Ch. 24 Section 1 What is Money?

advertisement

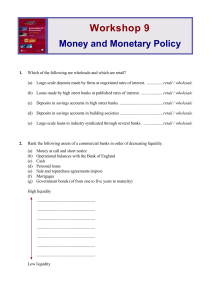

Ch. 24 Section 1 What is Money? Money 1. Money has three functions in our society: Medium of exchange we can trade money for goods and services; without it we would have to barter (goods for other goods) 2. Store of Value we can hold our wealth in the form of money until we are ready to use it 3. Measure of Value acts as a measuring stick that can be used to assign value to a good/service Money (cont.) Anything that people will accept in exchange for goods can serve as money. Throughout history, civilizations have used salt, animal pelts, precious stones/metals, tobacco, beads, as a medium of exchange We accept coins, metallic forms of money and currency, both coins and paper money Checking and savings accounts are also considered forms of money Money (cont.) We value and accept money because know with confidence that someone will accept its value or worth. If not for this confidence, we would not accept it as payment Money by itself has no other value. The material used to make coins and paper are worth less than the value of the items as currency The Financial System Like we mentioned previously in Chapter 24, money saved at a financial institution does not stay there. It has to circulate if you want it to grow. The banks lend your deposits, the interest charged on the loan pays for operating expenses and earns profits for the bank. All financial institutions are meant to bring savers and borrowers together. Financial Institutions Commercial Banks – financial institutions which offer full banking services to individuals and businesses; Most people have their checking and savings accounts in these banks. Large amount of influence in our economy because of sheer number of people and businesses using them. Financial Institutions (cont.) Savings and Loan associations (S&Ls) financial institutions that traditionally loaned money to people who wanted to buy homes; take deposits and offer savings accounts In the 1970’s worked off the unofficial “3-6-3” business model. Take peoples deposits and offer them 3% on it Lend to individuals/businesses and charge 6% Make so much money this way, quit the day early and make your tee time at 3pm Financial Institutions (cont.) Credit Unions – work on a not-for-profit basis (non profit organization). These banks which are sponsored by large businesses, labor unions, or government institutions, are open only for its members; only workers of the sponsor may use the credit union Usually pay higher dividends on deposits and charge lower interest rates on loans for their members Some of the largest Credit Unions in the U.S. - N.C. state employees credit union - Boeing employees - Orange Co. Teachers Federal credit union (CA) Safeguarding Our Financial Institutions The safety of our banks and the confidence of depositors stems from two things: Regulation and Insurance Banks have to follow the rules and be accountable for their practices under federal guidelines; this lowers the chance that a bank will make risky loans. The FDIC insures individual accounts in banks. If the bank fails, the FDIC will return to depositors the amount of the deposit up to a maximum of $100,000. Created after the stock market crash of 1929 and the resulting bank collapses that wiped out people’s savings