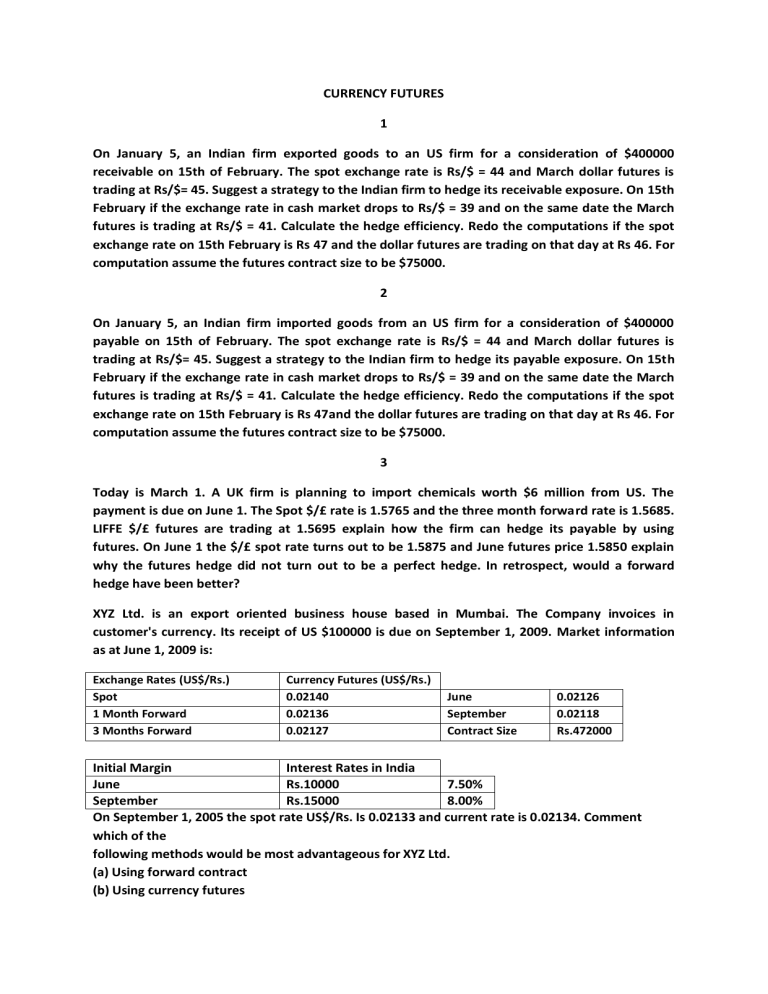

CURRENCY FUTURES 1 On January 5, an Indian firm exported goods to an US firm for a consideration of $400000 receivable on 15th of February. The spot exchange rate is Rs/$ = 44 and March dollar futures is trading at Rs/$= 45. Suggest a strategy to the Indian firm to hedge its receivable exposure. On 15th February if the exchange rate in cash market drops to Rs/$ = 39 and on the same date the March futures is trading at Rs/$ = 41. Calculate the hedge efficiency. Redo the computations if the spot exchange rate on 15th February is Rs 47 and the dollar futures are trading on that day at Rs 46. For computation assume the futures contract size to be $75000. 2 On January 5, an Indian firm imported goods from an US firm for a consideration of $400000 payable on 15th of February. The spot exchange rate is Rs/$ = 44 and March dollar futures is trading at Rs/$= 45. Suggest a strategy to the Indian firm to hedge its payable exposure. On 15th February if the exchange rate in cash market drops to Rs/$ = 39 and on the same date the March futures is trading at Rs/$ = 41. Calculate the hedge efficiency. Redo the computations if the spot exchange rate on 15th February is Rs 47and the dollar futures are trading on that day at Rs 46. For computation assume the futures contract size to be $75000. 3 Today is March 1. A UK firm is planning to import chemicals worth $6 million from US. The payment is due on June 1. The Spot $/£ rate is 1.5765 and the three month forward rate is 1.5685. LIFFE $/£ futures are trading at 1.5695 explain how the firm can hedge its payable by using futures. On June 1 the $/£ spot rate turns out to be 1.5875 and June futures price 1.5850 explain why the futures hedge did not turn out to be a perfect hedge. In retrospect, would a forward hedge have been better? XYZ Ltd. is an export oriented business house based in Mumbai. The Company invoices in customer's currency. Its receipt of US $100000 is due on September 1, 2009. Market information as at June 1, 2009 is: Exchange Rates (US$/Rs.) Spot 1 Month Forward 3 Months Forward Currency Futures (US$/Rs.) 0.02140 0.02136 0.02127 June September Contract Size 0.02126 0.02118 Rs.472000 Initial Margin Interest Rates in India June Rs.10000 7.50% September Rs.15000 8.00% On September 1, 2005 the spot rate US$/Rs. Is 0.02133 and current rate is 0.02134. Comment which of the following methods would be most advantageous for XYZ Ltd. (a) Using forward contract (b) Using currency futures (c) Not hedging currency risks. It may be assumed that variation in margin would be settled on the maturity of the futures contract. 4 The corporate treasurer of a US multinational receives a fax on 21st February from its European subsidiary. The subsidiary will transfer 10 million to the parent company on 16th august. The corporate treasurer decides to hedge the position using currency futures. The available spot and futures rate of the Euro on the 21st February are: Spot per euro September Future euro December Future euro US$1.0600 US$1.0000 US$1.600 a. What expiry month will be chosen for the future by the corporate treasurer? b. Will the corporate treasurer go long or short on the euro future? c. If the corporate treasurer plans to hedge through futures in the European currency market, will he buy or sell dollar futures? d. What is the unhedged and hedged outcome on 16th august, if the spot and futures rate on the 16th august are as follows: Spot per euro September Future euro December Future euro US$1.0100 US$1.0200 US$1.200