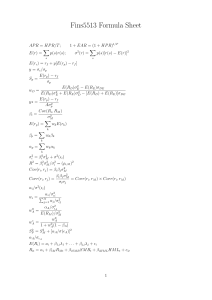

International Investments 1/5 Formula sheet Portfolio risk and return E (r ) p( s )r ( s ) s C y P E ( rP ) r f SP P 2 p(s)[r (s) E (r )]2 s Cov(rX , rY ) Pr( s)[rX ( s) E (rX )][rY ( s) E (rY )] s (X, Y) i Cov(rX , rY ) XY Cov(ri, rM ) M2 E (ri ) rf i[ E (rM ) rf ] k rf [ E ( r M ) r f ] E (rc ) yE (rp ) (1 y )rf rf y[ E (rp) rf ] y* E ( rp ) rf A P2 U E (r ) 0.5 A 2 E (rP ) wXE (rX ) wYE (rY ) P2 wX2 X2 wY2 Y2 2w w Cov(r , r ) X Y X Y Cov(rX , rY ) XY X Y [ E (rX ) rf ] Y2 [ E (rY ) rf ]Cov(rX , rY ) wX [ E (rX ) rf ] Y2 [ E (rY ) rf ] X2 [ E (rX ) rf E (rY ) rf ]Cov(rX , rY ) wMin ( X ) Y2 Cov(r , r ) X2 Y2 2Cov(r , r ) X Y X Y Formula sheet International Investments 2/5 Formula sheet Stock and bond valuation D1 D2 DH PH V0 ... 2 1 k (1 k ) (1 k ) H P0 D1 kg E (r ) Dividend yield Capital gains yield D1 P 1 P 0 D 1 g P0 P0 P0 E1 PVGO k g ROE b P0 T Coupon Par value t (1 r )T t 1 (1 r ) V0 T D t wt t 1 CFt /(1 y )t Bond price D D* 1 y P D * y P wt Convexity 1 P (1 y ) 2 T CFt [ (1 y) t 1 t (t 2 t )] P 1 D * y Convexity (y ) 2 P 2 P / P Effective duration r Asset duration w duration1 (1 w) duration 2 1 y y 1 y T Durationannuity y (1 y )T 1 Durationperpetuity Durationcoupon bond 1 y (1 y ) T (c y ) y c[(1 y )T 1] y Durationcoupon bond at par 1 y 1 [1 ] y (1 y )T International Investments 3/5 Formula sheet The index model i2 i2 M2 (2ei ) Cov(ri, rj ) i j M2 1 2 (2e ) (e) n P Options P C S 0 PV ( X ) PV ( Dividends ) H CU CD uS 0 dS 0 pupward ( risk neutral ) 1 r d ud C 0 S 0 N (d 1) Xe rT N (d 2) d1 ln( S 0 / X ) (r 2 / 2)T T d 2 d1 T Term structure, futures and forwards (1 yn ) n (1 rn ) (1 yn 1) n 1 (1 yn ) n 1 fn (1 yn 1) n 1 F 0 S 0(1 rf ) D S 0(1 rf d ) F (T 2) F (T 1)(1 rf d )(T 2T 1) Performance measures and performance contribution E ( rP ) r f Sharpe ' s measure Treynor ' s measure P E ( rP ) rf P (e ) Jensen ' s measure E (r ) [r [ E (r ) r ) Information ratio P P P P n n n i 1 i 1 i 1 f P rP rB wPirPi wBirBi ( wPirPi wBirBi ) M f International Investments Discount factors and annuity tables 4/5 Formula sheet International Investments Cumulative normal distribution 5/5 Formula sheet International Investments Finite Geometric series: Sn = a. [1 – (k)n] / [1 - k], k=quotient Infinite Geometric series: (n goes to infinity) Sn = a. [1] / [1 - k], k=quotient (<1) 6/5 Formula sheet