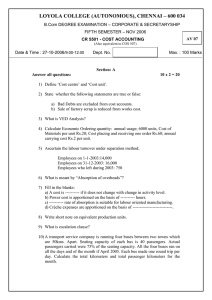

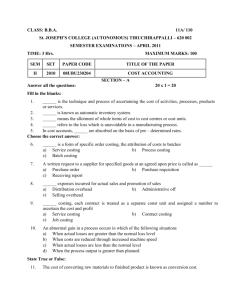

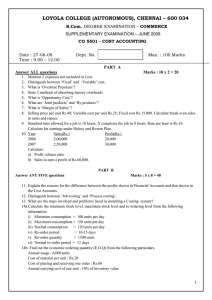

Advanced Cost & Management Accounting Course Material

advertisement