EOQ Illustrative Problems: Inventory Management Examples

advertisement

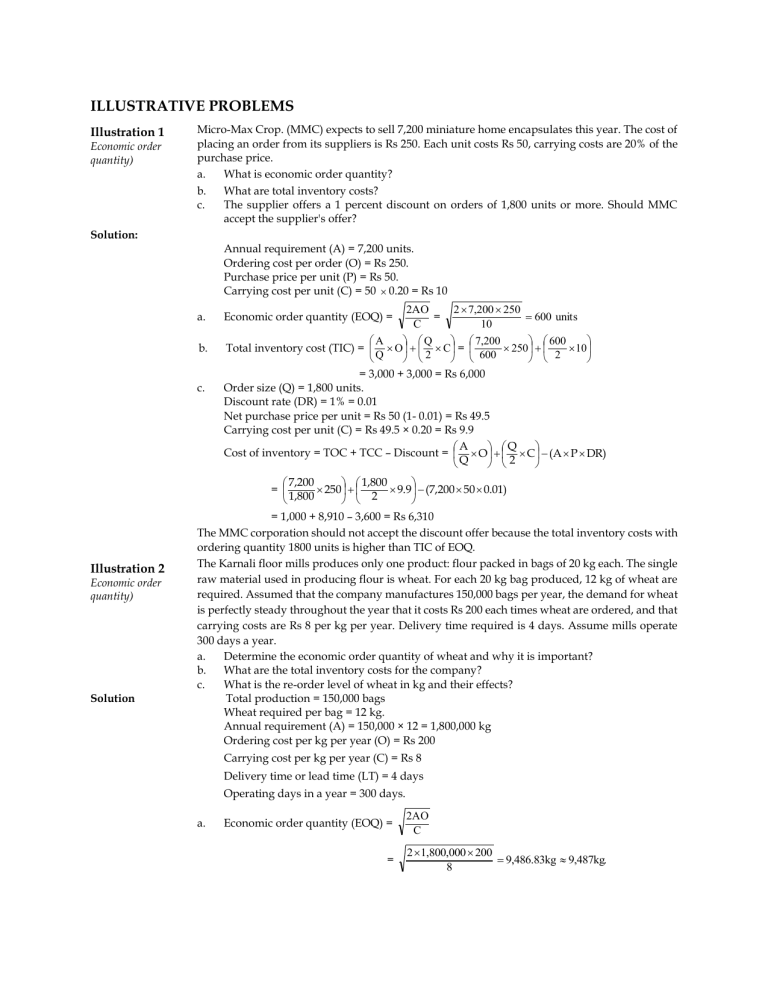

ILLUSTRATIVE PROBLEMS Illustration 1 Economic order quantity) Micro-Max Crop. (MMC) expects to sell 7,200 miniature home encapsulates this year. The cost of placing an order from its suppliers is Rs 250. Each unit costs Rs 50, carrying costs are 20% of the purchase price. a. What is economic order quantity? b. What are total inventory costs? c. The supplier offers a 1 percent discount on orders of 1,800 units or more. Should MMC accept the supplier's offer? Solution: Annual requirement (A) = 7,200 units. Ordering cost per order (O) = Rs 250. Purchase price per unit (P) = Rs 50. Carrying cost per unit (C) = 50 0.20 = Rs 10 a. b. c. Illustration 2 Economic order quantity) Solution 2 7,200 250 2AO = 600 units 10 C A Q 7,200 600 250 10 Total inventory cost (TIC) = O C = 600 2 Q 2 Economic order quantity (EOQ) = = 3,000 + 3,000 = Rs 6,000 Order size (Q) = 1,800 units. Discount rate (DR) = 1% = 0.01 Net purchase price per unit = Rs 50 (1- 0.01) = Rs 49.5 Carrying cost per unit (C) = Rs 49.5 × 0.20 = Rs 9.9 A Q Cost of inventory = TOC + TCC – Discount = O C (A P DR) Q 2 7,200 1,800 = 250 9.9 (7,200 50 0.01) 1,800 2 = 1,000 + 8,910 – 3,600 = Rs 6,310 The MMC corporation should not accept the discount offer because the total inventory costs with ordering quantity 1800 units is higher than TIC of EOQ. The Karnali floor mills produces only one product: flour packed in bags of 20 kg each. The single raw material used in producing flour is wheat. For each 20 kg bag produced, 12 kg of wheat are required. Assumed that the company manufactures 150,000 bags per year, the demand for wheat is perfectly steady throughout the year that it costs Rs 200 each times wheat are ordered, and that carrying costs are Rs 8 per kg per year. Delivery time required is 4 days. Assume mills operate 300 days a year. a. Determine the economic order quantity of wheat and why it is important? b. What are the total inventory costs for the company? c. What is the re-order level of wheat in kg and their effects? Total production = 150,000 bags Wheat required per bag = 12 kg. Annual requirement (A) = 150,000 × 12 = 1,800,000 kg Ordering cost per kg per year (O) = Rs 200 Carrying cost per kg per year (C) = Rs 8 Delivery time or lead time (LT) = 4 days Operating days in a year = 300 days. a. Economic order quantity (EOQ) = = 2AO C 2 1,800,000 200 9,486.83kg 9,487kg. 8 At order size 9,487kg the mill can minimize its inventory cost. If it orders more than EOQ quantity, the ordering costs decrease but carrying costs increase and total costs of inventory will be higher than total inventory costs at EOQ. Similarly, if it orders less than EOQ, the number of order increases and it also increases ordering cost and decrease carrying cost but total cost will be again higher than total cost at EOQ. So, EOQ is important for minimizing inventory cost b. Total inventory cost (TIC) at Q = EOQ = 9,487 kg. A Q 9,487 1,800,000 O C = 200 8 Q 2 9,487 2 TIC = = 37,947 + 37,948 = Rs 75,895 c. If lead time is greater than order cycle then goods in transit is existed. Therefore, calculation of order cycle is necessary to determine the goods in transit and ROL. Order cycle (OC) = Days in a year EOQ 360 9,487 = = 1.581 days Annual requrement 1,800,000 Since, order cycle is less than lead time the good in transit is existed. Thus, Number of order in transit = LT 4 1 1 1.153 2 order OC 1.581 Therefore, Goods in transit (GIT) = Number of order in transit EOQ = 2 9,487 = 18,974 units. Hence, Re-order level (ROL) = SS + (Average usage x LT) - GIT Annual requiremen t = SS+ LT - Goods in transit Working days in a year 1,800,000 =0+ 4 - 18,974 = 5,026 units. 300 When the inventory level of wheat reaches 5,026kg (i.e. remaining inventory 5,026 kg in store), the mill should place next order. Due to GIT 18,874 kg, the mill can maintain re-order level lower than average daily usage. Illustration 3 Economic order quantity) Solution Nepaagro Centre sells 300,000 bags of Nepaagro annually though total demand may be equal to 350,000 bags. The optimal safety stock (Which is on hand initially) is 1,500 bags. Each bag costs Centre Rs 5, inventory carrying costs are 20 percent, and the cost of placing an order with its suppliers is Rs 30. a. b. c. d. e. What is the economic order quantity? What is the maximum inventory of fertilizer? What will Center's average inventory be? How often must the Centre order? If lead time is approximately 20 days, at what inventory level an order be made? Assume 360 days in a year. a. Here annual requirement (A) is 300,000 bags because one major assumption of EOQ model is sales can be forecasted perfectly and evenly distributed throughout the year. Therefore, the annual demand 350,000 bags are not the annual requirement because it is uncertain. Ordering Cost per order (O) = Rs 30 Carrying cost per unit (C) = Rs 5 × 0.20 = Rs 1 Economic order quantity (EOQ) = 2 300,000 30 1 b. = 4,242.64 or 4,243 bags. Maximum inventory = EOQ + SS = 4,243 + 1,500 = 5,743 bags. c. Average inventory = EOQ 4,243 SS 1,500 3,622bags. 2 2 d. If lead time is greater than order cycle then goods in transit is existed. Therefore, calculation of order cycle is necessary to determine the goods in transit and ROL. Order cycle (OC) = Days in a year EOQ 360 4,243 = = 5.09 days Annual requrement 300,000 Since, order cycle is less than lead time the good in transit is existed. Thus, LT 20 1 1 2.93 3 orders OC 5.09 Therefore, Goods in transit (GIT) = Number of order in transit EOQ = 2 4,243 = 12,729 bags. Hence, Re-order level (ROL) = SS + (Average usage x LT) – GIT Number of order in transit = Annual requiremen t = 1,500 + LT - GIT Days in a year 300,000 = 1,500 + 20 - 12,729 = 5,438 bags. 360 Illustration 4 Economic order quantity) The following relationships for inventory costs have been established for the Himal Corporation. 1. 2. 3. 4. 5. 6. a. b. c. d. e. f. h. Solution Annual sales are 585,000 units. The purchase price per unit is Rs 2.00 The carrying cost is 26 percent of the purchase price of goods. The cost per order place is Rs169. Desired safety stock is 10,000 units (On hand initially) Two weeks are required for delivery. What is the economic ordering quantity? What is the total cost of ordering and carrying inventories at the EOQ? What is the optimal number of orders to be placed? At what inventory level should Dalymple order? How would you answer change if the delivery time were six weeks? If annual unit sales double, what is the percent increase in the EOQ? What is the elasticity of EOQ with respect to sales (percent change in EOQ/percent change in sales)? If the cost per order doubles, what is the elasticity of EOQ with respect to cost per order? If the carrying cost declines by 50 percent, what is the elasticity of EOQ with respect to that changes? If the purchase price declines by 50 percent, what is the elasticity of EOQ with respect to that change? Annual sales (A) = 585,000 units. Purchase price (P) = Rs 2 Ordering costs per order (O) = Rs 169 Safety stock (SS) = 10,000 units. Lead time (LT) = 2 weeks. Carrying costs per unit (C) = 26% of P = 0.26 2= Rs 0.52 a. Economic order quantity (EOQ) = 2A0 2 585,000 1.69 19,500 units. C 0.52 Total inventory cost (TIC) at Q = EOQ AO Q 585,000 169 19,500 TIC= 1,000 0.52 SS C. = Q 2 19,500 2 = 5,070 + 10,270 = Rs 15,340. 585 ,000 = 30 times 19 ,500 b. Number of order (N) = A/EOQ = c. Calculation of Re-order level. (ROL) If lead time is greater than order cycle then goods in transit is existed. Therefore, calculation of order cycle is necessary to determine the goods in transit and ROL. Order cycle (OC) = weeks in a year EOQ 52 19,500 = = 1.733 weeks Annual requrement 585,000 When lead time (LT) = 2 weeks LT 2 1 1 0.1538 1 order OC 1.733 Therefore, Goods in transit (GIT) = Number of order in transit EOQ = 1 19,500 = 19500 units. Hence, Re-order level (ROL) = SS + (Average usage x LT) - GIT Again, Number of order in transit = Annual requiremen t = SS + LT - Goods in transit Weeks in a year 585,000 = 10,000+ 2 - 19,500 = 13,000 units. 52 When lead time (LT) = 6 weeks LT 6 1 1 2.46 3 orders OC 1.733 Therefore, Goods in transit (GIT) = Number of order in transit EOQ = 3 19,500 = 58,500 units. Hence, Re-order level (ROL) = SS + (Average usage x LT) - GIT Again, Number of order in transit = Annual requiremen t = SS + LT - Goods in transit Weeks in a year d. 585,000 = 10,000+ 6 - 58,500 = 19,000 units. 52 Elasticity of EOQ with respect to sales: 2 x 1170,000 x 169 = 27,577 units 0.52 27,577 19,500 New EOQ Old EOQ % Change in EOQ = = = 41.42% Old EOQ 19,500 New EOQ = 2AO = C % Change in sales = New sales - Old sales 1,170,000 585,000 1 100% = Old sales 585,000 Elasticity of EOQ with respect to sales = = e. % change in EOQ % change in sales 41 .42 % = 0.4142. 100 % The elasticity of EOQ 0.4142 indicates that the 1% change in sales, result in 0.4142% change in EOQ. Elasticity of EOQ with respect to cost per order. Old cost per order = 169 New cost per order = 169 2 =338 % change in cost per order = = New cost per order Old cost per order Old cost per order 338 169 = 1 = 100% 169 Elasticity of EOQ with respect to cost per order = % change in EOQ % change in cost per order 41.42% 0.4142 100% The elasticity of EOQ 0.4142 indicates that the 1% change in cost per order, result in 0.4142% change in EOQ. f. Elasticity of EOQ with respect to carrying costs. When carrying cost decline by 50%. EOQ New = 2AO 2 585,000 169 27,577units C 0.26 % change in EOQ = 27,577 19,500 = 0.4142 = 41.42% 19,500 % change in EOQ % change in order cost Elasticity of EOQ with respect to carrying costs = g. 41.42 - 0.82 50 The elasticity of EOQ 0.4142 indicates that the 1% change in carrying cost, result in – 0.82% change in EOQ. Elasticity of EOQ with respect to purchase price. = EOQ New = 2AO 2 585,000 169 27,577units C 0.26 % change in EOQ = 27,577 19,500 = 0.4142 = 41.42% 19,500 Elasticity of EOQ with respect to purchase price = = % change in EOQ % change in purchase price 41.42% 0.82 - 50% The elasticity of EOQ 0.4142 indicates that the 1% increase in purchase price, result in 0.4142% decrease in EOQ and vice versa. Illustration 5 Economic order quantity) Beauty Cents Inc. makes various scents for use in the manufacture of food products. Although the company does maintain a safety stock, it has a policy of maintaining, "lean" inventories, with the result that customers sometimes must be turned away. In an analysis of the situation, the company has estimated the cost of being out of stock associated with various levels of safety stock. Present safety stock level New safety stock level -1 New safety stock level -2 New safety stock level -3 New safety stock level -4 New safety stock level -5 Solution levels of safety stock (in gallons) 5,000 7,500 10,000 12,500 15,000 17,500 Annual cost of stock outs Rs 26,000 14,000 7,000 3,000 1,000 0 Carrying costs are Rs 0.65 per gallon per year. What is the best level of safety stock for the company? Carrying cost per gallon (c) = Rs 0.65 Calculation of best level of safety stock for the company Inventory Safety stock Annual stock Carrying cost Total Level (A) (B) out costs (C) (D = B × 0.65) E = (C + D) Present safety 5000 26000 3250 29250 stock level New safety stock level - 1 New safety stock level - 2 New safety stock level- 3 New safety stock level -4 New safety stock level – 5 New safety stock level minimum. Illustration 6 Economic order quantity) Solution 7500 14000 4875 18875 10000 7000 6500 13500 12500 3000 8125 11125 15000 1000 9750 10750 17500 0 11375 11375 – 4 is the best level of safety stock because at that level total cost is To reduce production start-up costs, Tata Truck Company may manufacture longer runs of the same truck. Estimated saving from the increase in efficiency are Rs 260,000 per year. However, inventory turnover will decrease from eight times a year to six times a year. Cost of goods sold is Rs 48 million on an annual basis. If the required before-tax rate of return on investment in inventories is 15 percent, should the company instigate the new production plan? Given Estimated saving form increase in efficiency = Rs 260,000 Existing inventory turnover ratio = 8 times New inventory turnover ratio = 6 times Cost of goods sold = Rs 48 million Required rate of return (K) = 15% Ошибка! = Ошибка! = Rs 6 million New level of inventory = Ошибка! = Ошибка! = Rs 8 million Existing level of inventory = Reduction in level of inventory = Rs 18 million – 6 million = Rs. 2 million Opportunity cost = Redn in level of inventory × K = Rs 2 million × 0.15 = Rs 300000 So, the company should not instigate the new production plan because opportunity cost is greater than efficiency saving. SUMMARY Inventory management is the process of determining how much inventory to hold, when to place orders, and how many units to order in order to maintain optimum level of inventories at minimum cost. An efficient inventory management system ensures the regular availability of inventories for smooth production and sales operation. Inventory management is significant to avoid excessive and inadequate levels of inventories and to minimize the cost of inventory. Stock of various forms of raw materials, work –in- progress, finished goods and other supplies held by the firms are known as inventory. Thus, inventories can be grouped into four categories: raw materials, work-in-progress finished goods other supplies. The firms hold inventory with the objectives of the transactions motive Precautionary motive and speculative motive. Carrying costs and ordering costs are the two major types of inventory costs. Carrying cost includes the cost of capital tied up, storage cost, insurance, property taxes, depreciation and obsolescence. Ordering cost includes ordering and production set up costs, shipping and handling cost, inspection and store placement cost, fax, long distance telephone cost, etc. Total inventory cost is the sum of total carrying cost (TCC) and total ordering cost (TOC) Economic order quantity (EOQ) is the order size or ordering quantity (Q) each time at which total inventory costs will be minimum. At EOQ total carrying costs and total ordering costs will be equal if the firm does not hold the safety stock The reorder level is that level of inventory in the store at which a new order should be placed to replenish the inventory. By determining reorder level, the problem when to order can be solved. It is depends upon lead time, goods in transit (GIT), level of safety stock etc. A GIT will build up if a new order must be placed before the previous order is received. If lead time is greater than order frequency then GIT exists. Safety stock is the minimum level of stock to be maintained by the firm to meet the uncertainty. Nature and size of business, seasonal effect, production cycle, lead time, expected price change, scarcity of materials, discount facility, etc. are the determinants of inventories. Similarly, ABC analysis, two Bin system, Red–line method, JIT system, Order cycling, Computerized system, out sourcing, etc. are major inventory control systems which can be used by the firms THEORETICAL QUESTIONS 1. What do you mean by inventory management? Explain how do you manage and control inventories in a business enterprise. 2. Why do the firms hold inventories? Explain the various forms of inventories. 3. Explain in brief about importance of inventory management. 4. What are the objectives of holding inventories? Comment. 5. How economic order quantity is calculated? Explain. 6. Explain the relationship between order size, carrying costs, and ordering costs in respect of inventory costs. 7. What do you mean by reorder level? How it is calculated? Explain. 8. What do you mean by safety stock? Why it is necessary? 9. What is ABC system of inventory control? Explain with examples. 10. What are the determinants of inventories? Explain. 11. What are the various methods of controlling the inventories? Comment. 12. Write short notes on a. Economic order quantity. b. Safety stocks. c. Lead time. d. Re-order point. e. Goods in transit. f. ABC analysis. g. Computerized system of inventory control. 13. How does goods in transit inventory affect the inventory recorder print. Problems Problem 1 Problem 2 DG Computer Supplies Inc. must order floppy diskettes from its supplier in lots of one dozen boxes. Given the following information, complete the table below and determine the economic ordering quantity of floppy diskettes for DG Computer supplies Inc. 26,000 dozen Costs per order placed: Rs 30.00 Carrying cost: 20% Price per dozen: Rs 7.80 Order Size (dozens) 250 500 1,000 2,000 13,000 26,000 Number of orders – – – – – – Average inventory – – – – – – Carrying cost – – – – – – Order cost – – – – – – Total cost – – – – – – A college bookstore is attempting to determine the optimal order quantity for a popular book on psychology. The store sells 5,000 copies of this book a year at a retail price of Rs12.50, and the cost to the store is 20 percent less, which represents the discount from the publisher. The store figures that it costs Rs1 per year to carry a book in inventory and Rs100 to prepare an order for new books. a. b. c. Problem 3 Annual demand: Determine the total inventory costs associated with ordering 1, 2, 5, 10 and 20 times a year. Determine the economic order quantity. Give the reasons for the behavior of total inventory cost calculated in part (a). The Nanglo Bread Company buys and then sells (as bread) 2.6 million bushels of wheat annually. The wheat must be purchased in multiples of 2,000 bushels. Ordering costs, which include grain elevator removal charge of Rs 3,500, are Rs 5,000 per order. Annual carrying costs are 2 percent of the purchase price of Rs 5 per bushel. The company maintains a safety stock of 200,000 bushels. The delivery time is 6 weeks. a. b. c. What is the EOQ? At what inventory level should an order be placed to prevent having to draw on the safety stock? How would your answer change if the delivery time were 12 weeks? What are the total inventory costs, including the costs of carrying the safety stock? d. Problem 4 Problem 5 Problem 6 Valley Garden Centers sells 240,000 bags of lawn fertilizer annually. The optimal safety stock (which is on hand initially) is 1,200 bags. Each bag costs valley Rs 4, inventory carrying costs are 20 percent, and the cost of placing an order with its supplier is Rs25. a. What is the economic ordering quantity? b. What is the maximum inventory of fertilizer? c. What will valley's average inventory be? d. How often must the company order? Balaju Industries sells high-quality equipment. It has a yearly demand of 15,000 units. Carrying costs are Rs.0.30 per unit, and the cost of placing an order with its supplier is Rs.30. The lead-time for placing an order is 5 days. Balaju keeps a 6-day supply on hand as a safety stock. The purchase price is Rs. 10 per unit. Assume 360 days in a year. a. What is the economic order quantity? b. What is the total cost of EOQ? c. On average, how many units are sold per day? d. How much safety stock does the firm have on hand? e. What is the reorder point? Koshi Toys, a large manufacturer of toys and dolls, uses large quantities of flesh colored cloth in its doll production process. Throughout the year, the firm uses 1,250,000 square yards of this cloth. The fixed costs of placing and receiving an order are Rs 2,000, which includes a Rs 1,500 setup charge at the mill. The price of the cloth is Rs 2.50 per square yard, and the annual cost of carrying this inventory item is 20 percent of the price. Koshi maintains a 12,500-square-yard safety stock. The cloth supplier requires a 2-week leadtime from order to delivery. a. b. c. d. Problem 7 The wheat processor agrees to pay the elevator removal charges if Nanglo Bread will purchase wheat in quantities of 650,000 bushels. Would it be to Nanglo Bread's advantage to order this alternative quantity? What is the EOQ for this cloth? What is the average inventory rupees value, including the safety stock? What is the total cost of ordering and carrying the inventory, including the safety stock? (Assume that the safety stock is on hand at the beginning of the year.) Using a 52-week year, at what inventory unit level should an order be place? (Again, assume the 12,500-square-yard safety stock is on hand.) The following inventory data have been established for the Sherpa Company. 1. 2. 3. 4. 5. 6. 7. a. b. c. Orders must be place in multiples of 100 units. Annual sales are 338,000 units. The purchase price per unit is Rs 6. Carrying cost is 20 percent of the purchase price of goods. Fixed order cost is Rs 48. Desired safety stock is 12,000 units; this amount is on hand initially. Two weeks are required for delivery. What is EOQ? How many orders should Thompson place each year? At what inventory level should an order be made? [Hint: Reorder point = safety stock + (Lead time × Ave. Usage) - goods in transit.] d. Problem 8 The Balaju Corporation manufactures only one product: planks. The single raw material used in making planks is the dint. For each plank manufactured, 12 dints are required. Assume that the company manufactures 150,000 planks per year, the demand for planks is perfectly steady through the year, that it costs Rs 200 each time dints are ordered, and that carrying costs are Rs 8 per dint per year. a. b. c. Problem 9 Calculate the total cost of ordering and carrying inventories if the order quantity is (1) 4,000 units, (2) 4,800 units, or (3) 6,000 units. (4) What are the total costs if the order quantity is the EOQ? Determine the economic order quantity of dints. What are total inventory costs for Hedge (total carrying costs plus total ordering costs)? How many times per year would inventory be ordered? Healthy Foods, Inc., buy 50,000 boxes of ice-cream cones every 2 month to service steady demand for the product. Order costs are Rs100 per order and carrying costs are Rs0.40 per box. a. b. Problem 10 Problem 11 Determine the optimal order quantity. The vendor offers Healthy Foods a quantity discount of Rs 0.02 per box if it buys cones in order sizes of 10,000 boxes. Should Favorite foods avail itself of the quantity discount? Compare these with the total savings available through the quantity discount. Sony Electronic Company expects to sell 7,200 miniature home encapsulates this year. The cost of placing an order from its supplier is Rs. 250. Each unit costs Rs. 50 and carrying costs are 20 percent of the purchase price? a. What is the economic order quantity? b. What are total costs- order costs plus carrying costs-of inventory over the course of the year? c. Suppose now that the supplier offers a 1 percent discount on orders of 1,800 units or more. Should Sony accept the supplier's offer? National Filter Company is a distributor of air filter to retail stores. It buys its filters from several manufactures. Filters are ordered in lot sizes of 1,000 and each order costs Rs 40 to place. Demand from retail stores is 20,000 filters per month, and carrying cost is Rs 0.10 a filter per month. a. Problem 12 What is the optimal order quantity with respect to so many lot sizes (that is, what multiple of 1,000 units should be ordered)? b. What would be optimal order quantity if the carrying cost were Rs 0.05 a filter per month? c. What would be the optimal order quantity if ordering costs were reduce to Rs 10 per order? d. Explain how optimal order quantity varies with monthly requirement, ordering cost and carrying cost. You are given the following information related to inventory management of XYZ company. Total requirement of materials = 400,000 units Optimal safety stock to maintain = 10,000 units Carrying cost = 20% of inventory value Cost per order placed = Rs 25 Purchase price = Rs 5 per unit It takes two weeks for delivery of the materials once the order is placed. The orders must be placed in multiples of 10 units. XYZ is seeking your help to know the following: a. What order size must he place at the outset to maintain the desired safety level? b. What is the most economical order quantity? c. What is the average inventory? d. What is the average investment in inventory? e. What is the reorder level? f. How many orders will he have to place per year?