -0.50011 0.000649 0.043681 -0.518823 0.692832 0.558795 2.134259 5.16897 0 Standard Error 0.119894 0.297884 0.109066 0.004256 0.028523 0.075782 Prob. 0.0057 0.7326 0 0.8794 0.1314 0 Table 4.3 shows the results of the Panel Regression Analysis of Dependent Variable which is NOP along with other independent and controlling Variables. As, we can see in the table that the value of R-square is 0.692832 which shows that independent variables are responsible for 69.28% variation in dependent variable which is NOP(Net operating Profit). The remaining 31.72% consist of those independent variables which are not taken in studies. The value of Adjusted R squared is 0.558795 which is 55.87%. The value of DurbinWatson test is 2.134259 which is greater than 2, which indicates that the negative correlation exist. The value of Prob. (F-statics) is 0 which is less than 0.05 that mean it is significant. Dependent Variable: ROA Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Moderated Regression Results: Variables C IP FP LQ SG ROA(-1) FS FS*IP Coefficient (B) -79.41603 -39.10687 25.97508 14.43834 -0.342103 -0.514643 11.40126 9.631354 Standard 36.45361 92.98596 20.50544 4.206163 1.563792 0.160532 5.160371 13.20331 prob. 0.0341 0.6759 0.2111 0.0012 0.8277 0.0023 0.0318 0.4691 17 FS*FP FS*LQ FS*SG R-squared Adjusted R-squared Durbin-Watson stat F-statistic Prob (F-statistic) -4.69222 -2.524711 0.128034 0.605739 0.377068 2.497448 2.648952 0.00121 2.982539 0.722025 0.252767 0.122 0.001 0.6147 From the table 4.3, reveals that there is a positive relationship between IP and ROA when multiplied by the moderator FS (Firm Size). The coefficients of FP and LQ showed a negative relationship with Depended variable ROA when multiplied by moderator FS, while SG shows a positive relationship with ROA by multiplied by the moderator FS. The value of R square in the table is 0.605739 which reveals that independent variables are responsible for 60.57% variation in the Dependent Variable ROA and 39.34% other factors are responsible which are not taken. The value of the Adjusted R-square is 0.377068 which is 37.70%. The value of the Durbin-Watson stat is 2.497448 which Dependent Variable: NOP Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Moderated Regression Results: Variables C IP FP LQ SG NOP(-1) FS FS*IP FS*FP FS*LQ FS*SG R-squared Coefficient Standard prob. (B) -0.514197 0.945907 0.5891 -1.343166 2.444479 0.5851 -0.290954 0.539387 0.592 0.048683 0.111806 0.6651 0.0355 0.041849 0.4003 -0.561539 0.07612 0 0.129812 0.133394 0.3352 0.198334 0.346365 0.5695 -0.037497 0.07924 0.6381 -0.006424 0.019191 0.7392 -0.006018 0.006764 0.3778 0.73397 18 Adjusted R-squared Durbin-Watson stat F-statistic Prob (F-statistic) 0.579673 2.106194 4.756858 0.000001 The above table shows that the interaction of moderator firm size and IP has a positive impact on the dependent variable NOP, which clearly shows that an increase in firm size and the resultant increase in IP leads to an increase in NOP and vice versa which shows a direct relationship among them. However the relationship between is non-significant (0.5695 is greater than 0.05). The interaction between FS into FP is negative (-0.0374), this shows an inverse and negative impact on the dependent variable NOP. This means than an increase of one unit in FS and FP that would lead to a decrease in one unit of NOP. The relationship is non-significant because the probability is 0.6381 which is greater than 0.05 The interaction between FS into LQ is negative (-0.0064), this shows an inverse and negative impact on the dependent variable NOP. This means than an increase of one unit in FS and LQ that would lead to a decrease in one unit of NOP. The relationship is non-significant because the probability is 0.7392 which is greater than 0.05 The interaction between FS into SG is negative (-0.0060), this shows an inverse and negative impact on the dependent variable NOP. This means than an increase of one unit in FS and SG that would lead to a decrease in one unit of NOP. The relationship is non-significant because the probability is 0.3778 which is greater than 0.05 The value of R square which is 73% shows that all the interacting variables cause a 73% variation on the dependent variable. The adjusted r square value shows it all the interacting variables cause a 57% variation on the dependent. The durbin Watson value which is 2.10 (less than 2.5), this shows that auto correlation does not exist. The coefficient value of IP is -1.343, one unit increase in IP would lead a 1.3 unit decrease in NOP. The coefficient value of IP is -0.290, one unit increase in FP would lead a 0.29 unit decrease in NOP. The coefficient value of IP is 0.048, one unit increase in LQ would lead a 0.048 unit increase in NOP. The coefficient value of IP is 0.0355, one unit increase in SG would lead a 0.0355 unit increase in NOP. The probability value is 0.000001, which is less than 0.05, this shows a significant relation. 19 Dependent Variable: NOP Cross Sections Included: 20 Total Panel (balanced) Observations: 80 Table 4.3: Moderated Regression Results: Variables C IP FP LQ SG ROA(-1) FS FS*IP FS*FP FS*LQ FS*SG R-squared Adjusted Rsquared Durbin-Watson stat F-statistic Prob (F-statistic) Coefficient (B) -64.61323 -253.2767 60.44337 2.688336 1.094413 -0.2735 10.57568 33.15471 -8.931738 -0.179373 0.145515 0.63054 0.416253 2.525335 2.942505 0.000392 Standard 65.21567 151.4168 38.25771 21.15454 7.088905 0.157134 9.288526 21.46236 5.640237 3.154599 1.211913 prob. 0.3266 0.1006 0.1204 0.8994 0.8779 0.0879 0.2603 0.1287 0.1196 0.9549 0.9049 20 Hypothesis Testing: H1: There is a positive relationship between IV and DV. According to the Regression panel analysis of the dependent variables ROA, ROE and NOP. The results show a significant relationship. From this we can conclude that there is a positive relationship between the independent variable working capital policy and dependent variable firm financial performance. Thus H1 is accepted. H2: Firm size moderates the relationship between IV and DV. According to the moderated regression analysis of the dependent variables ROA, ROE and NOP. The results show a significant relationship. Thus H2 is accepted. Chapter No. 5: Conclusion The WCM effective way is critical for the success of any organization. This study was conducted with a aim to investigate the impact of WCP on FP in the context of the cement industry in Pakistan, moderated by firm size, and controlled for liquidity and sales growth. The previous literature suggests that WCP has a significant impact on a firm's profitability and liquidity, and firm size plays a moderating role in this relationship. The Study’s Methodology includes Hausman test and fixed-effect regression models. According to results, the regression analysis suggests that the selected independent variables have a significant impact on the firm performance as measured by ROA and ROE. However, the impact varies based on the moderator effect of firm size. It is important to note that there may be other unobserved factors that may influence firm performance, And the results of the correlation analysis suggest that the Financing Policy, Firm Size, Investment Policy, Liquidity, Net Operating Profit, Return on Assets and Return on Equity are important variables that are significantly correlated with each other and may have significant impacts on the financial performance of the firms. The study aims to provide empirical evidence on this relationship, filling the gap in the existing literature. The findings of this study will offer insights to organizations on the importance of designing and implementing effective working capital policies that would positively impact their financial performance in the long run, ultimately leading to success and growth. 21 Future Implications The working capital policy impact on firm financial performance moderated by firm size and firm age is a complex and complicated issue with many variables at play. Further research and analysis are needed to fully determine the impact of WCP on firm FP and to identify the best policy for different firm sizes and ages. Below are some future implementations: 1. One possible direction for future research is to analyze how a company's working capital policy affects its financial performance, taking into account industry-specific factors. Different industries have different capital needs and face different competitive factors, which may affect the best working capital policy. Identifying these factors can provide useful information for businesses in designing their policies to improve their financial performance. 2. Another possible direction for future research that is WC by looking at how different companies in the same industry handle their finances. By comparing these practices, it can show which methods lead to better financial performance and efficiency. This comparative analysis can help to identify effective practices in working capital management that helps for higher financial performance and efficiency, and provide targets for firms to evaluate their policies 3. Many f the existing research focuses on the short-term impact of WCP on firm FP. Future research can analyze the long-term impact of WCP on firm FP moderated by firm size and firm age. Such empirical analysis is necessary to understand whether the short-term benefits of a specific working capital policy balance the long-term drawbacks. 22 Chapter No. 6: Recommendations 1. Based on our findings, it is recommended that firms should develop industry-specific guidelines to determine the best way to manage their working capital. This will help them understand how different factors affect their working capital policy. 2. We recommend that future research should investigate the long-term impact of WCP on firm FP moderated by firm size and firm age. This long-term analysis will provide insights into whether the short-term benefits of a specific WCP outweigh the long-term drawbacks 3-Firms should use certain metrics to measure how well their working capital policy is working. This will help them compare their performance to other companies in the same industry. 4. To improve their management of working capital, firms can use financial technology (FinTech) tools to manage their cash flow, inventory, and other financial information.