EOQ Model Case Study: Computer Center Inventory Management

advertisement

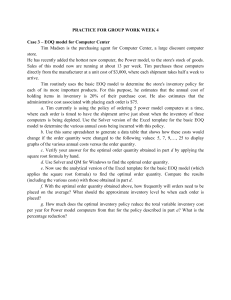

PRACTICE FOR GROUP WORK WEEK 4 Case 3 – EOQ model for Computer Center Tim Madsen is the purchasing agent for Computer Center, a large discount computer store. He has recently added the hottest new computer, the Power model, to the store's stock of goods. Sales of this model now are running at about 13 per week. Tim purchases these computers directly from the manufacturer at a unit cost of $3,000, where each shipment takes half a week to arrive. Tim routinely uses the basic EOQ model to determine the store's inventory policy for each of its more important products. For this purpose, he estimates that the annual cost of holding items in inventory is 20% of their purchase cost. He also estimates that the administrative cost associated with placing each order is $75. a. Tim currently is using the policy of ordering 5 power model computers at a time, where each order is timed to have the shipment arrive just about when the inventory of these computers is being depleted. Use the Solver version of the Excel template for the basic EOQ model to determine the various annual costs being incurred with this policy. b. Use this same spreadsheet to generate a data table that shows how these costs would change if the order quantity were changed to the following values: 5, 7, 9, ...., 25. Then use the EOQ Analysis module in your Interactive Management Science Modules to display graphs of the various annual costs versus the order quantity. c. Verify your answer for the optimal order quantity obtained in part d by applying the square root formula by hand. d. Use Solver and QM for Windows to find the optimal order quantity. e. Now use the analytical version of the Excel template for the basic EOQ model (which applies the square root formula) to find the optimal order quantity. Compare the results (including the various costs) with those obtained in part d. f. With the optimal order quantity obtained above, how frequently will orders need to be placed on the average? What should the approximate inventory level be when each order is placed? g. How much does the optimal inventory policy reduce the total variable inventory cost per year for Power model computers from that for the policy described in part a? What is the percentage reduction?