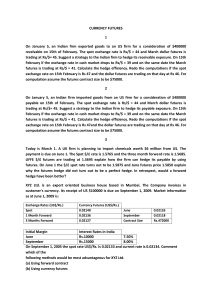

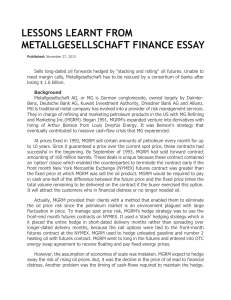

THE UNIVERSITY OF THE WEST INDIES, MONA DEPARTMENT OF ECONOMICS ECON3007 (EC30P): INTERNATIONAL FINANCE Tutorial Paper 4 – Foreign Exchange Risk Question 1 a) Distinguish between translation exposure, transaction exposure and economic exposure. b) Discuss the advantages and disadvantages of: (i) Foreign currency forward contracts; (ii)Foreign currency futures contracts: (iii) Foreign currency options (iv) Foreign exchange swap Question 2 a) Carefully explain how each of the following is used to hedge foreign exchange risk. i) Speeding (slowing) payments of currencies expected to appreciate (depreciate). ii) Speeding (slowing) collection of currencies expected to depreciate (appreciate). b) i) Does an efficient foreign exchange market rule out all opportunities for speculative profits? Explain your answer. ii) If foreign stock markets are efficient, why should this allow us to buy foreign stocks as safely as we buy domestic stocks? Question 3 a) Assume that the Spot rate is US2/UK and the three-month forward rate is US1.96/UK. Carefully explain, how an importer who will have to pay UK10,000 in three months can hedge the foreign exchange risk? b) Briefly answer the following questions. (i) Explain the similarities and differences between the forward and futures markets (ii) Why might you prefer an option to a futures or forward contract? 1 2