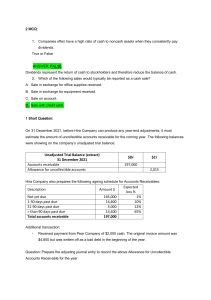

CHAPTER 8 OUTLINE LEARNING OBJECTIVES 8-1 1 Explain how companies recognize accounts receivable. 2 Describe how companies value accounts receivable and record their disposition. 3 Explain how companies recognize, value, and dispose of notes receivable. 4 Describe the statement presentation of receivables and the principles of receivables management. Explain how companies recognize receivables. Receivables are amounts due from individuals and companies that are expected to be collected in cash. Amounts customers owe on account that result from the sale of goods and services. Written promise (formal instrument) for amount to be received. Accounts Receivable Notes Receivable 8-2 Nontrade receivables such as interest, loans to officers, advances to employees, and income taxes refundable. Other Receivables ACCOUNTS RECEIVABLE Two accounting issues: 1. Recognizing accounts receivable. 2. Valuing accounts receivable. RECOGNIZING ACCOUNTS RECEIVABLE 8-3 Service organizations record a receivable when it performs service on account. Merchandisers record accounts receivable at the point of sale of merchandise sold on account. Describe how companies value accounts receivable and record their disposition. VALUING ACCOUNTS RECEIVABLE Accounts Receivable is A current asset. Valued at: net realizable value (also called cash realizable value). NRV = Total Receivables – Allowance for Doubtful Accounts net means subtract something Uncollectible Accounts Receivable Sales on account raise the possibility of accounts not being collected. Seller records losses that result from extending credit as Bad Debt Expense. 8-4 VALUING ACCOUNTS RECEIVABLE Methods of Accounting for Uncollectible Accounts Direct Write-Off Theoretically undesirable: Allowance Method Losses are estimated: No matching revenues and expenses. Better matching of revenues and expenses. Receivable not stated at net realizable value. Receivable stated at net realizable value. Not acceptable for financial reporting under GAAP. Required by GAAP. 8-5 Allowance Method for Uncollectible Accounts 1.Is all of A/R collectible? If not, then… 2.Estimate uncollectible accounts receivable.* 3.Standard JE to record Bad Debt Expense: Dr. Bad Debt Expense Cr. Allowance for Doubtful Accounts *Sometimes you will have to calculate the estimate, sometimes the estimate will be given to you. Either way, THE ESTIMATE IS ALWAYS THE ENDING BALANCE IN THE ALLOWANCE FOR DOUBTFUL ACCOUNTS. 4.Standard JE to record the write-off of a specific uncollectible account: Dr. Allowance for Doubtful Accounts Cr. Accounts Receivable What type of account is Allowance for Doubtful Accounts (AFDA)? CONTRA-ASSET (listed with A/R on the B/S as a subtraction. AFDA has a normal credit balance) 8-6 ACCOUNTS RECEIVABLE Note: Allowance for Doubtful Accounts is also called -Allowance for Uncollectible Accounts -Allowance for Bad Debts 8-7 Note: AR – AFDA = Net AR Net AR = 475 Recording Bad Debt Expense & Write-off of Uncollectible Accounts Assume Hampson Furniture has credit sales of $1,200,000 in 2015, of which $200,000 remains in Accounts Receivable at December 31. The credit manager estimates that $12,000 of this AR balance will prove uncollectible. Assuming a zero beg. bal. in AFDA, the adjusting entry to record the estimated uncollectible amount is: Dr. Bad Debt Expense 12,000 Cr. Allowance for Doubtful Accounts 12,000 Assume that on March 1, 2016 the vice-president of finance of Hampson Furniture authorizes a write-off of a $500 balance owed by R. A. Ware. The entry to record the write-off is: Dr. Allowance for Doubtful Accounts 500 Cr. Accounts Receivable 500 8-8 AFDA- 2015 0 12,000 12,000 Bad Debt Exp - 2015 12,000 AR- 2016 200,000 500 199,500 AFDA - 2016 12,000 500 11,500 Recording Bad Debt Expense & Write-off of Uncollectible Accounts Assume Hampson Furniture has credit sales of $1,200,000 in 2015, of which $200,000 remains in Accounts Receivable at December 31. The credit manager estimates that $12,000 of this AR balance will prove uncollectible. Assuming a zero beg. bal. in AFDA, the adjusting entry to record the estimated uncollectible amount is: Dr. Bad Debt Expense 12,000 Cr. Allowance for Doubtful Accounts 12,000 Assume that on March 1, 2016 the vice-president of finance of Hampson Furniture authorizes a write-off of a $500 balance owed by R. A. Ware. The entry to record the write-off is: Dr. Allowance for Doubtful Accounts 500 Cr. Accounts Receivable 500 8-9 AFDA- 2015 0 12,000 12,000 Bad Debt Exp - 2015 12,000 AR- 2016 200,000 500 199,500 AFDA - 2016 12,000 500 11,500 Collection of Previously Written-off Accounts Before Write-off After Write-off Accounts receivable 200,000 199,500 Allowance for doubtful 12,000 11,500 accounts Net Cash realizable value 188,000 188,000 of AR NRV is always the same before and after write-off If R.A. Ware were to subsequently pay the account already written off by Hampson, then two journal entries are required AFDA Put $500 back in 1. Reverse write-off AFDA & AR Dr. Accounts Receivable 500 Cr. Allowance for Doubtful Accounts 500 2. Record collection of AR Dr. Cash 500 Cr. Accounts Receivable 8-10 What is NRV after A/R is collected? $187,500 11,500 500 12,000 AR 500 NRV changes as Accounts Receivable are collected 199,500 500 199,500 500 Methods for Estimating the Allowance 1. A percentage of accounts receivable balance 2. Using an aging of accounts receivable schedule. 8-11 ESTIMATING THE ALLOWANCE Aging of Accounts Receivable 8-12 ▼ HELPFUL HINT The percentage-ofreceivables basis may use only a single percentage rate. Percentage of Receivables Example Example: Ending AR of $250,000 and a 2% uncollectible estimate. Calculate $ estimate of Ending AFDA balance = Ending AR * % uncollectible $5,000 = $250,000 * .02 1. Journal Entry for above, assuming $0 beg. balance in AFDA AFDA Dr. Bad Debt Expense 5,000 0 Cr. Allowance for Doubtful Accounts 5,000 5,000 The debit is always to Bad Debt Expense 5,000 2. Journal Entry for above, assuming $1,500 beg. credit balance in AFDA Dr. Bad Debt Expense 3,500 Cr. Allowance for Doubtful Accounts 3,500 AFDA 8-13 1,500 3,500 5,000 Bad Debt Expense and Write-offs Ending AR = $400,000 Management estimates 5% uncollectible AFDA had a credit balance of $2,000 at the beginning of the year During the year, there was a write off of $1,200 Calculate estimate of Ending AFDA balance = Ending AR * % uncollectible $20,000 = $400,000 * .05 Dr. Allowance for Doubtful Accounts 1,200 Cr. Accounts Receivable Dr. Bad Debt Expense 19,200 Cr. Allowance for Doubtful Accounts 8-14 AFDA 1,200 19,200 1,200 2,000 19,200 20,000 Bad Debt Expense and Write-offs Ending A/R = $400,000 Management estimates 5% uncollectible AFDA had a credit balance of $2,000 at the beginning of the year During the year, there was a write off of $3,000 Calculate estimate of Ending AFDA balance = Ending AR * % uncollectible $20,000 = $400,000 * .05 Dr. Allowance for Doubtful Accounts Cr. Accounts Receivable 3,000 3,000 Dr. Bad Debt Expense 21,000 Cr. Allowance for Doubtful Accounts 8-15 21,000 AFDA 3,000 2,000 21,000 20,000 Bad Debt Expense and Write-offs Brule Co. has been in business for five years. The unadjusted trial balance at the end of the current year shows: Accounts Receivable Sales Revenue Allowance for Doubtful Accounts $30,000 Dr. $180,000 Cr. $2,000 Dr. Bad debts are estimated to be 10% of receivables. Prepare the entry to adjust Allowance for Doubtful Accounts. Ending Balance AFDA: $3,000 = (10% x $30,000) Bad Debt Expense Allowance for Doubtful Accounts 8-16 *($3,000 + $2,000) 5,000 5,000* What does a debit balance in AFDA mean? Actual write-offs in previous period exceeded estimated bad debt expense AFDA 2,000 5,000 * 3,000 Print for Class - More practice At the beginning of the current period, Griffey Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) 1. 2. 3. 4. 5. 6. Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. What is the net realizable value of the receivables at the end of the period? 1. Prepare entries to record sales and collections during the period Dr. Accounts Receivable Cr. Sales Revenue Dr. Cash 763,000 Cr. Accounts Receivable 8-17 800,000 800,000 763,000 AR 200,000 763,000 800,000 AFDA 9,000 Print for Class - More practice At the beginning of the current period, Griffey Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) 1. 2. 3. 4. 5. 6. Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. What is the net realizable value of the receivables at the end of the period? 2. Prepare entry to record write-off of uncollectible accounts. Dr. Allowance for Doubtful Accounts Cr. Accounts Receivable 7,300 7,300 3. Prepare entries to record recovery of uncollectible accounts. Dr. Accounts Receivable 3,100 Cr. Allowance for Doubtful Accounts 3,100 Dr. Cash Cr. Accounts Receivable 8-18 3,100 3,100 AR 200,000 763,000 800,000 7,300 3,100 3,100 229,700 AFDA 7,300 9,000 3,100 Print for Class - More practice At the beginning of the current period, Griffey Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) 1. 2. 3. 4. 5. 6. Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. What is the net realizable value of the receivables at the end of the period? AR 4. Prepare entry to record bad debt expense. Dr. Bad Debt Expense 20,200 Cr. Allowance for Doubtful Accounts 200,000 763,000 800,000 7,300 3,100 3,100 229,700 20,200 The debit is always to Bad Debt Expense 5. Ending Balance AR = 229,700; Ending Balance AFDA = 25,000 6. NRV = Ending AR - Ending Balance AFDA = $204,700 8-19 AFDA 7,300 9,000 3,100 20,200* 25,000 *25,000+7,300-9,000-3,100=20,200 Explain how companies recognize, value, and dispose of notes receivable. A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. Promissory notes may be used 1. when individuals and companies lend or borrow money, 2. when amount of transaction and credit period exceed normal limits, or 3. in settlement of accounts receivable. 8-20 NOTES RECEIVABLE To the payee, the promissory note is a note receivable. To the maker, the promissory note is a note payable. 8-21 ILLUSTRATION 8-12 Promissory note DETERMINING THE MATURITY DATE Maturity date of a promissory note may be stated in one of three ways: 1. On demand. 2. On a stated date. 3. At the end of a stated period of time. Note terms are expressed in: 8-22 Months Days COMPUTING INTEREST When counting months, only count FULL months. Examples: June 1 – Dec. 31: 7 monthsJune 30 – Oct. 1: 3 months June 30 – Dec. 31: 6 months June 1 – Oct. 1: 4 months 8-23 RECOGNIZING NOTES RECEIVABLE Illustration: Brent Company wrote a $1,000, two-month, 8% promissory note dated May 1, to settle an open account. Prepare the entry to record the Note Receivable (NR). May 1 Dr. Notes Receivable Cr. Accounts Receivable 1,000 1,000 • Notes Receivable is initially recorded at its Face Value • Interest Revenue is earned (accrued) as time passes 8-24 VALUING NOTES RECEIVABLE Report short-term notes receivable at their cash (net) realizable value. NR allowance account is Allowance for Doubtful Accounts. DISPOSING OF NOTES RECEIVABLE 8-25 Held to maturity date (Note is honored) Maker may default (Note is dishonored) Holder sells. Honor of Notes Receivable Illustration: Holder Co. lends Higley Inc. $10,000 on June 1, accepting a five-month, 9% interest note. Holder presents the note to Higley Inc. on November 1, the maturity date. Holder’s June 1 & Nov. 1 entries are: Record the Note Receivable June 1 Dr. Notes Receivable Cr. Cash 10,000 10,000 Record pay off of Note Receivable & Interest earned Nov. 1 Dr. Cash 10,375 Cr. Notes Receivable Cr. Interest Revenue 10,000 375 ($10,000 x 9% x 5/12 = $375) 8-26 Accrual of Interest Receivable Illustration: Suppose instead that Holder Co. prepares financial statements as of September 30. The adjusting entry by Holder is for four months ending Sept. 30. Accrual-type adjusting entries always involve a revenue account or an expense account Illustration 8-15 Timeline of interest earned Sept. 30 Dr. Interest Receivable Cr. Interest Revenue ($10,000 x 9% x 4/12 = $ 300) 8-27 300 300 Accrual of Interest Receivable Illustration: Prepare the entry Holder would make to record the honoring of the Higley note on November 1. Reminder of entries from previous slides: June 1 Dr. Notes receivable Cr. Cash 10,000 Sept. 30 Dr. Interest receivable Cr. Interest revenue 10,000 300 Nov. 1 Dr. Cash 10,375 Cr. Notes Receivable 10,000 Cr. Interest Receivable Cr. Interest Revenue ($10,000 × 9% × 1/12) 8-28 300 300 75 Notes Receivable & Interest – Print for Class These transactions took place for Glavine Co. • May 1, 2016: Received a $5,000, 12-month, 6% note in exchange for an outstanding account receivable from Rooney. • Dec. 31, 2016: Accrued interest revenue on the Rooney note. • May 1, 2017: Received principal plus interest on the Rooney note. (No interest has been accrued since Dec. 31, 2016). Record the transactions in the general journal. Glavine only makes entries to accrue interest at Dec. 31. 5,000 May 1, 2016 Notes Receivable Accounts Receivable 5,000 Dec. 31, 2016 Interest Receivable Interest Revenue 200 200 ($5,000 x 6% x 8/12 = $ 200) May 1, 2017 8-29 Cash 5,300 Notes Receivable Interest Receivable Interest Revenue ($5,000 × 6% × 4/12) 5,000 200 100 Describe the statement presentation of receivables and the principles of receivables management. 8-30 MANAGING RECEIVABLES Managing accounts receivable involves five steps: 1. Determine to whom to extend credit. 2. Establish a payment period. 3. Monitor collections. 4. Accelerate cash receipts from receivables when necessary. 5. Evaluate the liquidity of receivables with ratios (not covering in this class). 8-31 MANAGING RECEIVABLES 8-32 Extending Credit If the credit policy is too tight, you will lose sales. If the credit policy is too loose, you may sell to customer who will pay either very late or not at all. It is important to check references on potential new customers as well as periodically to check the financial health of continuing customers. Establishing a Payment Period Companies should determine a required payment period and communicate that policy to their customers. The payment period should be consistent with that of competitors. MANAGING RECEIVABLES Monitoring Collections 8-33 Companies should prepare an accounts receivable aging schedule at least monthly. ► Helps managers estimate the timing of future cash inflows. ► Provides information about the collection experience of the company and identifies problem accounts. Significant concentrations of credit risk must be discussed in the notes to its financial statements. Accelerating Cash Receipts Sell receivables to a factor (which is a company that buys receivables from businesses for a fee and then collects the payments directly from the customers). Three reasons for the sale of receivables: ► Size of receivables. ► Companies may sell receivables because they may be the only reasonable source of cash. ► Billing and collection are often time-consuming and costly. ETHICS INSIGHT Cookie Jar Allowances There are many pressures on companies to achieve earnings targets. For managers, poor earnings can lead to dismissal or lack of promotion. It is not surprising then that management may be tempted to look for ways to boost their earnings number. One way a company can achieve greater earnings is to lower its estimate of what is needed in its Allowance for Doubtful Accounts (sometimes referred to as “tapping the cookie jar”). For example, suppose a company has an Allowance for Doubtful Accounts of $10 million and decides to reduce this balance to $9 million. As a result of this change, Bad Debt Expense decreases by $1 million and earnings increase by $1 million. Large banks such as JP Morgan Chase, Wells Fargo, and Bank of America recently decreased their Allowance for Doubtful Accounts by over $4 billion. These reductions came at a time when these big banks were still suffering from lower mortgage lending and trading activity, both of which lead to lower earnings. They justified these reductions in the allowance balances by noting that credit quality and economic conditions had improved. This may be so, but it sure is great to have a cookie jar that might be tapped when a boost in earnings is needed. 8-34