Thomas D. Larson

advertisement

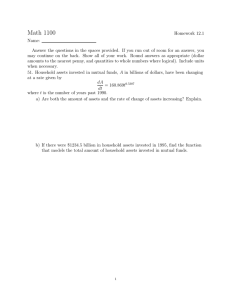

Restructuring for Troubled Times 5th Annual Farmer Cooperatives Conference November 13-15, 2002 St. Louis, Missouri Applying information and lessons learned from the 2001 Farmer Cooperatives Conference to Our Cooperative Thomas D. Larson Executive Vice President Member and Public Affairs Today’s Discussion • • • • Review 2001 value creation concept What and how CHS implementing What and how implementing local co-op Performance management module Overview • Current co-op financial performance unacceptable • Ag supply has many untapped opportunities • Winning in future food landscape will be critical • Need to execute against a 5-part success model Value creation is a key metric Return on invested capital* Value created = Annual return of investment above that expected given risk level ROIC – Cost of capital X Invested capital Rate of return required to compensate investors for risk 4 *Impact of extraordinary items excluded Value Creation • Industry • Regional co-ops • Local co-ops Most ag segments destroy value ESTIMATE Contribution to GDP, $ billions, 1999 Feed Seed Financing Fuel and electric Equipment Ag chem Fertilizer Farm services 1,522 797 152 412 Ag inputs 57 Input Distribution 70 Farm production 106 Primary processing Cost of capital Percent 11.1 10.9 10.4 10.9 Value created Percent, share of invested capital -2.0 -7.0 -5.4 -1.1 Secondary processing 16.4 % of U.S. GDP Food distribution 10.8 10.6 -2.3 0.1 6 Financial performance of distribution particularly poor Revenue $ Billions Value created $ Millions Value created/ invested capital Percent ESTIMATE ROIC Percent Machinery 19 -187 -2.5 7.9 Feed 16 -53 -1.3 8.5 Fertilizer 11 -122 -3.5 9.1 Chemicals 11 2 Total Input Distribution 0.1 -360 57 138 -2.0 -2,519 -7.0 12.6 9.1 3.9 Regionals struggled to create value in 1999… Revenue $ Billions 11 Farmland Dairy Farmers of America 8 Value created $ Millions Value created/ invested capital Percent ESTIMATE ROIC Percent -168 -8.6 -0.6 -40 -2.8 5.2 Cenex Harvest States 6 -54 -4.0 4.1 Land O’Lakes 6 -74 -6.4 1.6 -17 -2.5 5.2 Agrilink 1 Value Created Across Local Co-ops Value created** $ Thousands Revenue** Quartile* $ Millions 1 24 2 27 3 4 Total Value created/ invested capital ROIC Percent Percent 26 14 23 * Segmented by value created/invested capital ** Mean values for co-ops in quartile Source: Member co-op survey; team analysis 248 -169 5.1 -3.0 Cost of capital Percent 14.2 9.2 6.3 9.3 -424 -7.8 1.8 9.5 -559 -18.7 -9.3 9.4 -227 -4.8 4.6 9.4 9 CHS Value Creation (EVA) • • • • • Mid 1990s Executive management and board Operating management Financial measurement Recognition program EVA (economic value-added) Earnings minus (equity x minimum acceptable rate of return) • EVA recognizes there is no free capital • Equity represents an investment • Investor expects a return CHS Co-op Performance Measurements • • • • • Profit EVA Cash Flow ROI Investment Grade Local Co-op value creation • • • • 4% above cost of borrowed capital 9 - 12% ROE Numerous meetings Benchmarking Return on Local Equity Analysis Rate of # Return Accts. % of Sales % of Local Savings % of Accounts % Greater than 50% Term Debt/ Local Equity 9%+ 216 52% 96% 39% 37% 5-9% 110 15% 15% 20% 0-5% 108 17% 6% 20% 27% Below 0% 117 16% (17%) 21% 49% 16% Cooperative System Ag Supply $(0-10) $(10-25) $(25-50) Grain $(50-75) $(75-100) $(100+) 9%+ -------------------------------------------278 accounts -------------------------------------------49 accounts 63% savings 49% savings 203 accounts 23 accounts (10%) savings (2%) savings 5-9% 0-5% Below 0 Summary Return on local equity # accounts 481 % savings 53% # accounts 72 % savings 47% $ Sales Volume # accts. 216 savings- 96% PFP success model Strategy 2 4 Pursue operational excellence Drive customer integration 5 1 Leverage horizontal scale Create performance obsession 3 Exploit vertical opportunities Structure Existing Emerging Thank you!!