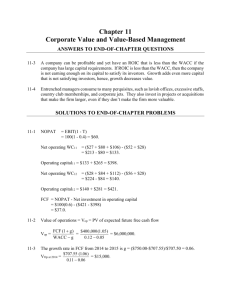

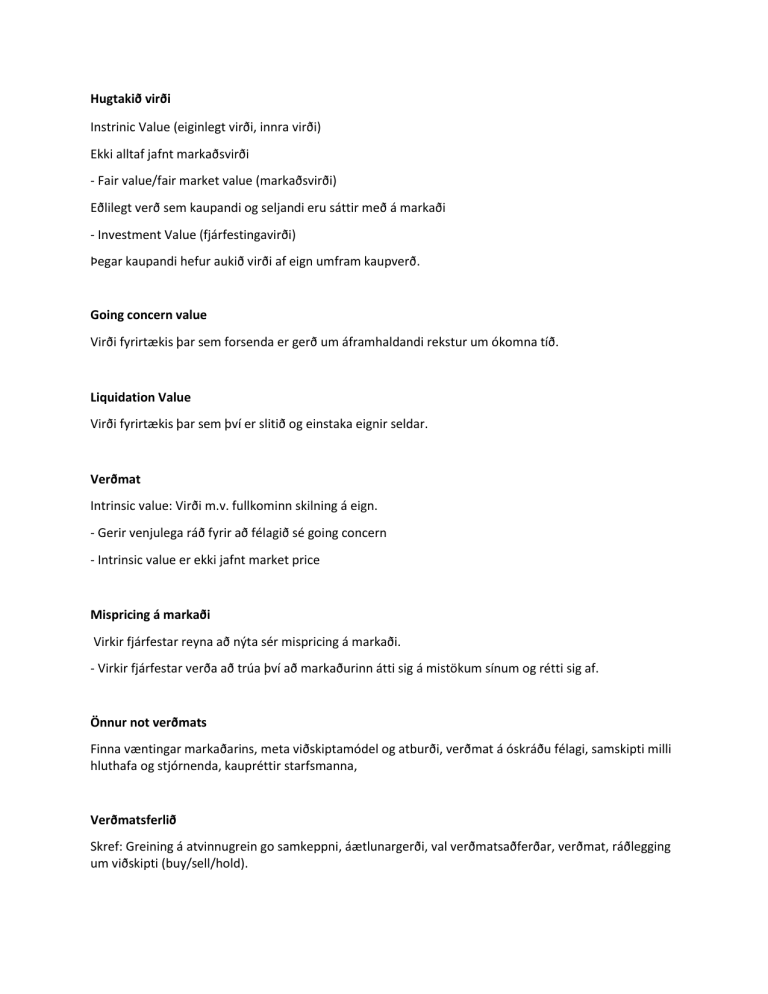

Valuation Concepts: Intrinsic Value, CAPM, WACC, and FCF

advertisement