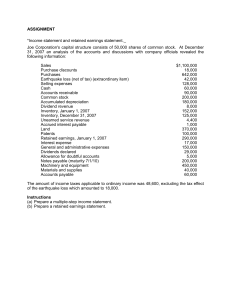

Cash and Cash Equivalents BONAMANA Corporation keeps all its cash in checking account. An examination of the Company’s accounting records and bank statement for the month ended December 31,2010 revealed the following information: The cash balance as of December 31,2010 represents Bank statement balance P84,690 Book balance 85,240 A deposit of P9,500 through the bank’s night depository box on December 29, 2010 did not appear on the bank statement. The bank statement shows that on December 28,2010, the bank collected a note for BONAMANA and credited the proceeds of P9,350 to the company’s account. The proceeds include P350 interest, all of which BONAMANA earned during the current accounting period, BONAMANA has not yet recorded the collection. Check outstanding on December 31,2010: No. 504 P1,500 No. 509 480 NO. 519 720 BONAMANA discovered that check no. 523, written in December 2010 for P1,830 in payment to a supplier, had been recorded in the company’s records as P1,380. Included with the December 31,2010 bank statement was an NSF check for P2,500 that BONAMANA had received from SPY company on account on December 19. BONAMANA has not yet the returned check. The bank statement shows a P150 service charge for December. REQUIRED: 1. Corrected cash balance, December 31 2. Increase in cash balance 3. The adjusting entry would be: Solution: Balance per bank statement, December 31 P84,690 Deposit in transit 9500 Outstanding Checks (2,700) Corrected cash Balance P91,940 Unadjusted balance per books, December 31 (85,240) Increase in cash balance P 6,250 Adjusting Entry Cash P6,250 Accounts Payable 450 Accounts Receivable 2,500 Bank service charge 150 Notes receivable P9,000 Interest revenue 350 MOONLIGHT Company has an current account in Zambales Bank. Your audit of the company’s cash account reveals the following: a. b. Balances taken from the company’s general ledger: a. Cash balance, November 30, 2012 P637,860 b. Cash Balance, December 31,2012 576,420 c. Receipts, December 1-31, 2012 306,220 Outstanding checks, November 30,2012 a. (26,140 was paid by bank in December) c. Checks written and recorded in December not included 64,140 in the checks returned with the December bank statement 36,080 d. Deposit in transit, November 30, 2012 e. Deposit in transit, December 31,2012 f. A bank credit memo was issued in December 15,260 16,140 to correct an erroneous charge made in November g. 1,500 Note collected by bank in December (company was not informed of the collection) h. A check for P2,020 (payable to a supplier) was i. recorded in the Check Register in December as P3,000 2,060 980 a check for P2,240 was charged by the bank as 2420 in December j. 180 MOONLIGHT Co. issued a stop payment order to the bank in December. This pertains to a check written in December which was not received by the payee. A new check was written and recorded in the check register in December. The old check was written off by a journal entry, also in December. k. 780 Bank Service charge, November 30, 2012 60 REQUIRED: 1. Total outstanding checks on December 31, 2012 2. Bank statement balance on November 30, 2012 3. Bank statement balance on December 31, 2012 4. Total bank disbursements for the month of December SOLUTION: 1. Outstanding check 64,140 - 26,140 + 36080 = 2. P74,080 Nov. 30 Book balances P637,860 Receipts Disbursements 306,220 Dec.30 367,660 576,420 Outstanding checks November 64,140 64,140 December (74,080) 74,080 Deposit in transit November (15,260) December 15,260 (16,140) Erroneous bank charge in November (1,500) Note Collected by bank in (16,140) 1,500 2,060 2,060 December Over-book disb. (980) 980 Over-bank disb, 180 (180) Check stopped payment (780) Bank service charge Bank Balances (60) P685,180 (780) (60) P308,120 356,080 637,220 The following information was included in the bank reconciliation for GROWL Company for June: Checks and Charges recorded by bank in June (including a June service charge of P300), P172,100; Service charge made by bank in May and recorded on the books in June, P200; Total of credits to cash in all journals during June, P198,020; Customer’s NSF check returned in May and redeposited in June (no entry made on books in either May or June), 2,500; Outstanding checks at June,P80,600 and deposit in transit in June, P6000. What were the total outstanding checks at the beginning of June? Checks paid by the bank Total disbursements Less: Charges not representing checks 172,100 NSF Service charge- June P 1,000 300 1,300 P170,800 Less: Checks issued by the company: Total Disbursements P198,020 Service Charge- May 200 Total checks issued 197,820 Less: outstanding checks, end 80,600 Outstanding checks, beginning 117,220 P 53,580 RECEIVABLES PROBLEM 1 The adjusted trial balance of MLL Corporation on December 31, 2013, includes the following cash and receivables balances. Cash – Metrobank P2,250,000 Currency on Hand 800,000 Petty Cash Fund 50,000 Cash in bond sinking fund 750,000 Notes receivable (including notes discounted with recourse, P 155,000 Accounts Receivable Allowance for Doubtful accounts 1,825,000 P4,280,000 (207,500) Interest Receivable 4,072,500 26250 Current liabilities reported in the December 31, 2013, statement of financial position included: Obligation on discounted notes receivable 775,000 Transactions during 2014 included the following: a) Sales on account were 38,350,000. b) Cash collected on accounts totaled P28,825,000, including accounts of P4,650,000 with cash discounts of 2%. c) Notes received in settlement of accounts totaled P4,125,000. d) Note receivable discounted as of December 31, 2013, were paid at maturity with the exception of one P150,000 note on which the company had to pay the bank P154,500, which include interest and protest fees. It is expected that recovery will be made on this note early in 2013. e) Customer notes of P2,925,000 were discounted with recourse during the year, proceeds from their transfer being P2,925,000. (all discounting transactions were recorded as loans.) Of this total, P2,400,000 matured during the year without notice of protest. f) Customer accounts of P436,000 were written off during the year as worthless. g) Recoveries of bad debts written off in prior years were P101,000. h) Notes Receivable collected during the year totaled P1,350,000 and interest collected was 122,500 i) On December 31, accrued interest on note receivable was P31,500. j) Cash of P1,750,000 was borrowed from Metrobank with accounts receivable of P2,000,000 being pledged on the loan. Collection of P975,000 has been made on these receivables (included in the total given in transaction(b)}, and this amount was applied on December 31, 2013, to payment of accrued interest on the loan of P30,000, and the balance to the partial payment of the loan k) The petty cash fund was reimbursed( meaning that cash was removed from the bank account and in the petty cash fund) based following analysis of expenditure vouchers; Travel Expense Entertainment expense P5,600 3,900 Postage expense 4,650 Office supplies expense 8,650 Cash short or over(an income account) l) 300 Cash of P150,000 was added to bond retirement fund. m) Currency on hand at December 31, 2013, was P600,000. n) Total cash payment for all expenses during the year were P34,000,000. Charge to general expenses. o) Uncollectible accounts are estimated to be 5% of the December 31. 2013, Accounts receivable. REQUIRED: Based on the above and the result of your audit, answer the following: 1. The total cash to be reported in the company’s December 31, 2013 statement of financial position 2. The doubtful accounts expense to be reported for the year ended December 31, 2013 3. The net accounts receivable as of December 31, 2013 4. Net trade and other receivable to be reported in the company’s statement of financial position as of December 31, 2013 Solution: ITEM CASH A B Note Interest Receivable Receivable Receivable 38,350,000 28,825,000 C D Account (28,918,000) (4,125,000) (154,500) 4,125,000 (620,500) E 2925000 (2,400,000) F (436,000) G 101,000 H 1,472,500 (1,350,000) I J 31,500 775,000 K L (150,000) M 600,000 N (34,000,000) ADJ> 394,000 4,871,000 (245,500) 2,427,500 4,280,000 1,825,000 9,151,000 1,579,500 balances PCF Adjusted 31,500 50,000 2,871,500 31,500 1. 2,871,500 2. Doubtful account expense Required allowance (9,151,000 x 3. 9,151,000 5%) 457,550 Write-off 436,000 Recovery (101,000) Beginning Balance (207,500) Doubtful account expense 585,050 4. (9.151,000 - 457,550 + 1,579,500+ 31,500)= 10,304,450 Problem 2 D.O Company started operations in 2006. The company has no allowance for doubtful accounts. Uncollectible receivables were expensed as written off and recoveries were credited to income as collected. Data from the company’s records for five years is as follows: Year Credit Sales Amount Written- Recovery Off 2006 3,000,000 30,000 0 2007 4,500,000 76,000 5,400 2008 5,900,000 104,000 5,000 2009 6,600,000 130,000 9,600 2010 8,000,000 166,000 10,000 Balances of accounts receivables are as follows: As of December 31, 2009 P3,000,000 As of December 31, 2010 3,500,000 On March 1, 2010, right after the 2009 financial statements were released, management realized that company’s policy regarding treatment of bad accounts was not correct, and decided that an allowance method must be followed. A policy was established to set up an allowance of doubtful accounts based on the company’s historical debt loss percentage applied to year-end accounts receivable. The historical bad debts loss percentage shall be recomputed each year based on the average of all available past years up to maximum of five years. REQUIRED: Based on the above and the result of your audit, you are to provide the answers to the following: 1. The amount of allowance for doubtful accounts that should be set up as of January 1,2010 (with corresponding charge to retained earnings) 2. The average percentage of net doubtful accounts to credit sales that should be used in setting up the 2010 allowance 3. The balance of allowance for doubtful accounts as of December 31,2010 4. The doubtful accounts expense for 2010 Solution: Question 1: Year Credit Sales Amount Written-Off Recovery NET 2006 3,000,000 30,000 0 30,000 2007 4,500,000 76,000 5,400 70,600 2008 5,900,000 104,000 5,000 99,000 2009 6,600,000 130,000 20,000,000 9,600 340,000 120,400 20,000 320,000 Net accounts written off 320,000 Divided by credit sales 20,000,000 Percentage of uncollectible accounts 1.60% Allowance for doubtful accounts,1/1/10(3,000,000x1.6%) P48,000 Question 2: Year Credit Sales Amount Written-Off Recovery NET 2006 3,000,000 30,000 0 30,000 2007 4,500,000 76,000 5,400 70,600 2008 5,900,000 104,000 5,000 99,000 2009 2010 6,600,000 130,000 9,600 120,400 8,000,000 166,000 10,000 156,000 28,000,000 506,000 30,000 476,000 Net accounts written off 476,000 Divided by credit sales 28,000,000 Percentage of uncollectible accounts 1.70% Question 3: Allowance for doubtful accounts,12/31/10(3,500,000x1.7%) P59,500 Question 4: Required allowance, 12/31/2010 Accounts written off in 2010 Bad debts recoveries 59,500 166,000 10,000 Allowance for doubtful, 1/1/10 48,000 Doubtful account expense in 2010 P167,500 PROBLEM 3 On February 1, 2011, XOXO Corporation factored receivables with a carrying amount of P2,000,000 to Moonlight Corporation. XOXO Corporation assesses a finance charge of 3% of the receivable and retains 5% of the receivables. Question 1: If the factoring is treated as sale, what amount of loss from sale should the company report in its 2011 statement of comprehensive income for the year 2011? Question 2: Assume that XOXO Corporation retained significant amount of risks and rewards of ownership and had a continuing involvement on the factored financial asset, what amount of loss from factoring should the company recognize? Solution: Question 1: Amount factored Less: Finance Charge (2,000,000 x 3%) Holdback(2,000,000 x 5%) P2,000,000 60,000 100,000 160,000 Amount received Add: New Asset received(holdback) Total consideration received Less: Carrying value of the receivable equal to face Loss on factoring Question 2: NONE. INVENTORIES 1,840,000 100,000 1,940,000 2,000,000 60,000 The MAMA COMPANY is an importer and wholesaler. Its merchandise of purchased from a number of suppliers and is warehoused until sold to consumers. In conducting his audit for the year ended December 31, 2012, the company’s CPA determined that the system of internal control was good. Accordingly, he observed the physical inventory at an interim date, November 30, 2012, instead of at year-end. The following information was obtained from the general ledger: Inventory, January 1, 2012 P117,000 Inventory, November 30, 2012 292,500 Sales for eleven months ended November 30, 2012 Sales for the year ended December 31, 2012 1,040,000 1,235,000 Purchases for eleven months ended November 30, 2012 (before audit adjustments) 936,000 Purchases for year ended December 31, 2012(before audit adjustment) 1,053,000 Additional information: a) Goods received on November 28 but recorded as purchases in December 13,000 b) Deposits made in October 2012 for purchases to be made in 2013 but charged to Purchases 18,200 c) Defective merchandise returned to suppliers: a. Total at November 30, 2012 6,500 b. Total at December 31, 2012, excluding November items 9,100 The returns have not been recorded pending receipt of credit memos from the suppliers. The defective goods were not included in the inventory. d) Goods shipped in November under FOB destination And received in December recorded as purchases in November 24,050 e) Through the carelessness of the client’s warehouseman, certain goods were damaged in December and sold in the same month at its cost. f) 26,000 Audit of the client’s November inventory summary revealed the following: Items duplicated 3,900 Purchases in transit: Under FOB shipping point 15,600 Under FOB destination 24,050 Items counted but not included in the inventory Summary 9,100 Errors in extension that overvalued 5,200 REQUIRED: 1. Correct amount of net purchases up to November 30, 2012 2. Correct amount of net purchases up to December 31, 2012 3. Correct amount of net purchases for the month of December 2012 4. Correct inventory on November 30, 2012 5. Gross income for eleven months ended December 31, 2012 6. Cost of sale ratio for eleven months ended November 30,2012 7. Total cost of goods sold for the amount of December 2012? 8. Estimated inventory on December 31, 2012 SOLUTION: UP TO Nov. 30 Dec. 31 Per books 936,000 1,053,000 November purchase recorded in December 13,000 October deposits recorded as purchases (18,200) (18,200) (6,500) (15,600) Defective items returned December purchases recorded in November (24,050) P900,250 P1,019,200 1. P900,250 2. P1,019,200 3. P1,019,200- P900,250= 118,950 4. Per count P292,500 Items duplicated (3,900) In transit under FOB destination (24,050) Items counted but not included in list 9,100 Overvaluation – extension errors (5,200) P268,450 5. Sales P1,040,000 Cost of sales: Inventory, Jan, 1 Net Purchases GAFS Inventory, Nov. 30 117,000 900,250 1,017,250 (268,450) 748,800 Gross Income P291,200 6. Cost ratio (748,800/1,040,000) 7. Regular sales (P169,000 x 72%) 72% 121,680 Sale of damaged items Cost of goods sold for December 8. Inventory, Nov. 30 26,000 P147,680 268,450 December net purchases 118,950 Cost of goods sold (147,680) Estimated inventory, Dec. 31 P 239,720 On September 15, 2011, a fire destroyed a significant portion of merchandise inventory of GOODBYE SUMMER Corporation. The following information was available from the records of the company: January 1, 2011 To Date of Fire Sales Sales Returns and allowances Purchases Purchase returns and allowances Beginning Inventory 2010 P900,400 P1,060,360 10,200 11,960 756,490 810,952 20,590 22,220 211,120 240,320 The company determined the cost of inventory not damaged to be P139, 476. Damaged merchandise, which cost P30,000, had an estimated realizable value of P10,000. REQUIRED: 1. Gross profit percentage 2. Estimated ending inventory at cost 3. Estimated fire loss Solution: Sales, 2010 1,060,360 Less: Sales return and allowances 11,960 Net Sales, 2010 1,048,400 100% Less: Cost of Sales, 2010 Beginning inventory Add: Purchases 240,320 810,952 Purchase return & Allowances Less: Ending Inventory (22,220) (211,300) Gross Profit 817,752 78% 230,648 22% Beginning inventory, 2011 211,300 Add: Net purchases Purchases Purchase returns & allowances 756,490 (20,590) 735,900 TGAS P947,200 Less: Estimated COS Sales 900,040 Sales Return & Allowances (10,200) Net Sales X Cost ratio 890,200 .78 Estimated ending Inventory at cost Less: Undamaged Inventory 694,356 P252,844 P139,476 Net realizable value of damaged inventory Estimated Fire Loss 10,000 149,476 P51,684 The OVERDOSE Corporation uses the lower of cost or net realizable value inventory. Data regarding the items in work-in-Process inventory are presented below Markers Historical cost Selling Price Estimated cost to complete Replacement Cost Pens P48,000 P37,760 36,000 43,600 9600 9600 41,600 33,600 25% 25% Normal Profit Margin Required: 1. What is the amount of markers inventory to be reported in Savior’s statement of financial position? 2. What is the amount of pens inventory to be reported in Savior’s statement of financial position? Solution: 1. COST(lower) 48,000 NRV: Selling Price 72,000 Less: Estimated cost to complete (9,600) 62,400 2. COST 37,760 NRV: Selling Price 43,600 Less: Estimated cost to complete (9,600) PROPERTY, PLANT & EQUIPMENT Problem 1 34,000 On January 1, 2010, SBS Corporation purchased a tract of land (site number 345) with a building for P6,000,000. SBS paid real estate broker’s commission of P150,000, legal fees of 60,000, and a title guarantee insurance of P18,000. The closing statement indicated that the land value was P5,000,000 and the building value was P1,000,000. Shortly after acquisition, the building was razed at a cost of 75,000. SBS entered into a P3,000,000 fixed price contract with the TAO BUILDERs, Inc. on March 1, 2010 for the construction of an office building on land site number 123. The building was completed and occupied on September 30, 2011. Additional construction costs were incurred as follows: Plans, specifications and blueprints..................120,000 Architects’ fees for design and supervision...........250,000 The building is estimated to have a forty-year life from date of -completion and will be depreciated using the 150%-declining-balance method. To finance the construction cost, SBS borrowed 3,000,000 on March 1,2010. The loan is payable in ten equal annual installments of P300,000 plus interest at the rate of 14%, SBS’ average amounts of accumulated building construction expenditures were as follows: For the period March 1 to December 31, 2010 For the period January 1 to September 30,2011 900,000 2,300,000 REQUIRED: 1. Total cost of land account 2. If borrowing cost is added to the asset constructed, what is the capitalized cost of the office building? 3. Depreciation to be recognized on December 31,2011. Solution: 1. Acquisition cost 6,000,000 Real estate tax 150,000 Legal fees 60,000 Title Guarantee 18,000 Cost of razing the building 75,000 Cost of Land 6,303,000 2. Contract Price P3,000,000 Plans, specification and blueprint 120,000 Architect Fees 250,000 Borrowing cost(900,000 x 14% x 10/12) 105,000 (2,300,000 x 14% X 9/12) 241,500 Cost of Building 3,716,500 3. (1/40 x 1.5) 3.75% (3,716,500 x 3.75% x 3/12) P34,842 Problem 2 The CRAZY-IN-LOVE company acquired a tract of land containing an extractable natural resource. The company is required by its purchase to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the land will have a value of 1,200,000 after restoration. Relevant cost information follows: Land Estimated restoration costs P9,000,000 1,800,000 Question 1: If the company maintains no inventories of extracted materials, how much should be charged to depletion expense per ton of extracted material assuming the amount of estimated restoration cost was already recognized as a liability? Question 2: if the company maintains no inventories of extracted materials, how much should be charged to depletion expense per ton of extracted material assuming the amount of estimated restoration cost has yet to be recognized? Solution: Question 1 Cost 9,000,000 Estimated restoration cost Estimated Salvage value 1,800,000 (1,200,000) Depletable cost Divided by life in units P9,600,000 2,000,000 Depletion per unit P 4.80 Question 2 Cost P9,000,000 Estimated salvage value (1,200,000) Depletable cost Divided by life in units Depletion per unit 7,800,000 2,000,000 P 3.90 Problem 3 On January 1, 2008, CHEN Company purchased an asset for P1,000,000, worth an estimated useful life of 10 years. Straight-line method of depreciation is to be used. On January 1, 2010, it was properly determined that the recoverable amount of the asset is P640, 000. On January 1, 2011, it was properly computed that the recoverable of the asset is P740,000. Question 1: Under the cost model for long lived assets, what are the amounts to be reported in the income statement and shareholder’s equity respectively, immediately on January 1, 2011? Question 2 under the revaluation model for long lived assets, what are the amounts to be reported in the profit or loss and shareholder’s equity on January 1, 2011? Solution: Question 1: 140,000; NONE Historical cost – January 1,2008 1,000,000 Accumulated depreciation from 1/1/08 To 1/1/10(1,000,00 x 2/10) 200,000 Carrying value on January 1, 2010 800,000 Recoverable Value As of January 1, 2010 Carrying Value 640,000 800,000 80,000 100,000 560,000 700,000 Depreciation for 2010: (640,000/8 years Carrying amount QUESTION 2: 140,000; 40,000 Recoverable value – January 1, 2011 P740,000 Less: Carrying amount based on its previous recoverable Amount 560,000 Increase in the value of the asset Carrying amount-01/01/11(based on historical cost) 180,000 700,000 Carrying amount-01/1/11( based on its previous fair value) 560,000 Reversal of impairment loss recognized as income in the income statement 140,000 Question 2: Recoverable value- January 1, 2011 Less: Carrying amount based on its previous P740,000 recoverable amount 560,000 Increase in the value of the asset 180,000 Less: Reversal of impairment loss recognized previously: Recoverable – January 1, 2011 560,000 Carrying value on January 1,2011 700,000 140,000 Revaluation surplus to be reported in the shareholder’s Equity 40,000 INTANGIBLES AND PREPAYMENTS ****** During 2010, JAR OF HEARTS COMPANY purchased a building site for its proposed research and development laboratory at a cost of P1,560,000. Construction of the building was started in 2010. The building was completed on December 31, 2011, at a cost of P7,280,000 and was placed in service on January 2, 2012. The estimated useful life of the building for depreciation was to be employed and there was no estimated salvage value. Management estimates that about 50% of the projects of the research and development group will result in long- term benefits (I.e. at least 10 years to the corporation. However, JAR OF HEARTS fails to demonstrate how such projects will generate probable future economic benefits. The remaining projects either benefit the current period or are abandoned before completion. A summary of the number of projects and the directs incurred in conjunction with the research and development activities for 2012 appears below Upon recommendation of the research and development group, JAR OF HEARTS Company acquired a patent for manufacturing rights at a cost of P2,080,000. The patent was acquired on April 1 2011, and has an economic life of 10 years. Number of Salaries and employee Projects benefits Other Expenses(excluding depreciation Charges) Completed projects with long-term 30 2,340,000 1,300,000 20 1,690,000 390,000 indeterminate 10 1,040,000 312,000 Total 60 5,070,000 2,002,000 benefits Abandoned projects or projects that benefit the current period Projects in process – results REQUIRED: 1. The total research and development expenses for 2012. 2. What is the amount of patent amortization for 2012? 3. What is the book value of the building on December 31, 2012? 4. What is the carrying value of the patent at December 31, 2012? Solution: 1. Salaries and employee benefits Depreciation – building (7,280,000/20 years) P5,070,000 364,000 Other expenses 2,002,000 Total research and development expenses 7,436,000 2. Patent amortization for 2012(P2,080,000/10 years) P208,000 3. Costs of building P7,280,000 Less: Accumulated depreciation, December 31, 2012 (7,280,000/20 years) 364,000 Book value, December 31, 2012 P6,916,000 4. Cost of patent purchased April 1, 2011 P2,080,000 Less: Amortization: April 1 – Dec. 31, 2011 (P2,080,000/10 x 9/12) P156,000 Jan. 1 – Dec. 31,2012 (P2,080,000/10) 208,000 Carrying value, Dec. 31,2012 364,000 P1,716,000 LIVE-IT-UP CORPORATION was organized in 2011. Its accounting records include only one account for all intangible assets. The following is a summary of the debit entries that have been recorded and posted during 2011 and 2012: INTANGIBLE ASSETS July 1, 2011 8- year franchise; expires June 30, 2019 P126,000 Oct, 1, 2011 Advance payment on leasehold (term of lease is 2 years) 84,000 Dec. 31, 2011 Net loss for 2011 including incorporation fee, P3,000, and 48,000 related legal fees of organizing, P15,000(all fees incurred in 2011) Jan. 2, 2012 Acquired patent (10-year life 222,000 Mar. 1, 2012 Cost of developing a secret formula 225,000 Apr. 1, 2012 Goodwill purchased 835,200 July 1, 2012 Legal fee for successful defense of patent purchased above 37,950 Oct, 1, 2012 Research and development costs 480,000 Ignore income tax effects. REQUIRED: 1. The unamortized patent cost at December 31, 2012 2. The unamortized franchise cost at December 31, 2012 3. The amount of prepaid rent to be reported in KIKITAT’s December 31, 2012, statement of financial position. 4. The adjusting entries on December 31, 2012, should include a net debit to the retained earnings account of 5. As a result of the adjustments at December 31, 2012, the total charges against KIKIKTAT’s 2012 income should be SOLUTION: 1. Cost of patent, Jan. 2, 2012 P222,000 Less: Amortization for 2012(222,000/10 years) 22,200 Unamortized patent cost 199,800 2. Cost franchise, July 1, 2011 P126,000 Less: Amortization, July 1, 2011 – Dec. 31, 2012 (P126,000/8 x 6/12) 23,625 Unamortized franchise cost, Dec. 31, 2012 P102,375 3. Prepaid rent, December 31, 2012(P84,000 x 9/24) 4. December 31, 2011 48,000 (126,000/8x6/12) (84,000x3/24) P 31,500 7,875 10,500 Net debit to R/E 5. Research and development expense 66,375 705,000 Legal Fees expense Franchise amortization 37,950 15,750 Rent expense Patent amortization expense TOTAL 42,000 22,200 822,900 ******* On January 2, 2002, SNSD Company spent P480,000 to apply for and obtain a patent on a newly developed product. The patent had an estimates useful life of 10 years, at the beginning of 2006, the company spent P144,000 in successfully prosecuting an attempted patent infringement. At the beginning of 2007, the company purchased for P280,000 a patent that was expected to prolong the life of its original patent by 5 years. On July 1, 2010, a competitor obtained rights to a patent that made the company’s patent obsolete. REQUIRED: 1. Carrying amount of patent as of December 31, 2006 2. Amortization of patent in 2007 3. Carrying amount of patents as of December 31,2009 4. Loss on patent obsolescence in 2010 Solution 1. Cost of patent P480,000 Less: Accumulated Amortization ( 480,000 x5/10) 240,000 Carrying amount of patent, 12/31/06 240,000 2. Amortization of original patent (240,000/10) P24,000 Amortization on related patent (280,000/10) 28,000 Total amortization in 2007 52,000 3. Original patent (240,000 x 7/10) P168,000 Related patent (280,000 x 7/10) 196,000 Carrying amount of patents, 12/31/09 364,000 4. Carrying amount of patents, 12/31/09 364,000 Less: Amortization, 1/1/10 to 7/10: Original patent (P240,000/10 x 6/12) P12,000 Related patent (280,000/10 x 6/12) 14,000 Loss on patent obsolescence 26,000 P338,000 Problem no.1 In connection with the audit of the PAKYO COMPANY for the year ended December 31, 2010 you are called upon to verify the accounts payable transactions. You find that the company does not make use of a voucher register but enters all merchandise purchases in a Purchases Journal, from which posting are made to a subsidiary accounts payable ledger. The subsidiary ledger balance of P1,500,000 as of December 31, 2010 agrees with the accounts payable balance in the company’s general ledger. An analysis of the account disclosed the following: Trade creditors, credit balances P1,363,000 Trade creditors, debit balances 63,000 Net Estimated warranty on products sold P 1,300,000 100,000 Customer’s deposits Due to officers and shareholders for advances 9,000 50,000 Goods received on consignment at selling price (offsetting debit made to Purchases) 41,000 P 1,500,000 A further analysis of the “Trade Creditors” debit balances indicates: Date Items Amount Miscellaneous debit balances prior to 2007 No information available due to loss of records in a fire. 03/03/07 P 3,000 Manila Co. –Merchandise returned for credit, but the company is now out of business 8,000 06/10/09 Cebu Corp. – Merchandise returned but Cebu says “never received” 07/10/10 7,000 Jolo Distributors – Allowance granted on defective merchandise after the invoice was paid 5,000 10/10/10 Bulacan Co – Overpayment of invoice 12/05/10 Advance to Zambales Co. This company agrees to supply certain articles on a cost –plus basis 24,000 12,000 12/05/10 Goods returned for credit and adjustments on price after the invoices were paid; credit memos from supplier not yet received 4,000 63,000 Your next step is to check the invoices in both the paid and the unpaid invoice files against ledger accounts. In this connection, you discover an invoice from Atlas Co. of P45,000 dated December 12, 2010 marked “Duplicate”, which was entered in the Purchase Journal in January 2011. Upon inquiry, you discover that the merchandise covered by this invoice was received and sold, but the original invoice apparently has not been received. In the bank reconciliation working papers, there is a notation that five checks totaling P 63,000 were prepared and entered in the Cash Disbursements Journal of December, but these checks were not issued until January 10, 2011. The inventory analysis summary discloses good in transit of P 6,000 at December 31, 2010, not taken up by the company under audit during the year 2010. These goods are included in your adjusted inventory. 1. The Accounts payable – Trade balance at December 31, 2010 should be 2. The net adjustment to Purchases should include a 3. The entry to adjust the Accounts payable account for those accounts with debit balances should include a debit to 4. The entry to adjust the Accounts payable account for those accounts with debit balances should include a debit to 5. Auditor confirmation of accounts payable balances at the end of the reporting period may be necessary because A. There is likely to be other reliable external evidence to support the balances B. Correspondence with the audit clients attorney will reveal all legal action by vendors for nonpayment C. This is a duplication of cutoff test D. Accounts payable at the end of reporting period may not be paid before the audit is completed. Solution: 1. (1,363,000 + 45,000 + 63,000 + 6,000 = 1,477,000 2. Net debit 10,000 3. 18,000 4. Advances to supplier - 24,000 5. A Problem 2 You were able to obtain the following from the accountant for Maverics Corp. Related to the companys liability as of December 31, 2010. Accounts payable Notes payable – trade Notes payable – bank Wages and salaries payable Interest payable P 650,000 190,000 800,000 15,000 ? Mortgage notes payable – 10% 600,000 Mortgage notes payable – 12% 1,500,000 Bonds Payable 2,000,000 The following additional information pertains to these liabilities: a. All trade notes payable are due within six months of the balance sheet date. b. Bank notes payable include two separate notes payable Allied Bank. (1) A P300,000, 8% note issued March 1, 2008, payable on demand. Interest is payable every six months. (2) A 1-year, P500,000, 11 ½% note issued January 2, 2010. On December 30, 2010 Mavericks negotiated a written agreement with Allied Bank to replace the note with 2-year, P500,000, 10% note to be iss7ued January 2, 2011. The interest was paid on December 31, 2010 c. The 10% mortgage note was issued October 1, 2007. With a term of 10 years. Terms of the note give the holder the right to demand immediate payment of the company fails to make a monthly interest payment within 10 days of the date the payment is due. As of December 31, 2010, Mavericks is three months behind in paying its required interest payment. d. The 12% mortgage note was issued May 1, 2001, with a term of 20 years. The current principal amount due is P 1,500,000. Principal and interest payable annually on April 30, A payment of P220,000 is due April 30, 2011. The payment includes interest of P 180,000. e. The bonds payable is 10-year, 8% binds, issued June 30, 2001. Interest is payable semi-annually every June 30 and December 31. Based on the above and the result of your audit, answer the following: 1. Interest payable as of December 31, 2010 is 2. The portion of the Notes payable – bank to be reported under current liabilities as of December 31, 2010 is 3. Total current liabilities as of December 31, 2010 is 4. Total noncurrent liabilities as of December 31, 2010 is Solution: 1. 300,000 x 8% x 4/12 = 8,000 600,000 x 10% x 3/12 = 15,000 1,500,000 x 12% x 8/12 = 120,000 Interest Payable 143,000 2. Note payable to bank 3. Accounts Payable P300,000 P650,000 Notes Payable – trade 190,000 Notes payable – bank 300,000 Wages and Salaries payable 15,000 Interest payable 143,000 Mortgage note payable 640,000 Bond payable Total current Liabilities 4. Note payable-bank 2,000,000 3,938,000 p500,000 Mortgage note payable (1,500,000 – 40,000) 1,460,000 1,960,000 On January 1, 2009, WIZARDS CORPORATION issued 2,000 of its 5-year, P1,000 face value 11% bonds date January 1 at an effective annual interest rate (yield) of 9%. Interest is payable each December 31. Wizards uses the effective interest method of amortization. On December 31, 2010. The 2,000 bonds were extinguished early through acquisition on the Open Market by Wizard for P1,980,000 plus accrued interest. On July 1, 2009, Wizards issued 5,000 of its P1,000 face value, 10% convertible bonds at pat. Interest is payable every June 30 and December 31. On the date of issue, the prevailing market interest rate for similar debt without the conversion option is 12%. On July 1, 2010, an investor in Wizards convertible bonds tendered 1,500 bonds for conversion into 15,000 shares of Wizards common stock, which had a fair value of P105 and a par value of P1 at the date of conversion. Shareholders’ Equity EMERALD Company reported the following shareholders’ equity on January 1, 2013. Share Capital, 1,500,000 shares 1,500,000 Share Premium 15,000,000 Retained Earnings 8,100,000 Treasury Shares, 100,000 at cost (900,000) All of the outstanding and treasury shares were originally issued in 2011 for 11 per share. The treasury shares are reacquired on March 31, 2012. During 2013, the following events or transactions occurred relating to shareholders’ equity: February 15 – Issued 400,000 shares for P12.5 per share June 15 – Declared a cash dividend of P0.20 per share to shareholders of record on April 15. This was the first dividend ever declared. September – The president retired, the entity purchased from the retiring president 100,000 shares for P13.00 per share which was equal to market value on this date. These shares were cancelled. December 15 – Declared a cash dividend ofP0.20 per share to shareholders of record on January 2, 2014. On December 31, 2013, the entity is being sued by two separate parties for patent infringement. The management and outside legal counsel share the following opinion regarding these suits: Suit Likelihood of losing the suit Estimated Loss #1 Reasonably possible 600,000 #2 Probable 400,000 Required: 1. What is the increase in share premium arising from the issuance of 400,000 shares on February 15? 2. What is the decrease in share premium arising from the retirement of 100,000 shares on September 15? 3. What amount of loss contingencies should be appropriated by a charge to unappropriated retained earnings? 4. What amount of cash dividend should be charged against unappropriated retained earnings in 2013? 5. What amount should be reported in the notes to financial statement as restriction on retained earnings because of acquisition of treasury shares? SOLUTION: 1. 400,000 x 11.50 = 4,600,000 2. 100,000 x 10 = 1,000,000 3. SUIT no.1 is a possible loss which require disclosure that can be done by appropriation of Retained Earnings 4. 1,800,000 x .2 = 360,000 1,700,000 x .2 = 340,000 Total cash dividend 700,000 5. Treasury shares, at cost P900,000 ********************************************************************** You are a senior accountant responsible for the annual audit of LOBERIAL CO. for the year ended December 31, 2012. The information available to you is presented below. You may assume that any pertinent information not presented below has already been checked and found satisfactory. Excerpts from trial balance, December 31, 2012 Credit Retained Earnings P93,000 Allowance for decline in value of inventory 36500 Share capital (5,000 shares) 500,000 The books have not been closed, but all adjusting entries which the company expects to make have been posted. Their trial balance shows a P60,000 net income for the year. Ledger details of Retained Earnings: Retained Earnings 08/06/12 CD 2,000 12/31/11 Balance 134,500 10/10/12 J 10,000 4/29/12 CR 500 12/31/12 J 30,000 Note: The balance at 12/31/11 agrees with last year’s working papers. Analysis of selected cash receipts: Date Account Credited Amount 4/29/12 Share Capital 10,500 Sold 100 par shares Retained Earnings 500 at 105 Building 530,000 See corollary entry 10/10/12 dated 10/10/12 Analysis of selected cash disbursements: Date Account Debited Amount Explanation 08/06/12 Retained Earnings 2,000 Freak accident to company truck not covered by insurance: repairs by DJ Repairs Selected Entries in the general journal: Date Entry and Explanation Debit 10/10/12 Accumulated Depreciation 370,000 Retained Earnings Credit 10,000 Building 380,000 Sale of main office building 12/31/12 Retained Earnings 30,000 Allowance for decline in Value of Inventory 30,000 Provision to value at lower of cost and net realizable value Based on the preceding information, determine the following: 1. Loss on sale of building 2. Share capital balance 3. Share premium balance at December 31,2012 4. Net income for 2012 SOLUTION: 1. (910,000 – 370,000) – 570,000 = P10,000 2. 500,000 3. 500 4. (60,000-10,000-2,000-30,000) = P18,000 **************************************************************** The Perseverance Corporation has requested you to audit its financial statements for the year 2005. During your audit, Perseverance presented to you its balance sheet as of December 31, 2004 containing the following capital section: Preferred stock P10 par; 60,000 shares authorized and issued, of which 6,000 are treasury shares costing P90,000 and shown as an asset P600,000 Common stock, par value P4; 600,000 shares authorized, of which 450,000 are issued and outstanding 1,800,000 Additional paid in capital (P5 per share on preferred stock issued in 2000) 300,000 Allowance for doubtful accounts receivable 12,000 Reserve for depreciation 840,000 Reserve for fire insurance 198,000 Retained earnings 2,250,000 P6,000,000 Additional information: 1) Of the preferred stock, 3,000 shares were sold for P18 per share on August 30, 2005. Perseverance credited the proceeds to the Preferred Stock account. The treasury shares as of December 31, 2004 were acquired in one purchase in 2004. 2) The preferred stock carries an annual dividend of P1 per share. The dividend is cumulative. As of December 31, 2004, unpaid cumulative dividends amounted to P5 per share. The entire accumulation was liquidated in June, 2005, by issuing to the preferred stockholders 54,000 shares of common stock. 3) A cash dividend of P1 per share was declared on December 1, 2005 to preferred stockholders of record December 15, 2005. The dividend is payable on January 15, 2006. 4) At December 31, 2005, the Allowance for Doubtful Accounts Receivable and Reserve for Depreciation had balances of P25,000 and P1,050,000, respectively. 5) On March 1, 2005, the Reserve for Fire Insurance was increased by P60,000; Retained Earnings was debited. 6) On December 31, 2005, the Reserve for Fire Insurance was decreased by P30,000, which represents the carrying value of a machine destroyed by fire on that date. Estimated fire cleanup costs of P6,000 does not appear on the records. 7) The December 31, 2004 Retained Earnings consists of the following: Donated land from a stockholder (Market value on date of donation) P450,000 Gains from treasury stock transactions Earnings retained in business 51,000 1,749,000 P2,250,000 8) Net income for the year ended December 31, 2005 was P1, 297,500 per company’s records. QUESTIONS: Based on the above and the result of your audit, determine the adjusted balances of the following as of December 31, 2005. (Disregard tax implications) 1. Preferred stock 2. Common stock 3. Additional paid in capital 4. Appropriated retained earnings 5. Unappropriated retained earnings 6. Treasury stock 7. Total stockholders’ equity SOLUTION: 1. Preferred stock 600,000 2. Common stock 2,016,000 3. Additional paid in capital 864,000 4. Appropriated retained earnings 303,000 5. Unappropriated retained earnings 2,578,500 6. Treasury stock 45,000 7. Total stockholders’ equity 6,316,500