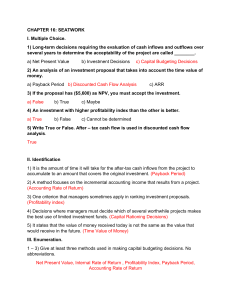

CAPITAL BUDGETING Specific Concerns for the Sports Business Product Line o Traditional vs Digital Products o Fans Engagement o Sustainability Market Competition o Global Competition o Technology Disruption o Changin Consumer Preferences Capital Budgeting process of identifying, analyzing, and selecting investment projects whose returns (cash flows) are expected to extend beyond one year process of deciding whether or not to commit resources to projects whose costs and benefits are spread over several time periods. It involves: o The preparation of annual budget for capital investment o The assessment of funding capacities o The allocation of resources to renewal and expansion projects which most clearly conform with the companies’ priorities Is an investment concept Key Considerations 1. Return on Investment (ROI) - he potential return on their capital investments. This involves analyzing factors like ticket sales, merchandise revenue, sponsorship deals, and media rights. 2. Risk Assessment - A thorough risk assessment is essential to understand the potential downsides and mitigate risks. 3. Financial Resources - Sports businesses need to consider their available financial resources and the potential need for external funding through loans or equity investments. 4. Project Feasibility and Sustainability - Capital projects must be feasible in terms of construction, operation, and long-term sustainability. 5. Fan Experience - Sports investments should focus on enhancing the fan experience, whether through improved facilities, technology, or entertainment options. Common Capital Budgeting Projects in Sports 1. Stadium and Arena Construction/ Renovation 2. Training Facilities 3. Technology Upgrades 4. Player Acquisitions 5. Marketing Promotion Challenges in Sports Capital Budgeting 1. Unpredictability of Sports Results 2. Competition and Market Dynamics 3. Long-Term Planning Capital Budgeting Process – is a system of interrelated steps for making a long-term investment decision. Capital Budgeting Process 1. Generating Project Proposal a. Replacement and Acquisition of Long-Term Assets b. Improvement of Products c. Expansion of Facilities d. Trading or Exchanging Assets e. Safety and/or Environmental Projects f. Mergers g. Other projects Categories of Capital Investment Decisions Independent Capital Investment Projects or Screening Decision – these are projects which are evaluated individually and reviewed against predetermined corporate standards of acceptability in an “accept” or “reject” decision. o The screening process for independent projects involves evaluating each project against pre-defined criteria to determine if it meets the company's minimum requirements. These criteria typically include: Minimum Rate of Return (Hurdle Rate): The project's expected return on investment must exceed the company's required rate of return. Risk Tolerance: The project's level of risk must be within the company's acceptable risk appetite. Strategic Alignment: The project must align with the company's overall strategic goals and objectives. o Investment in long-term assets such as property, plant and equipment o New product development o Undertaking a large-scale advertising campaign o Introduction of a computer o Corporate acquisitions (such as purchase of shares in subsidiaries affiliates). Mutually Exclusive Capital Investment or Preference Decision these relate to several acceptable alternatives. The project to be acceptable must pass the criteria of acceptability set by the company and better than the other investment alternatives. o Replacement against renovation of equipment or facilities o o o Rent or lease against ownership of facilities Manual bookkeeping system against computerized system Preventive maintenance against periodic overhaul of machineries 2. Collecting Relevant Information about Opportunities 3. Estimating Cash Flows Net Cash Flow is the difference between inflows and outflows of cash that result from a firm undertaking a project. Cash Flows of a project fall into three categories: o The net amount of investment o The operating cashflows or returns from the investment o The minimum acceptable rate of return on the investment. Net Initial Investment or Project Cost Net investment represents the initial cash outlay that is required to obtain future returns or the net cash outflows to support a capital investment project. The cash returns are the inflows of cash expected from the project reduced by the cash cost that can be directly attributed to the project. The minimum or lowest acceptable rate of return or opportunity cost may equal the average rate of return that the company will earn from alternative investment opportunities or the cost of capital which is the average rate of return that the firm must pay to attract investment fund. The cost of capital according to source may be computed as follows: o Cost of Debt o Cost of Preference Shares o Cost of Ordinary Shares Stock price-based Book-value based o Cost of Retained Earnings - same as cost of ordinary equity. This is used when dividend growth rate is not known. 4. Evaluating Project Proposals 5. Selecting Projects Three major factors in final selection of projects Project type Availity of funds Decision criteria 6. Implementing and Reviewing Projects Acceptable projects must then be implemented in a timely and efficient manner. The implementation stage involves developing formal procedures for authorizing the expenditures of funds for capital projects. The review stage involves analyzing projects that have been adopted in order to determine if they should be continued, modified or terminated. A final aspect of the capital budgeting process is the post –audit, which involves: Comparing actual results with those predicted by the project’s sponsor Explaining why any differences occurred Forecasting risk or estimation risk is the possibility that a bad decision will be made because of errors in the projected cash flows. Our goal in performing risk analysis is to assess the degree of forecasting risk and to identify the most critical components of the success or failure of an investment. Capital Budgeting Risk refers to the uncertainty surrounding the financial outcomes of long-term investment decisions. It encompasses the possibility that a project may not generate the expected returns, leading to financial losses for the company. Factors that can influence cash flows: Economic conditions: Changes in interest rates, inflation, and overall economic growth can impact a project's profitability. Market demand: Fluctuations in consumer demand for a product or service can affect sales and revenue. Technological advancements: Rapid technological changes can lead to obsolescence of equipment or products, impacting a project's lifespan and profitability. Competition: New competitors entering the market can erode market share and reduce profitability. Regulatory changes: Government regulations, such as environmental regulations or tax laws, can impact a project's costs and profitability. Operational risks: unexpected events, such as natural disasters, accidents, or labor strikes, can disrupt operations and affect project outcomes. Methods of Estimating and Measuring the Risk 1. Scenario Analysis – The basic form of “what-if” analysis 2. Sensitivity Analysis – is the process of changing one or more variables to determine how sensitive a projects’ returns are to these changes. 3. Simulation Analysis – is a combination of scenario and sensitivity analysis. Let all the items vary at the same time. Beta Estimation – This approach to risk measurement involves the concepts of Capital Asset Pricing Model (CAPM). It is a measure of systematic risk of a project. Systematic risk principle state that the reward of bearing risk depends only of that asset’s systematic risk. Capital Budgeting Techniques Non-discounted Cash Flow (Unadjusted Approach) 1. Payback Period (PBP) - also known as payoff and pay out period, measures the length of time required to recover the amount of initial investment. It is the time interval between time of the initial outlay and the full recovery of the investment. Decision Rule: The desirability of the project is determined by comparing the project’s payback period against the maximum acceptable payback period as predetermined by management. The project with shorter payback period than the maximum will be accepted. If: PB ≤ Maximum Allowed PB period; Accept If: PB > Maximum Allowed PB period: Reject Advantages It is easy to compute and understand It is used to measure the degree of risk associated with a project Generally, the longer the payback period, the higher the risk. It is used to select projects which provide a quick return of invested funds. Disadvantages It does not recognize the time value of money. It ignores the impact of cash inflows after the payback period. It does not distinguish between alternatives having different economic lives. The conventional payback computation fails to consider the salvage value, if any. It does not measure profitability – only the relative liquidity of the investment There is no necessary relationship between a given payback and investor wealth maximization so an investor would not know what an acceptable payback is. 2. Payback Reciprocal (PBR) is the rate of recovery of investment during the payback period. When the project is at least twice the payback period and the annual cash flows are approximately equal. The payback reciprocal may be used to estimate the discounted rate of return. A project with an infinite life would have a discounted rate of return exactly equal to its payback reciprocal. 3. Accounting Rate of Return (ARR) - also known as book value rate of return, measures profitability from the conventional accounting standpoint by relating the required investment to the future annual net income. Decision Rule: Under the ARR method, choose the project with the highest rate of return. Accept the project if the ARR is greater than the cost of capital. Thus: IF: ARR ≥ Required rate of return; ACCEPT IF: ARR < Required rate of return; REJECT Advantages It is easily understood by investor acquainted with financial statements. Emphasizes on profitability rather than liquidity. ARR considers income over the entire life of the asset. Disadvantages It ignores the time value of money by failing to discount the future cash inflows and outflows It does not consider the timing component of cash inflows Different averaging techniques may yield inaccurate answer. Ignore the effect Inflation. It utilizes the concepts of capital and income primarily designed for the purposes of financial statements preparation and which may not be relevant to the evaluation of investment proposal. Discounted Cash Flow (Time-Adjusted) Approach 1. Discounted Payback Period (DPBP) is a capital budgeting method that determines the length of time required for an investment cash flows, discounted at the investments cost of capital, to cover its cost. It is a method that recognizes the time value of money in a payback context. Decision Rule: Accept Project if Calculated DPB < Maximum Allowable Discounted Payback Reject Project if Calculated DPB > Maximum Allowable Discounted Payback 4. 2. Net Present Value (NPV) - is the excess of the present values of the project’s cash inflows (net operating cash flows plus net terminal cash) over the amount of the initial investment. Decision Rule: Accept the project if it’s NPV is equal or greater than zero; otherwise, the project is rejected. 3. Internal Rate of Return (IRR) - also known as discounted rate of return and time adjusted rate of return is the rate which equates the present value of the future cash inflows with the cost of the investment which produces them. The IRR Technique is, by far, the most popular rate-based capital budgeting technique. 4. Profitability Index (PI) - is the ratio of the total present value of future cash inflows divided by its net investment. The index expresses the present value of cash benefits as to an amount per peso of investment in a project and is used as a means of ranking in a descending order of desirability. Decision Rule: The higher the PV Index the more desirable the project Why is Capital Budgeting Important? This process helps the management invest in the assets that can maximize the firm’s value. It brings to light a potentially bad investment option, which, if avoided, helps to maximize the firm value.