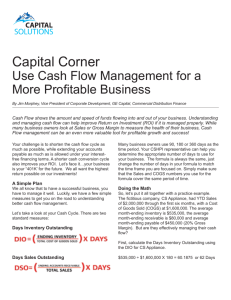

Making Sense of Formulas: 1. Days Sales Outstanding: The average number of days to collect sales revenue: that is, accounts receivable divided by sales multiplied by 365. 2. Days Inventory Held: This is the inventory divided by sales, multiplied by 365. 3. Days Payable Outstanding: Accounts payable divided by sales, multiplied by 365. 4. Cash to Cash: This is the total number of days from purchasing goods to collecting revenue from customers. It is calculated by adding the days sales outstanding figure and the days inventory held figure, then subtracting the days payable outstanding. The lower the result, the better: negative is best. 5. Trade Working Capital/Sales: The percentage change in working capital divided by sales between the last two sets of annual financial statements. A negative change is an improvement in working capital. 6. EBITA/Sales: This is the percentage change in earnings before interest, tax, depreciation and amortization divided by sales over the last two sets of annual financial statements. This figure is included because improvements in working capital can be at the expense of profits.