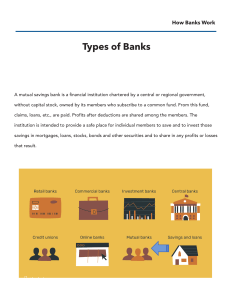

What is a commercial bank? 1. A retail bank that provides financial services to its customers, like savings, loans, and mortgages. How does a commercial bank operate? 1. They accept deposits from customers and then lend that money to people who have a demand for it. They act as a financial intermediary and make a profit from charging a higher interest rate to borrowers than the interest rate they pay to people who deposit them. How is a commercial bank regulated? 1. The government places regulations and supervises them. An organization determines certain rates, and all commercial banks must follow those rates. What economic function does the bank play? 1. It accepts deposits from customers, lends money to those who need money, and enables customers to make payments, as well as other secondary functions. These banks help provide services to consumers with demand for them in society, which ensures economic stability and growth. What are the customers of a commercial bank? 1. Consumers with a demand for money 2. Consumers with want to store money What economic system does a commercial bank operate in? 1. Market economic system Commercial bank example: 1. Chase Bank from JPMorgan Chase In a situation like the Great Depression, what would a commercial bank do? How are they similar and different? 1. Similar: they both 2. Different: they have different motives, a central bank does not operate with the aim to make money, while a commercial bank does. Commercial banks serve individuals and firms, while a central bank serves the government.