midterm =pka03j^ 59224](http://s2.studylib.net/store/data/026091151_1-421c07338dc1fb9144d7500f7c3d543d-768x994.png)

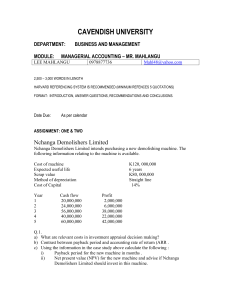

Version A HONG KONG UNIVERSITY OF SCIENCE AND TECHNOLOGY FINA2203 AND FINA2303 SPRING 2016 MIDTERM EXAMINATION Student Name: _____________________________________________ Student ID Number: ___________________________________________ Do NOT open this exam paper until you are told to do so. Instructions: This exam has 40 questions and it lasts 2.5 hours. Select only one (best) answer for each question. You must blacken your answers clearly on the electronic answer sheet provided to you, and not on this exam paper. Only answers marked on the electronic answer sheet will be graded. Put your name and student ID number on this exam paper AND mark the bubbles on the answer sheet. Answer sheets with no identification will be graded zero. This is a closed book examination. No draft paper or notes are allowed. No calculator with text display function is allowed. Do NOT tear off any page of this exam paper. After completing the exam, you must turn in both the exam paper AND the answer sheet to the proctor. PLEDGE: Honesty and integrity are most essential. I know that cheating will lead to serious consequences. By signing below, I am committed as a student to the university’s Academic Honor Code. Sign here: ______________________________ Paper No.: 1 Venue: LTA Seat No: A7 1 2 1. 2. 3. Please turn to the cover sheet of the exam. What letter do you see in the upper right hand corner of the exam? A. A B. B C. C D. D E. E Which of the following would NOT be considered a secondary market transaction? A. A buy order to a broker for shares of stock in a company listed on Hong Kong Stock Exchange. B. A buy order to an investment banker for a new initial public offering (IPO) of stock. C. A buy order to a broker for shares of stock in a company on the Shanghai Stock Exchange. D. A buy order to a dealer for outstanding bonds of a company trading on the over the counter (OTC) market. E. A buy order to a broker for a stock listed on the Shenzhen stock exchange. Which of the following statements is true? A. Profit maximization is the goal of financial management. B. Working capital management is NOT one of the financial management decisions. C. A CFO should maximize the market value of the existing owners' equity. D. Private business always has different goals from public firms. E. None of the above 3 4. Benson Inc., a manufacturer of power tools, decides to offer a rebate of $120 on its 16-inch mid-range chain saw, which currently has a retail price $520. Benson estimate that, as a result of the rebate, sales of this model will increase from 60,000 to 80,000 units next year. The profit margin for Benson before the rebate is $180. Based on the given information, does it make sense for Benson to give the rebate? 5. 6. A. No, since costs are $6,000,000 more than benefits. B. No, since costs are $6,800,000 more than benefits. C. Yes, since the benefits are $3,400,000 more than the costs. D. Yes, since the benefits are $7,300,000 more than the costs. E. The answer cannot be determined based on the information given. You make the following five end-of-year deposits into your investment account that earns 9% annual interest: $600 in year 1, $700 in year 2, $500 in year 3, $300 in year 4, and $400 in year 5. Note that the first cash flow of $600 which occurs at the end of year 1 earns interest for four years. What is the balance in your investment account at the end of year 5? Round to the nearest dollar amount. A. $3,400 B. $2,500 C. $2,865 D. $3,075 E. $3,565 If the interest rate is 8% per annum, how long will it take to double your money? A. 4 years B. 6 years C. 8 years D. 9 years E. 12 years 4 7. What is the value at the end of year 4 of the following set of cash flows? Assume an annual interest rate of 5%. Year Cash flow 8. 1 $1000 A. Less than -$6 B. Between -$6 and $0 C. Between $0 and $6 D. Between $6 and $12 E. None of the above 2 -$1000 3 -$1000 4 $1000 Your son is four years old now and will be going to college in 14 years. You would like to have $625,000 in a savings account to fund his education at that time. If the account promises to pay a fixed interest rate of 3% per year, how much money do you need to put in the account today to ensure that you will have $625,000 in 14 years? A. $249,869 B. $347,040 C. $401,164 D. $413,199 E. None of the above 5 9. A project produces the following cash flows: Year Flow 1 2 3 $457 $347 $996 If the cost of capital is 10 percent, what is the project’s PV? 10. A. $1,098 B. $1,800 C. $1,210 D. $1,375 E. $1,451 You are evaluating two annuities. They are identical in every way, except that one is an ordinary annuity and one is an annuity due (i.e., the cash flows start at the beginning of each period). Which of the following is FALSE? A. The ordinary annuity must have a lower present value than the annuity due. B. The ordinary annuity must have a lower future value than the annuity due. C. The annuity due must have the same present value as the ordinary annuity. D. The two annuities will differ in present value by the factor (1+r). E. The annuity due and the ordinary annuity will make the same number of total payments over time. 6 11. 12. 13. You can earn 0.5 percent per month at your bank. If you deposit $1,000, how long must you wait until your account has grown to $3,000? A. 220.27 months B. 246.32 months C. 284.46 months D. 156.78 months E. None of the above You plan to pursue graduate study and expect to study part-time for 3 years. The annual spending including tuition and other related expenses are estimated to be $80,000 payable at the end of each year, growing at 5% per year. Assume that you can earn 8% interest on your savings. What is the lump sum that you will need before you start your graduate study? A. $206,168 B. $216,107 C. $233,395 D. $252,200 E. $549,781 You are scheduled to receive annual payments of $10,000 for each of the next 25 years. Interest rate is 8.5%. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year? A. $10,850 B. $8,017 C. $9,438 D. $10,000 E. $8,699 7 14. 15. 16. Six years from now you will begin to receive cash flows of $50 per year. These cash flows will continue forever. If the discount rate is 10%, what is the present value of these cash flows? A. $282.24 B. $310.46 C. $341.51 D. $500.00 E. None of the above It is December 31, 2014 and you are planning for your daughter’s college education. She is now 8 and you will save for the next 10 years, making deposits into a savings account beginning December 31, 2015 and ending December 31, 2024 (10 deposits). Your daughter wants to go to the University of New South Wales. To pay for the tuition and other expenses, you will make withdrawals of $50,000 per year for the following 4 years. The first withdrawal will be December 31, 2025 and the lasts withdrawal will be December 31, 2028 (4 withdrawals). After the last withdrawal, your account should be empty. The interest rate is 5%. Ignore taxes and inflation. How much do you need to save in each of the 10 years? A. $20,000 B. $22,961 C. $23,046 D. $14,096 E. $11,928 You have just won the Hong Kong championship and you can choose from one of the following prizes. If the interest rate is 8%, which is the most valuable prize? A. $100,000 now. B. $150,000 at the end of five years. C. $15,500 for each of the next ten years D. $8,000 a year forever (with payments starting next year) E. $5,000 next year and increasing thereafter by 3% a year forever. 8 17. You are considering investing in an oil pipeline that will generate a $3 million net cash inflow at the end of the coming year. The pipeline is expected to last for a very long time. Unfortunately, the volume of oil shipped in declining, and cash flows are expected to decline by 3 percent per year. The discount rate is 9%. What is the PV of the pipeline’s cash flows if its cash flows are assumed to last forever? 18. 19. A. $50 million B. $30 million C. $27 million D. $25 million E. None of the above You are planning to save your salary bonus from work and are comparing savings accounts: Account A compounds semiannually while account B compounds monthly. If both accounts have the same effective annual rate of interest, you should choose A. account A because it has a higher APR B. account B because it has a higher APR C. account B because it is compounded more often D. account A because you will pay less in taxes E. either since you would be indifferent between the two You are thinking of saving for your retirement and considering among several investments that the bank is offering you. Which would you prefer? A. An investment paying interest of 10.00 APR percent compounded annually. B. An investment paying interest of 9.75 APR percent compounded semiannually. C. An investment paying interest of 9.65% APR compounded quarterly. D. An investment paying interest of 9.60% APR compounded monthly. E. An investment paying interest of 9.58% APR compounded daily. 9 20. 21. Stella Electronics is looking at its financing options for an expansion program. Bank A offers to lend Stella the required funds on a loan in which interest must be paid monthly, and the quoted rate is 8 percent. Bank B will charge 9%, with interest due at the end of the year. What is the difference in the effective annual rates charged by the two banks? A. 0.30% B. 0.50% C. 0.70% D. 0.90% E. 1.00% The Hang Seng bank charges 10% APR on its business loans, compounded semiannually while the Bank of China charges 9.6% APR, compounded monthly. If you plan to borrow money from one of the two banks, which loan is more attractive to you (based on the EAR)? A. The Hang Seng bank loan is better to you since its EAR is higher. B. The Hang Seng bank loan is better to you since its EAR is lower. C. The Bank of China loan is better to you since its EAR is higher. D. The Bank of China loan is better to you since its EAR is lower. E. None of the above Use the information for the two question(s) below. Your firm needs to invest in a new delivery truck. You can borrow funds and pay the full price upfront. Or, you can lease from the dealer by making monthly payments. Your firm can borrow at 13% APR with quarterly compounding. 22. The effective annual rate on your firm's borrowings is: A. 13.00% B. 13.28% C. 13.44% D. 13.65% E. 13.85% 10 23. 24. 25. To evaluate the leasing decision for the truck, the monthly discount rate that you should use is: A. 1.062% B. 1.072% C. 1.083% D. 1.105% E. 1.138% Thomas bought a yacht at a total cost of $328,000. He finances this with a five-year loan at 6.2% APR with monthly payments. After he has made the first 20 payments, how much is the outstanding principal balance on his loan? A. $150,970 B. $229,722 C. $250,700 D. $287,153 E. $302,290 In comparing two projects using an NPV profile, at the point where the net present values of the two projects are equal, _____________. A. the IRR of each is equal to zero B. the IRR of each is equal to the cost of capital C. the discount rate that equates them is called the crossover rate D. the projects both have NPVs equal to zero E. the AAR exceeds the cost of capital 11 26. 27. 28. An investment project has multiple IRRs. What must be true about this project? A. The project has a large initial outlay. B. The project has a negative AAR. C. A project has negative cash flows in the first few years, but positive cash flows thereafter. D. At least one of the future cash flows is negative. E. The project cash flows must change signs at least twice. Consider a project with an initial investment and positive future cash flows. As the discount rate increases, the ________. A. IRR remains constant while the NPV increases B. IRR decreases while the NPV remains constant C. IRR remains constant while the NPV decreases D. IRR increases while the NPV remains constant E. IRR decreases while the NPV decreases The following are some of the shortcomings of the IRR method except: A. IRR is conceptually easy to communicate B. Projects can have multiple IRRs C. IRR method cannot distinguish between borrowing project and a lending project D. IRR does not measure the amount of wealth created by a project E. IRR is not easy to calculate by just using formulas 12 29. 30. Your firm is trying to decide between three mutually exclusive investment opportunities. Project A lasts 3 years. Project B lasts 5 years and Project C lasts 4 years. Assuming that these are recurring opportunities. The most appropriate tool for identifying the correct decision is: A. Incremental IRR. B. Equivalent annual annuity (EAA). C. Internal rate of return (IRR). D. Modified Internal Rate of Return (MIRR) E. Profitability index (PI). Which of the following statements about the payback investment rule is INCORRECT? A. The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the net present value (NPV). B. The payback rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea. C. The payback rule is reliable because it considers the time value of money and depends on the cost of capital. D. The payback rule assumes most investment opportunities expenses occur initially and cash is received later. E. More than half of the firms surveyed reported using the payback rule for making investment decisions. 13 31. Consider two projects: Beta and Gamma. They are both two year projects. The following table provides the cash outflow in year 0 and the cash inflows in years 1 and 2 for both projects. Year 0 1 2 Beta -4,000 2,430 2,915 Gamma -2,000 1,309 1,719 IRR 21% 31% Assume that the discount rate is 8%. Suppose you cannot take both projects. You have to choose between the two projects. Which project would you take? 32. A. Project Beta B. Project Gamma C. Both projects are worth investing into D. Both projects are not worth investing into E. Difficult to say based on the information provided Project A and Project B are mutually exclusive projects with equal risk. Both projects have an initial cash outflow followed by a series of cash inflows. Project A requires $1million in initial outlay, and has an internal rate of return of 13%, while Project B requires $ 800,000 in initial outlay, and has an internal rate of return of 15%. The two projects have the same net present value when the cost of capital is 7%. In other words, the crossover point is 7%. Which of the following statements is correct? I. II. III. If the cost of capital is 10%, both projects will have a positive net present value. If the cost of capital is 5%, Project B has a higher net present value than Project A. If the cost of capital is 10%, Project B has a higher net present value than Project A. A. I only B. II only C. III only D. I & II only E. I & III only 14 33. Which of the following statements is FALSE? A. In general, the difference between the cost of capital and the internal rate of return (IRR) is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision. B. The internal rate of return (IRR) can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital. C. If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate. D. E. 34. For a project with conventional cash flows, the net present value (NPV) will be positive if the cost of capital estimate is more than the internal rate of return (IRR). None of the above. Which of the following statements is FALSE? A. The payback investment rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea. B. An internal rate of return (IRR) will always exist for an investment opportunity. C. A net present value (NPV) will always exist for an investment opportunity. D. In general, there can be as many internal rates of return (IRRs) as the number of times the project's cash flows change sign over time. E. None of the above. 15 35. 36. Which of the following statements is FALSE? A. The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the net present value (NPV). B. For most investment opportunities, expenses occur initially and cash is received later. C. The payback rule is reliable because it considers all the cash flows of the project. D. Fifty percent of firms surveyed reported using the payback rule for making decisions. E. All of the above. Consider two mutually exclusive projects with the following cash flows: A B A-B 0 (10,000) (6,000) (4,000) 1 5000 3300 1,700 2 6000 3000 3,000 3 6500 6000 500 IRR 32.4% 40.9% 16.3% At a cost of capital of 8%, the correct investment decision is to choose …………. with the stated reason. A. Project A because its NPV is positive. B. Project A because the crossover rate is larger than 8% C. Project B because its IRR is larger. D. Project B because its NPV is positive E. Project B because the crossover rate is larger than 8%. 16 37. You are considering four investment opportunities. All investments are expected to be sold after 5 years, and their cost of capital is the same at 20%. If you have a total capital budget of $500,000, given the following information, which projects will you choose? Project I II III IV 38. Cost ($) 300,000 500,000 300,000 200,000 A. Project II B. Project III C. Projects I & III D. Projects I and IV E. Projects III and IV Expected cash inflow ($) 1,600,000 2,800,000 1,900,000 1,100,000 A garage is comparing the cost of buying two different garage doors. Model A will cost $40,000, require servicing cost of $2,000 at the end of every two years, and last ten years. Model B will cost $30,000; require servicing cost of $1,600 at the end of each year, and last eight years. If the cost of capital is 7%, which is the better option, given that the firm has an ongoing requirement for the garage door? A. Model A, since it has an equivalent annual annuity of -$4,678. B. Model A, since it has an equivalent annual annuity of -$6,624. C. Model A, since it has an equivalent annual annuity of -$6,660. D. Model B, since it has an equivalent annual annuity of -$4,994. E. Model B, since it has an equivalent annual annuity of -$6,624. 17 39. Michael Security has learned that a rival has offered to supply a parking garage with security for ten years for $45,000 up front and a further $15,000 per year. Michael Security offers to provide security for eight years for an upfront cost of $60,000 and a separate yearly payment. What should the yearly payment be so that Michael's offer matches the equivalent annual annuity of their rival's offer? (Assume a cost of capital of 5%.) 40. A. $9,486 B. $11,544 C. $13,287 D. $15,599 E. $20,828 You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? Year Project A Project B Difference (A-B) 0 -$75000 -$75000 0 1 24800 22000 2800 2 29500 27500 2000 3 45300 51300 -6000 If the crossover rate is 14.96% and the cost of capital is 8 %, which project you should choose? A. Project A B. Project B C. Choose both of them D. Choose none of them E. Not enough information to decide 18 41. Consider the three investments: Investment A: Year: 0 1 Cash flow: -$15,000 $8000 2 $6000 3 $6000 4 5 $6000 $6000 Investment B: Year: 0 1 Cash flow: -$13,000 $6000 2 $6000 3 $7000 4 5 $7000 $7000 Investment C: Year: 0 1 Cash flow: -$12,000 $8,000 2 $2000 3 $6000 4 5 $2000 $2000 The cash flows for three projects are shown above. The cost of capital is 9.5%. If an investor decided to take project with a shortest payback period, which of these projects would he take? A. Investment A B. Investment B C. Investment C D. None of these investments E. Not enough information to decide <End of Paper> 19 20 Draft Paper <This page MUST remain attached to the question paper> 21