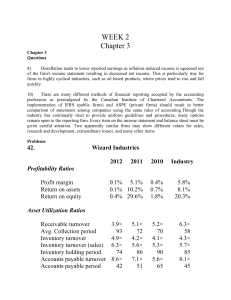

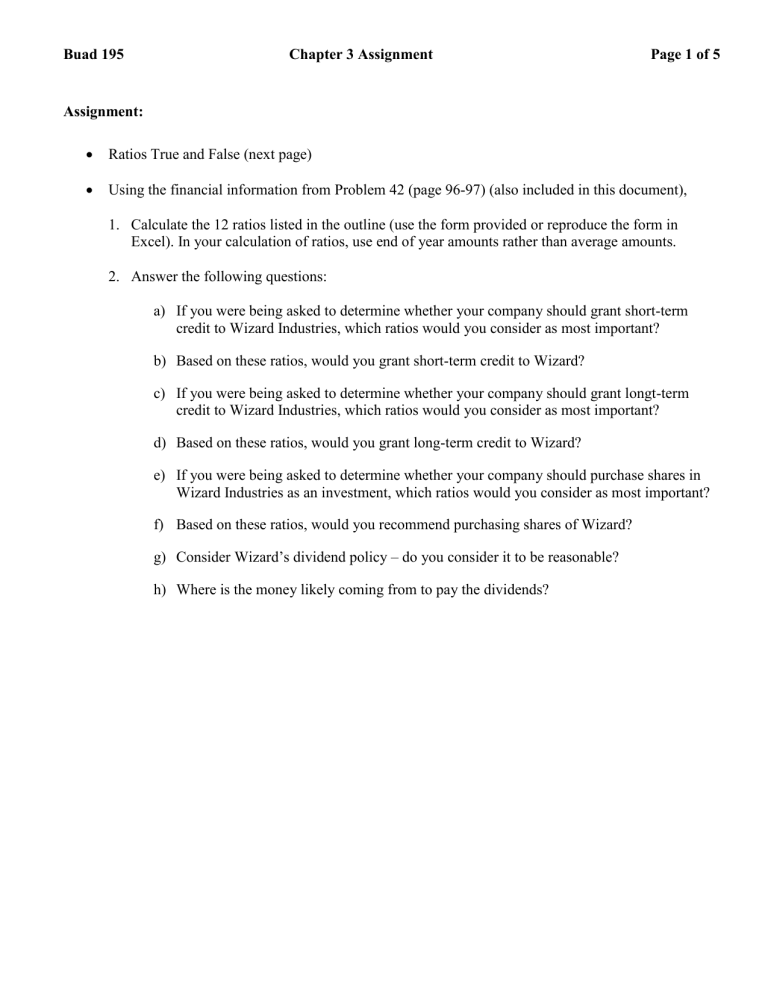

Buad 195 Chapter 3 Assignment Page 1 of 5 Assignment: Ratios True and False (next page) Using the financial information from Problem 42 (page 96-97) (also included in this document), 1. Calculate the 12 ratios listed in the outline (use the form provided or reproduce the form in Excel). In your calculation of ratios, use end of year amounts rather than average amounts. 2. Answer the following questions: a) If you were being asked to determine whether your company should grant short-term credit to Wizard Industries, which ratios would you consider as most important? b) Based on these ratios, would you grant short-term credit to Wizard? c) If you were being asked to determine whether your company should grant longt-term credit to Wizard Industries, which ratios would you consider as most important? d) Based on these ratios, would you grant long-term credit to Wizard? e) If you were being asked to determine whether your company should purchase shares in Wizard Industries as an investment, which ratios would you consider as most important? f) Based on these ratios, would you recommend purchasing shares of Wizard? g) Consider Wizard’s dividend policy – do you consider it to be reasonable? h) Where is the money likely coming from to pay the dividends? Buad 195 Page 2 of 5 Chapter 3 Assignment Profitability Ratios _____1. Earnings per share measures the dollar amounted earned and distributed to shareholders. F _____2. A high price-earnings ratio indicates that investors have confidence in a company. T _____3. Investors are highly interested in the profitability ratios. T _____4. A company has $700,000 in assets and $200,000 in debt. It reports income of $140,000. It has an ROA of 20%. T _____5. The company in #4 above has an ROE of 28%. T _____6. In 2007, Costco’s stock price dropped when Costco reported increased profits, but a lower profit margin. A lower profit margin is due to lower sales. F Asset Utilization Ratios _____7. A high inventory turnover ratio is usually better than a low inventory ratio. T _____8. A company that is regularly stocking-out would have a very high inventory turnover ratio. T _____9. A company has extended its credit terms to allow customers to pay in 60 days instead of 30 days. Receivables turnover will be lower. T _____10. A firm has sales of $1,000,000 and average accounts receivable of $100,000. The average collection period is 36.5 days. T _____11. An increasing average collection period indicates that the company is becoming more efficient in its collection activities. F _____12. Investors and analysts wanting to evaluate the operating efficiency of a firm’s managers would probably look closely at the firm’s asset utilization ratios. T Liquidity Ratios _____13. A higher current ratio is always better. F _____14. In computing the quick ratio, accounts receivable are not included in current assets. F _____15. Liquidity measures the ability to pay long-term debts. F _____16. A company with a high current ratio and a much smaller quick ratio has a large amount of inventory. T _____17. A supplier would be very interested in the liquidity ratios of a new major customer. T _____18. Net working capital is current assets divided by current liabilities. F _____19. The current ratio is a more rigorous test of liquidity than the quick ratio. F _____20. In 2003, Danier Leather reported a current ratio of 4.4 and quick ratio of .9. The industry average is 2.2 and 1.0. Danier Leather was carrying less inventory than the rest of the industry. F Debt Utilization Ratios _____21. A high “times interest earned” ratio means a company can easily cover its interest payments. T _____22. Company X has EBIT of $500,000, interest expense of $100,000 and EBT of $400,000. It has a times interest earned ratio of 4. F _____23. Company A has a debt to assets ratio of 60%, Company B is at 75%. Company A is riskier. F _____24. A high degree of financial leverage means a company has a high degree of debt. T _____25. High financial leverage increases risk and potential return for shareholders. T _____26. Danier Leather’s debt to asset ratio was 34% in 2005 and 42% in 2006. This shows improvement from 2005 to 2006. F Buad 195 Page 3 of 5 Chapter 3 Assignment Buad 195 Page 4 of 5 Chapter 3 Assignment Buad 195 Page 5 of 5 Chapter 3 Assignment 20XX 20XW 20XV Industry 0.1% 0.1% 0.4% 5.1% 10.2% 29.6% 0.4% 0.7% 1.8% 5.8% 8.1% 20.3% 3.9X 93 4.9X 9.9X 1.8X 5.1X 72 4.2X 10.6X 2.0X 5.2X 70 4.1X 8.4X 1.9X 6.3X 58.3 days 4.3X 8.0X 1.7X 1.72 1.08 1.71 93 1.55 0.82 1.6 1.1 71.4% 1.02X 65.3% 3.42X 64.7% 1.15X 60.0% 4.3X Profitability Ratios Profit Margin Return on Assets Return on Equity Asset Utilization Ratios Receivables Turnover Average Collection Period Inventory Turnover Capital Asset Turnover Total Asset Turnover Liquidity Ratios Current Ratio Quick Ratio Debt Utilization Ratios Debt to Total Assets Times Interest Earned