ACC3006

Business Valuation and

Analysis

Chapter 6. Prospective Analysis: Forecasting

Warning: This Chapter May Be Deleterious to

Your Mental Health

• The material in this chapter is irritating and complicated but not difficult.

• Why irritating?

• Because pro forma financial models require a lot of assumptions and

analysis.

• Everything is related to almost everything else.

• And because they require you to recall some basic accounting

concepts. This is all irritating!

How Financial Models Work: Theory and

an Initial Example

How Financial Models Work: Theory

• Almost all financial statement models are sales driven

• The most important financial statement variables are assumed to be

functions of the sales level of the firm.

• To solve a financial planning model, we must distinguish between those

financial statement items that are functional relationships of sales and

perhaps of other financial statement items and those items that involve

policy decisions.

• The asset side of the balance sheet is usually assumed to be dependent

only on functional relationships.

• The current liabilities may also be taken to involve functional

relationships only, leaving the mix between long-term debt and equity as

a policy decision.

The “Plug”

• The most important financial policy variable in the financial statement

modeling is the “plug”: This relates to the decision as to which balance

sheet item will “close” the model.

• How do we guarantee that assets and liabilities are equal (this is

“closure” in the accounting sense)?

• How does the firm finance its incremental investments (this is “financial

closure”)?

• In general the plug in a pro forma model will be one of three financial

balance sheet items:

i. Cash and marketable securities

ii. Debt

iii. Stock

The “Plug”

• Assume that cash and

marketable securities will be the

plug. This assumption has two

meanings:

1. The mechanical meaning of

the plug:

• Cash and marketable

securities = Total liabilities and

equity – Current assets – Net

fixed assets

• Guarantee that assets and

liabilities will always be equal

The “Plug”

• Assume that cash and marketable securities will be the plug. This assumption has

two meanings:

1. The mechanical meaning of the plug:

• Cash and marketable securities = Total liabilities and equity – Current assets –

Net fixed assets

• Guarantee that assets and liabilities will always be equal

2. The financial meaning of the plug:

• Make a statement about how the firm finances itself

• All incremental financing (if needed) for the firm will come from the cash and

marketable securities account; the firm sells no additional stock, does not pay

back any of its existing debt, and does not raise any more debt

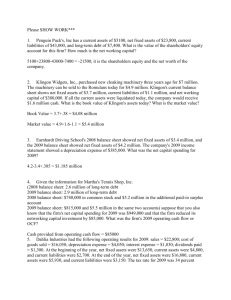

Your First Financial Model

• xSiTe > Content > Application exercises

• Week 6 – First Financial Model

• Build your first financial model

• Projecting Next Year’s Balance Sheet and Income Statement

Projecting Next Year’s Balance Sheet and

Income Statement

Sales growth: 10%

Setting up the Financial Statement Model

Income statement

Year

Sales

Costs of goods sold

Interest payments on debt

Interest earned on cash and marketable securities

Depreciation

Profit before tax

Taxes

Profit after tax

Dividends

Retained earnings

0

1

1,000

(500)

(32)

6

(100)

374

(150)

225

(90)

135

1,100

(550)

(32)

9

(117)

410

(164)

246

(98)

148

<-- =B15*(1+$B$2)

<-- =-C15*$B$6

<-- =-$B$8*(B37+C37)/2

<-- =$B$9*(B28+C28)/2

<-- =-$B$7*(C31+B31)/2

<-- =SUM(C15:C19)

<-- =-C20*$B$10

<-- =C21+C20

<-- =-$B$11*C22

<-- =C23+C22

Setting up the Financial Statement Model

Balance sheet

Year

Cash and marketable securities

Current assets

Fixed assets

At cost

Depreciation

Net fixed assets

Total assets

Current liabilities

Debt

Stock

Accumulated retained earnings

Total liabilities and equity

0

1

80

150

144 <-- =C40-C29-C33

165 <-- =C15*$B$3

1,070

(300)

770

1,000

1264

(417)

847

1,156

<-- =C33-C32

<-- =B32+C19

<-- =C15*$B$5

<-- =C33+C29+C28

80

320

450

150

1,000

88

320

450

298

1,156

<-- =C15*$B$4

<-- =B37

<-- =B38

<-- =B39+C24

<-- =SUM(C35:C38)

Setting up the Financial Statement Model

Income statement

Year

Sales

Costs of goods sold

Interest payments on debt

Interest earned on cash and marketable securities

Depreciation

Profit before tax

Taxes

Profit after tax

Dividends

Retained earnings

Balance sheet

Year

Cash and marketable securities

Current assets

Fixed assets

At cost

Depreciation

Net fixed assets

Total assets

Current liabilities

Debt

Stock

Accumulated retained earnings

Total liabilities and equity

0

1

1,000

(500)

(32)

6

(100)

374

(150)

225

(90)

135

0

2

3

4

5

2

3

4

5

1,100

(550)

(32)

9

(117)

410

(164)

246

(98)

148

1

80

150

144

165

1,070

(300)

770

1,000

1264

(417)

847

1,156

80

320

450

150

1,000

88

320

450

298

1,156

Circular References in Excel - Windows

• Financial statement models in Excel almost always involve cells that are

mutually dependent. As a result the solution of the model depends on the

ability of Excel to solve circular references.

• If you open a spreadsheet that involves iteration and if your spreadsheet is

not set up for circular references you will see the following Excel error

message:

Circular References in Excel - Mac

• Financial statement models in Excel almost always involve cells that are

mutually dependent. As a result the solution of the model depends on the

ability of Excel to solve circular references.

• If you open a spreadsheet that involves iteration and if your spreadsheet is

not set up for circular references you will see the following Excel error

message:

Circular References in Excel - Windows

• To make sure your spreadsheet recalculates, you have to go to:

• File|Options|Formulas box and click Enable iterative calculation

Circular References in Excel - Mac

• To make sure your spreadsheet recalculates, you have to go to:

• On the Excel menu, click Preferences

Circular References in Excel - Mac

Extending the Model to Years 2 and Beyond

• Now that you have the model set up, you can extend it by copying the

columns

• Most common mistake: failure to mark the model parameters with dollar

signs. If you commit this error, you will get zeros in places where there

should be numbers.

• Choose a consistent sign convention

The Case of Caterpillar

Step 1: Collect Historical Data

• Try to get historical financial statements for at least three years – five is

better – and make sure that they are based on consistent accounting

policies.

• It is also essential to collect some of the explanatory material (the

footnotes) that goes with the statements.

• Collect some historical data for the company’s industry and its major

competitors - to create some benchmarks to judge if the company has

been doing well or poorly and where the room for improvement is.

• If possible, get some industry forecasts for market growth, pricing trends,

etc.

• Some general economic forecasts for expected GDP growth, interest rate

trends, etc.

Step 2: Develop Comprehensive Assumptions

• Key step, DO NOT skip it

• Remember the model is only as good as the assumption built into it.

• Know the company’s plans for the future

• For example, a company may be considering building a new warehouse

to expand its sales.

• This will probably require investment in not just the warehouse but in

additional working capital and other things.

• However, the action is expected to increase sales, and the cost of goods

sold, and other expenses will increase in tandem as well.

Forecasting line items

• There is no one right way to forecast any line item

• The method used most often (and the one that you should try first) may be

called sales-driven forecasting

• Many line items in the financial statements tend to be sales-driven

• Most financial statement forecasting models use sales growth rate as the

key independent variable

• Look at the historical common size statements and financial ratios to spot

some stable relationships and trends

• Try to confirm these relationships using a combination of industry numbers

and company numbers to decide what specific percentage numbers to use

in any forecast

Step 3: Build the Model

• Caterpillar’s financial statements for the five years 2007 – 2011 are given

• xSiTe > Content > Application Exercise: Week 6 – The Case of Caterpillar –

Spreadsheet

• Rewrite the Balance Sheet: use worksheet “Balance Sheet – Rewrite”

• Rewrite all the operating current assets as one item

• =SUM('Balance Sheet'!B5:B9)

• Rewrite all the operating current liabilities as one item

• =SUM('Balance Sheet'!B27:B32)

• Rewrite to combine the short- and long-term financial debt items

• ='Balance Sheet'!B25+'Balance Sheet'!B26+'Balance Sheet'!B34+'Balance

Sheet'!B35+'Balance Sheet'!B39+'Balance Sheet'!B40+'Balance Sheet'!B45

Step 3: Build the Model

• Rewrite the Balance Sheet: use worksheet “Balance Sheet – Rewrite”

• Rewrite to combine the short- and long-term financial debt items

• ='Balance Sheet'!B25+'Balance Sheet'!B26+'Balance Sheet'!B34+'Balance

Sheet'!B35+'Balance Sheet'!B39+'Balance Sheet'!B40+'Balance Sheet'!B45

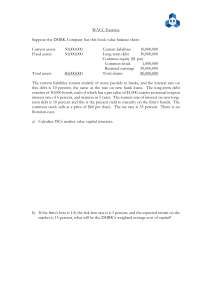

Rewrite the Balance Sheet

Assets

Current assets

Cash and short-term investments

Operating current assets

Property, plant and equipment--net

Long-term receivables

Investments in unconsolidated affiliated companies

Noncurrent deferred and refundable income taxes

Intangible assets

Goodwill

Other assets

Total assets

Liabilities

Operating current liabilities

Debt

CATERPILLAR BALANCE SHEETS, 2007-2011

2007

2008

2009

2010

2011

1,122

2,736

4,867

3,592

3,057

9,997

14,147

598

1,553

475

1,963

1,922

56,132

12,524

15,743

94

3,311

511

2,261

1,705

67,782

12,386

13,250

105

2,714

465

2,269

1,632

60,038

12,539

12,057

164

2,493

805

2,614

1,538

64,020

14,395

13,078

133

2,157

4,368

7,080

2,107

81,446

2007

2008

2009

2010

2011

Sales Projections

• Year-on-year sales growth

Year

ANALYSIS OF CATERPILLAR SALES

Sales of

Revenues Total sales Year-onmachinery of financial and

year

products

revenues

growth

2000

18,913

1,262

20,175

2001

19,027

1,423

20,450

2002

18,648

1,504

20,152

2003

21,048

1,759

22,807

2004

28,336

1,970

30,306

2005

34,006

2,333

36,339

2006

28,869

2,648

31,517

2007

41,962

2,996

44,958

2008

48,044

3,280

51,324

2009

29,540

2,856

32,396

2010

39,867

2,721

42,588

2011

57,392

2,746

60,138

Sales Projections

• Cumulative average growth rates (CAGR)

𝑆𝑎𝑙𝑒𝑠2011

CAGR =

𝑆𝑎𝑙𝑒𝑠2000

CAGR

2001-2011

2002-2011

2003-2011

2006-2011

2001-2010

2002-2010

2003-2010

2005-2010

1

11

− 1 = 10.44%

Growth measures

10.44% <-- =(D14/D3)^(1/11)-1

CAGR is very affected by end points!

11.39% <-- =(D14/D4)^(1/10)-1

12.92% <-- =(D14/D5)^(1/9)-1

12.88% <-- =(D14/D6)^(1/8)-1

13.79% <-- =(D14/D9)^(1/5)-1

8.49%

9.80%

9.33%

3.22%

<-<-<-<--

=(D13/D4)^(1/9)-1

=(D13/D5)^(1/8)-1

=(D13/D6)^(1/7)-1

=(D13/D8)^(1/5)-1

Sales Projections

• Regression of sales on the year

𝑆𝑎𝑙𝑒𝑠𝑡 = 𝑎 + 𝑏 × 𝑌𝑒𝑎𝑟

Sales Projections

Sales Projections

• Regression of sales on the year

𝑆𝑎𝑙𝑒𝑠𝑡 = 𝑎 + 𝑏 × 𝑌𝑒𝑎𝑟

Current Assets and Current Liabilities

CATERPILLAR ANALYSIS OF RATIOS

2007

2008

2009

2010

CA/Sales

CL/Sales

Model values

CA/Sales

CL/Sales

2011

Operating Costs

• Separate depreciation from to compute the operating costs without

depreciation.

CATERPILLAR OPERATING COSTS

2007

2008

2009

Operating costs from P&L

Depreciation

Operating costs net of depreciation

Sales

Net operating costs/Sales

Model value

2010

2011

Fixed Assets and Sales

• Net FA/Sales or Gross FA/Sales

• Depreciation rate

Fixed Assets and Sales

• Net FA/Sales or Gross FA/Sales

• Depreciation rate

CATERPILLAR—ANALYSIS OF FIXED ASSETS

2007

2008

2009

Land

189

575

639

Buildings and land improvements

3,625

4,647

4,914

Machinery, equipment and other

9,756

12,173

12,917

Equipment leased to others

4,556

4,561

4,717

Construction-in-process

1,082

1,531

1,034

2010

682

5,174

13,414

4,444

1,192

2011

753

5,857

14,435

4,285

1,996

Total property, plant and equipment, at cost

Less: Accumulated depreciation

Property, plant and equipment—net

19,208

-9,211

9,997

23,487

-10,963

12,524

24,221

-11,835

12,386

24,906

-12,367

12,539

27,326

-12,931

14,395

Sales

44,958

51,324

32,396

42,588

60,138

Net PPE/Sales

Gross PPE/Sales

Model value: Net PPE/Sales

Fixed Assets and Sales

• Net FA/Sales or Gross FA/Sales

• Depreciation rate

Depreciation analysis

%Buildings and land improvements

%Machinery, equipment and other

%Equipment leased to others

Depreciation rates

Buildings and land improvements

Machinery, equipment and other

Equipment leased to others

Average depreciation rate

Model depreciation rate

Other Liabilities and Pension Liabilities

Other liabilities

Year-on-year growth

CAGR Whole period

CAGR Excluding 2011

Model value

Pension liabilities

Year-on-year growth

CAGR Whole period

CAGR Excluding 2011

Model value

OTHER LIABILITIES AND PENSIONS

2007

2008

2009

2,003

2,190

2,496

5,059

9,975

7,420

2010

2,654

2011

3,583

7,584

10,956

Accumulated and Other Comprehensive Income

ACCUMULATED OTHER COMPREHENSIVE INCOME

2007

2008

2009

2010

Accumulated and other

-1,808

-5,579

-3,764

-4,051

comprehensive income (loss)

Year-on-year growth

CAGR Whole period

Model value

2011

-6,328

Dividends

Dividends

Year-on-year growth

Dividend CAGR

Profit

Dividend Payout Ratio

Model value

CATERPILLAR DIVIDENDS

2007

2008

2009

845

953

1029

3541

3557

895

2010

1084

2011

1159

2700

4928

Long-Term Receivables

• Long-Term Receivables

• The firm uses long-term receivables as a marketing tool to provide

financing to the purchases of its equipment, so that it makes sense that

this item grows at the same rate as sales.

Tax Rate

Profits before taxes

Taxes

Tax rate

Model value

CATERPILLAR ANALYSIS OF TAX RATE

2007

2008

2009

4,990

4,501

569

1,485

953

-270

2010

3,750

968

2011

6,725

1,720

Cost of Debt

CATERPILLAR ANALYSIS OF INTEREST RATE

2007

2008

2009

Debt

Interest expense of Financial Products

Interest expense excluding financial products

Interest rate

Model value: include financial products

2010

2011

Choose the “Plug”

Sales

Cash

Cash/Sales

Debt

Total shareholders equity

Capital

Debt/Capital

Common stock

CAGR

Model values

Cash/Sales

Debt/Capital

Common stock growth

The Plug

CATERPILLAR: VARIOUS PLUGS

2007

2008

2009

44,958

51,324

32,396

1,122

2,736

4,867

2010

42,588

3,592

2011

60,138

3,057

28,429

8,996

36,059

6,190

32,108

8,823

28,879

10,864

35,065

12,929

2,744

3,057

3,439

3,888

4,273

Choose the “Plug”

The Pro Forma Model - Assumptions

Sales growth

Current assets/Sales

Current liabilities/Sales

Net fixed assets/Sales

Operating costs/Sales

Long-term receivables, growth

Depreciation rate

Pension liabilities, growth

Other liabilities, growth

Accumulated and other comprehensive income

(loss), growth

Cash/Sales

Debt/Capital

Common stock growth

Interest rate on debt

Interest paid on cash & mkt. sec.

Tax rate

Dividend, growth

The Pro Forma Model – Income Statement

The Pro Forma Model – Balance Sheet – Assets

The Pro Forma Model – Balance Sheet – Liabilities