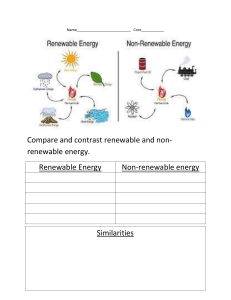

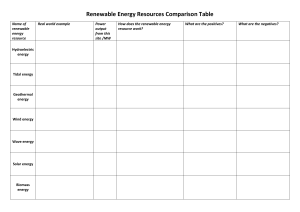

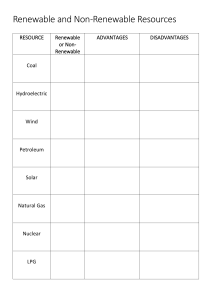

Sustainable Investing By Yimeng Wang, Fernando Ortiz, Dave Kim and Everett Brun Climate Change - Problem and Opportunity ● Climate Change is the problem of our generation ○ ○ ○ ● Climate change is incredibly expensive ○ ○ ● Global temperatures have risen 1 degree celsius Projected to reach 2-4 degrees celsius by 2100 Current preventative measures fall very short Natural disasters are increasing in frequency and intensity $23 trillion in global economic losses per year - unavoidable Current Shift towards Sustainability ○ ○ Government - Corporations - Consumers United States efforts are still very insufficient These problems and circumstances provide unique investment opportunities 1 - Renewable Energy ETFs - ICLN QCLN ● Renewable energy ETFs are involved with the alternative energy sector ○ ● Why invest in renewable energy ETFs? ○ ○ ○ ● Renewable energy market outlook Lower carbon footprint Portfolio diversification iShares Global Clean Energy Index ETF (ICLN) ○ ● Solar, wind, hydroelectric, and geothermal Tracks 100 related clean-energy companies First Trust NASDAQ Clean Edge Green Energy Index ETF (QCLN) ○ Tracks the performance of clean energy companies publicly traded in the U.S. 2 - Carbon Credits (KRBN) What is Carbon Credits? ● Carbon Credit is a permit that motivate organization to produce less carbon emissions. Each companies are assigned with certain amount of Carbon and they can buy or sell their unused carbon emissions allowance. KraneShares Global Carbon ETF (KRBN) ● ● Investment on future contact of Carbon credit. As Carbon emission regulation become worldwide, it increase the price of Carbon credit. 3 - Short or avoid climate vulnerable industries 1. Insurance The report states that last year just under a third of the $116 billion in worldwide losses from weather-related disasters were covered by insurance, according to data from the reinsurer Swiss Re. 2. Agriculture While higher temperatures can help crops grow faster, for many crops, faster growth means less time for seeds to mature, reducing global yields. Food prices could rise as much as 84 percent by 2050 as production declines, according to a United Nations report. 3.The energy the risks posed by global warming are mostly about government's’ effort to slow it. Regulations on fossil fuels are likely to increase, threatening the lucrative oil, gas and coal industries. 4. Skiing In the United States, the $12.2 billion ski and snowmobile industry has already experienced a $1 billion loss brought on by changing weather patterns. 5. Commercial fishing As sea levels rise, that would be a harsh loss for these fisheries, which are worth somewhere between $1.5 and $14 billion a year, according to an analysis from the Natural Resources Defense Council. Conclusion ● Climate change is happening and will be one of the most influential macroeconomic trends over the next century. ● There will be many new investment opportunities as our economy will be forced to shift from indulgent, hyper consumerism to more a preservative and sustainable driving forces.