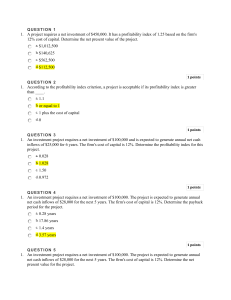

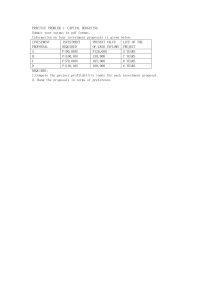

CHAPTER 16: SEATWORK I. Multiple Choice. 1) Long-term decisions requiring the evaluation of cash inflows and outflows over several years to determine the acceptability of the project are called ________. a) Net Present Value b) Investment Decisions c) Capital Budgeting Decisions 2) An analysis of an investment proposal that takes into account the time value of money. a) Payback Period b) Discounted Cash Flow Analysis c) ARR 3) If the proposal has ($5,600) as NPV, you must accept the investment. a) False b) True c) Maybe 4) An investment with higher profitability index than the other is better. a) True b) False c) Cannot be determined 5) Write True or False. After – tax cash flow is used in discounted cash flow analysis. True II. Identification 1) It is the amount of time it will take for the after-tax cash inflows from the project to accumulate to an amount that covers the original investment. (Payback Period) 2) A method focuses on the incremental accounting income that results from a project. (Accounting Rate of Return) 3) One criterion that managers sometimes apply in ranking investment proposals. (Profitability index) 4) Decisions where managers must decide which of several worthwhile projects makes the best use of limited investment funds. (Capital Rationing Decisions) 5) It states that the value of money received today is not the same as the value that would receive in the future. (Time Value of Money) III. Enumeration. 1 – 3) Give at least three methods used in making capital budgeting decisions. No abbreviations. Net Present Value, Internal Rate of Return , Profitability Index, Payback Period, Accounting Rate of Return 4 – 5) For two points, write down the title of our report including the chapter number. Chapter 16, Capital Expenditure Decisions IV. Simple Problem Computation 1) Suppose a company invests $300,000 in a new production line, and the production line then produces positive cash flow of $100,000 per year, then the payback period is? (3 points) PP = ($300,000) / $100,000 = 3 years 2) Give the formula for profitability index. Profitability index = Present value of cash flows exclusive of initial investment / Initial Investment or Profitability index = Cash Inflows / Cash Outflows