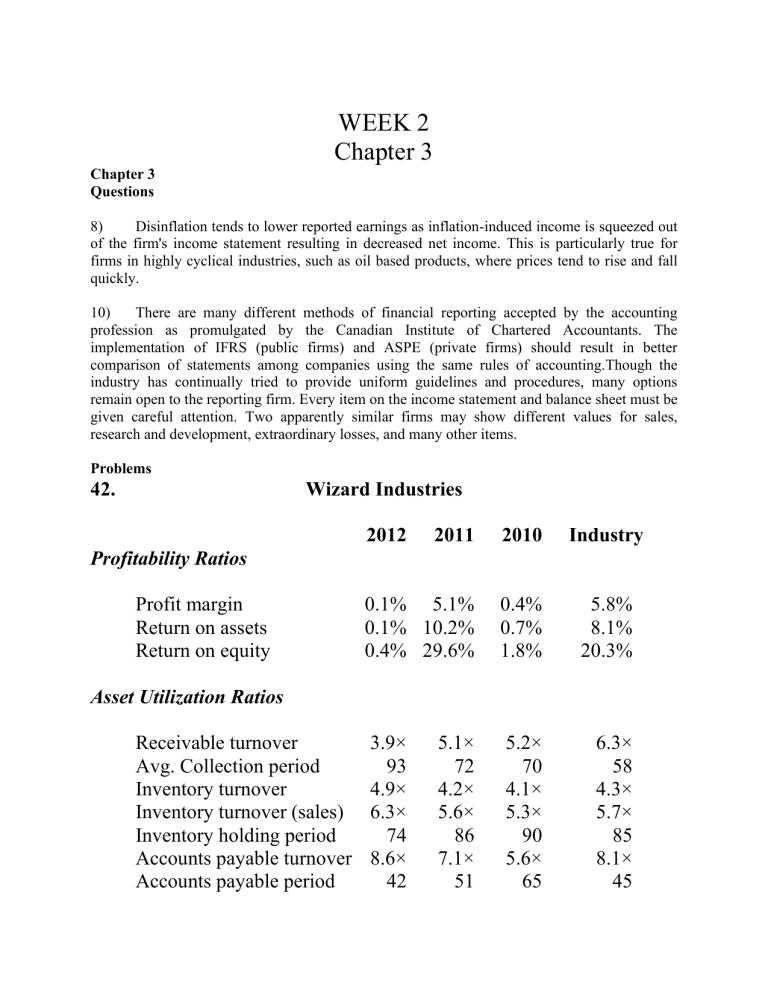

WEEK 2 Chapter 3 Chapter 3 Questions 8) Disinflation tends to lower reported earnings as inflation-induced income is squeezed out of the firm's income statement resulting in decreased net income. This is particularly true for firms in highly cyclical industries, such as oil based products, where prices tend to rise and fall quickly. 10) There are many different methods of financial reporting accepted by the accounting profession as promulgated by the Canadian Institute of Chartered Accountants. The implementation of IFRS (public firms) and ASPE (private firms) should result in better comparison of statements among companies using the same rules of accounting.Though the industry has continually tried to provide uniform guidelines and procedures, many options remain open to the reporting firm. Every item on the income statement and balance sheet must be given careful attention. Two apparently similar firms may show different values for sales, research and development, extraordinary losses, and many other items. Problems 42. Wizard Industries 2012 2011 2010 Industry 0.1% 5.1% 0.1% 10.2% 0.4% 29.6% 0.4% 0.7% 1.8% 5.8% 8.1% 20.3% 3.9× 93 4.9× 6.3× 74 8.6× 42 5.2× 70 4.1× 5.3× 90 5.6× 65 6.3× 58 4.3× 5.7× 85 8.1× 45 Profitability Ratios Profit margin Return on assets Return on equity Asset Utilization Ratios Receivable turnover Avg. Collection period Inventory turnover Inventory turnover (sales) Inventory holding period Accounts payable turnover Accounts payable period 5.1× 72 4.2× 5.6× 86 7.1× 51 Capital asset turnover Total asset turnover 9.9× 1.8× 10.6× 2.0× 8.4× 1.9× 8.0× 1.7× 1.72 1.08 1.71 .93 1.55 0.82 1.6 1.1 71.4% 65.3% 64.7% 1.02× 3.42× 1.15× 1.02× 3.42× 1.15× 60% 4.3× Liquidity Ratios Current ratio Quick ratio Debt Utilization Ratios Debt to total assets Times interest earned Fixed charge coverage The profitability ratios do not appear healthy. Even in 2011 the profit margin did not reach the industry average. The relatively good performance in year 2011 seems to be dependent on strong sales. Good return on assets results from high asset turnover and the high return on equity is due to high debt levels. When sales The asset utilization ratios reveal problems. The slowdown in the collection of accounts receivable is of considerable concern. The working capital position has become more dependent on A/R and we must question the quality of these receivables. Turnover is far below the industry average. The accounts payable period is now below the industry average which suggests Wizard is not taking advantage of supplier credit to the full extent possible or suppliers are starting to cut back on credit to Wizard. Capital asset turnover is above the industry average and probably reveals that Wizard is overtrading and may not be reinvesting in assets. The increased inventory turns may also indicate overtrading. The liquidity ratios appear to be good. We should ask why. We have already identified the increasing A/R position. This would increase the liquidity ratios but it is hardly a healthy position. Furthermore, the long-term debt position has been increasing, perhaps as a substitute for short-term borrowings. The debt utilization ratios suggest an increasingly precarious position. The profit failure has severely impacted on the debt load. Interestingly, dividends have been maintained, Creditors are increasingly holding the bag. Do not grant credit! Debt loads are increasing and shareholders are not showing a full commitment to the firm. An equity contribution and reduction of dividends is required. Furthermore sales are weak and this is impacting on profitability measures. Those sales that are made are being collected in a longer time. Are they less creditworthy? There is also evidence of a reluctance to reinvest in equipment (capital assets).