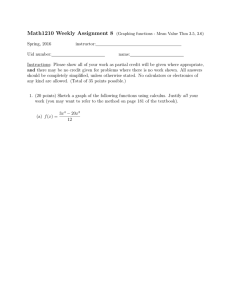

®ICMAB

CMA MAY 2024 EXAMINATION

INTERMEDIATE LEVEL I

INTERMEDIATE FINANCIAL ACCOUNTING

Course Code

Roading Time

: FR222

:15 minutes

H

Total Marks

Writing Time

ICMWhTMIftrwcuw1'

t 100

; 180 minutes

Ins truet ions fo

• You MUST NOT write anything during Iho reading time.

You should attempt ALL quosbens.

*

* Answers should be properly siruelured and relevant.

• Carefully read ALL the requirements end sub-questions before a Sampling a specific question.

• ALL answers must be written in the answer book.

• AVOID WRI71NG/MARKING on the question paper al any lime which may cause disciplinary

action,

•

*

Sian answering each question from a fresh sheeL

Answers should be clearly numbered with Ihe cub-quo stion number.

Allowable Materials

»

Writing Stationeries

• Non-programmablc Calculator

Assessment Structure

Subgect^ori

A

Question 1

Question 2

Question 3

Question 4

Section Question 5

5

Question 6

Question 7

Multiple-choice questions.

Modified True/Falsc

Matching

Es&ay/Computaltenal/Case

Essay/Computational/Case

Essay/Computalional/Case

EGsay/Compulallonal/Cass

Revision

Total

queslion

10

5

5

3

2

2

3

Marks

to

5

5

20

Expected Time

Required

20 minutes

10 minutes

10 minutes

32.50 minutes

20

20

20

100

RESTRICTED USE

This paper MUST NOT BE REMOVED from the examination venue

Do not tom the page until instructed

32.50 minutes

32.50 minutes

32 50 minutes

10 minutes

180 minutes

SECTION A [3Q MARKS]

THERE ARE 3 (THREE) QUESTIONS IN THIS SECTION. ANSWER ALL THE QUESTIONS |N

THE ANSWER SCRIPT FOLLOWING THE EXAMPLE PROVIDED FOR THE SPECIFIC

QUESTION.

QUESTION 1

[iox1 = 1O MARKS]

Wo am ton (10) multiple*chctcc questions with five options. Pick Iha oplion that best explains the

given question. Write your answer on ths answer script (DO NOT PUT ANY MARK ON THE

QUESTION PAPER). Follow (he example given below In providing your answer.

Example:

-

(i) ICMAB stands For the

(a) In^tuto of Cost Management Accounting of Bangladesh

(b) Institute of Cost and Management Accountants of Bangladesh

(c) institute tor Cost Managers and Accounting of Bangladesh

(d) Institute of Cost Management Accountants of Bangladesh

(e) Industrial Cost Management Accountants of Bangladesh

Answer; (t) (b)

Which accounting standard deals with the recognition, measurement, presentation, and

disclosure of financial instruments?

(a) IAS 39

(b) IFRS 9

(C) IFRS 15

(d) 1FRS 16

(e)lFRS t

(n) Which of the following is a method of Internal re construction?

(a) Merger

(b) Demerger

(c) Reduction of share capital

(d) Bonus issue

(e) Right Issue,

fr*i)

What is the primary objective of liquidation?

(a) Maximizing shareholders' wealth

(b) Settling creditors' claims

(c) Distributing profits to shareholders

(d) Expanding the business

(e) Minimizing shareholders' wealth

(hr)

Which inventory valuation method assumes that tho most recently purchased items are the

first to bo sold?

(a) FIFO (First-In. First-Owl)

(b) LIFO(UsHn. Firat-Oul)

(c) Weighted average

(d) Specific identification

(aj None of the above

According to IFRS 15. revenue should be recognized when:

(a) The goods are shipped

(b)The customer pays

(c) The performance obligation is satisfied

(d) The contract is signed

(e) All of the above.

(v)

CMA Muy 2024 ExUfninutioH, FR222 [Page 2 aj7]

W Undur IFRS 16. how should a lessee recognize a right -of-use asset and tease liability for an

operating lease?

(a) Initially at for value

(b) Over Iho lease term using the oifocUvo interest method

(c) At the present value of minimum lease payments

(d) Al the end of the lease term

(e) As and when required.

(vii) When testing foe impairment of goodwill. which Jove! of reporting units should be cornidorc'd first?

(a } Operating tegmenl

(b) Reporting segmoni

(c} Cosh-gon orating unit

(d) Business unh

(e) Investing unit.

(viiil How is diluted EPS calculated?

(a J Mal income drvided by weighted average common shares outstanding

(b) Net income minus preferred dividends divided by weighted average common shares

outstanding

(c) Net income divided by diluted weighted average common shares outstanding

(d) Net income divided by basic weighted average common shares outstanding

(e^ Nel income divided by total number of shares outstanding

i nr)

Which criterion is used to determine whether an operating (segment should be reported

separately?

(a) Revenue Lest

(b) Profit cr loss test

(c) Asset test

(d) All of the above

fo) None of the above

(x)

Both fair values and subsequent growth of the investee arc nol as relevant for invastm&nts in

which of the following categories?

(a) Securities reported under Iho equity method

(b) Trading securities,

{c) HeId-tD- maturity Securities.

(d) Securities available for sale

[e) None of Une above.

(5 * 1 « 5 MARKS]

QUESTION 2

There arc five (5} statemonls given under the question Identify the statements as True or Fatso. If

the statement is false, rewrite the statement on the answer script to make 11 True'. Reasoning is

NOT required. Follow the example given below in providing your answer,

Example:

(a) ICMAB stands for the Industrial Cost Management and Accounling of Bangladesh.

Answar:

(a) FqIm. fCMAB stands for the Institute of Cost and Management Accountants of

Bangladesh.

Noto:

• You will not get any murk if you simply rewrite os ICMAB does nof stand for the Industrial

Cost Management Accountants of Bangladesh.

• If the statement is true, you need NOT to rewrite the statement rather only mention that

the statement Is True.

CAM Muy 202-1 EtamiMtion. FR122 [Puyc J uf 1]

ta)

(b)

(c)

(d]

(e)

Ths accounting for changes In accounting principles and changes in accounting ostimatus are

the same for both GAAP and 1FRS.

The relationship between current liabrlillcs and currant assets is important in evaluating

company's ability to pay off its long term debt.

Depreciation is provided for an Item of property that Is idle, or retired from active use unless it

is fully deprecfolod

When equipment held under an operating lease Is subleased by the original lessee, the

original lessee would account for the sublease as operating lease

Discount on bond payable is not contra liability.

QUESTION 3

[5*1= 5 MARKS]

Match the items of column A with the moat suitable items of column S. Match only one item of

column A with one item of column B. Write your answer on the answer script. Follow the example

given below in providing your answer.

Example:

Column A

1. 1CMAB

Column B

(a) Professional accountancy body

(b) University

Answer: 1 (a)

Column A

The best accountants don't just seo numbers; they see

the potential for

2. COGS is based on the cost of the earliest purchased

materials, while the remaining inventory value is based

on the cost of the latest purchased

3. Proper inventory management allows businesses to

minimize costs and create or receive goods on

4. Understanding assets and liabilities is essential for

making informed financial

5. IFRS 9 specifies how an entity should classify and

measure financial assets, financial liabilities, and some

contracts to buy or sei!

1,

Column S

a) estimated

b) financial transformation

cj notified

d) materials

e) the reporting process

f) an as-needed basis.

g) decisions

hj impairment

1) non-financial items.

j) correction of errors

END OF SECTION A

CMA Muy 2024 Esamitfutiun, FB222 /Page 4 of7j

SECTION B [BQ MARKSJ

4

(FOUR)

QUESTIONS IN THIS SECTION, ANSWER ALL THE QUESTIONS IN THE

THERE/ARE

ANSWERSCRIPT. SHOW ALL RELEVANT COMPUTATION.

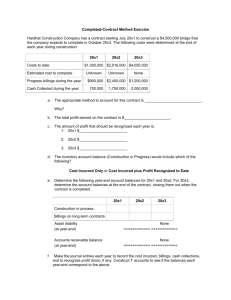

QUESTION 4

(a)

(b)

[Marks; 4+3+(8+5) = 20]

As a Profossional Accountant you havo to apply the fundamental pnnopfos of the code.

Write down 5 principles and discuss any two of them.

The capital structure for Nissan Furniture Inc. on 3CT Juno 2023 are as follows:

(tare*

Tk.

12,00,000

40,35,000

21.60,000

Capital Stock, Tk. 20 par

(c)

Premium on Capital Stock

Retained Earnings

At this limo shares of ihu company arc selling al Tk. 35.

What entries would you malto in ouch case beliow7

(1) A slock dividend of 10% Is declared and issued.

(2) A 2 for 1 stock split is declared and issued.

Presented bellow is information related to Shistr company for 2023:

Account tiUes

} mirtrt e

t a unmu

A r4 eJi

1a ni 1 Slfu 1

iiii lys jjiiuciiy

ifrs 2

AmountfTk.)

q nn

' - ’ J,DU j.UUU

„

2,50.00,000

Sales for the year

of yoods sold

interest revenue

.i1 yn

nn nnn

/UjUU'UUU

t

70,000

47 nn onn

WritB-off goodwill

the ywr

' income tax fnr

sale of investment (normal recurring)

on

the

Gain

। LU4u

/Fjctraordinarv item-net of taxV

tn (lend

1 ni=c dtia SV

IIWUM rfamane

UCUHOyG ^aliuwi

J

Loss on the disposition of the wholesale division (net of tax)

. Loss on tne operation or tne wnoiesaie a(vision \nei or lax,;

common stock

। Dividend declared on

Dividend declared on preferred stock

vf

—

8.20.000

-

-9,05.000

1.10,000

3.90.000

—

——

4^40^000

an nnn

-

2.50.000

-70,000

Other information;

(r)

The company decided to discontinue its entire wholesale division ant to retain the

manufacturing section. On September 15. 2023 the company sold the wholesale

division.

(it) Dunng 2023 there were 3.00,000 shares of outstanding.

Required:

(i)

Income statement far the year ended December 31, 2023

(ii)

earnings statement showing Ute EPS.

eps

Retained

[Marks; (5+5H4+4+2) = 20]

Q1JESTJ0N !5

(a>—<5uring the year ended December 31. 202x, Iho liliyun Care PLC. reported Tk.95,000 of

revenues, Tk.70.000 of operaling expenses, and Tk.5.000 of income taxes expense.

Following is a list of transactions Iha t occurred during the year:

(3) Depreciation expense. Tk.3.000 (included with operaIIng expenses)

(b) Increase m wages payable, Tk.5O0

(c)

(d)

(e)

(f)

(g)

(h)

(i)

Increase in accounts receivable, Tk.900

Decrease in merchandise inventory, Tk.1,200

Amortization of patent, Tk.100

cash flow

Non-current borrowings paid in cash. Tk.5.000

Issuance of common slock tar cash, Tk.12.500

Equipment, cost Tk. 10.000, acquired by issuing common stock

At the end of the fiscal year, a Tk.5.000 cash dividend was declared but not paid.

CMA May 2024 Examination, FR222 (Page 5 of 7/

U)

Old machinery sold lor Tk 6.000 cash; it originally cost Tk 15.000 (one-half depre elated).

Loss reported on income statement as ordinary item and included in the Tk 70,000 of

operating expenses.

(k) Decrease in accounts payable. Tk. 1,000.

(11

Cash Bl January 1, 202x was Tk. 1,000; increase in cash dunng the year, Tk.37.900

(m) There was no change in income taxes owing

Required;

Prepare a stalement of cash flows.

p)

(il) Explain what this statement lolls you aboul THiyun Care PLC.

b)

Somih Textures Inc has Tk. 1 million of 7%. convertible bonds outstanding. Each Tk 1.000

Pond ,s convertible into 30 no-par value common shares. The bonds pay interest each January

31 and July 31. On July 31. 2020, just after the intcrosl payment, the holders of Tk. 600.000

worth cf these bonds oxerclsod their conversion entitlement. Cn that date, 1he following

infemtabon iws determined;

Market pneo of the bonds

Morkel price of the common shares

Carrying vstuo of the common shares

Balance in the contributed surplus convertible bonds

Unamortued bond premium

-

Tk.102

Tk. 26

Tk. 16

fin ins

Tk. 150,000

Tk. 80.000

। he remaining bonds were not converted, and al Iheir maturity date they were retired, The

company follows IFRS.

Required:

Prepare the journal entry for the bond conversion on July 31, The company uses the

(i)

hook value method.

(ii) Prepare the journal entry for the remaining bonds at maturity, if nol converted to shares.

(Q) What risks arise ii bondholders choose to wait to convert the bonds?

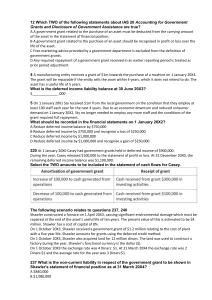

[Marks: 4 (6+10) = 20]

The normal selling price of an item included In yearend inventories is Tk.21 per unit. The item

originally cost Tk.15 per unit, but could only be sold al the normal selling pnee after

modifications were made after the year end at a cqsl of Tk.5 per unit The scrap value of the

item tsTk.11 per unit

Under IAS 2 Inventories at what amount should the Item be included in the financial

QUESTION 6

(a)

statements?

(b)

Difficulties can arise in the presentation of financial insinjmcnls in 1he statement of financial

position of an entity in relation Ip iheir classification as liabilities and equity and to the related

interest, dividends, losses and gams.

The abjective of IAS 32 Financial instruments: Presentation is to address this problem by

establishing principles for presenting financial instruments as liabilities or equity and for

oft setting financial assets and financial liabilities.

On 1 January 20X3 Woodseats Ltd had only 50m Tk.1 ordinary shares in issue, which had

been in issue for many years During Ihe year ended 31 December 20X3 Woodseats Ltd

entered inio the following financing transactions.

(1) On 1 January 20X3 Woodseals Ltd issued 20 million 8% TK.1 preference shares at par.

Tho preference shares are redeemable al par on 30 June 20X8. The appropriate

dividend in respect of these shares was paid on 31 December 20X3.

(2) On 30 June 20X3 Woodseats Ltd issued 10 million 12% Tk.1 irredeemable preference

shares al par. Dividends are discretionary and n on-cumulative. The appropriate dividend

in respect af these shores was paid on 31 December 20X3

In reviewing ihc draft financial statements of Woodseals Lid ihe auditors drew attention to an

error which had begun in the previous year’s financial statements Expenditure had been

capitalized as an Intengibte assel which did nol meet the criteria in IAS 38. The carrying

amount of the intangible asset included in the draft statement of financial position was as

follows.

CAM Afm- 2024 Extminalion. FR222 (Pug!: 6 uf 7]

At 1 January 20X3

fin ins

Tk.m

45

Costs Incurred during 20X3

2.0

Amortization charge

(0 5)

At 31 December 20X3

6.0

The draft pnotd for 20X3. before adjusting for tfwco capitalized costs, was Th 15 million.

Retained namings at 1 January 20X3 wero Tk.75 million.

Required;

(0

Describe tho concept of ‘subslenco over form' and Ils application to the presentation of

financial liabilities under IAS 32 Finflhdal Instruments; Presentation.

(n) Prepare extracts from ttwj financial slatentenls of Woodscats Ltd for tho year ended 31

December 20X3 to the extent the information io available, showing how the above would

be reflected in those financial statements,

Notes to the accounts are not required. Ignore taxation

[Marks: 4+4+(8+4) - 20]

Douglas Ltd is developing a new production process. During 20X7. expenditure incurred was

Tk.100,000. of which Tk.90,000 was incurred before 1 December 20X7 and Tk.10,000

between 1 December 20X7 and 31 December 20X7. Douglas Ltd can demonstrate that, at 1

December 20X7, the production process met the criteria for recognition as an intangible asset.

Tho recoverable amount of the know-how embodied in the process is estimated to be

Tk 50,000. How should the expenditure be treated?

An intangible asset is carried by a company under the revaluation model. The asset was

revalues by Tk.800 in 20X6; this was recognized In other comprehensive income, so that there

is a revaluation surplus of Tk.800 in the statement of financial position. At the end of 20X7, the

asset is revalued downward by Tk. 1.000. State the accounting treatment for the downward

revaluation.

Parson Ltd has entered into the following transaclions during the year ended 31 December

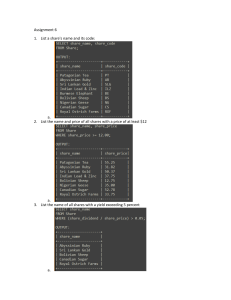

QUESTION 7

ias38 (a)

ias38 (b)

IFRS 15 (cl

(1}

20X3

On 1 October 20X3 Parson Ltd received Tk.400.000 in advance subscriptions. The

subscriptions aro for 20 monthly issues of a magazine published by Parson Ltd. Three issues

of the magazine had been dispatched by the year end. Each magazine is of the same value

and costs approximately the same to produce.

(2) A batch of unseasoned timber, which had cost Tk. 250.000. was sold to Banko Lid for

Tk.100.000 on 1 January 20X3. Parson Ltd has an option to repurchase the timber in 10 years’

time The repurchase price will ba Tk.100,000 plus interest charged at 8% per annum from 1

January 20X3 to ihe date cf repurchase. The market value of the timber is expected to

increase as it seasons

(3) Parson Ltd made a major sale on 1 January 20X3 for a lee of Tk.450.000, which related to a

completed sate and after-sales support for three years. The cost of providing the after-sales

support is estimated al Tk.50.000 per annum, and the mark-up on similar after-sales only

contracts is 20% on cost

(4) The food division of Parson Ltd operates its retail outlets on a franchise basis. On 1 January

20X3 a new outlet was opened. Ihe franchisee paying a fee of Tk.500.000 to cover the initial

services. The franchise is lor five years, and the franchisee will pay an additional annual fee of

Tk.60,000 commencing on 1 January 20X3 to cover marketing, managerial and other support

services provided by Parson Ltd during the franchise period. Parson Ltd has estimated that the

cost of providing these services Is Tk.80.000 par annum, and has achieved a gross margin of

20% on providing similar services on other contracts

Required:

(i) Prepare extracts from Parson Lid s financial statements for the year ended 31 December

20X3, dearly showing how each of the above would be reflected. Notes lo the financial

statements are not required.

(ii) With reference to transaction (2) above explain the concept of ’substance over form'.

= END OF SECTION B =

CAM May 202-1 Exuminaliiw, FR222 [Page 7 of 7]