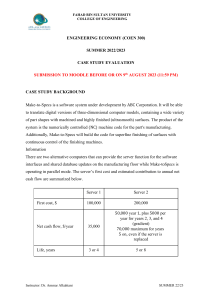

1-Make-to-Specs is a software system under development by ABC Corporation. It will be able to translate digital versions of three-dimensional computer models, containing a wide variety of part shapes with machined and highly finished (ultra smooth) surfaces. The product of the system is the numerically controlled (NC) machine code for the part's manufacturing. Additionally, Make-to-Specs will build the code for the superfine finishing of surfaces with continuous control of the finishing machines. Information Two alternative computers can provide the server function for the software interfaces and shared database updates on the manufacturing floor while Make-to-Specs is operating in parallel mode. The server’s first cost and estimated contribution to annual net cash flow are summarized below Solution: Let us carry out the analysis assuming 3-year life for server 1 and 5 years life for server 2 Part a: T Year A B PW1=A/(1+12%)^T PW2=B/(1+12%)^T Cash Flow Server 1 Cash Flow Present Worth of Present Worth of Server 2 server 1 @ 12% server 2 @ 12% MARR MARR 0 -100000 -200000 -100000.00 -200000.00 1 -35000 50000 31250.00 44642.86 2 35000 55000 27901.79 43845.66 3 35000 60000 24912.31 42706.81 4 65000 0.00 41308068 5 70000 0.00 39719.88 Net PresentWorth -15935.91 12223.89 Annual Worth function =-15935.91*(A|P, 12%, 3) =12223.89*(A|P, 12%, 5) Annual Worth factor 0.416349 0.277410 Annual Worth -6634.90 3391.03 We can see above: On the basis of PW, Server 2 must be chosen; and on the basis of AW as well, server 2 must be chosen Part b : T Year A B I=B-A Cash Flow Server 1 Cash Flow Incremental cash flow Present worth of (B-A) incremental cash Server 2 PW=I/(1+20.12%)^T flow @ RoR 20.12% 0 -100000 -200000 -100000.00 -1000000.00 1 -35000 50000 15000 12488.03 2 35000 55000 20000 13862.31 3 35000 60000 25000 14426.08 4 0 65000 65000 31226.57 5 0 70000 70000 27997.01 Net Present 0.00 Worth of Incremental cash flow at RoR 20.12% (must be zero) Since RoR of 20.12% of incremental cash flow above is greater than 12% MARR, server 2 must be chosen. Part c: T B2 Year B1 Cash Cash Flow Flow Server 2 with 8 year life I=B1-B2 PW=I/(1+1500%)^T Incremental cash flow (B-A) Present worth of Server 2 incremental cash flow @ RoR 1500% with 5 year life 0 -200000 -200000 0 0.00 1 50000 50000 0 0.00 2 55000 55000 0 0.00 3 60000 60000 0 0.00 4 65000 65000 0 0.00 5 70000 70000 0 0.00 6 0 70000 70000 0.00 7 0 70000 70000 0.00 8 0 70000 70000 0.00 Net Present 0.00 Worth of Incremental cash flow at RoR 1500% (must be Zero Even though it looks surprising, but all we can say is it's any time better to use server 2 for 8 years than for 5 years 2- The life estimates were developed by two different individuals: a design engineer and a manufacturing manager. They have asked that, at this stage of the project, all analyses be performed using both life estimates for each system. Case Study Exercises Use spreadsheet analysis to determine the following: 1 -If the MARR = 12%, which server should be selected? Use the PW or AW method to make the selection. 2- Use incremental ROR analysis to decide between the servers at MARR = 12%. 3- Use any method of economic analysis to display on the spreadsheet the value of the incremental ROR between server 2 with a life estimate of 5 years and a life estimate of 8 years Solution: Now, let us carry out the analysis assuming 5 years' life for server 1 and 8 years' life for server 2 T Year B2 B1 Cash Flow Cash Flow Server 1 Server 2 I=B1-B2 PW=I/(1+1500%)^T Present Worth of Present Worth of server 1 @ 12% server 2 @ 12% MARR MARR 0 -100000 -200000 -100000.00 -200000.00 1 35000 50000 31250.00 44642.86 2 35000 55000 27901.79 43845.66 3 35000 60000 24912.31 42706.81 4 35000 65000 22243.13 41308.68 5 35000 70000 19859.94 39719.88 6 70000 35464.18 7 70000 31664.45 8 70000 28271.83 26167.17 Net 107624.34 Present Worth Annual Worth function =26167.17*(A|P,12%, 5) =107624.34*(A|P, 12%, 8) Annual Worth factor 0.277410 0.201303 Annual Worth 7259.03 21665.09 We can see above: On the basis of PW, Server 2 must be chosen; and on the basis of AW as well, server 2 must be chosen Part b : Since RoR of 6.91% of incremental cash flow above is less than 12% MARR, server 1 must be chosen