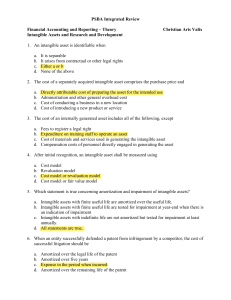

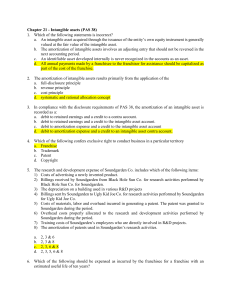

Intangible Assets

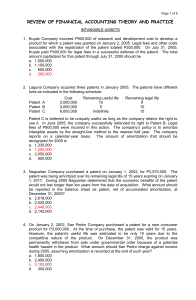

advertisement

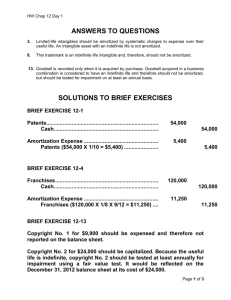

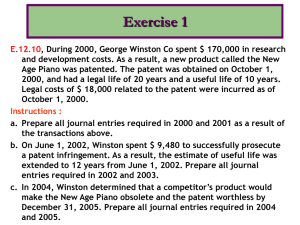

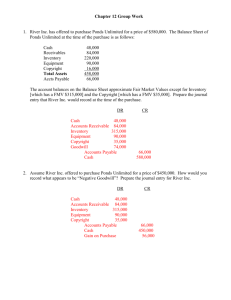

Intangible Assets: • Purchased – Patents, franchise, trademarks, copyrights, goodwill • Self developed – Patents, trademarks, copyrights, software Purchased Intangible Assets: • Record at cost • If no limited useful life (e.g., trademark, goodwill) – Maintain original cost – Evaluate periodically for impairment • If impairment determined – write down Problem 12 – 5 (b) Goodwill on 12/31/2003 should be A. B. C. D. $350,000 $200,000 $150,000 $ 50,000 Problem 12 – 5 (c) Goodwill on 12/31/2003 should be A. B. C. D. $350,000 $200,000 $150,000 $ 50,000 Purchased Intangible Assets: • Record at cost • If limited useful or legal life (patents, copyrights, e.g.) – Amortize, straight line, generally time based – Amortize over shorter of useful or legal life Exercise 12 -9: The patent should be reported on the 2004 Balance sheet at A. B. C. D. $ 2,000,000 $ 1,600,000 $ 1,440,000 $1,200,000 Exercise 12 -9: The franchise should be reported on the 2004 Balance sheet at A. B. C. D. $ 480,000 $ 432,000 $ 400,000 $380,000 Exercise 12 -17: Research and development expense for 2003 is A. B. C. D. $ 337,000 $ 427,000 $ 393,000 $ 707,000 Internally developed Intangibles • Generally all costs expensed as R&D or other expenses (advertising, salaries, etc.) • Exceptions: – Legal fees (register patent, defend patent) – Some costs for software developed for third party use Software Developed for Third Party Use (FAS 86) • Until technological feasibility is established all costs are expensed to R&D • Once technological feasibility is established, costs are capitalized and subsequently amortized Exercise 12-19 • Determine the amount at which the software should be reported on the balance sheet at December 31, 2004 Software Developed for Third Party Use (FAS 86) Amortization: Straight Line • Either over time OR • Proportionate to expected revenue, whichever is greater. Software Developed for Third Party Use (FAS 86) Example: Capitalized cost: $300,000 Expected life 3 years Expected revenue $1,000,000 Year 1 revenue earned: 400,000 Amortization (years) $100,000 Revenue based: 400/1000 * 300 = $120 $120 > $100, Amortization: $120,000 Software Developed for Third Party Use (FAS 86) • Software developed for external use must be reported at the lower of amortized cost or net realizable value. • Once written down, may NOT be written up again.