20110420- Exchange Traded Funds

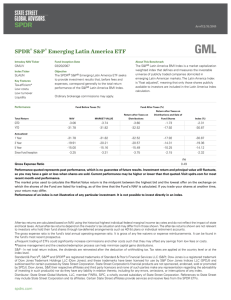

advertisement

Exchange Traded Funds Presentation 20 April, 2011 Disclaimer In case you prefer to shoot and ask questions later • I am NOT a registered financial advisor. • I am not paid any commissions to sell ETFs. • I am paid to write an ETF column by Investors Monthly. • I am paid to write a quarterly ETF Review for Itransact. • This presentation should NOT be construed as advice or a recommendation of any kind. Warren Dick Some call me slim.... • • • • • • Degree in economics and finance from UNISA 7 years at Investec Private Bank Financial journalist writing for Investors Monthly Financial analyst for Investorcentre Called the financial crisis of ‘07/08 Blah blah blah The most important slide you’ll ever see Stock markets generally tend to go up.... Source: Profile media JSE All Share Index 1960 - 2011 Exchange Traded Funds What are they? • • • • A basket of shares, bonds or commodities. Put together in a methodical way. Listed on an exchange. Use indices as their building blocks. Some famous indices: Pick one you like • All Share index: Tracks the performance of 161 shares on JSE. • Consumer Price index: tracks the change in the prices of a basket of goods. • Dow Jones Industrial Average – NYSE. Indices are everywhere And ETFs aim to mimic them! Regulated by: • JSE as a listed entity • FSB as a collective investment scheme ETF Structure ETF Issuer: eg RMB Appoints: • Trustees (Bank) to administer company • Asset manager to track the index being followed • Market Maker to provide liquidity Issuer creates Management Company Man company usually a Pty Ltd. Issues: Debentures or participatory interests Market Maker ensures shares trade at NAV Investors purchase and sell debentures/PI’s through JSE How are they constituted? Market Cap Methodology Include shares in the index based on their Market capitalisation= No of shares x share price Anglo American Market Capitalisation Closing share price 19 April: R342.70 No of shares: 1,342m Market cap = R342.70 x 1,342m Market cap = R460.2bn Top 40 index: ranks companies on size The Top 40 by Industry A little skewed to resources… Industrials, 2.90% Healthcare, 0.79% Oil and Gas, 5.84% Telecoms, 7.61% Financials, 17.50% Consumer Goods & Services, 22.38% Source: Satrix, Investorcentre Basic Resources, 42.98% So then its a process of natural selection? We’ve heard this before! • Companies enter and exit the Top 40 when portfolio is rebalanced • Only the strongest survive • This is a process of ‘natural selection’ • Don’t buy the needle buy the hastack. And has been replicated on indices around the world: • Locally: industrial companies “Indi”, resource companies “Resi”, financial companies “fini” • Overseas: FTSE 100 (Footsie) S&P 500, Nikkei Then they got smart… • Instead of picking on size, you pick on value (fundamentals) • Research Affiliates Fundamental Indexation (RAFI) • Enhanced Research Affiliates Fundamental Indexation (eRAFI) eRAFI vs RAFI RAFI (Satrix) eRAFI (ABSA Capital) 1. 2. 3. 4. Applies a further two SA specific criteria: Net Operating Assets ratio Debt Coverage ratio A company’s Book Value A company’s Sales A company’s Dividend A company’s Cash flow Is rebalanced annually Screens all companies on the JSE Is rebalanced quarterly Only selects companies from the Top 100. Charges a performance fee when it beats index On this team, we fight for that inch. On this team, we tear ourselves, and everyone around us to pieces for that inch. We CLAW with our finger nails for that inch. Cause we know when we add up all those inches that's going to make the f%$*ing difference between WINNING and LOSING between LIVING and DYING. Performance: Making rands and sense of it… Equity Funds Ranked TER (2007-2009) Funds Average TER Total Return (%) 5 Most Expensive Funds 2,97 10,88 10 Most Expensive Funds 2,65 15,67 Overall Average 1,59 14,89 10 cheapest Funds 0,92 19,19 5 Cheapest Funds 0,72 21,35 Source: DRW Investment Research (November 2010) “Investors will do well to avoid the most expensive funds; simply because their actual performances do not justify the higher fees. Investors should rather, all else being equal, invest in low-cost funds and therefore stand a better chance of improving their returns.” Equity Unit Trusts versus the Benchmarks Equity Funds Number of funds Best performing fund Worst performing fund 1-Year 3-Year 5-Year 97 83 63 26,0% 14,5% -11,7% 8,0% Top quartile Median 20,6% 18,3% 6,8% 5,1% 14,5% 12,9% Bottom quartile 16,5% 3,1% 11,4% Average 18,2% 4,8% 12,9% Benchmark: ALSI 19,0% 6,5% 15,2% 37% 33% 15% 20,9% 7,1% 15,1% 22% 16% 12% Benchmark: SWIX % Funds outperforming SWIX 1. 2. 3. 10-Year 50 38 24,5% 29,9% 14,7% 13,3% 20,7% 19,5% 17,9% 20,2% 17,8% 15,8% 19,5% 18,4% 21,0% 18,1% 26% 49% 18,5% 1,0% % Funds outperforming ALSI 7-Year Equity unit trusts in categories: General, Growth and Value Funds Total Returns Annualised Source: DRW Investment Research 21,6% 15% Fees (TER) as at 31 December 2010 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% But don’t take my word for it The Oracle of Omaha says so…. "Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals.“ - Warren Buffett in letter to shareholders, 1996 Your guide to the universe… As at 31 December 2010 ETPs - a big deal overseas (US$ bn) --------ETFs ---------ETPs Source: Bloomberg, Blackrock Equity ETFs Fixed Income ETFs Commodity ETFs But still small locally (R’bn) 33.3 27.51 16.52 12.02 13.38 9.18 2.75 2000 3.58 2001 4.73 2002 Source: Bloomberg 5.61 6.04 2003 2004 2005 2006 2007 2008 2009 2010 Summary: • Market cap indices are based on the size of the companies. • Fundamental indices introduce different ways of picking the shares. • You can get exposure to all asset classes locally. • ETFs are cheaper than unit trust funds Getting some more of the good stuff Now that you’re sold: ETF column in Investors Monthly (Business Day) Factsheets of product providers. ETF Quarterly Review – sign up for the email. ETFSA website THANK YOU