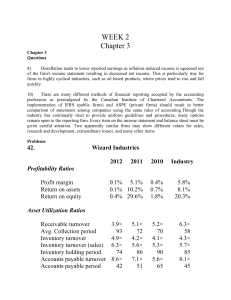

Plagiarism Scan Report Summary Report Genrated Date 11 Sep, 2016 100% Unique Plagiarism Status Total Words 637 Total Characters 3739 m Any Ignore Url Used s. co Content Checked For Plagiarism: Sm al lS eo To ol We have used the financial ratios method to evaluate the performance of Barry Computer Company. Financial ratios are helpful when determining the company profitability, short and long term liquidity and to check the performance against set standards. The results from the ratios are compared with the industry average and based upon findings of the results we conclude that the performance of the company is below against the industry average. (Appendix) The results from the current asset and quick ratio show that the company is enjoying strong short term liquidity position and the result of these ratios are similar to the industry average but the company needs to increase the worth of current assets so that it does not face the problem of liquidity in near future. The company credit policy is not effective and there is a need to redefine the credit terms. The result from the daily outstanding sales shows 76 days while the industry average is 35 days. The company’s collection period is relatively low which may result in bad debt and other losses. The inventory turnover ratio is below the industry average. The inventory turnover ratio of the company is quite low as compared to industry average which means company’s current funds are tied up in the inventory. The inventory turnover ratio suggests the times the inventory is converted to sales. The asset turnover ratio of the company is 2 against the industry average of 3. The company needs to improve its efficiency so that assets can be better utilized to generate more revenue for the company. Asset turnover ratio shows the efficiency of the company to utilize its assets to generate sales. The company has net profit margin of 1.70% which is higher than the industry average which is a positive sign for the company. The company can further improve its profitability by having more control over its expenses. The company is having return on assets of 2.9% against the 3.6% as per industry. The company needs to work on the efficiency of utilizing its assets so that more earnings can be generated. The return on equity is 8% against the industry average of 9%. The company should generate more earnings so that higher return can be given to the shareholders and potential investors will also be attracted. Return on capital employed of the company is same as return on assets as it has no dividend and no additional capital invested. The ratio of industry is quite high as compared to company’s return on capital employed. Time Interest earned ratio shows the ability of the company to cover its interest expenses with the earnings. In other words it is the ratio which shows the extent to which interest is covered by earnings before interest and tax. The Interest coverage ratio of the company is 3 times which meets the industry norm and thus its shows that company is efficient in covering its interest cost. The debt to capital ratio sows the leverage of the company. It shows the extent to which the capita of the company is financed from outside sources. The higher the ratio, higher is the outside dependency. The company’s debt ratio is quite high as compared to the industry norm. The total debt forms 62% of total capital of the company. Conclusion The company needs to hold more current assets and to revise the credit policy. They must utilize the assets in an effective way to generate more income to improve the performance of the company. The company funds are tied up in the inventory as the conversion of the inventory into cash is below the industry average. There is a need that the Management of the company must consider the findings of ratio analysis and to take action to improve the performance of the company. Appendix -552450-50165 Sm al lS eo To ol s. co m Report generated by smallseotools.com