Fixed-interest products come with own risks

advertisement

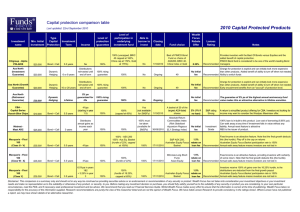

TODAY'S PAPER VIDEOS INFOGRAPHICS MARKETS DATA MY P R E M I U M AFR LOGOUT search the AFR PREMIUM NEWS BUSINESS MARKETS STREET TALK REAL ESTATE OPINION TECHNOLOGY PERSONAL FINANCE LEADERSHIP LIFESTYLE ALL Home / Markets / Debt Markets Mar 10 2012 at 12:04 AM Updated Mar 19 2012 at 8:13 AM SAVE ARTICLE PRINT REPRINTS & PERMISSIONS Fixed-interest products come with own risks by Alison Kahler Brokers have earned a cheeky $60 million, or thereabouts, by selling hybrid securities and subordinated notes to investors over the past few months. The 1 per cent commission that’s usually paid for selling such issues adds up to that amount after a slew of issues worth a total $6 billion. The bonanza has compensated the industry for lean times in which it’s been almost impossible to earn a decent buck by selling shares to a public still scarred by the financial crisis. Investors have stockpiled cash since the nadir of the crisis in 2008 and are itching to spend it – giving issuers and brokers a captive, though often uninformed market, from which they can raise capital. The imminent launch of bond exchange-traded funds (ETFs) will create a competing product for hybrids and if the government has its way, there may also soon be a retail corporate bond market. The pitch for all these products – and, again, there will be plenty of brokers selling them – will be that people need more fixed income in their portfolios as insurance against sharemarket volatility. This is probably true, but smart people won’t simply swallow that pitch but instead analyse each offer spruiked to them to determine how it works and if it’s actually suited to their circumstances. This will involve some hard graft as investors get their heads around concepts including the yield curve, capital structures, step-ups and all sorts of other factors that make up proper credit analysis. It’s an arcane area that can make the head spin wildly but there is no point buying any of these new fixed-interest products without a proper understanding of their mechanics. Hybrid securities and notes are not the same as a corporate bond, let alone as safe as cash. “Investors do need to be aware that these securities are not a substitute for fixed income," UBS head of investment strategy George Boubouras told the bank’s private clients in a recent note. “They offer an attractive yield versus conventional bonds due to the additional risk." The bond ETFs expected to be launched within weeks could be a combination of any of the above asset classes plus others like government and semi-government bonds to RELATED ARTICLES $A rebounds, global equities higher $A extends slide on greenback rally Greenback surges, equities smashed Global equities mixed, $A steady US interest rate rise speculation surges complicate matters more. The underlying structure of an ETF will add an additional layer of complexity to investment decision-making. Investors need to how the ETF invests, the fees it charges and if there additional risks in the fund’s own mechanics. LATEST STORIES ANZ traders talked dirty with other banks 11 mins ago Taxpayers over-claim $3.5b of expenses Already, there are concerns that people who bought into the recent note issues consider them to be relatively safe, as well as homogenous. 1 hr ago “We’re at pains to emphasise the risk. We try to make people understand these are Liberal party cash comes with Chinese strings attached unsecured," says Ravi Reddy, an analyst at research house Morningstar. “People have lost money in the past." Sulieman Ravell, from advisory company Wealth Focus, has a similar view. “People have to realise that issues can be very, very different," Ravell says. “Even one ANZ issue, for example, is different to the next ANZ issue. I can see people are going to get their fingers burnt down the road." The Australian Financial Review RECOMMENDED FROM AROUND THE WEB Carl's Jr is fat, raunchy and wanting to take over Australia 4 Students reveal their Money-Making System on Live TV! Biznews247 George Soros sees echoes of 2008 crisis When to buy and sell shares AMP Capital RBA weighs market turmoil, eyes potential domestic jobs impact Recovery risks: China's slide, Iran's return may prolong oil collapse Nikkei Asian Review Coffee lover's guide to improving performance and memory. Hint: it's all… Real estate agent discharged over stinky delivery Bill Gross says investors will need extra doses of Xanax You’ve turned 50, now what? A to-do list to get retirement-ready Domain Personal - Commonwealth Bank Recommended by MY FINANCIAL REVIEW FAIRFAX BUSINESS MEDIA My Alerts | Create alert Portfolio Account My Saved Articles (1) The Australian Financial Review Magazine BOSS BRW Chanticleer CONNECT WITH US