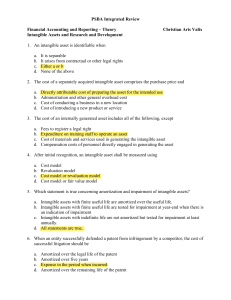

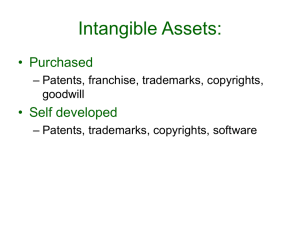

Chapter 21 - Intangible assets (PAS 38) 1. Which of the following statements is incorrect? a. An intangible asset acquired through the issuance of the entity’s own equity instrument is generally valued at the fair value of the intangible asset. b. The amortization of intangible assets involves an adjusting entry that should not be reversed in the next accounting period. c. An identifiable asset developed internally is never recognized in the accounts as an asset. d. All annual payments made by a franchisee to the franchiser for assistance should be capitalized as part of the cost of the franchise. 2. The amortization of intangible assets results primarily from the application of the a. full-disclosure principle b. revenue principle c. cost principle d. systematic and rational allocation concept 3. In compliance with the disclosure requirements of PAS 38, the amortization of an intangible asset is recorded as a: a. debit to retained earnings and a credit to a contra account. b. debit to retained earnings and a credit to the intangible asset account. c. debit to amortization expense and a credit to the intangible asset account d. debit to amortization expense and a credit to an intangible asset contra account. 4. Which of the following confers exclusive right to conduct business in a particular territory a. Franchise b. Trademark c. Patent d. Copyright 5. The research and development expense of Soundgarden Co. includes which of the following items: 1) Costs of advertising a newly invented product. 2) Billings received by Soundgarden from Black Hole Sun Co. for research activities performed by Black Hole Sun Co. for Soundgarden. 3) The depreciation on a building used in various R&D projects 4) Billings sent by Soundgarden to Ugly Kid Joe Co. for research activities performed by Soundgarden for Ugly Kid Joe Co. 5) Costs of materials, labor and overhead incurred in generating a patent. The patent was granted to Soundgarden during the period. 6) Overhead costs properly allocated to the research and development activities performed by Soundgarden during the period. 7) Training costs of Soundgarden’s employees who are directly involved in R&D projects. 8) The amortization of patents used in Soundgarden’s research activities. a. b. c. d. 2, 3 & 6 2, 3 & 8 2, 3, 6 & 8 2, 3, 5, 6 & 8 6. Which of the following should be expensed as incurred by the franchisee for a franchise with an estimated useful life of ten years? a. b. c. d. Legal fees paid to the franchisee's lawyers to obtain the franchise Periodic payments to the franchisor based on the franchisee's revenues Amount paid to the franchisor for the franchise Periodic payments to a company, other than the franchisor, for the company's franchise 7. Should the following fees associated with the registration of an internally developed patent be capitalized? Legal fees Registration fees a. No No b. No Yes c. Yes No d. Yes Yes 8. Which of the following assets typically are amortized? Patents Trademarks a. No No b. Yes Yes c. No Yes d. Yes No 9. What is proper time or time period over which to match the cost of an intangible asset with revenues if it is likely that the benefit of the asset will last for an indefinite period? a. Forty years b. Fifty years c. Immediately d. At such time as reduction in value can be quantitatively determined. 10. Which of the following statements concerning patents is correct? a. Legal costs incurred to successfully defend an internally developed patent should be capitalized and amortized over the patent’s remaining economic life. b. Legal fees and other direct costs incurred in registering a patent should be capitalized and amortized on a straight-line basis over a five-year period. c. Research and development contract services purchased from others and used to develop a patented manufacturing process should be capitalized and amortized over the patent’s economic life. d. Research and development costs incurred to develop a patented item should be capitalized and amortized on a straight-line basis over seventeen years. e. None of these 11. Intangible assets, other than goodwill, are accounted for under a. PAS 38 b. PFRS 8 c. PAS 26 d. PAS 20 12. ABC Co. made expenditures for the following: • Cost in activities aimed at obtaining new knowledge • Marketing research to study consumer tastes • Cost of developing and producing a prototype model • Cost of testing the prototype model for safety and environmental friendliness • Cost revising designs for flaws in the prototype model ₱10,000 5,000 3,000 40,000 15,000 • Salaries of employees, consultants, and technicians involved in R&D • Cost of conference for the introduction of the newly developed product including fee of a model hired as endorser • Advertising to establish recognition of the newly developed product 20,000 100,000 30,000 How much is recognized as research and development expense? a. 68,000 b. 72,000 c. 88,000 d. 94,000 Solution: • • • Cost in activities aimed at obtaining new knowledge Cost of developing and producing a prototype model Cost of testing the prototype model for safety and environmental friendliness • Cost revising designs for flaws in the prototype model • Salaries of employees, consultants, and technicians involved in R&D Total research and development expense 13. ABC Co. made expenditures for the following: • Cost incurred on search for alternatives for materials, devices, products, processes, systems or services • Cost of final selection of possible alternatives for a new process • Trouble-shooting during commercial production • Periodic or routine design changes to existing products • Modification of design for a specific customer • Payments made to XYZ, Inc. for R&D performed by XYZ for ABC • Cost of R&D performed by ABC for Alpha Corp. ₱10,000 3,000 40,000 15,000 20,000 ₱88,000 ₱10,000 8,000 5,000 3,000 40,000 15,000 20,000 How much is recognized as research and development expense? a. 33,000 b. 42,000 c. 52,000 d. 53,000 Solution: • Cost incurred on search for alternatives for materials, devices, products, processes, systems or services • Cost of final selection of possible alternatives for a new process • Payments made to XYZ, Inc. for R&D performed by XYZ for ABC Total research and development expense ₱10,000 8,000 15,000 ₱33,000