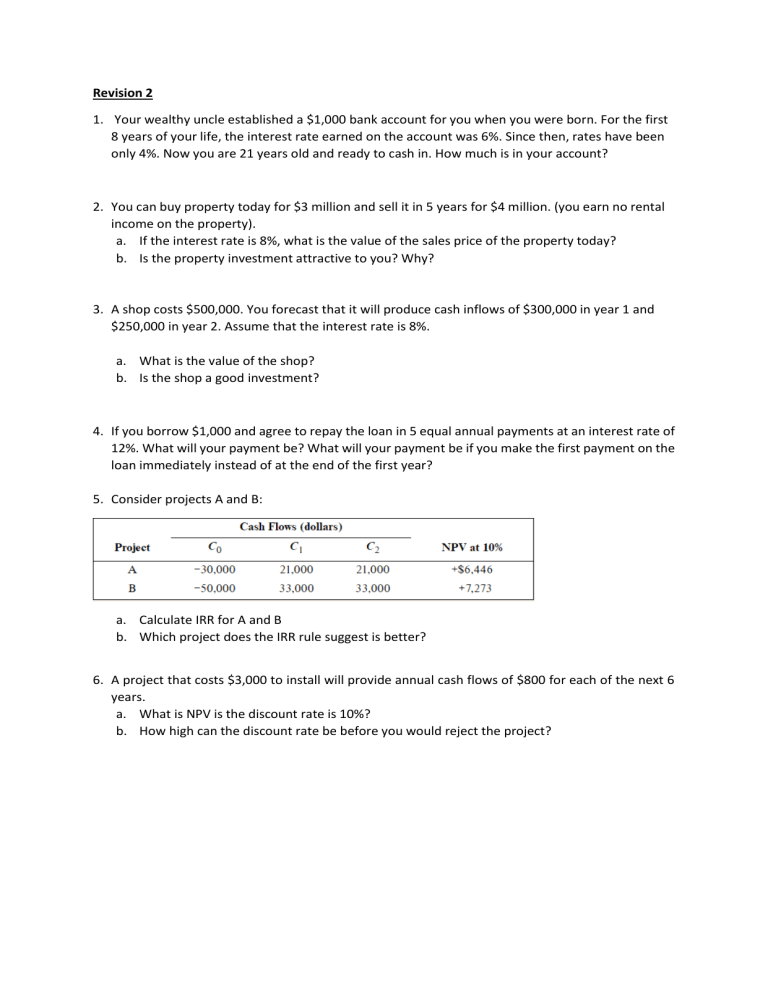

Revision 2 1. Your wealthy uncle established a $1,000 bank account for you when you were born. For the first 8 years of your life, the interest rate earned on the account was 6%. Since then, rates have been only 4%. Now you are 21 years old and ready to cash in. How much is in your account? 2. You can buy property today for $3 million and sell it in 5 years for $4 million. (you earn no rental income on the property). a. If the interest rate is 8%, what is the value of the sales price of the property today? b. Is the property investment attractive to you? Why? 3. A shop costs $500,000. You forecast that it will produce cash inflows of $300,000 in year 1 and $250,000 in year 2. Assume that the interest rate is 8%. a. What is the value of the shop? b. Is the shop a good investment? 4. If you borrow $1,000 and agree to repay the loan in 5 equal annual payments at an interest rate of 12%. What will your payment be? What will your payment be if you make the first payment on the loan immediately instead of at the end of the first year? 5. Consider projects A and B: a. Calculate IRR for A and B b. Which project does the IRR rule suggest is better? 6. A project that costs $3,000 to install will provide annual cash flows of $800 for each of the next 6 years. a. What is NPV is the discount rate is 10%? b. How high can the discount rate be before you would reject the project?