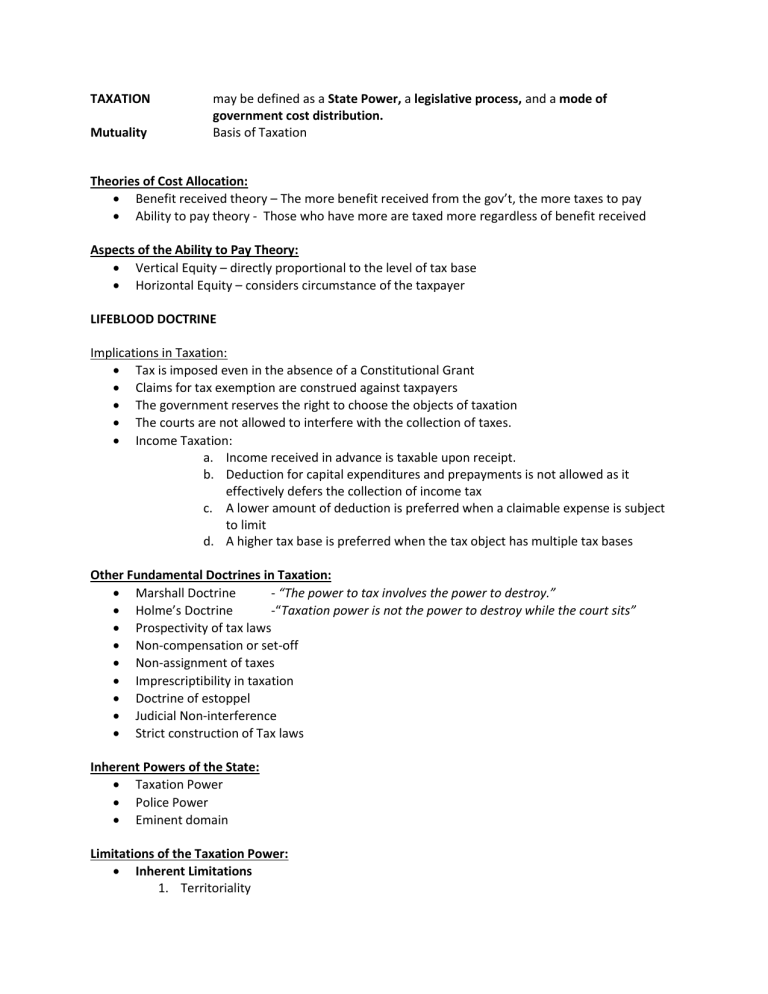

TAXATION Mutuality may be defined as a State Power, a legislative process, and a mode of government cost distribution. Basis of Taxation Theories of Cost Allocation: Benefit received theory – The more benefit received from the gov’t, the more taxes to pay Ability to pay theory - Those who have more are taxed more regardless of benefit received Aspects of the Ability to Pay Theory: Vertical Equity – directly proportional to the level of tax base Horizontal Equity – considers circumstance of the taxpayer LIFEBLOOD DOCTRINE Implications in Taxation: Tax is imposed even in the absence of a Constitutional Grant Claims for tax exemption are construed against taxpayers The government reserves the right to choose the objects of taxation The courts are not allowed to interfere with the collection of taxes. Income Taxation: a. Income received in advance is taxable upon receipt. b. Deduction for capital expenditures and prepayments is not allowed as it effectively defers the collection of income tax c. A lower amount of deduction is preferred when a claimable expense is subject to limit d. A higher tax base is preferred when the tax object has multiple tax bases Other Fundamental Doctrines in Taxation: Marshall Doctrine - “The power to tax involves the power to destroy.” Holme’s Doctrine -“Taxation power is not the power to destroy while the court sits” Prospectivity of tax laws Non-compensation or set-off Non-assignment of taxes Imprescriptibility in taxation Doctrine of estoppel Judicial Non-interference Strict construction of Tax laws Inherent Powers of the State: Taxation Power Police Power Eminent domain Limitations of the Taxation Power: Inherent Limitations 1. Territoriality 2. International comity 3. Public Purpose 4. Exemption of the government 5. Non-delegation Constitutional Limitations 1. Due Process of law 2. Equal protection of the law 3. Uniformity rule 4. Progressive System 5. Non-imprisonment for non-payment of debt or poll tax 6. Non-impairment of obligation and contract 7. Free worship rule 8. Exemption of religious or charitable entities, non-profit cemeteries , churches and mosque from property taxes. 9. Non-appropriation of public funds or property for the benefit of any church, sect, or system of religion 10. Exemption from taxes of the revenues and assets of non-profit, non-stock educational institutions including grants, endowments, donations, or contributions for educational purposes. 11. Concurrence of a majority of all members of Congress for the passage of a law granting tax exemption 12. Non-diversification of tax collections 13. Non-delegation of the power of taxation 14. Non-impairment of the jurisdiction of the Supreme Court to review tax cases 15. Appropriations, revenue, or tariff bills be originating exclusively in the House of Representatives, but the senate may propose or concur with amendments 16. Delegation to local government units Stages of the exercise of taxation power: Levy or imposition – Impact of taxation/legislative act Assessment and collection – incidence of taxation/administrative act SITUS OF TAXATION – Place of taxation 1. Business Tax situs 2. Income tax situs on services 3. Income tax situs on goods 4. Property Tax Situs 5. Personal Tax Situs DOUBLE TAXATION Elements: 1. Primary: Same Object 2. Secondary: a. Same type of tax b. Same purpose of tax c. Same taxing jurisdiction d. Same tax period Types: : in the place the business is conducted : where they are rendered : in the place of sale : in their location : in their place of residence 1. Direct Double Taxation 2. Indirect Double Taxation ESCAPES FROM TAXATION A. Those that result to loss of government revenue 1. Tax Evasion 2. Tax Avoidance 3. Tax Exemption B. Those that do not result to loss of government revenue 1. Shifting a. Forward Shifting b. Backward Shifting c. Onward Shifting 2. Capitalization 3. Transformation Tax Amnesty -General Pardon granted by the government -Both Civil and Criminal Liabilities -Retrospective -Forgiving past violations -condition upon the taxpayer paying the government a portion of the tax vs. Tax Condonation -Tax Remission -Civil Liabilities only -Prospective -Unpaid balance of tax - no payment TAXATION LAW Types: Tax laws Tax Exemption laws Sources: 1. Constitution 2. Statutes and Presidential Decrees 3. Judicial Decisions or case laws 4. Executive Orders and Batas Pambansa 5. Administrative Issuance 6. Local Ordinances 7. Tax treaties and conventions with foreign countries 8. Revenue Regulations Types: 1. Revenue regulations 2. Revenue memorandum orders 3. Revenue memorandum rulings 4. Revenue memorandum circulars 5. Revenue bulletins 6. BIR rulings Types of rulings: Value-Added Tax (VAT) International Tax Affairs Division (ITAD) rulings BIR rulings Delegated Authority (DA) rulings CLASSIFICATION OF TAXES A. As to purpose 1. Fiscal or revenue tax – general purpose 2. Regulatory – imposed to regulate 3. Sumptuary – tax levied to achieved some objectives B. As to subject matter 1. Personal,Poll or Capitation – tax on persons 2. Property Tax – tax on property 3. Excise or privilege tax – tax impose upon performance C. As to incidence 1. Direct Tax – Only taxpayer 2. Indirect Tax – paid by another person D. As to amount 1. Specific tax - fixed amount ( per unit basis ) 2. Ad valorem – fixed proportion ( value of tax object ) E. As to rate 1. Proportional Tax – flat or fixed rate tax 2. Progressive or graduated tax – increase rate as tax base increase 3. Regressive tax – decrease rate tax base increase 4. Mixed Tax – combination of any from above F. As to imposing authority 1. National Tax – Imposed by national government 2. Local tax – imposed by municipal or local government