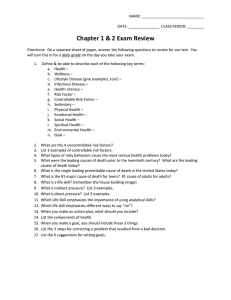

Final Exam: Chapters 1-14

ISV Managerial Accounting, 4e

Name ______________________________________

Instructor ___________________________________

Section # ______________ Date _______________

Part

Points

I

II

III

IV

V

Total

60

18

19

14

14

125

Score

PART I — MULTIPLE CHOICE (60 points)

Instructions: Designate the best answer for each of the following questions.

____

1. A responsibility center that incurs costs (and expenses) and generates revenues is classified as a(n)

a. cost center.

b. revenue center.

c. profit center.

d. investment center.

____

2. The most useful measure for evaluating a manager's performance in controlling revenues and costs in a profit center is

a. contribution margin.

b. contribution net income.

c. contribution gross profit.

d. controllable margin.

____

3. Ramsey Corporation desires to earn target net income of $90,000. If the selling price per unit is $30, unit variable cost is

$24, and total fixed costs are $360,000, the number of units that the company must sell to earn its target net income is

a. 30,000.

b. 75,000.

c. 45,000.

d. 60,000.

____

4. Shane Corporation uses a process cost accounting system. Given the following data, compute the number of units

transferred out during the current period.

Beginning Work in Process

Ending Work in Process

Started into Production

____

a. 125,000

b. 141,667

c. 145,000

d. 150,000

5. Witten Company applies overhead on the basis of machine hours. Given the following data, compute overhead applied

and the under- or overapplication of overhead for the period:

Estimated annual overhead cost

$1,200,000

Actual annual overhead cost

$1,150,000

Estimated machine hours

300,000

Actual machine hours

280,000

a.

b.

c.

d.

____

20,000 units (1/2 complete)

25,000 units (1/3 complete)

150,000 units

$1,120,000 applied and $30,000 underapplied

$1,200,000 applied and $30,000 overapplied

$1,120,000 applied and $30,000 overapplied

$1,150,000 applied and neither under- nor overapplied

6. The following data has been collected for use in analyzing the behavior of main-tenance costs of Ridell Corporation:

Month

January

Maintenance Costs

$121,000

Machine Hours

20,000

February

March

April

May

June

July

125,000

128,000

159,000

168,000

178,000

181,000

23,000

24,000

34,000

36,000

38,000

40,000

Using the high-low method to separate the maintenance costs into their variable and fixed cost components, these

components are

a. $5 per hour plus $20,000.

b. $5 per hour plus $30,000.

c. $4 per hour plus $41,000.

d. $3 per hour plus $61,000.

____

7. Given the following information for Hett Company, compute the company's ROI: Sales — $1,000,000; Controllable

Margin — $120,000; Average Operating Assets — $500,000.

a. 40%

b. 50%

c. 12%

d. 24%

____

8. Given the following data for Glennon Company, compute (A) total manufacturing costs and (B) costs of goods

manufactured:

Direct materials used

Direct labor

Manufacturing overhead

Operating expenses

____

$120,000

50,000

150,000

175,000

Beginning work in process

Ending work in process

Beginning finished goods

Ending finished goods

$20,000

10,000

25,000

15,000

(A)

(B)

a. $310,000

$330,000

b. $320,000

$310,000

c. $320,000

$330,000

d. $330,000

$340,000

9. The production cost report shows both quantities and costs. Costs are reported in three sections: (1) costs accounted for,

(2) unit costs, and (3) costs charged to department. The sections are listed in the following order:

a. (1), (2), (3).

b. (1), (3), (2).

c. (2), (1), (3).

d. (2), (3), (1).

____

10. The starting point of a master budget is the preparation of the

a. cash budget.

b. sales budget.

c. production budget.

d. budgeted balance sheet.

____

11. The most useful measure for evaluating the performance of the manager of an investment center is

a. contribution margin.

b. controllable margin.

c. return on investment.

d. income from operations.

____

12. Which of the following capital budgeting techniques explicitly takes the time value of money into consideration?

a. Annual rate of return

b. Internal rate of return

c. Net present value

d. Both (b) and (c) above

____

13. The cost classification scheme most relevant to responsibility accounting is

a. controllable vs. uncontrollable.

b. fixed vs. variable.

c. semivariable vs. mixed.

d. direct vs. indirect.

Use the following information for questions 14 and 15.

Grant Company estimates its sales at 60,000 units in the first quarter and that sales will increase by 6,000 units each quarter over the

year. It has, and desires, a 25% ending inventory of finished goods. Each unit sells for $25. 40% of the sales are for cash. 70% of the

credit customers pay within the quarter. The remainder is received in the quarter following sale.

____

14. Cash collections for the third quarter are budgeted at

a. $1,017,000.

b. $1,476,000.

c. $1,773,000.

d. $2,052,000.

____

15. Production in units for the third quarter should be budgeted at

a. 73,500.

b. 69,000.

c. 91,500.

d. 72,000.

16. Stine Company incurs the following costs in producing 50,000 units of product:

____

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

$100,000

50,000

100,000

300,000

An outside supplier has offered to supply the 50,000 units at $7.00 each. All of Stine's related variable costs, but only

$200,000 of the fixed costs would be eliminated if the offer is accepted. Acceptance will result in a

a. savings of $200,000.

b. loss of $100,000.

c. savings of $100,000.

d. loss of $200,000.

____

17. Finney Company has a production process where two products result from a joint processing procedure; both can be sold

immediately or processed further. Given the following additional per unit information, determine which of the products

should be processed further.

Product

A

B

a.

b.

c.

d.

Allocated

Joint Cost

$100

60

Selling Price

$200

100

Additional

Processing Cost

$180

50

New

Selling Price

$400

160

A

B

Both

Neither

____

18. A flexible budget

a. is also called a static budget.

b. can be considered a series of related static budgets.

c. can be prepared for sales or production budgets, but not for an operating expense budget.

d. typically uses an activity index different from that used in developing the predetermined overhead rate.

____

19. Carey Company's equipment account increased $800,000 during the period; the related accumulated depreciation

increased $60,000. New equipment was purchased at a cost of $1,400,000 and used equipment was sold at a loss of

$40,000. Depreciation expense was $200,000. Proceeds from the sale of the used equipment were

a. $420,000.

b. $500,000.

c. $560,000.

d. $640,000.

____

20. Which of the following combinations presents correct examples of liquidity, profitability, and solvency ratios, respectively?

____

Liquidity

Profitability

Solvency

a. Inventory turnover

Inventory turnover

Times interest earned

b. Current ratio

Inventory turnover

Debt to total assets

c. Receivables turnover

Return on assets

Times interest earned

d. Quick ratio

Payout ratio

Return on assets

21. A company’s planned activity level for next year is expected to be 100,000 machine hours. At this level of activity, the

company budgeted the following manufacturing overhead costs:

Variable

Indirect materials

Indirect labor

Fixed

$60,000

80,000

Depreciation

Taxes

$25,000

5,000

Factory supplies

10,000

Supervision

20,000

A flexible budget prepared at the 90,000 machine hours level of activity would allow total manufacturing overhead costs of

a. $135,000.

b. $180,000.

c. $185,000.

d. $150,000.

____

22. A company developed the following per unit materials standards for its product: 3 gallons of direct materials at $5 per

gallon. If 4,000 units of product were produced last month and 12,500 gallons of direct materials were used, the direct

materials quantity variance was

a. $1,500 favorable.

b. $2,500 unfavorable.

c. $1,500 unfavorable.

d. $2,500 favorable.

____

23. The standard direct labor cost for producing one unit of product is 5 direct labor hours at a standard rate of pay of $8. Last

month, 5,000 units were produced and 24,500 direct labor hours were actually worked at a total cost of $180,000. The

direct labor quantity variance was

a. $4,000 unfavorable.

b. $6,000 unfavorable.

c. $6,000 favorable.

d. $4,000 favorable.

____

*24. Smythe Company applies overhead to products based on direct labor hours. Manufacturing overhead at the expected

normal level of activity is $50,000 per month plus $5 per direct labor hour. During June, actual manufacturing overhead

costs amounted to $85,000 when 6,100 actual direct labor hours were worked. The standard number of direct labor hours

that should have been worked for the output achieved was 6,000 direct labor hours. The overhead controllable variance

for June was

a. $4,500 unfavorable.

b. $3,400 favorable.

c. $5,000 unfavorable.

d. $5,000 favorable.

____

25. Under the time-and-material-pricing approach, the charges for any particular job include each of the following except the

a. labor charge.

b. charge for materials.

c. material loading charge.

d. overhead charge.

____

26. The transfer pricing approach that does not reflect the selling division’s true profit-ability is the

a. cost-based approach.

b. market-based approach.

c. negotiated price approach.

d. time-and-material-pricing approach.

Use the following information for questions 27 and 28.

Robot Toy Company manufactures two products: X-O-Tron and Mechoman. Robot’s overhead costs consist of setting up machines,

$200,000; machining, $450,000; and inspecting, $150,000 Additional information on the two products is:

Direct labor hours

Machine setups

Machine hours

Inspections

X-O-Tron

15,000

600

24,000

800

____

27. Overhead applied to Mechoman using traditional costing is

a. $320,000.

b. $384,000.

c. $416,000.

d. $500,000.

____

28. Overhead applied to X-O-Tron using activity-based costing is

a. $300,000.

b. $384,000.

c. $416,000.

Mechoman

25,000

400

26,000

700

d.

$480,000.

____

29. An appropriate cost driver for an assembling cost pool is the number of

a. purchase orders.

b. setups.

c. parts.

d. direct labor hours.

____

30. Which of the following is included in the cost of goods manufactured under absorption costing but not under variable

costing?

a. Direct materials

b. Variable factory overhead

c. Fixed factory overhead

d. Direct labor

Instructions: Designate the terminology that best represents the definition or statement given below by placing the identifying letter(s)

in the space provided. No term should be used more than once.

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

K.

L.

M.

Activity-based costing

Annual rate of return

Budgetary control

Contribution margin

Contribution margin ratio

Controllable costs

Absorption costing

Cost accounting

Cost centers

Cost of capital

Equivalent units of production

Fixed costs

Free cash flow

N.

O.

P.

Q.

*R.

*S.

T.

U.

V.

W.

X.

Y.

Z.

Job cost sheet

Noncontrollable costs

Non-value-added activity

Operating budgets

Overhead controllable variance

Overhead volume variance

Physical units

Process cost systems

Product costs

Profit center

Value-added activity

Variable costs

Variances

____

1. Costs that a manager has the authority to incur within a given period of time.

____

2. A form used to record the costs chargeable to a job.

____

3. A responsibility center that incurs costs and also generates revenues.

____

4. The difference between overhead budgeted for standard hours allowed and overhead incurred.

____

5. The amount of revenue remaining after deducting variable costs.

____

6. Used to apply costs to similar products that are mass produced in a continuous fashion.

____

7. Costs that vary in total directly and proportionately with changes in the activity level.

____

8. The differences between actual costs and standard costs.

____

9. Determines profitability of a capital expenditure by dividing expected net income by the average investment.

____

10. The rate a company must pay to obtain funds from creditors and stockholders.

____

11. Costs that are an integral part of producing the finished product.

____

12. Allocates overhead to multiple cost pools and assigns the cost pools to products by means of cost drivers.

____

13. Involves the measuring, recording, and reporting of product costs.

____

14. A measure of the work done during the period, expressed in fully completed units.

____

15. A costing approach in which all manufacturing costs are charged to the product.

____

16. Increase the worth of a product or service to customers.

____

17. The amount of cash from operations after deducting capital expenditures and cash dividends paid.

____

18. Individual budgets that culminate in a budgeted income statement.

The Olson Company developed the following standard costs for its product in 2008:

Direct materials

Direct labor

Manufacturing overhead

Variable

Fixed

Standard Cost Card

(5 pounds @ $4 per pound)

(4 hours @ $8 per hour)

Unit Standard Cost

$20

32

(4 hours @ $4 per hour)

(4 hours @ $3 per hour)

16

12

$80

The company planned to work 100,000 direct labor hours and produce 25,000 units of product in 2008. Actual results for 2008 are as

follows:

24,000 units of product were produced.

Actual direct materials purchased and used during the year amounted to 122,000 pounds at a cost of $475,800.

Actual direct labor costs were $779,000 for 95,000 direct labor hours worked.

Total actual manufacturing overhead incurred amounted to $685,500.

Instructions

Calculate the following variances showing all computations supporting your answers. Indicate if the variances are favorable (F) or

unfavorable (U).

(a) Direct materials price and direct materials quantity variances.

(b) Direct labor price and direct labor quantity variances.

*(c) Overhead controllable and overhead volume variances.

PART IV — RATIO ANALYSIS (14 points)

The condensed financial statements of Jenner Corporation for 2008 are presented below.

Jenner Corporation

Balance Sheet

December 31, 2008

Assets

Current assets

Cash and short-term

investments

Accounts receivable

Inventories

Total current assets

Property, plant, and

equipment (net)

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term liabilities

Stockholders' equity

Total liabilities and

stockholders' equity

Jenner Corporation

Income Statement

For the Year Ended December 31, 2008

$ 30,000

70,000

140,000

240,000

760,000

$1,000,000

Revenues

Expenses

Cost of goods sold

Selling and administrative

expenses

Interest expense

Total expenses

Income before income taxes

Income tax expense

Net income

$2,000,000

960,000

740,000

50,000

1,750,000

250,000

100,000

$ 150,000

$ 100,000

350,000

550,000

$1,000,000

Additional data as of December 31, 2007: Inventory = $100,000; Total assets = $800,000; Stockholders' equity = $450,000.

Instructions: Compute the following ratios for 2008 showing supporting calculations.

(a)

Current ratio = __________________________________________________________________________.

(b)

Debt to total assets ratio = _________________________________________________________________.

(c)

Times interest earned = ___________________________________________________________________.

(d)

Inventory turnover = _____________________________________________________________________.

(e)

Profit margin = __________________________________________________________________________.

(f)

Return on stockholders' equity = ____________________________________________________________.

(g)

Return on assets = ______________________________________________________________________.

PART V — MISCELLANEOUS MANAGERIAL MINI-PROBLEMS (14 points)

Carson Corporation manufactures paper shredding equipment. You are requested to "audit" a sampling of computations made by

Carson's internal accountants via your independent recalculation of the information.

Instructions: Compute the requested information for each of the following independent situations (present supporting calculations).

(a)

Carson uses a process costing system. 2,000 units were in process at the beginning of the period, 60% complete. 20,000 units

were started into production during the period; 1,000 were in process at the end of the period, 60% complete. Compute equivalent

units for conversion costs.

(b)

Carson sells each unit for $500. Variable costs per unit equal $300. Total fixed costs equal $800,000. Carson is currently selling

5,000 units per period and would like to earn net income of $400,000. Compute: (1) break-even point in dollars; (2) sales units

necessary to attain desired income; and (3) margin of safety ratio for current operations.

(1)

Break-even point = $________________________________________________.

(2)

Desired sales = ___________________________________________ units.

(3)

Margin of safety = _____________________________________________%.

Solutions — Final Exam: Chapters 1-14

PART I — MULTIPLE CHOICE (60 points)

1.

2.

3.

4.

5.

6.

c

d

b

c

a

d

7.

8.

9.

10.

11.

12.

d

c

d

b

c

d

13.

14.

15.

16.

17.

18.

a

c

a

c

c

b

19.

20.

21.

22.

23.

*24.

a

c

c

b

d

c

V

A

H

K

G

16.

17.

18.

X

M

Q

25.

26.

27.

28.

29.

30.

d

a

d

c

c

c

PART II — MATCHING (18 points)

1.

2.

3.

*4.

5.

F

N

W

R

D

6.

7.

8.

9.

10.

U

Y

Z

B

J

11.

12.

13.

14.

15.

PART III — VARIANCE ANALYSIS (19 points)

(a)

Direct materials price and direct materials quantity variances.

Direct materials price variance

(122,000 × $3.90) – (122,000 × $4.00) = MPV

$475,800 – $488,000 = $12,200 F

Direct materials quantity variance

(122,000 × $4.00) – (120,000 × $4.00) = MQV

$488,000 – $480,000 = $8,000 U

(b)

Direct labor price and direct labor quantity variances.

Direct labor price variance

(Actual Hours × Actual Rate) – (Actual Hours × Standard Rate) = LPV

(95,000 × $8.20) – (95,000 × $8) = LPV

$779,000 – $760,000 = $19,000 U

Direct labor quantity variance

(Actual Hours × Standard Rate) – (Standard Hours × Standard Rate) = LQV

(95,000 × $8) – (96,000 × $8) = LQV

$760,000 – $768,000 = $8,000 F

*(c)

Overhead controllable variance

Actual overhead

Budgeted overhead — 24,000 × 4 =

Variable

$685,000

96,000

× $4

$384,000

300,000

Fixed — 100,000 × $3 =

Overhead volume variance

Budgeted overhead (see above)

Overhead applied (96,000 × $7)

684,000

$ 1,500 U

$684,000

672,000

$ 12,000 U

PART IV — RATIO ANALYSIS (14 points)

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Current ratio =

$240,000

———— = 2.40:1.

$100,000

$450,000

————— = 45%.

$1,000,000

Debt to total assets ratio =

Times interest earned =

Inventory turnover =

Profit margin =

$300,000

———— = 6 times.

$50,000

$960,000

————— = 8 times.

$120,000

$150,000

————— = 7.5%.

$2,000,000

Return on stockholders' equity =

Return on assets =

$150,000

———— = 30%.

$500,000

$150,000

———— = 16.7%.

$900,000

PART V — MISCELLANEOUS MANAGERIAL MINI-PROBLEMS (14 points)

(a)

Units transferred out (20,000 + 2,000 – 1,000)............................................................................

Ending work in process (1,000 × 60%)........................................................................................

Equivalent units for conversion costs.................................................................................

PART II — MATCHING (18 points)

PART III — VARIANCE ANALYSIS (19 points)

(b)

$800,000

(1) Break-even point =

———— = $2,000,000.

.4

(2) Desired sales =

(3) Margin of safety =

$800,000 + $400,000

—————————— = 6,000 units.

200

$500,000

—————— = 20%.

$2,500,000

21,000

600

21,600

CHAPTER 9: RESPONSIBILITY ACCOUNTING

Multiple Choice

c 1. Goal congruence exists when

a. the goals of the company harmonize with each other.

b. the company's managers are pursuing their own goals

effectively.

c. the company's managers are pursuing the goals of the

company.

d. all of the above are true.

c 2. Goal congruence is most likely to result when

a. reports to managers include all costs.

b. managers' behavior is affected by the criteria used to

judge their performances.

c. performance evaluation criteria encourage behavior in

the company's best interests as well as in the

manager's best interests.

d. a manager knows the criteria used to judge his or her

performance.

d 3. In responsibility accounting the most relevant

classification of costs is

a. fixed and variable.

b. incremental and nonincremental.

c. discretionary and committed.

d. controllable and noncontrollable.

c 4. Which of the following is critically important for a

responsibility accounting system to be effective?

a. Each employee should receive a separate performance

report.

b. Service department costs should be allocated to the

operating departments that use the service.

c. Each manager should know the criteria used for

evaluating his or her performance.

d. The details on the performance reports for individual

managers should add up to the totals on the

report to their supervisor.

c 5. Which of the following items is LEAST likely to appear on

the performance report of the manager of a product

line?

a. Variable manufacturing costs for products in the line.

b. Selling expenses for the line.

c. A share of company-wide advertising.

d. Revenues from the line.

b 6. The sequence that reflects increasing breadth of

responsibility is

a. cost center, investment center, profit center.

b. cost center, profit center, investment center.

c. profit center, cost center, investment center.

d. investment center, cost center, profit center.

a 7. The criteria used for evaluating performance

a. should be designed to help achieve goal congruence.

b. can be used only with profit centers and investment

centers.

c. should be used to compare past performance with

current performance.

d. motivate people to work in the company's best interests.

b 8. A balanced scorecard approach to performance

measurement

a. can only be used in profit or investment centers.

b. balances financial measures with nonfinancial

measures.

c. uses only qualitative data to evaluate performance.

d. uses budgeted data rather than historical data.

b 9. If a company has a favorable sales volume variance, its

a. sales price variance is also favorable.

b. total contribution margin might be less than planned.

c. total contribution margin will be more than planned.

d. income will be positive.

c 10. Transfer prices

a. reduce employee turnover.

b. are necessary for investment centers.

c. should encourage the kinds of behavior that upper-level

management wants.

d. are not used for departments with high amounts of fixed

costs.

b 11. A transfer price is

a. an accounting device to turn profit centers into

investment centers.

b. the price charged by one segment of the company for

goods or services provided to another segment.

c. only useful in a segment that deals with outsiders as well

as with other segments of the same company.

d. the amount charged by a cost center for a service

performed for a profit center.

c 12. The cost allocation policy most likely to encourage use of

a service is based on

a. budgeted total costs of the service department.

b. actual total costs of the service department.

c. budgeted variable costs for the service department.

d. actual variable costs for the service department.

c 13. Which of the following statements is true?

a. A company changes its total income when it changes the

bases used to allocate indirect costs.

b. A company should select an allocation basis so as to

raise or lower reported income on given products.

c. A company's total income will remain unchanged no

matter how indirect costs are allocated.

d. Costs should be allocated on an "ability-to-bear" basis.

a 14. If a company allocates costs of a service department to

other departments, it should

a. consider the likely effects of the allocations on the use of

the services.

b. use the method that best reflects the relative sizes of the

departments.

c. turn the service department into an investment center.

d. allocate only the fixed costs of the service department.

a 15. If a computer department does work for other

departments, charging a flat price per hour, the

computer department is

a. an artificial profit center.

b. a cost center.

c. an investment center.

d. none of the above.

a 16. The WORST method of allocating service department

costs is

a. to allocate total actual costs based on actual use of the

service.

b. to allocate total budgeted costs based on long-term

expected use of the service.

c. to allocate total budgeted costs based on actual use of

the service.

d. none of the above, because all the above are equally

undesirable.

b 17. As a general rule, the best transfer price to use to

transfer the costs of a service center to an operating

department is

a. the price charged by an outside company for the same

service.

b. the price that encourages goal congruence.

c. one that is based on budgeted variable cost.

d. one that is based on budgeted total cost.

b 18. Which of the following costs is LEAST likely to appear on

the performance report for the foreman of a

production department?

a. Wages of direct laborers.

b. Rent on machinery used in department.

c. Repairs to machinery used in department.

d. Cost of materials used.

d 19. ABC Company operates a factory that makes

components for other ABC factories to assemble. The

factory could be treated as

a. a cost center.

b. an artificial profit center.

c. an investment center.

d. any of the above.

d 20. For reports to follow the principles of responsibility

accounting, which of the following must be true?

a. Each segment of the entity is an artificial profit center.

b. The company is decentralized.

c. The company uses transfer prices.

d. The reports show controllable costs separately from

noncontrollable costs.

c 21. The effective use of responsibility accounting requires

that performance reports for cost centers

a. show only variable costs.

b. show a fair share of allocated costs.

c. distinguish between controllable and noncontrollable

costs.

d. show a fair share of revenues attributable to the center.

b 22. Criteria for evaluating performance should be carefully

selected because

a. they must be approved by the IRS.

b. a manager's behavior can be affected by the criteria

used to judge his or her performance.

c. managers may find out what they are.

d. stockholders inquire about them at annual meetings.

d 23. Which of the following is NOT a good reason for

allocating indirect costs to operating departments?

a. To remind managers of the need to cover indirect costs.

b. So that operating managers will encourage service

department managers to keep costs down.

c. To encourage managers to use services wisely.

d. To determine the true costs of operating departments.

b 24. An artificial profit center

a. has no investment.

b. does not provide its goods or services outside the entity.

c. cannot control its costs.

d. could not be operated as a cost center.

c 25. A responsibility center is

a. any department.

b. any manager.

c. any area of activity for which a manager is responsible.

d. only large departments.

a 26. ABC's actual selling price was less than planned and

actual unit volume more than planned. Therefore,

a. ABC had a favorable sales volume variance.

b. ABC's total contribution margin was more than planned.

c. ABC had a favorable sales price variance.

d. ABC's actual total sales equaled planned total sales.

b 27. The term "dual rates" refers to

a. allocating costs to several operating departments.

b. allocating fixed costs based on capacity requirements

and variable costs based on use.

c. allocating both actual costs and budgeted costs.

d. using the budgeted rate to allocate some costs, the

actual rate to allocate others.

a 28. Which of the following methods of allocating the costs of

service departments provides the broadest

recognition of departments served?

a. Reciprocal allocation.

b. Step-down allocation.

c. Direct allocation.

d. Arbitrary allocation.

d 29. Which of the following is a good reason for allocating

indirect costs to operating departments?

a. The company could lose money if the operating

departments do not pay for the services they use.

b. To remind managers of the need to cover indirect costs.

c. To encourage managers to use more services.

d. To determine the true costs of operating departments.

b 30. When a manager takes an action that benefits his or her

responsibility center, but not the company as a whole,

a. it is a non-controllable action.

b. there is a lack of goal congruence.

c. the center must be an artificial profit center.

d. the manager should be fired.

d 31. Which of the following is a good reason for NOT

allocating indirect costs to operating departments?

a. The company saves money if the operating departments

do not pay for the services they use.

b. To remind managers of the need to cover indirect costs.

c. To encourage managers to use more services.

d. The costs are not controllable by the operating

departments.

d 32. Which of the following is a good reason for NOT

allocating indirect costs to operating departments?

a. To remind managers that revenues must cover indirect

costs.

b. To recognize that operating departments benefit from

the services.

c. To encourage managers to use services wisely.

d. Because allocating them might prompt operating

managers to use nonincremental costs in making

decisions.

b 33. A profit center is a responsibility center

a. that sells its output outside the company.

b. whose manager is responsible for both revenues and

costs.

c. that provides a service to other responsibility centers.

d. within an investment center.

d 34. An investment center is

a. larger than a cost center.

b. larger than a profit center.

c. seldom the responsibility of a single manager.

d. not truthfully characterized in any of the above

statements.

a 35. The managerial level at which a particular cost is

controllable

a. varies from company to company.

b. depends on whether the cost is fixed or variable.

c. depends on whether the cost is direct or indirect.

d. is irrelevant to the preparation of performance reports.

d 36. If at all possible, a manager's performance report should

a. consider the results that the manager can control.

b. consider only the results that the manager can control.

c. not be influenced by the results of decisions made by

other managers.

d. reflect all of the above characteristics.

d 37. Comparing budgeted and actual amounts is important in

evaluating the performance of

a. the manager of a cost center.

b. the manager of a profit center.

c. the manager of an investment center.

d. any manager.

c 38. Direct, step-down, and reciprocal are names for

a. the allocation methods most likely to produce goal

congruence.

b. transfer-pricing methods.

c. methods for allocating costs of service departments to

operating departments.

d. alternative organizational structures.

b 39. Cascade Company had the following results in June.

Planned

Actual

------------Sales

$80,000

$78,900

Variable costs

50,000

48,500

------------Contribution margin $30,000

$30,400

=======

=======

Planned sales were 10,000 units; actual sales were 9,700 units. The sales price variance is

a. $1,100 U.

b. $1,000 F.

c. $900 U.

d. $400 F.

c 40. Cascade Company had the following results in June.

Planned

Actual

------------Sales

$80,000

$78,900

Variable costs

50,000

48,500

------------Contribution margin $30,000

$30,400

=======

=======

Planned sales were 10,000 units, actual sales were 9,700 units. The sales volume variance is

a. $1,100 U.

b. $1,000 F.

c. $900 U.

d. $400 F.

b 41.

Certainty Stores has three stores and one service center. The percentage of services used in the current year are Store X,

35%; Store Y, 40%; and Store Z, 25%. The service center costs were budgeted at $160,000 fixed and $240,000 variable.

Actual fixed costs were $140,000 and actual variable costs were $270,000. Actual service center costs are allocated to the

stores based on actual usage of the service center. Service center costs allocated to Store Y are

a. $64,000.

b. $164,000.

c. $410,000.

d. some other number.

c 42.

Certainty Stores has three stores and one service center. The percentage of services used in the current year are Store X,

35%; Store Y, 40%; and Store Z, 25%. The service center costs were budgeted at $350,000 fixed and $250,000 variable.

Actual fixed costs were $370,000 and actual variable costs were $280,000. Budgeted service center costs are allocated to the

stores based on actual usage of the service center. Service center costs allocated to Store Y are

a. $140,000.

b. $148,000.

c. $240,000.

d. $260,000.

c 43.

Wabasha Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$240 $400

Services performed by Dept. A

40% 40%

Services performed by Dept. B. 20%

70%

c 44.

20%

10%

Wabasha uses the direct method to allocate service department costs. The service department cost allocated to Department Y

is

a. $88.

b. $96.

c. $130.

d. $240.

Wabasha Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$250 $400

Services performed by Dept. A

40% 40%

Services performed by Dept. B. 20%

70%

20%

10%

Wabasha uses the step-down method to allocate service department costs. Department A costs are allocated first. The service

department cost allocated to Department Y is

a. $90.

b. $97.50.

c. $112.50.

d. $130.

c 45.

Wabasha Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$150 $300

Services performed by Dept. A

40% 40%

Services performed by Dept. B. 20%

70%

20%

10%

Wabasha uses the reciprocal method to allocate service department costs. The service department cost allocated to

Department Y is

a. $60.

b. $75.

c. $85.

d. $135.

d 46.

Olson Stores has three stores and one service center. The percentage of services used in the current year are Store A, 40%;

Store B, 25%; and Store C, 45%. The expected long-term budgeted usages are Store A, 30%; Store B, 30%; and Store C,

40%. The service center costs were budgeted at $450,000 fixed and $550,000 variable. Actual fixed costs were $430,000 and

actual variable costs were $570,000. Olson allocates the budgeted variable costs of the central purchasing unit based on

actual use of the unit's services, and allocates budgeted fixed costs based on expected long-term use of the unit's services.

Service center costs allocated to Store A are

a. $135,000.

b. $220,000.

c. $300,000.

d. $355,000.

b 47.

Olson Stores has three stores and one service center. The percentage of services used in the current year are Store A, 45%;

Store B, 35%; and Store C, 20%. The expected long-term budgeted usages are Store A, 30%; Store B, 40%; and Store C,

30%. The service center costs were budgeted at $450,000 fixed and $550,000 variable. Actual fixed costs were $430,000 and

actual variable costs were $570,000. Olson allocates the budgeted variable costs of the central purchasing unit based on

actual use of the unit's services, and allocates budgeted fixed costs based on expected long-term use of the unit's services.

Service center costs allocated to Store B are

a. $350,000.

b. $372,500.

c. $400,000.

d. $550,000.

d 48.

Basin Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

A

B

X

Y

------- ------ ------ -----Direct costs

$200 $400

Services performed by Dept. A

20% 40%

Services performed by Dept. B. 30%

60%

40%

10%

Basin uses the direct method to allocate service department costs. The service department cost allocated to Department X is

a. $280.

b. $300.

c. $320.

d. $443.

a 49.

Basin Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

A

B

X

Y

------- ------ ------ -----Direct costs

$200 $400

Services performed by Dept. A

20% 40%

Services performed by Dept. B. 30%

60%

40%

10%

Basin uses the step-down method to allocate service department costs. Department A costs are allocated first. The service

department cost allocated to Department X is

a. $457.

b. $443.

c. $320.

d. $300.

c 50.

Basin Co. has two service departments (A and B) and two producing departments (X and Y). Data provided are as follows:

Service Depts. Operating Depts.

A

B

X

Y

------- ------ ------ -----Direct costs

$200 $400

Services performed by Dept. A

20% 40%

40%

Services performed by Dept. B. 30%

60%

10%

Basin uses the reciprocal method to allocate service department costs. The service department cost allocated to Department

X is

a. $300.

b. $340.

c. $417.

d. $468.

True-False

F 1. All responsibility centers are either natural or artificial.

F 2. The sales volume variance is the difference between actual and planned unit sales multiplied by the actual contribution margin per

unit.

F 3. The principle of controllability is less important to the internal reporting for a centralized company than for a decentralized one.

F 4. Allocated costs are less important to the internal reporting for a centralized company than for a decentralized company.

F 5. Achieving goal congruence is less important in a centralized organization than in a decentralized one.

T 6. It is not always possible to separate the variable and fixed components of actual costs.

F 7. A profit center will always have sales to outside customers.

T 8. The sales price variance is the difference between the actual selling price and the planned selling price multiplied by actual units

sold.

T 9. The direct method of allocating service department costs ignores all of the interactions between service departments.

F 10. The reciprocal method of allocating service department costs considers only the usage by the producing departments in

determining the allocations.

Problems

1.

The following data are for Billings Stores, which has two stores and one service center.

Helena Butte

------- ----Percentage of services used in current year

20%

80%

Expected long-term use of services

30%

70%

Budgeted central purchasing costs were $225,000 fixed and $125,000 variable. Actual fixed costs were $240,000 and actual

variable costs were $115,000. The managers wish to allocate the actual central purchasing costs to the stores based on actual

use of the central purchasing service.

a. Compute the allocation to the Helena store.

b. Compute the allocation to the Butte store.

SOLUTION:

a.

To Helena: $71,000 [20% x ($240,000 + $115,000)]

b.

To Butte: $284,000 [80% x ($240,000 + $115,000)]

2.

The following data are for Billings Stores, which has two stores and one service center.

Helena Butte

------- ----Percentage of services used in current year

20%

80%

Expected long-term use of services

30%

70%

Budgeted central purchasing costs were $225,000 fixed and $125,000 variable. Actual fixed costs were $240,000 and actual

variable costs were $115,000. The company wishes to allocate the budgeted variable costs of the central purchasing unit based

on actual use of the unit's services and to allocate budgeted fixed costs based on expected long-term use of the unit's services.

a.

Compute the total cost allocated to the Helena store for the services of the central purchasing unit.

b.

Compute the total cost allocated to the Butte store for the services of the central purchasing unit.

SOLUTION:

a.

To Helena: $92,500 ($125,000 x 20% + $225,000 x 30%)

b.

To Butte: $257,500 ($125,000 x 80% + $225,000 x 70%)

3.

Following are data about Alphabet Co.'s two service departments and two operating departments.

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$200 $500 $1,500 $2,000

Services performed by Dept. A

20% 40% 40%

Services performed by Dept. B. 10%

90%

a.

Alphabet allocates costs of its service departments using the direct method of allocation. Find the total cost that will be

allocated to Dept. X.

b.

Alphabet allocates the costs of its service departments using the step-down method, beginning with Dept. A. Find the total

amount of cost that will be allocated to Dept. X.

SOLUTION:

a.

Allocated to X: $600 [($200 x 40/(40 + 40)] + [$500 x (90/90)]

b.

Allocated to X: $620

A

B

X

Y

---- ---- ---- ---A's direct cost

$200

A's cost allocated (200) $ 40 $80

B's direct cost

500

----Total for allocating

$540

B's costs allocated

(540) 540

-----Allocated to X

$620

Allocated to Y

$80

4.

$80

0

Following are data about Alphabet Co.'s two service departments and two operating departments.

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$400 $1,000 $3,000 $4,000

Services performed by Dept. A

20% 40% 40%

Services performed by Dept. B. 10%

90%

Alphabet allocates costs of its service departments using the reciprocal method of allocation. Find the total cost that will be

allocated to Dept. X.

SOLUTION:

Allocated to X: $1,195.92

A = $400 + .1B A = 510.20

B = $1,000 + .2A B = 1,102.04

A

B

X

Y

------- ------- ------- ------Direct costs

$400.00 $1,000.00

A's cost allocated (510.20) 102.04 $204.08

B's costs allocated 110.20 (1,102.04) 991.84

------- ------Allocated to X

$1,195.92

Allocated to Y

$204.08

5.

$204.08

0

The following data are for Lexington Stores, which has two stores and one service center.

Concord Graham

------- -----Percentage of services used in current year

40%

60%

Expected long-term use of services

30%

70%

Budgeted central purchasing costs were $100,000 fixed and $75,000 variable. Actual fixed costs were $140,000 and actual

variable costs were $105,000. The managers wish to allocate the actual central purchasing costs to the stores based on actual

use of the central purchasing service.

a. Compute the allocation to the Concord store.

b. Compute the allocation to the Graham store.

SOLUTION:

a.

To Concord: $98,000 [40% x ($140,000 + $105,000)]

b.

To Graham: $147,000 [60% x ($140,000 + $105,000)]

6.

The following data are for Lexington Stores, which has two stores and one service center.

Concord Graham

------- -----Percentage of services used in current year

40%

60%

Expected long-term use of services

30%

70%

Budgeted central purchasing costs were $100,000 fixed and $75,000 variable. Actual fixed costs were $140,000 and actual

variable costs were $105,000. The company wishes to allocate the budgeted variable costs of the central purchasing unit based

on actual use of the unit's services and to allocate budgeted fixed costs based on expected long-term use of the unit's services.

a.

Compute the total cost allocated to the Concord store for the services of the central purchasing unit.

b.

Compute the total cost allocated to the Graham store for the services of the central purchasing unit.

SOLUTION:

a.

To Concord: $60,000 ($75,000 x 40% + $100,000 x 30%)

b.

To Graham: $115,000 ($75,000 x 60% + $100,000 x 70%)

7.

Following are data about Hamilton Co.'s two service departments and two operating departments.

Service Depts. Operating Depts.

-------------- --------------A

B

X

Y

------- ------ ------ -----Direct costs

$400 $600 $2,000 $3,000

Services performed by Dept. A

30% 30% 40%

Services performed by Dept. B. 20%

70% 10%

a.

Hamilton allocates costs of its service departments using the direct method of allocation. Find the total cost that will be

allocated to each of the operating departments.

b.

Hamilton allocates the costs of its service departments using the step-down method, beginning with Dept. A. Find the total

amount of cost that will be allocated to each of the operating departments.

c.

Hamilton allocates costs of its service departments using the reciprocal method of allocation. Find the total cost that will be

allocated to each of the operating departments.

SOLUTION:

a.

Allocated to X: $696.43 {$400 x [30/(30 + 40)] + $600 x [70/(70 + 10)]}

Allocated to Y: $303.57 {$400 x [40/(30 + 40)] + $600 x [10/(70 + 10)]}

b.

Allocated to X: $750.00,

Allocated to Y: $250.00

A

B

X

Y

---- ---- ------- ------A's direct cost

$400

A's cost allocated (400) $120 $120.00 $160.00

B's direct cost

600

---Total for allocating

$720

B's costs allocated

(720) 630.00 90.00

------- -----Allocated to X

$750.00

Allocated to Y

$250.00

c.

Allocated to X: $702.13,

A = $400 + .2B A = 553.19

B = $600 + .3A B = 765.96

Allocated to Y: $297.87

A

B

X

Y

------- ------- ------- ------Direct costs

$400.00 $600.00

A's cost allocated (553.19) 165.96 $165.96

B's costs allocated 153.19 (765.96) 536.17

------- ------Allocated to X

$702.13

Allocated to Y

$297.87

$221.27

76.60

8. Following are data about Hawley Co.'s two service departments and three operating departments.

Service Depts.

Operating Depts.

-------------- ---------------------A

B

X

Y

Z

------- ------ ------ ------ -----Direct costs

$400 $600

Services performed by Dept. A

30% 40% 20% 10%

Services performed by Dept. B. 40%

20% 20% 20%

Hawley allocates costs of its service departments using the reciprocal method of allocation. Find the total costs that will be

allocated to each of the operating departments.

SOLUTION:

Allocated to x: $454.55, allocated to Y: $309.09, Allocated to Z: $236.36

A = $400 + .4B A = 727.27

B = $600 + .3A B = 818.18

A

B

X

Y

Z

------- ------- ------- ------- ------Direct costs

$400.00 $600.00

A's cost allocated (727.27) 218.18 $290.91 $145.45 $ 72.72

B's costs allocated 327.27 (818.18) 163.64 163.64 163.64

------- ------- ------Allocated to X

Allocated to Y

Allocated to Z

9.

$454.55

$309.09

$236.36

Following are data about Augusta Co.'s three service departments and two operating departments.

Service Depts.

Operating Depts.

--------------------- ---------------A

B

C

X

Y

------- ------ ------ ------ -----Direct costs

$150 $300 $350

Services performed by Dept. A

20% 30% 40% 10%

Services performed by Dept. B. 10%

20% 50% 20%

Services performed by Dept. C 30%

40%

15% 15%

a.

Augusta allocates costs of its service departments using the direct method of allocation. Find the total cost that will be

allocated to Dept. X.

b.

Augusta allocates the costs of its service departments using the step-down method, beginning with Dept. A followed by Dept.

B. Find the total amount of cost that will be allocated to Dept. X.

SOLUTION:

a.

Allocated to X: $509.29 {$150 x [40/(40 + 10)] + $300 x [50/(50 + 20)] + $350 x [15/(15 + 15)]}

b.

Allocated to X: $477.50

A

B

C

X

Y

---- ---- ------- ------- ------A's direct cost

$150

A's cost allocated (150) $ 30 $ 45.00 $ 60.00 $ 15.00

B's direct cost

300

---Total for allocating

$330

B's costs allocated

(330) 73.33 183.34 73.33

C's direct cost

350.00

------Total for allocating

$468.33

C's costs allocated

(468.33) 234.16 234.16

------ -----Allocated to X

$477.50

Allocated to Y

$322.50

10. Osseo Company had the following results in June.

Planned

Actual

--------------Sales

$160,000

$162,500

Variable costs at $5 per unit

100,000

102,500

--------------Contribution margin

$ 60,000

$ 60,000

========

========

Planned sales were 20,000 units, actual sales were 20,500 units.

a. Find the sales price variance. Indicate F or U

b. Find the sales volume variance. Indicate F or U

SOLUTION:

a. $1,500 U {20,500 x [($162,500/20,500) - $8]}

b. $1,500 F [$3 x (20,500 - 20,000)]

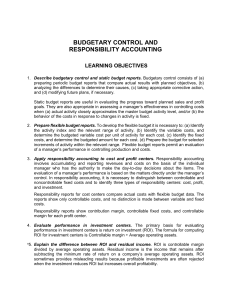

CHAPTER 10

BUDGETARY CONTROL AND

RESPONSIBILITY ACCOUNTING

Summary of Questions by STUDY Objectives and Bloom’s Taxonomy

sg

True-False Statements

1.

1

K

9.

3

2.

1

C

10.

3

3.

1

K

11.

3

4.

2

K

12.

3

5.

2

C

13.

3

6.

2

C

14.

3

7.

2

K

15.

3

8.

2

C

16.

3

C

K

K

C

C

C

K

K

17.

18.

19.

20.

21.

22.

23.

24.

3

3

4

4

4

4

4

5

K

K

C

C

C

C

C

C

25.

26.

27.

28.

a

29.

a

30.

sg

31.

sg

32.

5

6

7

7

8

8

1

2

K

K

K

K

C

C

K

K

sg

33.

34.

sg

35.

sg

36.

a,sg

37.

3

4

5

7

8

K

C

K

K

K

Multiple Choice Questions

38.

1

K

62.

3

39.

1

C

63.

3

40.

1

K

64.

3

41.

1

C

65.

3

42.

1

K

66.

3

43.

1

K

67.

3

44.

1

K

68.

3

45.

2

C

69.

3

46.

2

C

70.

3

47.

2

C

71.

3

48.

2

C

72.

3

49.

2

C

73.

3

50.

2

C

74.

3

51.

2

C

75.

3

52.

2

C

76.

3

53.

2,3 C

77.

3

54.

3

C

78.

3

55.

3

AP 79.

3

56.

3

AP 80.

3

57.

3

AP 81.

4

58.

3

C

82.

4

59.

3

C

83.

4

60.

3

K

84.

4

61.

3

C

85.

4

C

K

C

K

C

C

K

K

AP

C

C

C

AP

AP

AP

AP

AP

AP

AP

K

AP

C

C

C

86.

87.

88.

89.

90.

91.

92.

93.

94.

95.

96.

97.

98.

99.

100.

101.

102.

103.

104.

105.

106.

107.

108.

109.

4

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

6

6

6

6

6

6

6

6

K

C

C

C

C

K

C

C

C

C

K

C

C

C

C

C

K

C

K

C

C

AP

C

AP

110.

111.

112.

113.

114.

115.

116.

117.

118.

119.

120.

121.

122.

123.

124.

125.

126.

127.

128.

129.

130.

131.

132.

133.

6

6

6

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

C

C

AP

AN

AP

AN

AP

AP

AP

AP

AP

AP

AP

AN

AP

AP

C

C

K

C

K

AP

K

K

134.

135.

136.

137.

a

138.

a

139.

a

140.

a

141.

a

142.

a

143.

a

144.

a

145.

sg

146.

sg

147.

st

148.

sg

149.

st

150.

sg

151.

st

152.

sg

153.

st

154.

sg

155.

st

156.

sg

157.

7

7

7

7

8

8

8

8

8

8

8

8

1

2

2

3

3

3

3

4

4

6

7

7

AP

C

AP

C

AP

K

C

C

C

AP

AP

AN

C

K

K

AP

K

K

K

K

K

K

K

AP

sg

Summary of Questions by STUDY Objectives and Bloom’s Taxonomy

Brief Exercises

158. 3

AP 161.

159. 3

AP 162.

160. 3

AP 163.

3

4

6

AP

AP

AP

164.

165.

166.

7

7

7

AP

AP

AP

167.

a

168.

a

169.

7

8

8

AN

AP

AP

Exercises

170. 2

171. 2,3

172. 3

173. 3

3

3

3

3

AP

AP

AP

AP

178.

179.

180.

181.

3

3

3,6

4,5

AP

AP

AP

AP

182.

183.

184.

185.

5

5

6

7

AN

AP

AN

AP

K

K

K

196.

197.

198.

4

4

4

K

K

K

199.

200.

201.

7

7

7

K

K

K

AP

AP

AP

AP

174.

175.

176.

177.

Completion Statements

190. 1

K

193. 3

191. 1

K

194. 3

192. 1

K

195. 4

186.

187.

188.

189.

7

7

7

7

AN

AN

AN

AN

Ite

Typ

Ite

Type

SUMMARY OF STUDY OBJECTIVES BY QUESTION TYPE

Ite

Typ

Ite

Typ

Ite

Typ

Ite

Typ

Ite

Typ

TF

MC

MC

40.

41.

42.

MC

MC

MC

43.

44.

146.

MC

MC

MC

190.

191.

192.

C

C

C

TF

TF

TF

45.

46.

47.

MC

MC

MC

48.

49.

50.

MC

MC

MC

51.

52.

53.

MC

MC

MC

147.

148.

170.

MC

MC

Ex

171.

Ex

TF

TF

MC

MC

MC

MC

MC

MC

MC

60.

61.

62.

63.

64.

65.

66.

67.

68.

MC

MC

MC

MC

MC

MC

MC

MC

MC

69.

70.

71.

72.

73.

74.

75.

76.

77.

MC

MC

MC

MC

MC

MC

MC

MC

MC

78.

79.

80.

149.

150.

151.

152.

158.

159.

MC

MC

MC

MC

MC

MC

MC

BE

BE

160.

161.

171.

172.

173.

174.

175.

176.

177.

BE

BE

Ex

Ex

Ex

Ex

Ex

Ex

Ex

178.

179.

180.

193.

194.

Ex

Ex

Ex

C

C

TF

MC

MC

MC

MC

85.

86.

87.

88.

89.

MC

MC

MC

MC

MC

90.

91.

92.

93.

94.

MC

MC

MC

MC

MC

95.

96.

153.

154.

162.

MC

MC

MC

MC

BE

181.

195.

196.

197.

198.

Ex

C

C

C

C

TF

MC

98.

99.

MC

MC

100.

101.

MC

MC

181.

182.

Ex

Ex

183.

Ex

Study Objective 1

1.

2.

3.

TF

TF

TF

31.

38.

39.

Study Objective 2

4.

5.

6.

TF

TF

TF

7.

8.

32.

Study Objective 3

9.

10.

11.

12.

13.

14.

15.

16.

17.

TF

TF

TF

TF

TF

TF

TF

TF

TF

18.

33.

53.

54.

55.

56.

57.

58.

59.

Study Objective 4

19.

20.

21.

22.

23.

TF

TF

TF

TF

TF

34.

81.

82.

83.

84.

Study Objective 5

24.

25.

TF

TF

35.

97.

CHAPTER STUDY OBJECTIVES

1.

Describe the concept of budgetary control.

Budgetary control consists of (a) preparing periodic budget

reports that compare actual results with planned objectives, (b)

analyzing the differences to determine their causes, (c) taking

appropriate corrective action, and (d) modifying future plans, if

necessary.

2.

Evaluate the usefulness of static budget reports.

Static budget reports are useful in evaluating the progress

toward planned sales and profit goals. They are also

appropriate in assessing a manager's effectiveness in

controlling costs when (a) actual activity closely approximates

the master budget activity level, and/or (b) the behavior of the

costs in response to changes in activity is fixed.

3.

Explain the development of flexible budgets and

the usefulness of flexible budget reports. To develop the

flexible budget it is necessary to: (a) Identify the activity index

and the relevant range of activity; (b) Identify the variable

costs, and determine the budgeted variable cost per unit of

activity for each cost; (c) Identify the fixed costs, and determine

the budgeted amount for each cost; (d) Prepare the budget for

selected increments of activity within the relevant range.

Flexible budget reports permit an evaluation of a

manager's performance in controlling production and costs.

3.

Certain budget reports are prepared monthly,

whereas others are prepared more frequently depending on

the activities being monitored.

4.

The master budget is not used in the budgetary

control process.

5.

A master budget is most useful in evaluating a

manager's performance in controlling costs.

6.

A static budget is one that is geared to one level of

activity.

7.

A static budget is changed only when actual activity is

different from the level of activity expected.

8.

A static budget is most useful for evaluating a

manager's performance in controlling variable costs.

4

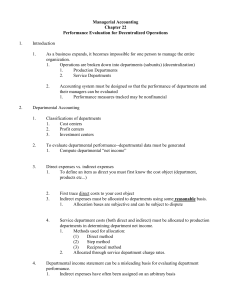

Describe the concept of responsibility

accounting. Responsibility accounting involves accumulating

and reporting revenues and costs on the basis of the individual

manager who has the authority to make the day-to-day

decisions about the items. The evaluation of a manager's

performance is based on the matters directly under the

manager's control. In responsibility accounting, it is necessary

to distinguish between controllable and noncontrollable fixed

costs and to identify three types of responsibility centers: cost,

profit, and investment.

5.

Indicate the features of responsibility reports for

cost centers. Responsibility reports for cost centers compare

actual costs with flexible budget data. The reports show only

controllable costs, and no distinction is made between variable

and fixed costs.

9.

A flexible budget can be prepared for each of the

types of budgets included in the master budget.

6.

Identify the content of responsibility reports for

profit centers. Responsibility reports show contribution

margin, controllable fixed costs, and controllable margin for

each profit center.

14.

The activity index used in preparing a flexible budget

should not influence the variable costs that are being

budgeted.

7.

Explain the basis and formula used in evaluating

performance in investment centers. The primary basis for

evaluating performance in investment centers is return on

investment (ROI). The formula for computing ROI for

investment centers is: Controllable margin ÷ Average operating

assets.

a

8.

Explain the difference between ROI and residual

income. ROI is controllable margin divided by average total

assets. Residual income is the income that remains after

subtracting the minimum rate of return on a company’s

average operating assets. ROI sometimes provides misleading

results because profitable investments are often rejected when

the investment reduces ROI but increases overall profitability.

TRUE-FALSE STATEMENTS

1.

Budget reports comparing actual results with planned

objectives should be prepared only once a year.

2.

If actual results are different from planned results, the

difference must always be investigated by management to

achieve effective budgetary control.

10.

A flexible budget is a series of static budgets at

different levels of activities.

11.

Flexible budgeting relies on the assumption that unit

variable costs will remain constant within the relevant range of

activity.

12.

Total budgeted fixed costs appearing on a flexible

budget will be the same amount as total fixed costs on the

master budget.

13.

A flexible budget is prepared before the master

budget.

15.

A formula used in developing a flexible budget is:

Total budgeted cost = fixed cost + (total variable cost per unit ×

activity level).

16.

Flexible budgets are widely used in production and

service departments.

17.

A flexible budget report will show both actual and

budget cost based on the actual activity level achieved.

18.

Management by exception means that management

will investigate areas where actual results differ from planned

results if the items are material and controllable.

19.

Policies regarding when a difference between actual

and planned results should be investigated are generally more

restrictive for noncontrollable items than for controllable items.

20.

A distinction should be made between controllable

and noncontrollable costs when reporting information under

responsibility accounting.

21.

Cost centers, profit centers, and investment centers

can all be classified as responsibility centers.

22.

More costs become controllable as one moves down

to each lower level of managerial responsibility.

23.

In a responsibility accounting reporting system, as

one moves up each level of responsibility in an organization,

the responsibility reports become more summarized and show

less detailed information.

24.

A cost center incurs costs and generates revenues

and cost center managers are evaluated on the profitability of

their centers.

25.

The terms "direct fixed costs" and "indirect fixed

costs" are synonymous with "traceable costs" and "common

costs," respectively.

a

30.

Residual income generates a dollar amount which

represents the increase in value to the company beyond the

cost necessary to pay for the financing of assets.

Additional True-False Questions

31.

Budget reports provide the feedback needed by

management to see whether actual operations are on course.

32.

A static budget is an effective means to evaluate a

manager's ability to control costs, regardless of the actual

activity level.

33.

The flexible budget report evaluates a manager's

performance in two areas: (1) pro-duction and (2) costs.

26.

Controllable margin is subtracted from controllable

fixed costs to get net income for a profit center.

34.

The terms controllable costs and noncontrollable

costs are synonymous with variable costs and fixed costs,

respectively.

27.

The denominator in the formula for calculating the

return on investment includes operating and nonoperating

assets.

35.

Most direct fixed costs are not controllable by the

profit center manager.

28.

The formula for computing return on investment is

controllable margin divided by average operating assets.

36.

The manager of an investment center can improve

ROI by reducing average operating assets.

a

a

37.

Residual income and ROI are used as performance

evaluation methods for profit center performance.

29.When evaluating residual income, the calculation tells

management what percentage return was generated by the

particular division being evaluated.

Answers to True-False Statements

Item

1.

2.

3.

4.

5.

6.

Ans.

F

F

T

F

F

T

Item

7.

8.

9.

10.

11.

12.

Ans.

F

F

T

T

T

T

Item

13.

14.

15.

16.

17.

18.

Ans.

F

F

T

T

T

T

MULTIPLE CHOICE QUESTIONS

38.

What is budgetary control?

a.

Another name for a flexible budget

b.

The degree to which the CFO controls the budget

c.

The use of budgets in controlling operations

d.

The process of providing information on budget

differences to lower level managers

39.

A major element in budgetary control is

a.

the preparation of long-term plans.

b.

the comparison of actual results with planned

objectives.

c.

the valuation of inventories.

d.

approval of the budget by the stockholders.

40.

Budget reports should be prepared

a.

daily.

b.

monthly.

c.

weekly.

d.

as frequently as needed.

41.

On the basis of the budget reports,

a.

management analyzes differences between actual

and planned results.

Item

19.

20.

21.

22.

23.

24.

Ans.

F

T

T

F

T

F

Item

25.

26.

27.

28.

a

29.

a

30.

Ans.

T

F

F

T

F

T

Item

31.

32.

33.

34.

35.

36.

Ans.

T

F

T

F

F

T

Item

a

37.

Ans.

F

b.

c.

d.

management may take corrective action.

management may modify the future plans.

all of these.

42.

is to

a.

b.

c.

d.

The purpose of the departmental overhead cost report

43.

a.

b.

c.

d.

control indirect labor costs.

control selling expense.

determine the efficient use of materials.

control overhead costs.

The purpose of the sales budget report is to

control selling expenses.

determine whether income objectives are being met.

determine whether sales goals are being met.

control sales commissions.

44.

The comparison of differences between actual and

planned results

a.

is done by the external auditors.

b.

appears on the company's external financial

statements.

c.

is usually done orally in departmental meetings.

d.

appears on periodic budget reports.

45.

A static budget

a.

should not be prepared in a company.

b.

is useful in evaluating a manager's performance by

comparing actual variable costs and planned variable costs.

c.

shows planned results at the original budgeted activity

level.

d.

is changed only if the actual level of activity is

different than originally budgeted.

46.

A static budget report

a.

shows costs at only 2 or 3 different levels of activity.

b.

is appropriate in evaluating a manager's effectiveness

in controlling variable costs.

c.

should be used when the actual level of activity is

materially different from the master budget activity level.

d.

may be appropriate in evaluating a manager's

effectiveness in controlling costs when the behavior of the

costs in response to changes in activity is fixed.

47.

A static budget is appropriate in evaluating a

manager's performance if

a.

actual activity closely approximates the master budget

activity.

b.

actual activity is less than the master budget activity.

c.

the company prepares reports on an annual basis.

d.

the company is a not-for-profit organization.

48.

When budgeted and actual results are not the same