Exchange-Traded Funds: Trillion-Dollar Babies | The Economist

advertisement

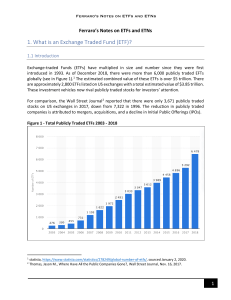

Exchange-traded funds: Trillion-dollar babies | The Economist 1 of 2 http://www.economist.com/node/15331133/print Exchange-traded funds Trillion-dollar babies A fast-growing asset class Jan 21st 2010 | from the print edition NOT all financial innovations have come to grief in the credit crunch. The explosive growth of exchange-traded funds (ETFs), investment pools that are listed on stockmarkets around the world, continued throughout the past decade. At the end of 2009 ETF assets under management topped the $1 trillion mark for the first time, according to BlackRock, a fund-management firm. The industry's assets were just $40 billion at the end of 1999. The industry has been growing faster than hedge funds, but with much less negative publicity. ETFs are usually linked to a stockmarket index or asset class and give retail investors a way of diversifying their assets at relatively low cost. The average expense ratio—the proportion of assets that gets eaten up by the cost of running a fund—of an American-based ETF was 31 basis points (less than a third of a percentage point) at the end of 2009. By contrast, the average expenses of index-tracking mutual funds were 78 basis points, and actively managed funds had expenses almost twice as high. This allows fund managers like Justin Urquhart-Stewart of Seven Investment Management to create private-client portfolios consisting completely of ETFs. “We can have more precise asset allocation at very low cost,” he says. The industry is dominated by BlackRock, which acquired the iShares brand when it took over Barclays Global Investors last year. Almost half of all global ETF assets are managed by iShares, with State Street a long way 1/15/2013 3:17 PM Exchange-traded funds: Trillion-dollar babies | The Economist 2 of 2 http://www.economist.com/node/15331133/print behind in second place with 15.6% of the market. There are genuine economies of scale in ETFs. Given that most products are designed to track an index, it costs little more to run a $2 billion fund than one managing $500m. Nevertheless, the speed of the industry's expansion is raising some troubling questions. First, new launches are focusing on specialised asset classes. In the latest example, Marshall Wace, a hedge fund, is launching its own ETF. The total costs on such funds are higher than on those tracking broad indices like the S&P 500, undermining the model's low-cost rationale. Second, although specialised funds are very useful for professional investors, they may tempt retail investors into taking too much risk. Emerging markets and commodities were among the fastest-growing ETF types in 2009. The biggest gold ETF, run by State Street, now has a higher market value than Barrick, the world's biggest gold miner. Some blame the rapid growth of gold ETFs for pushing the bullion price to record peaks in late 2009. Third, because it is easy for private investors to buy and sell ETFs, they may be tempted to trade them too often. This will erode their cost advantage, since every transaction involves a fee. Trading activity was down by 38% last year, at $50 billion a day. But if markets keep rising, ETFs may be to the next generation of day-traders what dotcom stocks were in the late 1990s. from the print edition | Finance and economics Copyright © The Economist Newspaper Limited 2013. All rights reserved. Terms of use Accessibility Privacy policy Cookies info Help 1/15/2013 3:17 PM