University of Chicago Financial Statements 2019-2020

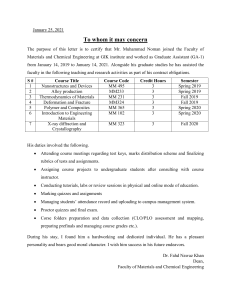

advertisement