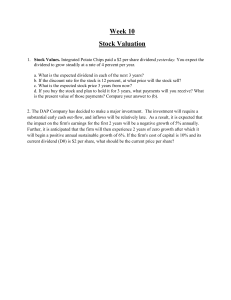

DIVIDEND POLICY Multiple Choice: True/False 1. The optimal distribution policy strikes that balance between current dividends and capital gains that maximizes the firm's stock price. ANS: True PTS: 1 2. Other things held constant, the higher a firm's target payout ratio, the higher its expected growth rate should be. ANS: False PTS: 1 3.Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays out in dividends has no effect on either its cost of capital or its stock price. ANS: True PTS: 1 4. Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays out in dividends has no effect on its cost of capital, but it does affect its stock price. ANS: False PTS: 1 5.If investors prefer firms that retain most of their earnings, then a firm that wants to maximize its stock price should set a low payout ratio. ANS: True PTS: 1 6. A 100% stock dividend and a 2:1 stock split should, at least conceptually, have the same effect on the firm's stock price. ANS: True PTS: 1 7. A “reverse split” reduces the number of shares outstanding. ANS: True PTS: 1 8. The announcement of an increase in the cash dividend should, according to MM, lead to an increase in the price of the firm's stock, other things held constant. ANS: False PTS: 1 9. The federal government sometimes taxes dividends and capital gains at different rates. Other things held constant, an increase in the tax rate on dividends relative to that on capital gains would logically lead to an increase in dividend payout ratios. ANS: False PTS: 1 10. The federal government sometimes taxes dividends and capital gains at different rates. Other things held constant, if the tax rate on dividends is high relative to that on capital gains, then individuals with low taxable incomes should favor stocks with low payouts and high-income individuals should favor high-payout companies. ANS: False PTS: 1 11. It has been argued that investors prefer high-payout companies because dividends are more certain (less risky) than the capital gains that are supposed to come from retained earnings. However, Miller and Modigliani say that this argument is incorrect, and they call it the “bird-in-the-hand fallacy.” MM base their argument on the belief that most dividends are reinvested in stocks, hence are exposed to the same risks as reinvested earnings. ANS: True PTS: 1 12. Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk. ANS: True PTS: 1 13. One implication of the bird-in-the-hand theory of dividends is that a given reduction in dividend yield must be offset by a more than proportionate increase in growth in order to keep a firm's required return constant, other things held constant. ANS: True PTS: 1 14. If a retired individual lives on his or her investment income, then it would make sense for this person to prefer stocks with high payouts so he or she could receive cash without going to the trouble and expense of selling stocks. On the other hand, it would make sense for an individual who would just reinvest any dividends received to prefer a low-payout company because that would save him or her taxes and brokerage costs. ANS: True PTS: 1 15.Some investors prefer dividends to retained earnings (and the capital gains retained earnings bring), while others prefer retained earnings to dividends. Other things held constant, it makes sense for a company to establish its dividend policy and stick to it, and then it will attract a clientele of investors who like that policy. ANS: True PTS: 1 16. Suppose a firm that has been earning P2 and paying a dividend of P1.00, or a 50% dividend payout, announces that it is increasing the dividend to P1.50. The stock price then jumps from P20 to P30. Some people would argue that this is proof that investors prefer dividends to retained earnings. Miller and Modigliani would agree with this argument. ANS: False PTS: 1 17. If the information content, or signaling, hypothesis is correct, then a change in a firm's dividend policy can have an important effect on its stock price and cost of equity. ANS: True PTS: 1 18.If a firm uses the residual dividend model to set dividend policy, then dividends are determined as a residual after providing for the equity required to fund the capital budget. Under this model, the better the firm's investment opportunities, the lower its payout ratio will be, other things held constant. ANS: True PTS: 1 19.If a firm uses the residual dividend model to set dividend policy, then dividends are determined as a residual after providing for the equity required to fund the capital budget. Under this model, the higher the firm's debt ratio, the lower its payout ratio will be, other things held constant. ANS: False PTS: 1 20.If management wants to maximize its stock price, and if it believes that the dividend irrelevance theory is correct, then it must adhere to the residual dividend policy. ANS: False PTS: 1 21.If on January 3, 2012, a company declares a dividend of P1.50 per share, payable on January 31, 2012, then the price of the stock should drop by approximate P1.50 on January 31. ANS: False PTS: 1 22.If on January 3, 2012, a company declares a dividend of $1.50 per share, payable on January 31, 2012, to holders of record on January 19, then the price of the stock should drop by approximately $1.50 on January 17, which is the ex-dividend date. ANS: True PTS: 1 ANS: True PTS: 1 23. One advantage of dividend reinvestment plans is that they allow shareholders to delay paying taxes on the dividends that they choose to reinvest. ANS: False PTS: 1 (15-4) Dividend reinvestment plans F R Answer: a MEDIUM There are two types of dividend reinvestment plans. Under one type of plan, the firm uses the cash that would have been paid as dividends to buy stock on the open market. Under the other type, the company issues new stock, keeps the cash that would have been paid out, and in effect sells new stock to those investors who choose to reinvest their dividends. ANS: True PTS: 1 24. a. b. True False (15-4) Dividend reinvestment plans F R Answer: a MEDIUM 25. If a firm pays out all of its earnings as dividends and its stockholders then elect to have all of their dividends reinvested, the company should reconsider its dividend policy and possibly move to a lower dividend payout ratio. ANS: True PTS: 1 a. b. True False (15-6) Stock split F R Answer: a MEDIUM 26. If a firm declares a 20:1 stock split, and the pre-split price was $500, then we might expect the post-split price to be $25. However, it often turns out that the post-split price will be higher than $25. This higher price could be due to signaling effects-investors believe that management split the stock because they think the firm is going to do better in the future. The higher price could also be because investors like lowerpriced shares. ANS: True PTS: 1 a. b. True False (15-3) Residual dividend model F R Answer: a HARD 27. Your firm uses the residual dividend model to set dividend policy. Market interest rates suddenly rise, and stock prices decline. Your firm's earnings, investment opportunities, and capital structure do not change. If the firm follows the residual dividend model, then its dividend payout ratio would increase. ANS: True PTS: 1 a. b. True False (15-5) WACC and dividend policy F R Answer: b HARD 28. Suppose you plotted a curve which showed a Firm U's WACC on the vertical axis and its debt ratio on the horizontal axis. Then you plotted a similar curve for Firm V. The curve for firm U resembled a shallow “U,” while that for Firm V resembled a sharp “V.” Both firms have debt ratios that cause their WACCs to be minimized. Other things held constant, it would be easier for Firm V than for Firm U to maintain a steady dividend in the face of varying investment opportunities and earnings from year to year. ANS: True PTS: 1 a. b. True False Multiple Choice: Conceptual (15-3) Dividend payout C R Answer: a EASY 29. In the real world, dividends a. are usually more stable than earnings. b. fluctuate more widely than earnings. c. tend to be a lower percentage of earnings for mature firms. d. are usually changed every year to reflect earnings changes, and these changes are randomly higher to lower, depending on whether earnings increased or decreased. e. are usually set as a fixed percentage of earnings, e.g., at 40% of earnings, so if EPS = $2.00, then DPS would equal $0.80. Once the percentage is set, then dividend policy is on “automatic pilot” and the dividend actually paid depends strictly on earnings. (15-6) Stock split C R Answer: b EASY 30. You own 100 shares of Troll Brothers' stock, which currently sells for $120 a share. The company is about to declare a 2-for-1 stock split. Which of the following best describes your likely position after the split? a. You will have 200 shares of stock, and the stock will trade at or near $120 a share. b. You will have 200 shares of stock, and the stock will trade at or near $60 a share. c. You will have 100 shares of stock, and the stock will trade at or near $60 a share. d. You will have 50 shares of stock, and the stock will trade at or near $120 a share. e. You will have 50 shares of stock, and the stock will trade at or near $600 a share. (15-1) Investors' div. preferences C R Answer: d MEDIUM 31. Myron Gordon and John Lintner believe that the required return on equity increases as the dividend payout ratio is lowered. Their argument is based on the assumption that a. investors are indifferent between dividends and capital gains. b. investors require that the dividend yield plus the capital gains yield equal a constant. c. capital gains are taxed at a higher rate than dividends. d. investors view dividends as being less risky than potential future capital gains. e. investors prefer a dollar of expected capital gains to a dollar of expected dividends because of the lower tax rate on capital gains. (15-3) Residual dividend model C R Answer: a MEDIUM 32. Your firm adheres strictly to the residual dividend model. All else equal, which of the following factors would be most likely to lead to an increase in the firm's dividend per share? a. The firm's net income increases. b. The company increases the percentage of equity in its target capital structure. c. The number of profitable potential projects increases. d. Congress lowers the tax rate on capital gains, leaving the rest of the tax code unchanged. e. Earnings are unchanged, but the firm issues new shares of common stock. (15-3) Residual dividend model C R Answer: b MEDIUM 33. If a firm adheres strictly to the residual dividend policy, and if its optimal capital budget requires the use of all earnings for a given year (along with new debt according to the optimal debt/assets ratio), then the firm should pay a. b. c. d. e. the same dividend as it paid the prior year. no dividends to common stockholders. dividends only out of funds raised by the sale of new common stock. dividends only out of funds raised by borrowing money (i.e., issuing debt). dividends only out of funds raised by selling off fixed assets. (15-3) Residual dividend model C R Answer: c MEDIUM 34. If a firm adheres strictly to the residual dividend model, the issuance of new common stock would suggest that a. b. c. d. e. the dividend payout ratio has remained constant. the dividend payout ratio is increasing. no dividends will be paid during the year. the dividend payout ratio is decreasing. the dollar amount of capital investments had decreased. (15-5) Factors in div. policy C R Answer: d MEDIUM 35. Which of the following does NOT normally influence a firm's dividend policy decision? a. The firm's ability to accelerate or delay investment projects without adverse consequences. b. A strong preference by most of its shareholders for current cash income versus potential future capital gains. c. Constraints imposed by the firm's bond indenture. d. The fact that much of the firm's equipment is leased rather than bought and owned. e. The fact that Congress is considering changes in the tax law regarding the taxation of dividends versus capital gains. (15-5) Factors in div. policy C R Answer: c MEDIUM 36. Which of the following would be most likely to lead to a decrease in a firm's dividend payout ratio? a. Its earnings become more stable. b. Its access to the capital markets increases. c. Its research and development efforts pay off, and it now has more high-return investment opportunities. d. Its accounts receivable decrease due to a change in its credit policy. e. Its stock price has increased over the last year by a greater percentage than the increase in the broad stock market averages. (15-6) Stock dividends and splits C R Answer: e MEDIUM 37. Which of the following statements is CORRECT? a. When firms are deciding on the size of stock splits--say whether to declare a 2for-1 split or a 3-for-1 split, it is best to declare the smaller one, in this case the 2-for-1 split, because then the after-split price will be higher than if the 3-for-1 split had been used. b. Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and reverse splits are illegal today. c. Stock splits create more administrative problems for investors than stock dividends, especially determining the tax basis of their shares when they decide to sell them, so today stock dividends are used far more often than stock splits. d. When a company declares a stock split, the price of the stock typically declines-for example, by about 50% after a 2-for-1 split--and this necessarily reduces the total market value of the firm's equity. e. If a firm's stock price is quite high relative to most stocks--say $500 per share-then it can declare a stock split of say 20-for-1 so as to bring the price down to something close to $25. Moreover, if the price is relatively low--say $2 per share--then it can declare a “reverse split” of say 1-for-10 so as to bring the price up to somewhere around $20 per share. (Comp.) Dividend theories C R Answer: e MEDIUM 38. Which of the following statements about dividend policies is CORRECT? a. Miller and Modigliani argued that investors prefer dividends to capital gains because dividends are more certain than capital gains. They call this the “bird-in-thehand” effect. b. One reason that companies tend to favor distributing excess cash as dividends rather than by repurchasing stock is that dividends are normally taxed at a lower rate than gains on repurchased stock. c. One advantage of dividend reinvestment plans is that they allow shareholders to delay paying taxes on the dividends that they choose to reinvest. d. One key advantage of the residual dividend model is that it enables a company to follow a stable dividend policy. e. The clientele effect suggests that companies should follow a stable dividend policy. (Comp.) Repurchases and DRIPS C R Answer: c MEDIUM 39. Which of the following statements is CORRECT? a. One disadvantage of dividend reinvestment plans is that they increase transactions costs for investors who want to increase their investment in the company. b. One advantage of dividend reinvestment plans is that they enable investors to postpone paying taxes on the dividends credited to their account. c. Stock repurchases can be used by a firm that wants to increase its debt ratio. d. Stock repurchases make sense if a company expects to have a lot of profitable new projects to fund over the next few years, provided investors are aware of these investment opportunities. e. One advantage of an open market dividend reinvestment plan is that it provides new equity capital and increases the shares outstanding. (Comp.) Divs., DRIPs, and repurch. C R Answer: d MEDIUM 40. Which of the following statements is CORRECT? a. Under the tax laws as they existed in 2011, a dollar received by an individual taxpayer as interest income is taxed at the same rate as a dollar received as dividends. b. One nice feature of dividend reinvestment plans (DRIPs) is that they reduce the taxes investors would have to pay if they received cash dividends. c. Empirical research indicates that, in general, companies send a negative signal to the marketplace when they announce an increase in the dividend. As a result, share prices fall when dividend increases are announced because investors interpret the increase as a signal that the firm expects fewer good investment opportunities in the future. d. If a company needs to raise new equity capital, a new-stock dividend reinvestment plan would make sense. However, if the firm does not need new equity, then an open market purchase dividend reinvestment plan would probably make more sense. e. Dividend reinvestment plans have not caught on in most industries, and today over 99% of all DRIPs are offered by utilities. (Comp.) Div. policy and repurchases C R Answer: d MEDIUM 41. Which of the following statements is CORRECT? a. Historically, the tax code has encouraged companies to pay dividends rather than retain earnings. b. If a company uses the residual dividend model to determine its dividend payments, dividend payout will tend to increase whenever its profitable investment opportunities increase relatively rapidly. c. The more a firm's management believes in the clientele effect, the more likely the firm is to adhere strictly to the residual dividend model. d. Large stock repurchases financed by debt tend to increase expected earnings per share, but they also tend to increase the firm's financial risk. e. A dollar paid out to repurchase stock has the same tax benefit as a dollar paid out in dividends. Thus, both companies and investors should be indifferent between distributing cash through dividends and stock repurchase programs. (Comp.) Dividend concepts C R Answer: c MEDIUM 42. Which of the following statements is CORRECT? a. If a company has a 2-for-1 stock split, its stock price should roughly double. b. Capital gains earned on shares repurchased are taxed less favorably than dividends, which is why companies typically pay dividends and avoid share repurchases. c. Very often, a company's stock price will rise when it announces that it plans to commence a share repurchase program. Such an announcement could lead to a stock price decline, but this does not normally happen. d. Stock repurchases increase the number of outstanding shares. e. The clientele effect is the best explanation for why companies tend to vary their dividend payments from quarter to quarter. (Comp.) Dividend concepts C R Answer: e MEDIUM 43. Which of the following statements is CORRECT? a. Firms with a lot of good investment opportunities and a relatively small amount of cash tend to have above-average dividend payout ratios. b. One advantage of the residual dividend model is that it leads to a stable dividend payout, which investors like. c. An increase in the stock price when a company cuts its dividend is consistent with signaling theory as postulated by MM. d. If the “clientele effect” is correct, then for a company whose earnings fluctuate, a policy of paying a constant percentage of net income will probably maximize its stock price. e. Stock repurchases make the most sense at times when a company believes its stock is undervalued. (Comp.) Dividend concepts C R Answer: b MEDIUM 44. Which of the following statements is CORRECT? a. One advantage of dividend reinvestment plans is that they enable investors to avoid paying taxes on the dividends they receive. b. If a company has an established clientele of investors who prefer a high dividend payout, and if management wants to keep stockholders happy, it should not adhere strictly to the residual dividend model. c. If a firm adheres strictly to the residual dividend model, then, holding all else constant, its dividend payout ratio will tend to rise whenever its investment opportunities improve. d. If Congress eliminates taxes on capital gains but leaves the personal tax rate on dividends unchanged, this would motivate companies to increase their dividend payout ratios. e. Despite its drawbacks, following the residual dividend model will tend to stabilize actual cash dividends, and this will make it easier for firms to attract a clientele that prefers high dividends, such as retirees. (Comp.) Dividend concepts C R Answer: b MEDIUM 45. Firm M is a mature company in a mature industry. Its annual net income and cash flows are consistently high and stable. However, M's growth prospects are quite limited, so its capital budget is small relative to its net income. Firm N is a relatively new company in a new and growing industry. Its markets and products have not stabilized, so its annual operating income fluctuates considerably. However, N has substantial growth opportunities, and its capital budget is expected to be large relative to its net income for the foreseeable future. Which of the following statements is CORRECT? a. Firm M probably has a lower target debt ratio than Firm N. b. Firm M probably has a higher target dividend payout ratio than Firm N. c. If the corporate tax rate increases, the debt ratio of both firms is likely to decline. d. The two firms are equally likely to pay high dividends. e. Firm N is likely to have a clientele of shareholders who want a consistent, stable dividend income. (Comp.) Dividend concepts C R Answer: a MEDIUM 46. Which of the following statements is CORRECT? a. If a firm repurchases some of its stock in the open market, then shareholders who sell their stock for more than they paid for it will be subject to capital gains taxes. b. An open-market dividend reinvestment plan will be most attractive to companies that need new equity and would otherwise have to issue additional shares of common stock through investment bankers. c. Stock repurchases tend to reduce financial leverage. d. If a company declares a 2-for-1 stock split, its stock price should roughly double. e. One advantage of adopting the residual dividend model is that this makes it easier for corporations to meet the requirements of Modigliani and Miller's dividend clientele theory. (Comp.) Dividend concepts C R Answer: e MEDIUM 47. Which of the following actions will best enable a company to raise additional equity capital, other things held constant? a. b. c. d. e. Refund long-term debt with lower cost short-term debt. Declare a stock split. Begin an open-market purchase dividend reinvestment plan. Initiate a stock repurchase program. Begin a new-stock dividend reinvestment plan. (Comp.) Repurchases and splits C R Answer: e MEDIUM 48. Which of the following statements is NOT CORRECT? a. Stock repurchases can be used by a firm as part of a plan to change its capital structure. b. After a 3-for-1 stock split, a company's price per share should fall, but the number of shares outstanding will rise. c. Investors may interpret a stock repurchase program as a signal that the firm's managers believe the stock is undervalued, or, alternatively, as a signal that the firm does not have many good investment opportunities. d. A company can repurchase stock to distribute a large one-time cash inflow, say from the sale of a division, to stockholders without having to increase its regular dividend. e. Stockholders pay no income tax on dividends if the dividends are used to purchase stock through a dividend reinvestment plan. (Comp.) Dividend concepts C R Answer: a MEDIUM/HARD 49. Which of the following statements is CORRECT? a. If a firm follows the residual dividend model, then a sudden increase in the number of profitable projects would be likely to lead to a reduction of the firm's dividend payout ratio. b. The clientele effect explains why so many firms change their dividend policies so often. c. One advantage of adopting the residual dividend model is that this policy makes it easier for a corporation to attract a specific and well-identified dividend clientele. d. New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity. e. Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received. (Comp.) Dividend concepts C R Answer: d MEDIUM/HARD 50. Which of the following statements is CORRECT? a. Suppose a firm that has been earning $2 and paying a dividend of $1.00, or a 50% dividend payout, announces that it is increasing the dividend to $1.50. The stock price then jumps from $20 to $30. Some people would argue that this is proof that investors prefer dividends to retained earnings. Miller and Modigliani would agree with this argument. b. Other things held constant, the higher a firm's target dividend payout ratio, the higher its expected growth rate should be. c. Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings that a firm pays out in dividends has no effect on its cost of capital, but it does affect its stock price. d. The federal government sometimes taxes dividends and capital gains at different rates. Other things held constant, an increase in the tax rate on dividends relative to that on capital gains would logically lead to a decrease in dividend payout ratios. e. If investors prefer firms that retain most of their earnings, then a firm that wants to maximize its stock price should set a high dividend payout ratio. Multiple Choice: Problems These problems can be changed algorithmically, and the computer can, at times, produce combinations of variables where the residual policy results in zero dividends and a zero payout ratio. We sometimes constrain the input variables to prevent this from occurring, but we sometimes permit it. When this possibility exists, we so indicate. (15-3) Residual dividend model C R Answer: d EASY 51. Portland Plastics Inc. has the following data. If it follows the residual dividend model, what is its forecasted dividend payout ratio? Capital budget % Debt 40% Net income (NI) a. b. c. d. e. $12,500 $11,500 25.36% 28.17% 31.30% 34.78% 38.26% (15-6) Stock split C R Answer: c EASY 52. Becker Financial recently declared a 2-for-1 stock split. Prior to the split, the stock sold for $80 per share. If the firm's total market value is unchanged by the split, what will the stock price be following the split? a. b. c. d. e. $36.10 $38.00 $40.00 $42.00 $44.10 (15-6) Stock split C R Answer: a EASY 53. Toombs Media Corp. recently completed a 3-for-1 stock split. Prior to the split, its stock sold for $90 per share. The firm's total market value was unchanged by the split. Other things held constant, what is the best estimate of the stock's post-split price? a. b. c. d. e. $30.00 $31.50 $33.08 $34.73 $36.47 (15-6) Stock split C R Answer: c EASY 54. Mid-State BankCorp recently declared a 7-for-2 stock split. Prior to the split, the stock sold for $80 per share. If the firm's total market value is unchanged by the split, what will the stock price be following the split? a. b. c. d. e. $20.63 $21.71 $22.86 $24.00 $25.20 (15-3) Residual dividend model C R Answer: b EASY/MEDIUM 55. Fauver Industries plans to have a capital budget of $650,000. It wants to maintain a target capital structure of 40% debt and 60% equity, and it also wants to pay a dividend of $225,000. If the company follows the residual dividend model, how much net income must it earn to meet its investment requirements, pay the dividend, and keep the capital structure in balance? a. b. c. d. e. $584,250 $615,000 $645,750 $678,038 $711,939 (15-3) Residual dividend model C R Answer: b MEDIUM 56. Ring Technology has a capital budget of $850,000, it wants to maintain a target capital structure of 35% debt and 65% equity, and it also wants to pay a dividend of $400,000. If the company follows the residual dividend model, how much net income must it earn to meet its capital budgeting requirements and pay the dividend, all while keeping its capital structure in balance? a. b. c. d. e. $ 904,875 $ 952,500 $1,000,125 $1,050,131 $1,102,638 (15-3) Residual dividend model C R Answer: a MEDIUM 57. D. Paul Inc. forecasts a capital budget of $725,000. The CFO wants to maintain a target capital structure of 45% debt and 55% equity, and she also wants to pay a dividend of $500,000. If the company follows the residual dividend model, how much income must it earn, and what will its dividend payout ratio be? a. b. c. d. e. $ 898,750; 55.63% $ 943,688; 58.41% $ 990,872; 61.34% $1,040,415; 64.40% $1,092,436; 67.62% (15-3) Residual dividend model C R Answer: d MEDIUM 58. Banerjee Inc. wants to maintain a target capital structure with 30% debt and 70% equity. Its forecasted net income is $550,000, and its board of directors has decreed that no new stock can be issued during the coming year. If the firm follows the residual dividend model, what is the maximum capital budget that is consistent with maintaining the target capital structure? a. b. c. d. e. $673,652 $709,107 $746,429 $785,714 $825,000 (15-3) Residual dividend model C R Answer: d MEDIUM 59. Dentaltech Inc. projects the following data for the coming year. If the firm follows the residual dividend model and also maintains its target capital structure, what will its dividend payout ratio be? EBIT $2,000,000 Interest rate 10% Debt outstanding Shares outstanding a. b. c. d. e. Capital budget $850,000 % Debt 40% $5,000,000 % Equity 60% 5,000,000 Tax rate 40% 37.2% 39.1% 41.2% 43.3% 45.5% (15-3) Residual dividend model C R Answer: c MEDIUM 60. Mortal Inc. expects to have a capital budget of $500,000 next year. The company wants to maintain a target capital structure with 30% debt and 70% equity, and its forecasted net income is $400,000. If the company follows the residual dividend model, how much in dividends, if any, will it pay? a. b. c. d. e. $45,125 $47,500 $50,000 $52,500 $55,125 (15-3) Residual dividend model C R Answer: e MEDIUM 61. Torrence Inc. has the following data. If it uses the residual dividend model, how much total dividends, if any, will it pay out? Capital budget % Debt 60% Net income (NI) a. b. c. d. e. $1,000,000 $625,000 $183,264 $192,909 $203,063 $213,750 $225,000 (15-3) Residual dividend model C R Answer: e MEDIUM 62. NY Fashions has the following data. If it follows the residual dividend model, how much total dividends, if any, will it pay out? Capital budget % Debt 65% Net income (NI) a. b. c. d. $20,363 $21,434 $22,563 $23,750 $1,500,000 $550,000 e. $25,000 (15-3) Residual dividend model C R Answer: a MEDIUM 63. Chicago Brewing has the following data, dollars in thousands. If it follows the residual dividend model, what will its dividend payout ratio be? Capital budget % Debt 45% Net income (NI) a. b. c. d. e. $5,000 $5,300 48.11% 50.52% 55.57% 61.13% 67.24% (15-3) Residual dividend model C R Answer: a MEDIUM 64. LA Moving Company has the following data, dollars in thousands. If it follows the residual dividend model, what will its dividend payout ratio be? Capital budget % Debt 45% Net income (NI) a. b. c. d. e. $5,000 $7,000 60.71% 63.75% 70.13% 77.14% 84.85% (15-3) Residual dividend model C R Answer: d MEDIUM 65. New Orleans Builders Inc. has the following data. If it follows the residual dividend model, what is its forecasted dividend payout ratio? Capital budget % Debt 35% Net income (NI) a. b. c. d. e. $7,500 $6,500 18.23% 20.25% 22.50% 25.00% 27.50% (15-6) Stock split C R Answer: c MEDIUM 66. Ross-Jordan Financial has suffered losses in recent years, and its stock currently sells for only $0.50 per share. Management wants to use a reverse split to get the price up to a more “reasonable” level, which it thinks is $25 per share. How many of the old shares must be given up for one new share to achieve the $25 price, assuming this transaction has no effect on total market value? a. b. c. d. 47.50 49.88 50.00 52.50 e. 55.13 (15-6) Stock split C R Answer: b MEDIUM 67. Keys Financial has done extremely well in recent years, and its stock now sells for $175 per share. Management wants to get the price down to a more typical level, which it thinks is $25 per share. What stock split would be required to get to this price, assuming the transaction has no effect on the total market value? Put another way, how many new shares should be given per one old share? a. b. c. d. e. 6.98 7.00 7.35 7.72 8.10 (15-6) Stock split C R Answer: b MEDIUM 68. Whited Products recently completed a 4-for-1 stock split. Prior to the split, its stock sold for $120 per share. If the firm's total market value increased by 5% as a result of increased liquidity and favorable signaling effects, what was the stock price following the split? a. b. c. d. e. $29.93 $31.50 $33.08 $34.73 $36.47 (15-3) Residual dividend model C R Answer: c MEDIUM/HARD 69. Clark Farms Inc. has the following data, and it follows the residual dividend model. Currently, it finances with 15% debt. Some Clark family members would like for the dividends to be increased. If Clark increased its debt ratio, which the firm's treasurer thinks is feasible, by how much could the dividend be increased, holding other things constant? Capital budget $3,000,000 Net income (NI) $3,500,000 % Debt now 15% % Debt after change 60% a. b. c. d. e. $1,093,500 $1,215,000 $1,350,000 $1,485,000 $1,633,500 (15-3) Residual dividend model C R Answer: a MEDIUM/HARD 70. Purcell Farms Inc. has the following data, and it follows the residual dividend model. Currently, it finances with 15% debt. Some Purcell family members would like for the dividend payout ratio to be increased. If Purcell increased its debt ratio, which the firm's treasurer thinks is feasible, by how much could the dividend payout ratio be increased, holding other things constant? Capital budget $3,000,000 Net income (NI) $3,500,000 % Debt now 15% % Debt after change 60% a. b. c. d. e. 38.6% 40.5% 42.5% 44.7% 46.9% (15-3) Residual dividend model C R Answer: c MEDIUM/HARD 71. Whitman Antique Cars Inc. has the following data, and it follows the residual dividend model. Some Whitman family members would like more dividends, and they also think that the firm's capital budget includes too many projects whose NPVs are close to zero. If Whitman reduced its capital budget to the indicated level, by how much could dividends be increased, holding other things constant? Original capital budget $3,000,000 New capital budget $2,000,000 Net income $3,500,000 % Debt 40% a. b. c. d. e. $486,000 $540,000 $600,000 $660,000 $726,000 (15-3) Residual dividend model C R Answer: e MEDIUM/HARD 72. Pavlin Corp.'s projected capital budget is $2,000,000, its target capital structure is 40% debt and 60% equity, and its forecasted net income is $900,000. If the company follows the residual dividend model, how much dividends will it pay or, alternatively, how much new stock must it issue? a. b. c. d. e. $462,983; $244,352 $487,350; $257,213 $513,000; $270,750 $540,000; $285,000 $ 0; $300,000 (15-6) Stock split C R Answer: b MEDIUM/HARD 73. Grullon Co. is considering a 7-for-3 stock split. The current stock price is $75.00 per share, and the firm believes that its total market value would increase by 5% as a result of the improved liquidity that should follow the split. What is the stock's expected price following the split? a. b. c. d. e. $32.06 $33.75 $35.44 $37.21 $39.07 (15-3) Residual dividend model C R Answer: c HARD 74. Walter Industries is a family owned concern. It has been using the residual dividend model, but family members who hold a majority of the stock want more cash dividends, even if that means a slower future growth rate. Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio. By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio? % Debt 35% % Equity = 1.0 – % Debt 65% Capital budget under the residual dividend model $5,000,000 Net income; it will not change this year dividends increase $3,500,000 Equity to support the capital = % Equity × Capital budget $3,250,000 Dividends paid = NI − Equity needed $250,000 Currently projected dividend payout ratio7.1% Target dividend payout ratio 70.0% a. b. c. d. e. even if budget -$2,741,538 -$3,046,154 -$3,384,615 -$3,723,077 -$4,095,385 (15-3) Residual dividend model C R Answer: e HARD 75. Sheehan Corp. is forecasting an EPS of $3.00 for the coming year on its 500,000 outstanding shares of stock. Its capital budget is forecasted at $800,000, and it is committed to maintaining a $2.00 dividend per share. It finances with debt and common equity, but it wants to avoid issuing any new common stock during the coming year. Given these constraints, what percentage of the capital budget must be financed with debt? a. b. c. d. e. 30.54% 32.15% 33.84% 35.63% 37.50% (15-3) Residual dividend model C R Answer: e HARD 76. Del Grasso Fruit Company has more positive NPV projects than it can finance under its current policies without issuing new stock, but its board of directors had decreed that it cannot issue any new shares in the foreseeable future. Your boss, the CFO, wants to know how the capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy. You obtained the following data, which shows the firm's projected net income (NI), its current capital structure and dividend payout policies, and three possible new policies. Projected net income for the coming year will not be affected by a policy change. How much larger could the capital budget be if (1) the target debt ratio were raised to the indicated amount, other things held constant, (2) the target payout ratio were lowered to the indicated amount, other things held constant, or (3) the debt ratio and dividend payout were both changed by the indicated amounts? Current Policy Changes Policy Increase Debt Lower Payout Projected NI $175.0 $175.0 $175.0 $175.0 % Debt 25.0% 75.0% 25.0% 75.0% % Equity 75.0% 25.0% 75.0% 25.0% % Payout 65.0% 65.0% 20.0% 20.0% a. b. c. d. e. $133.0; $ 85.5; $389.6 $140.0; $ 90.0; $410.1 $147.4; $ 94.8; $431.7 $155.2; $ 99.8; $454.4 $163.3; $105.0; $478.3 Do Both CHAPTER 15 ANSWERS AND SOLUTIONS 1. (15-1) Optimal distribution policy F R Answer: a EASY 2. (15-1) Target payout ratio Answer: b EASY F R The higher the payout ratio, the less of its earnings the firm reinvests in the business, and the lower the reinvestment rate, the lower the firm’s growth rate. 3. (15-1) Dividend irrelevance F R Answer: a EASY 4. (15-1) Dividend irrelevance F R Answer: b EASY 5. (15-1) Investors' div. preferences F R Answer: a EASY 6. (15-6) Stock dividends and splits F R Answer: a EASY 7. (15-6) Reverse split Answer: a EASY 8. (15-1) Dividends and stock prices F R Answer: b MEDIUM 9. (15-1) Dividends and stock prices F R Answer: b MEDIUM 10. (15-1) Dividends and stock prices F R Answer: b MEDIUM 11. (15-1) Dividends and stock prices F R Answer: a MEDIUM 12. (15-1) Dividend irrelevance F R Answer: a MEDIUM 13. (15-1) Dividend-growth tradeoff F R Answer: a MEDIUM 14. (15-2) Dividends and stock prices F R Answer: a MEDIUM 15. (15-2) Dividends and stock prices F R Answer: a MEDIUM 16. (15-2) Dividends and stock prices F R Answer: b MEDIUM F R MM would disagree. They would say that investors took the dividend increase as a signal that the firm's management expected higher future earnings. MM say dividends have information content regarding future earnings. 17. (15-2) Signaling hypothesis F R Answer: a MEDIUM 18. (15-3) Residual dividend model F R Answer: a MEDIUM 19. (15-3) Residual dividend model F R Answer: b MEDIUM The higher the debt ratio, the more dollars of debt will be used to fund a given capital budget. So, the higher the debt ratio, the less equity will be needed, and this results in a higher dividend payout ratio according to the residual dividend model. 20. (15-3) Residual dividend model F R Answer: b MEDIUM 21. (15-3) Dividend payment procedures F R Answer: b MEDIUM This is false. The stock price will drop on the ex-dividend date, which is two days prior to the holder of record date, which is well before the actual January 31 payment date. Also, because the dividend is taxable, the price decline is generally somewhat less than the full amount of the dividend. 22. (15-3) Dividend payment procedures F R Answer: a MEDIUM This is true. The stock price will drop on the ex-dividend date, which is two days prior to the holder of record date, which is well before the actual January 31 payment date. Note, though, that because the dividend is taxable, the price decline may be somewhat less than the full amount of the dividend. 23. (15-4) Dividend reinvestment plans F R Answer: b MEDIUM 24. (15-4) Dividend reinvestment plans F R Answer: a MEDIUM 25. (15-4) Dividend reinvestment plans F R Answer: a MEDIUM This is true, because if the company retains its earnings rather than paying them out, investors should receive capital gains rather than dividend income, and the taxes on those gains will be deferred until the stock is sold. Note that the money will be reinvested by the company in either case, so the risk to stockholders under dividend reinvestment and retained earnings should be the same. 26. (15-6) Stock split F R 27. (15-3) Residual dividend model F R Answer: a Answer: a MEDIUM HARD (1) The firm's WACC would increase, (2) this would cause fewer projects to be accepted, (3) this would lead to a smaller capital budget, (4) thus less money would be needed to fund the capital budget, (5) thus less equity would be needed, so (6) the dividend payout ratio would increase. 28. (15-5) WACC and dividend policy F R Answer: b HARD Firm U could fund its capital budget with varying amounts of debt without causing large changes in its WACC and thus in its value and stock price. Firm V could not vary its debt ratio without increasing its WACC. Thus, Firm V would have to raise and lower its dividend payout in order to obtain the equity it needed to support its capital budget. Firm U, on the other hand, could maintain a stable, steady dividend, and let the debt ratio vary without causing much harm to its stock price. 29. (15-3) Dividend payout C R Answer: a EASY 30. (15-6) Stock split C R Answer: b EASY 31. (15-1) Investors' div. preferences C R Answer: d MEDIUM 32. (15-3) Residual dividend model C R Answer: a MEDIUM 33. (15-3) Residual dividend model C R Answer: b MEDIUM 34. (15-3) Residual dividend model C R Answer: c MEDIUM 35. (15-5) Factors in div. policy C R Answer: d MEDIUM 36. (15-5) Factors in div. policy C R Answer: c MEDIUM 37. (15-6) Stock dividends and splits C R Answer: e MEDIUM 38. (Comp.) Dividend theories C R Answer: e MEDIUM 39. (Comp.) Repurchases and DRIPS C R Answer: c MEDIUM 40. (Comp.) Divs., DRIPs, and repurch. C R Answer: d MEDIUM 41. (Comp.) Div. policy and repurchases C R Answer: d MEDIUM 42. (Comp.) Dividend concepts C R Answer: c MEDIUM c is correct, but perhaps the easiest way to answer this question is to eliminate the other choices, which are obviously wrong. 43. (Comp.) Dividend concepts C R Answer: e MEDIUM 44. (Comp.) Dividend concepts C R Answer: b MEDIUM 45. (Comp.) Dividend concepts C R Answer: b MEDIUM 46. (Comp.) Dividend concepts C R Answer: a MEDIUM 47. (Comp.) Dividend concepts C R Answer: e MEDIUM 48. (Comp.) Repurchases and splits C R Answer: e MEDIUM 49. (Comp.) Dividend concepts C R Answer: a MEDIUM/HARD 50. (Comp.) Dividend concepts C R Answer: d MEDIUM/HARD 51. (15-3) Residual dividend model C R Capital budget Net income (NI) % Debt % Equity = 1.0 – %Debt = Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive, otherwise $0.0. Answer: d EASY $12,500 $11,500 40% 60% $7,500 $4,000 Payout ratio = Dividends paid/NI = 34.78% 52. (15-6) Stock split Number of new shares Number of old shares Old (pre-split) price C R Answer: c EASY C R Answer: a EASY C R Answer: c EASY 2 1 $80 New price = Old price × (Old shares/New shares) = $40.00 53. (15-6) Stock split Number of new shares Number of old shares Pre-split stock price 3 1 $90.00 Post-split stock price: P0/New per old = $30.00 54. (15-6) Stock split Number of new shares Number of old shares Old (pre-split) price 7 2 $80.00 New price = Old price × (Old shares/New shares) = $22.86 55. (15-3) Residual dividend model Capital budget $650,000 C R Answer: b EASY/MEDIUM % Equity Dividends to be paid 60% $225,000 Required net income = Dividends + (Capital budget × % Equity) = $615,000 56. (15-3) Residual dividend model Capital budget Equity ratio Dividends to be paid C R Answer: b MEDIUM Answer: a MEDIUM Answer: d MEDIUM $850,000 65% $400,000 Required net income = Dividends + (Capital budget × % Equity) = $952,500 57. (15-3) Residual dividend model Capital budget Equity ratio Dividends paid C R $725,000 55% $500,000 NI = Dividends + (Equity % × Capital budget) = $898,750 Payout = Dividends/NI = 55.63% 58. (15-3) Residual dividend model % Debt % Equity Net income Max. capital budget = NI/% Equity C R 30% 70% $550,000 $785,714 Check: Is calculated Max. capital budget × % Equity = NI? $550,000 = Net income 59. (15-3) Residual dividend model EBIT Interest rate Debt outstanding Shares outstanding $2,000,000 10% $5,000,000 5,000,000 C R Answer: d Capital budget % Debt % Equity Tax rate EBIT − Interest expense = Interest rate × Debt Taxable income − Taxes = Tax rate × Income Net income (NI) − Equity needed for capital budget = % Equity(Capital budget) MEDIUM $850,000 40% 60% 40% $2,000,000 500,000 $1,500,000 600,000 $ 900,000 510,000 Dividends = NI − Equity needed $ 390,000 Payout ratio = Dividends/NI = 43.33% 60. (15-3) Residual dividend model % Debt % Equity Capital budget Net income Equity requirement = Capital budget × % Equity C R Answer: c MEDIUM Answer: e MEDIUM 30% 70% $500,000 $400,000 $350,000 Dividends = NI − Equity requirement = $50,000 61. (15-3) Residual dividend model C R Capital budget Net income (NI) % Debt % Equity = 1.0 – % Debt Equity needed to support the capital budget = % Equity × Capital budget $1,000,000 $625,000 60% 40% $400,000 Dividends paid = NI − Equity needed if positive (otherwise, $0.0) = $225,000 62. (15-3) Residual dividend model C R Capital budget Net income (NI) % Debt % Equity = 1.0 – % Debt Equity needed to support the capital budget = % Equity × Capital budget Answer: e MEDIUM $1,500,000 $550,000 65% 35% $525,000 Dividends paid = NI − Equity needed if positive (otherwise, $0.0) = $25,000 63. 64. (15-3) Residual dividend model C R Answer: a Capital budget Net income (NI) % Debt % Equity = 1.0 – % Debt Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) $5,000 $5,300 45% 55% $2,750 $2,550 Payout ratio = Dividends paid/NI = 48.11% (15-3) Residual dividend model Answer: a C R Capital budget Net income (NI) % Debt % Equity = 1.0 – % Debt Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) MEDIUM MEDIUM $5,000 $7,000 45% 55% $2,750 $4,250 Payout ratio = Dividends paid/NI = 60.71% 65. (15-3) Residual dividend model Capital budget Net income (NI) C R Answer: d $7,500 $6,500 MEDIUM % Debt % Equity = 1.0 – % Debt Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) 35% 65% $4,875 $1,625 Payout ratio = Dividends paid/NI = 25.00% 66. (15-6) Stock split Current price Target price C R Answer: c MEDIUM Answer: b MEDIUM Answer: b MEDIUM $0.50 $25.00 Old shares surrendered per 1 new share = Target price/Old price = 50.00 67. (15-6) Stock split Current price Target price C R $175.00 $25.00 No. of new shares per 1 old share = Current price/Target price = 7.00 68. (15-6) Stock split New shares per 1 old share Pre-split stock price % value increase C R 4 $120 5% Post-split stock price = (P0/[New shares per old shares) × (1 + % Value increase)] = $31.50 69. (15-3) Residual dividend model C R % Debt % Equity = 1.0 – % Debt Capital budget Net income (NI) Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) Answer: c Old 15% 85% $3,000,000 $3,500,000 $2,550,000 $950,000 MEDIUM/HARD New 60% 40% $3,000,000 $3,500,000 $1,200,000 $2,300,000 Increase in dividends paid = $1,350,000 70. (15-3) Residual dividend model C R % Debt % Equity = 1.0 – % Debt Capital budget Net income (NI) Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) Dividend payout ratio Answer: a Old 15% 85% $3,000,000 $3,500,000 $2,550,000 $950,000 27.1% MEDIUM/HARD New 60% 40% $3,000,000 $3,500,000 $1,200,000 $2,300,000 65.7% Increase in dividend payout ratio = 38.6% 71. (15-3) Residual dividend model % Debt % Equity = 1.0 – % Debt C R Answer: c Old 40% 60% MEDIUM/HARD New 40% 60% Capital budget Net income (NI) Equity needed to support the capital budget = % Equity × Capital budget Dividends paid = NI − Equity needed if positive (otherwise, $0.0) $3,000,000 $3,500,000 $1,800,000 $1,700,000 $2,000,000 $3,500,000 $1,200,000 $2,300,000 Increase in dividends paid = $600,000 72. (15-3) Residual dividend model C R Answer: e Capital budget % Equity Net income (NI) Equity required for capital budget = % Equity × Capital budget Dividends = NI – Equity required if > 0 (otherwise, 0) = Required new stock = NI – Equity required if < 0 (otherwise, 0) = $2,000,000 60% $900,000 $1,200,000 $0 $300,000 Dividends: Dividends paid = NI − [% Equity(Cap. bud.)], stock issued if dividends zero or neg. $0 73. (15-6) Stock split C R Answer: b Number of new shares Number of old shares Old (pre-split) price % Increase in value New price before value increase = Old price/(New shares/Old shares) MEDIUM/HARD or new stock: $300,000 MEDIUM/HARD 7 3 $75.00 5% $32.14 New price after value increase = Prior × (1 + % Value increase) = $33.75 74. (15-3) Residual dividend model C R Answer: c Net income (NI) % Debt % Equity = 1.0 – % Debt Old $3,500,000 35% 65% New target dividend payout ratio Target dividend = Target dividend payout × NI Target retained earnings (RE) = NI – Dividends Max. capital budget = RE/% Equity Check: % Equity × Capital budget consistent = Calculated RE? Yes 70% $2,450,000 $1,050,000 $1,615,385 $1,050,000 HARD New $3,500,000 35% 65% New capital budget – Old capital budget = $1,615,385 – $5,000,000 = -$3,384,615 75. (15-3) Residual dividend model EPS Shares outstanding DPS C R Answer: e $3.00 500,000 $2.00 HARD Capital budget Net income = EPS × Shares outstanding Dividends paid = DPS × Shares outstanding Retained earnings available Capital budget − Retained earnings = Debt needed $800,000 $1,500,000 $1,000,000 $500,000 $300,000 Debt needed/Capital budget = % Debt financing = 37.5% 76. (15-3) Residual dividend model NI % Debt % Equity % Payout Dividends Ret. earnings, RE Max. cap. budget Found as: Given “ “ “ Payout % × NI NI – Dividends RE/% Equity C R Current Maximum $175.0 25.0% 75.0% 65.0% $113.8 $61.3 $81.7 Increase: New max. − Current max. = Percentage increase: New max./Current max. – 1.0 = Answer: e If Increase Debt $175.0 75.0% 25.0% 65.0% $113.8 $61.3 $245.0 $163.3 200.0% New Maximums: If Lower Payout $175.0 25.0% 75.0% 20.0% $35.0 $140.0 HARD $186.7 If Do Both $175.0 75.0% 25.0% 20.0% $35.0 $140.0 $560.0 $105.0 128.6% $478.3 585.7%