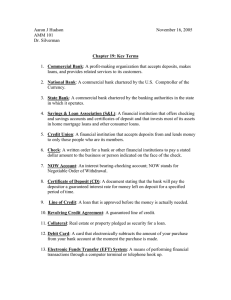

ACCOUNTMICS By Sir Irfan Jan M.Phil (Economics) All subjects home and online tuitions available for I.COM, B.COM, BBA & M.A Economics Cell # 0347-3643211 I.COM(2) BANKING ONLINE CLASSES LECTURE Topic : COMMERCIAL BANKS Definition of Commercial Bank A commercial bank is a financial institution which performs the functions of accepting deposits from the general public and giving loans for investment with the aim of earning profit. KINDS OF COMMERCIAL BANK SCHEDULE BANKS 1- Registered under charter of central bank 2- Clearing of cheque facility available 3- Must follow the directions given by central bank 4- Transfer of money 5- Take loan from central bank 6- People prefer Schedule bank for open their accounts 7- Number of branches are more than non-schedule banks NON- SCHEDULE BANKS 1- Not registered under charter of central bank 2- There is no clearing facility 3- Not liable to follow directions given by central bank 4- They cannot transfer money 5- They can not take loan from central bank 6- People do not prefer Non-schedule bank for open their accounts 7- Number of branches are less than schedule banks FUNTIONS OF COMMERCIAL BANKS TYPES OF FUCTIONS BY COMMERCIAL BANKS A. Number 1 are the Primary functions B. Number 2 are the Secondary functions A.Primary functions A) Receiving deposits Receive deposits in the form of current a/c, fixed a/c and saving a/c. • Current account: Payable on demand Bank does not pay interest on these deposits • Fixed account: Not paid on demand Bank paid interest on such type of deposits • Saving account: Objective to encourage people to save Such types of accounts open by house hold Payable on demand and also withdraw able by cheque A. Primary functions B) Advancing loans Receive deposits in the form of cash credit, demand loans and short term loans. • Cash credit: Loan given to the borrower with is withdrawn within his credit limit Interest is charge on the amount actually withdrawn • Demand loans: Loan can be recall by the bank at any time Interest is paid on the entire sum • Short term loans: Personal loans against some collateral security (Holding jewelery , property papers etc ) The borrower can withdraw money from his account Interest is paid on the entire sum B. Secondary functions A- PUBLIC/GENERAL UTITLITY SERVICES Definition of B/E It is a contract, binding one party to an agreedupon payment amount 1- Acceptance and discounting of bill of exchange • B/E used in both home & foreign trade • C.B accept B/E on customer’s behalf discount such bill by the hard cash paying 2- Creation of credit money It is the process of acceptance of deposits and granting loans, commercial banks are able to create credit 3- Underwriting of shares It issued share and debentures newly promoted joint stock companies Shares & Debentures Both are issued by JSC for expand our business. Shares can be convert into cash at any time But debentures is a type of long term that can be cash at the time of maturity B. Secondary functions 4- Letter of Credit (L/C) / travelers’ cheques A man going on a tour takes with him a letter of credit from his bank. It is mentioned there that he can be paid sums up to a certain limit. 5- Providing locker rent service Safeguard your Jewelry, Currency, documents 6- Transfer of funds Transfer of funds in quick , reliable way 7- Automatic Teller Machines (ATM) service Withdrew of cash 24X7 B. Secondary functions B- AGENCY SERVICES 1. Purchasing and selling stocks and shares on his behalf. 2. Making sundry payments like rent, insurance, premium, on his behalf. 3. Receive money on their behalf e.g. dividend, rent, interest etc. 4. Sale and purchase of securities. 5. Transfer or deposit money from one place or bank to another. 6. Collecting bills on behalf of K-electric, SSGS bills, water tax etc. C . MISCELLANEOUS SERVICES 1. 2. 3. 4. 5. 6. 7. Receipts of donations Receipts of fees on behalf of educational institutions Collection of salaries and dividends Collection of zakat Preparation of tax returns Receipts of Hajj applications Issuances of Qarz-e-Hasna PROCESS OF CREDIT CREATION BY COMMERCIAL BANKS Every deposit creates a loan. Commercial banks give loans and advances against some security to the public. AN EXAMPLE: This can be explained with an example. Suppose Primary Deposits = Rs 1,000 Bank can lend out = Rs 900 i.e., Primary Deposit — Cash Reserve = Derivative Deposit. Rs 1,000 — Rs 100 = Rs 900 (10% of 1000 is Rs 100) PROCESS OF CREDIT CREATION BY COMMERCIAL BANKS Primary Deposits 1000 900 810 - Cash Reserve Ratio Derivative Deposits (CRR) 100 900 90 810 81 729 10000 This process can be explained with a formula Total credit creation = Primary deposit X 1/CRR Total credit creation = 1000 X 1/10 X 100 Total credit creation = 1000 X 10 = 10000 PROCESS OF CREDIT CREATION BY COMMERCIAL BANKS ASSIGNMENT Primary deposits = Rs.1000 CRR = 20% Required: Compute how much commercial bank create credit? (within 10 minutes) Confirm me answer if you want? Via whatsapp If you want complete notes in pdf form of CHAPTER # 2 COMMERCIAL BANK YOU CAN GET FREE OF COST CONTACT ME SIR IRFAN JAN WHATSAPP # 0347-3643211