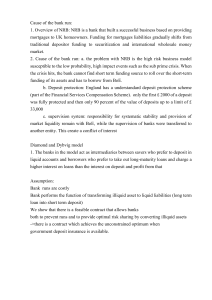

All banks are interested in maximizing the spread between their deposit and loan interest rates. In this regard, Eurobanks are no different from domestic banks. All banks are also concerned with managing risk, the risk associated with their assets and liabilities. Like all intermediaries, Eurobanks tend to borrow short term and lend long term. Thus if the deposit liabilities were reduced greatly, we would see deposit interest rates rise very rapidly in the short run. The advantage of matching the term structures of deposits and loans is that deposits and loans are maturing at the same time, so that the bank is better able to respond to a change in demand for deposits or loans.