Understanding Options Trading: A Beginner's Guide

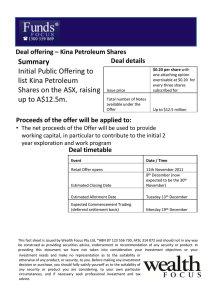

advertisement