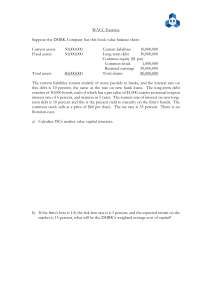

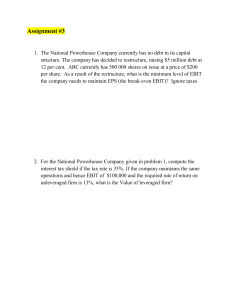

University of Kelaniya, Sri Lanka Dilrukshi Yapa Abeywardhana (PhD, UK) Professor Department of Accountancy, University of Kelaniya dilyapa@kln.ac.lk Leverage and Capital Structure Policy Learning outcome • At the end of the session students should be able to; 1. Describe the role of debt ratings in capital structure policy. 2. Explain the Modigliani–Miller propositions relevant to the capital structure, 3. Explain factors an analyst should consider in evaluating the impact of capital structure policy on valuation. 4. Demonstrate international differences in financial leverage and their implications for investment Department of Mass Communication, University of Kelaniya, Sri Lanka What is the Target Capital Structure? Basic Definitions • V = value of firm • FCF = free cash flow • WACC = weighted average cost of capital • rs and rd are costs of stock and debt • ws and wd are percentages of the firm that are financed with stock and debt. How can capital structure affect value? ∞ V = ∑ t=1 FCFt (1 + WACC)t WACC= wd (1-T) rd + wsrs The impact of capital structure on value depends upon the effect of debt on: WACC FCF The Effect of Additional Debt on WACC • Debtholders have a prior claim on cash flows relative to stockholders. • Debtholders’ “fixed” claim increases risk of stockholders’ “residual” claim. • Cost of stock, rs, goes up. • Firm’s can deduct interest expenses. • Reduces the taxes paid • Frees up more cash for payments to investors • Reduces after-tax cost of debt (Continued…) The Effect on WACC (Continued) • Debt increases risk of bankruptcy • Causes pre-tax cost of debt, rd, to increase • Adding debt increase percent of firm financed with low-cost debt (wd) and decreases percent financed with high-cost equity (ws) • Net effect on WACC = uncertain. (Continued…) The Effect of Additional Debt on FCF • Additional debt increases the probability of bankruptcy. • Direct costs: Legal fees, “fire” sales, etc. • Indirect costs: Lost customers, reduction in productivity of managers and line workers, reduction in credit (i.e., accounts payable) offered by suppliers (Continued…) • Impact of indirect costs • NOPAT goes down due to lost customers and drop in productivity • Investment in capital goes up due to increase in net operating working capital (accounts payable goes down as suppliers tighten credit). (Continued…) Consider Two Hypothetical Firms Identical Except for Debt Firm U Firm L Capital Rs.3500,000 Rs.3500,000 Debt Rs.0 Rs.1750,000 (12% rate) Equity Rs.3500,000 Rs.1750,000 Tax rate 40% 40% EBIT Rs.525,000 Rs.525,000 NOPAT Rs.315,000 Rs.189,000 ROIC 9% 11.4% Impact of Leverage on Returns Firm U Firm L EBIT Interest 525,000 0 525,000 210,000 EBT 525,000 315,000 Taxes (40%) 210,000 126,000 NI 315,000 189,000 9.0% 9.0% 11.4% 10.8% ROIC (NI+Int)/TA] ROE (NI/Equity) Impact of Leverage on Returns if EBIT Falls Firm U EBIT 346,500 Interest 0 EBT 346,500 Taxes (40%) 138,600 NI 207,900 ROIC 5.94% ROE 5.94% Leverage magnifies risk and return! Firm L 346,500 210,000 136,500 56,400 80,100 8.28% 4.57% Impact of Leverage on Returns if EBIT Rises Firm U EBIT 699,000 Interest 0 EBT 699,000 Taxes (40%) 279,600 NI 419,400 ROIC 11.98% ROE 11.98% Leverage magnifies risk and return! Firm L 699,000 210,000 489,000 195,600 293,400 14.38% 16.79% 14 Leverage Example • Suppose a new firm is being formed. The management of the firm is expecting a before tax rate of return of 24% on the estimated total investment of Rs. 500000. It is considering two alternative financial plans i)either to raise the entire funds by issuing 50000 common shares at Rs. 10 per share, or ii) to raise Rs. 250000 by issuing 25000 common shares at Rs. 10 per share and borrow Rs. 250000 at 15% rate of interest. Tax rate is 60%. What are the effects of the alternative plans for the shareholders earnings? What is operating leverage, and how does it affect a firm’s business risk? • Operating leverage is the use of fixed costs rather than variable costs. Operating leverage is the change in EBIT caused by a change in quantity sold. • The higher the proportion of fixed costs relative to variable costs, the greater the operating leverage. • If most costs are fixed, hence do not decline when demand falls, then the firm has high operating leverage. • More operating leverage leads to more business risk, for then a small sales decline causes a big profit decline. Rev. Rev. Rs. Rs. } TC Profit TC FC FC QBE Sales ◼What happens if variable costs change? QBE Sales Problem 1 • Alfa Ltd needs Rs.1000,000 for expansion. The expansion is expected to yield an annual EBIT of Rs. 160,000. In choosing a financial plan Alfa has an objective of maximising EPS. It is considering the possibility of issuing equity shares and raising debt of Rs. 100000 or Rs. 400000 or Rs. 600000. The current market price per share is Rs. 25 and is expected to drop to Rs. 20 if the funds are borrowed in excess of Rs. 500000. Funds can be borrowed at the rates indicated below.(a) Up to 100000 at 8%; (b) Over Rs. 100000 to Rs 500000 at 12%; (c) Over Rs. 500000 at 18%. Tax rate is 50%. Determine EPS for 3 alternatives. Problem 2 • A company needs Rs. 500000 for construction of a new plant. The following 3 financial plans are feasible. (i) The company may issue 50000 common shares at Rs. 10 per share. (ii) The company may issue 25000 common shares at rs. 10 per share and 2500 debentures of Rs. 100 denominations bearing a 8% of interest. (iii) The company may issue 25000 common shares at Rs. 10 per share and 2500 preferance shares bearing a 8% rate of dividend. • If the company’s EBIT are Rs. 10000, Rs 20000, Rs.40000, Rs.60000 and Rs. 100000 what are the EPS under each of the 3 financial plans? Which alternative would you recommend and why? Assume corporate tax rate is 50%. Problem 3 • Money incorporation has no debt outstanding and a total market value of Rs. 150000. Earnings before interest and taxes are projected to be Rs. 14000 if economic conditions are normal. If there is a strong expansion in the economy, then EBIT will be 30% higher. If there is a recession, then EBIT will be 60% lower. Money is considering a Rs. 60000 debt issue with a 5% interest rate. The proceeds will be used to repurchase shares of stock. There are currently 2500 shares outstanding. Ignore taxes for this problem. • (a) Calculate earning per share under each of the above 3 economic scenarios before any debt is issued. Also calculate the % changes in EPS when the economy expands or enters a recession. MM with Zero Taxes (1958) Proposition I: VL = VU. Proposition II: ksL = ksU + (ksU - kd)(D/S). Given the following data, find V, S, ks, and WACC for Firms U and L. Firms U and L are in same risk class. EBITU,L = Rs.500,000. Firm U has no debt; ksU = 14%. Firm L has Rs.1,000,000 debt at kd = 8%. The basic MM assumptions hold. There are no corporate or personal taxes. 1. Find VU and VL. VU = EBIT ksU VL = VU Questions: What is the derivation of the VU equation? Are the MM assumptions required? 2. Find the market value of Firm L’s debt and equity. VL = D + S 3. Find ksL. ksL = ksU + (ksU - kd)(D/S) 4. Proposition I implies WACC = ksU. Verify for L using WACC formula. WACC = wdkd + wceks = (D/V)kd + (S/V)ks MM relationships between capital costs and leverage as measured by D/V. Without taxes Cost of Capital (%) 26 ks 20 WACC 14 kd 8 0 20 40 60 80 100 Debt/Value Ratio (%) Find V, S, ks, and WACC for Firms U and L assuming a 40% corporate tax rate. With corporate taxes added, the MM propositions become: Proposition I: VL = VU + TD. Proposition II: ksL = ksU + (ksU - kd)(1 - T)(D/S). 1. Find VU and VL. VU = EBIT(1 - T) ksU Note: Represents a 40% decline from the no taxes situation. VL = VU + TD 2. Find market value of Firm L’s debt and equity. VL = D + S 3. Find ksL. ksL = ksU + (ksU - kd)(1 - T)(D/S) 4. Find Firm L’s WACC. WACCL = (D/V)kd(1 - T) + (S/V)ks When corporate taxes are considered, the WACC is lower for L than for U. WHY? MM relationship between capital costs and leverage when corporate taxes are considered. Cost of Capital (%) ks 26 20 14 8 0 20 40 60 80 WACC kd(1 - T) Debt/Value 100 Ratio (%) MM relationship between value and debt when corporate taxes are considered. Value of Firm, V (%) 4 VL 3 TD VU 2 1 Debt 0 0.5 1.0 1.5 2.0 2.5 (Millions of Rs.) Under MM with corporate taxes, the firm’s value increases continuously as more and more debt is used. Trade-off Theory • MM theory ignores bankruptcy (financial distress) costs, which increase as more leverage is used. • At low leverage levels, tax benefits outweigh bankruptcy costs. • At high levels, bankruptcy costs outweigh tax benefits. • An optimal capital structure exists that balances these costs and benefits. Signaling Theory Signaling Theory Signaling Theory • MM assumed that investors and managers have the same information.(Symmetric information) • But, managers often have better information. Thus, they would: • Sell stock if stock is overvalued. • Sell bonds if stock is undervalued. • Investors understand this, so view new stock sales as a negative signal. • Implications for managers? Pecking Order Theory • Managers have more information than investors (asymmetry of information) • Managers prefer to use internal finance • Then issuing debt • At a last resort, issue shares Pecking Order Theory Market Timing Theory Market Timing Theory • The market timing theory of capital structure argues that firms time their equity issues in the sense that they issue new stock when the stock price is perceived to be overvalued, and buy back own shares when there is undervaluation. Consequently, fluctuations in stock prices affect firms capital structures.