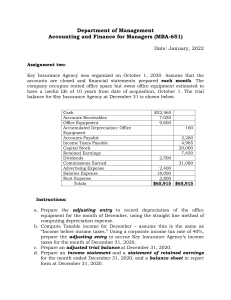

MARKING MEMORANDUM Applied Financial Accounting Module AFAC02-6 (NQF LEVEL 6) FORMATIVE ASSESSMENT – ASSIGNMENT Assignment B (AFAC02-6/DLO6 12/2020) Exam Date Marks 14 December 2020 20 © Milpark Education Applied Financial Accounting AFAC02-6 Assignment B Page 1 of 4 Assignment B (AFAC02-6/DLO6 12/2020) Total: 20 marks Note to student: You will be penalised for the copying of theory without explanation/application to the scenario provided. You should use the theory in support of your own answer. Non-application will result in a zero mark being awarded. SECTION A (20 MARKS) – PARAGRAPH QUESTIONS Answer all of the following questions. Question 1 (20 marks) The following details relate to assets that were on the books of an entity at the beginning of the financial year, 1 July 2019: Asset class Cost Land and R2 000 000 Accumulated depreciation R 60 000 buildings Depreciation policy Buildings: 5% straight line per year; buildings account for 60% of the total cost. Vehicles R 600 000 R150 000 25% reducing balance Machinery R 400 000 R 80 000 5 years: on the educing balance method The assets listed in the table above were purchased on 1 July 2018. The following transactions took place during the year ended 30 June 2020, and have not yet been taken into account: On 30 March 2020, an old vehicle with a cost of R120 000 and accumulated depreciation of R30 000 at 1 July 2019 was sold; R50 000 cash. On 1 January 2020, a new machine was purchased; R150 000. Depreciation still needs to be provided for all relevant assets. © Milpark Education Applied Financial Accounting AFAC02-6 Assignment B Page 2 of 4 Required: Using the information provided, prepare the property, plant and equipment (PPE) note to the financial statements as at 30 June 2020. Note: feel free to use the template provided below; however, you will need to reproduce it in your answer book. Also, be sure to show all your workings. Land and Vehicles Machinery Total buildings Carrying amount (1 July 2019) Cost Accumulated depreciation Additions at cost Disposals (carrying value) Depreciation Carrying amount (30 June 2020) Cost Accumulated depreciation (20) ANSWER: (Topic 2: Depreciation) Land and Vehicles Machinery Total buildings Carrying amount (1 1 940 000 450 000 320 000 2 710 000 2 000 000 600 000 400 000 3 000 000 (60 000) (150 000) (80 000) (290 000) Additions - - 150 000 150 000 Disposals (carrying - (73 125) - (73 125) July 2019) Cost Accumulated depreciation value) © Milpark Education Applied Financial Accounting AFAC02-6 Assignment B Page 3 of 4 Depreciation (60 000) (106 875) (79 000) 1 880 000 270 000 391 000 Cost 2 000 000 480 000 550 000 3 030 000 Accumulated (120 000) (210 000) (159 000) (489 000) Carrying amount (30 (245 875) 2 541 000 June 2020 depreciation Buildings = 0.05 x R2 000 000*0.6 = R60 000 Vehicles: Old vehicles not sold = 0.25 x (450 000-90 000) = R90 000 Old vehicle sold = 0.25 x (R120 000 – 30 000) x 9/12 = R16 875 Machinery: Old machines = 0.20 x (R400 000 – 80 000) = R64 000 New machine = 0.20 x R150 000 x 6/12 = R15 000 Asset disposal 30 March Vehicles 120 000 2020 30 Mar Accumulated 2020 depreciation – 46 875 Vehicles Bank 50 000 Profit and loss 23 125 account 120 000 120 000 TOTAL MARKS: 20 © Milpark Education Applied Financial Accounting AFAC02-6 Assignment B Page 4 of 4