Accounting Assignment: Bond Valuation, Depreciation, Intangibles

advertisement

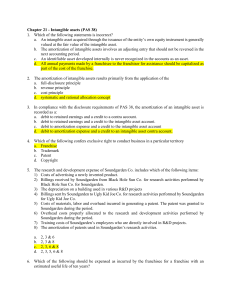

HMAN 104-Principles of Accounting Fall 2012/13, Assignment 4 Answer each question carefully and type your answers in word processing program, such as MS Word, right below the question. If needed, you can use spreadsheet programs (e.g. MS Excel). Please professionally format your homework. You will lose points for sloppy work. Assignment 4is due on November 25thby midnight.No late homework will be accepted. Each question is worth 25 points. 1. DuPont reports in a recent balance sheet $598 million of 5.25 percent notes payable due in 2016. The company's income tax rate is approximately 19 percent. a. Compute the company's after-tax cost of borrowing on this bond issue stated as a total dollar amount. b. Compute the company's after-tax cost of borrowing on this bond issue stated as a percentage of the amount borrowed. c. Describe briefly the advantage of raising funds by issuing bonds as opposed to stocks. 2. Swanson & Hiller, Inc., purchased a new machine on September 1, 2008 at a cost of $108,000. The machine's estimated useful life at the time of the purchase was five years, and its residual value was $8,000. Instructions a. Prepare a complete depreciation schedule, beginning with calendar year 2008, under each of the methods listed below (assume that the half-year convention is used): 1. Straight-line. 2. 200 percent declining-balance (double declining balance). b. Which of the three methods computed in part a is most common for financial reporting purposes? Explain. c. Assume that Swanson & Hiller sells the machine on December 31, 2011, for $28,000 cash. Compute the resulting gain or loss from this sale under each of the depreciation methods used in part a. Does the gain or loss reported in the company's income statement have any direct cash effects? Explain. 3. During the current year, Black Corporation incurred the following expenditures which should be recorded either as operating expenses or as intangible assets: a. Expenditures were made for the training of new employees. The average employee remains with the company for five years, but is trained for a new position every two years. b. Black purchased a controlling interest in a vinyl flooring company. The expenditure resulted in the recording of a significant amount of goodwill. Black expects to earn above-average returns on this investment indefinitely. c. Black incurred large amounts of research and development costs in developing a dirt-resistant carpet fiber. The company expects that the fiber will be patented and that sales of the resulting products will contribute to revenue for at least 25 years. The legal life of the patent, however, will be only 20 years. d. Black made an expenditure to acquire the patent on a popular carpet cleaner. The patent had a remaining legal life of 14 years, but Black expects to produce and sell the product for only six more years. e. Black spent a large amount to sponsor the televising of the Olympic Games. Black's intent was to make television viewers more aware of the company's name and its product lines. Instructions Explain whether each of the above expenditures should be recorded as an operating expense or an intangible asset. If you view the expenditure as an intangible asset, indicate the number of years over which the asset should be amortized, if any. Explain your reasoning.