Finance 301

Spring 2023 Final Exam

Formula Sheet

Chapter 7 - Interest Rates and Bond Valuation

Coupon Rate = Annual Coupon Payment/Bond Face Value

Bond Value = Present Value Coupon Annuity + Present Value Bond Face Value

= C [(1-{1/(1+r)t})/r] + Face Value/(1 + r)t

Yield to Maturity = Solve above equation for “r” via trial and error OR via financial

calculator.

Fisher Effect: 1+ Nominal Return (R) = Real Return (1+r) X Inflation (1+h) - or 1+R = (1+r) X (1+ h) = 1+(r+h) + rh

Chapter 8 - Stock Valuation

Dividend Growth Model = Pt = [Dt x (1+g)]/(r-g) = Dt+1/(r-g)

Cumulative Votes Needed to Win Election = 1/(1+N) + one share

% Dividend Yield = Annual Cash Dividend/Current Stock Price = D1/P0

Chapter 9 - NPV and Other Investment Criteria

Payback = Length of time until summation of project’s cash flows = original cost.

IRR = Discount Rate (r) That Makes NPV = Zero.

NPV = - Initial Cash Outflow + CFt/(1+r)t

Chapter 10 - Making Capital Investment Decisions

Annual MACRS Depreciation = MACRS % for that year X Asset cost

Depreciation Tax Shield = Annual Depreciation X Tax Rate

OCF = EBIT + Depreciation - Taxes

EBIT = Sales - Costs - Depreciation

Chapter 11 - Project Analysis and Evaluation

Accounting Break Even: Sales - Variable Costs - Fixed Costs - Depreciation = 0

Accounting Break Even Quantity: Q = (Fixed Costs + Depreciation)/(Price - Variable Costs)

General Break Even Quantity: Q = (Fixed Costs + Operating Cash Flow)/(Price - Variable Costs)

Cash Break Even Quantity: Q = (Fixed Costs)/(Price - Variable Costs)

Chapter 12 - Some Lessons from Capital Market History

Percentage Return = Total Dollar Return/Initial Investment

- or [Dividend @ End of Period + Change in Market Value]/Beginning Market Value

1+ Nominal Return (R) = Real Return (1+r) X Inflation (1+h)

Variance = 1/(T-1) X [(R1 - Ravg)2 + …..+ (RT - Ravg)2]

Standard Deviation = Square Root of the Variance

Finance 301

Spring 2023 Midterm Exam

Formula Sheet

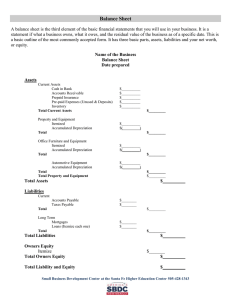

Chapter 2 - Financial Statements, Taxes, and Cash Flow

Operating Cash Flow = Earnings Before Interest and Taxes + Depreciation - Taxes

Net Capital Spending = Ending Net Fixed Assets - Beginning Net Fixed Assets +

Depreciation

Change in Net Working Capital = Ending Net Working Capital - Beginning Net

Working Capital

Net Working Capital = Current Assets - Current Liabilities

Cash Flow from Assets = Operating Cash Flow - Net Capital Spending - Additions to Net

Working Capital

Chapter 3 - Working With Financial Statements

Current Ratio = Current Assets/Current Liabilities

Debt/Equity Ratio = Total Debt/Total Equity

Return on Equity = NROS% x Asset Turnover x Equity Multiplier

Return on Equity = Net Income/Sales x Sales/Total Assets x Total Assets/Total Equity

Chapter 4 - Long-Term Financial Planning and Growth

External Financing Needed = Shortfall needed to balance Liabilities + Equity to Total

Assets for a given growth rate in Sales

Internal Growth Rate = [ROA x b]/[1 - (ROA x b)]

Internal Growth Rate = [Return on Assets x Retention Ratio]/[1 - (Return on Assets x

Retention Ratio)]

Return on Assets = Net Income/Total Assets

Retention Ratio (b) = Additions to Retained Earnings/Net Income = (1 - Dividend

Payout)

Sustainable Growth Rate = [ROE x b]/[1 - (ROE x b)]

Sustainable Growth Rate = [Return on Equity x Retention Ratio]/ [1 - (Return on Equity

x Retention Ratio)]

Chapter 5 - Introduction to Valuation: The Time Value of Money

Future Value = Present Value x (1 + r)t

Present Value = Future Value/(1 + r)t

Rule of 72:

72/r = t or 72/t = r (Approximate rate or time to double your money)

Chapter 6 - Discounted Cash Flow Valuation

Present Value of a Perpetuity = C/r

Present Value of an Annuity = C [(1-{1/(1+r)t})/r]

Future Value of an Annuity = C[((1+r)t -1)/r]

Effective Annual Return = [1 + (Quoted Rate/m)]m - 1