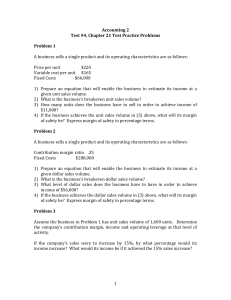

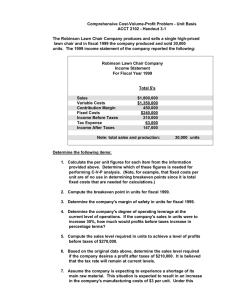

Cost-Volume-Profit Analysis MODULE 4 COST-VOLUME-PROFIT ANALYSIS THEORIES: 1. To which function of management is CVP analysis most applicable? A. Planning C. Directing B. Organizing D. Controlling 7. Which of the factors is (are) involved in studying cost-volume-profit relationships? A. Levels of production C. Fixed costs B. Variable costs D. All of these 8. At the breakeven point, fixed cost is always A. Less than the contribution margin B. Equal to the contribution margin. Bobadilla 2. The systematic examination of the relationships among selling prices, volume of sales and production, costs, and profits is termed: A. contribution margin analysis C. budgetary analysis B. cost-volume-profit analysis D. gross profit analysis Bobadilla 3. The term contribution margin is best defined as the: A. difference between fixed costs and variable costs. B. difference between revenue and fixed costs. C. amount available to cover fixed costs and profit. D. amount available to cover variable costs. C. More than the contribution margin D. More than the variable cost Bobadilla 9. At the break-even point: A. net income will increase by the unit contribution margin for each additional item sold above break-even. B. the total contribution margin changes from negative to positive C. fixed costs are greater than contribution margin D. the contribution margin ratio begins to increase Bobadilla 10. In cost-volume-profit analysis, the greatest profit will be earned at A. One hundred percent at normal productive capacity. B. The production point with the lowest marginal cost. C. The production point at which average total revenue exceeds average marginal cost. D. The point at which marginal cost and marginal revenue are equal. Bobadilla Bobadilla 4. Cost-volume-profit analysis allows management to determine the relative profitability of a product by A. Highlighting potential bottlenecks in the production process. B. Determining the contribution margin per unit and projected profits at various levels of production. C. Assigning costs to a product in a manner that maximizes the contribution margin. D. Keeping fixed costs to an absolute minimum. Bobadilla 5. Cost-volume-profit analysis cannot be used if which of the following occurs? A. Costs cannot be properly classified into fixed and variable costs. B. The per unit variable costs change. C. The total fixed costs change. D. Per unit sales prices change. Bobadilla 11. Which of the following is not an assumption underlying C-V-P analysis? A. The behavior of total revenue is linear. B. Unit variable expenses remain unchanged as activity varies. C. Inventory levels at the beginning and end of the period are the same. D. The number of units produced exceeds the number of units sold. Bobadilla 12. Which of the following assumptions is inherent to C-V-P analysis? A. In manufacturing firms, the beginning and ending inventory levels are the same. B. In a multi-product organization, the sales mix varies over time. C. The behavior of total revenue is curvilinear. D. he relevant range is not a consideration. Bobadilla Bobadilla 6. The most useful information derived from a breakeven chart is the A. Amount of sales revenue needed to cover enterprise variable costs. B. Amount of sales revenue needed to cover enterprise fixed costs. C. Relationship among revenues, variable costs, and fixed costs at various levels of activity. D. Volume or output level at which the enterprise breaks even. Bobadilla 13. Which of the following assumptions is closely relevant to cost-volume-profit analysis? A. for multiple product analysis, the sales mix is not important B. inventory levels remain unchanged C. total fixed costs and unit variable costs can be identified and remain constant over the relevant range D. B and C Bobadilla 97 Cost-Volume-Profit Analysis 20. As projected net income increases the A. degree of operating leverage declines. B. margin of safety stays constant. 14. Advocates of cost-volume-profit analysis argue that: A. Fixed costs are irrelevant for decision making. B. Fixed costs are mandatory for CVP decision making. C. Differentiation between the patterns of variable costs and fixed costs is critical. D. Fixed costs are necessary to calculate inventory valuations. Bobadilla 15. With respect to fixed costs, C-V-P analysis assumes total fixed costs A. per unit remains constant as volume changes B. remain constant from one period to the next C. vary directly with volume D. remain constant across changes in volume 21. Given the following notations, what is the breakeven sales level in units? SP = selling price per unit FC = total fixed cost VC = variable cost per unit A. SP / (FC/VC) C. VC/(SP – FC) B. FC/(VC/SP) D. FC/(SP – VC) Bobadilla Bobadilla 22. A company increased the selling price for its product from P1.00 to P1.10 a unit when total fixed costs increased from P400,000 to P480,000 and variable cost per unit remained unchanged. How would these changes affect the breakeven point? A. The breakeven point in units would be increased. B. The breakeven point in units would be decreased. C. The breakeven point in units would remain unchanged. D. The effect cannot be determined from the information given. Bobadilla 16. The CVP model assumes that over the relevant range of activity: A. only revenues are linear. C. unit variable cost is not constant. Bobadilla B. total fixed cost changes. D. revenues and total costs are linear. 17. Which of the following is not a limiting factor of Cost-Volume-Profit analysis? A. The process assumes a linear relationship among the variables. B. The process assumes variable costs per unit are available. C. Efficiency is assumed to be constant. D. Inventory levels are assumed to not change. C. break-even point goes down. Bobadilla D. contribution margin ratio goes up. 23. On January 1, 2007, Incremental Company increased its direct labor wage rates. All other budgeted costs and revenues were unchanged. How did this increase affect Incremental Company’s budgeted break-even point and budgeted margin of safety? Bobadilla A. B. C. D. Budgeted Break-even Point Increase Increase Decrease Decrease Expected Margin of Safety Increase Decrease Decrease Increase Bobadilla 18. Cost-volume-profit analysis is a technique available to management to understand better the interrelationships of several factors that affect a firm's profit. As with many such techniques, the accountant oversimplifies the real world by making assumptions. Which of the following is not a major assumption underlying CVP analysis? A. All costs incurred by a firm can be separated into their fixed and variable components. B. The product’s selling price per unit is constant at all volume levels within a relevant range. C. Operating efficiency and employee productivity is constant at all volume levels. D. For multi-product situations, the sales mix can vary at different volume levels. Bobadilla 24. As the variable cost increases but the selling price remains constant, the A. Degree of operating leverage declines C. Breakeven point goes down Bobadilla B. Margin of safety stays constant D. Contribution margin ratio goes up 25. A very high degree of operating leverage (DOL) indicates that a firm: A. has high fixed costs. C. has high variable costs. Bobadilla B. has a high net income. D. is operating close to its breakeven point. 19. Pines Company has a higher degree of operating leverage than Tagaytay Company. Which of the following is true? A. Pines has higher variable expense. B. Pines is more profitable than Tagaytay Company’s. C. Pines is more risky than Tagaytay is. D. Pines' profits are less sensitive to percentage changes in sales. Bobadilla 26. With the aid of computer software, managers can vary assumptions regarding selling prices, costs, and volume and can immediately see the effects of each change on the break-even point and profit. Such an analysis is called A. “What if” or sensitivity analysis. C. Computer aided analysis. B. Vary the data analysis. D. Data gathering. Bobadilla 98 Cost-Volume-Profit Analysis 27. If a company raises its target peso profit, its A. break-even point rises. B. fixed costs increase. C. required total contribution margin increases. D. selling price rises. 32. On a cost-volume-profit chart (break-even graph), where are the total fixed costs shown? A. As the point where the sales line intersects the vertical axis (pesos) B. As the point where the sales line crosses the total cost line C. As the point where the sales line crosses the horizontal axis (volume) D. As the point where the total cost line intersects the vertical axis (pesos) Bobadilla Bobadilla 28. Broadway Company sells three products: A, B and C. Product A's unit contribution margin is higher than Product B's which is higher than Products C's. Which one of the following events is most likely to increase the company's overall break-even point? A. The installation of new automated equipment and subsequent lay-off of factory workers. B. A decrease in Product C's selling price. C. An increase in the overall market demand for Product B. D. A change in the relative market demand for the products, with the increase favoring Product A relative to Product B and Product C. Bobadilla 33. When using conventional cost-volume-profit analysis, some assumptions about costs and sales prices are made. Which of the following is one of those assumptions? A. The contribution margin will change as volume increases B. The variable cost per unit will decrease as volume increases C. The sales price per unit will remain constant as volume increases D. Fixed cost per unit will remain the same as volume increases Bobadilla 34. Classifying a cost as fixed or variable depends on how it behaves A. per unit, as the volume of activity changes. B. in total, as the volume of activity changes. C. both A and B are correct. D. none of the above. 29. Which of the following is not a benefit of using sensitivity analysis? A. More people can see the impact of their ideas on the project. B. The use of a spreadsheet program increases the accuracy of the projections. C. What will happen is not known in advance so a variety of options can be explored prior to making a decision. D. A well-written spreadsheet will allow for a variety of questions to be answered in a minimal amount of time. Bobadilla Bobadilla 35. A fixed cost is the same percentage of sales in three different months. Which of the following is true? A. The company had the same sales in each of those months. B. The cost is both fixed and variable. C. The company is operating at its break-even point. D. The company is achieving its target level of profit. Bobadilla 30. A Cost-Volume-Profit graph contains an "Area of Loss" and an "Area of Profitability". Which of the following best explains the difference between the two points on the graph? A. The area of loss represents the difference between Sales and Variable Cost. B. The area of loss begins with the concept that fixed costs have to be recovered prior to sales contributing to profit. C. The area of profit represents the difference between Sales and Variable Cost. D. The area of profit begins with the concept that no company would have any level of sales below the break-even point. Bobadilla 36. Per-unit variable cost A. remains constant within the relevant range. B. increases as volume increases within the relevant range. C. decreases as volume increases within the relevant range. D. decreases if volume increases beyond the relevant range. 31. Which of the following best describes the impact of selling more units? A. The increase in sales volume increases total variable cost. B. The increase in sales volume means an increase in total fixed cost. C. The increase in sales increases contribution margin, causing net income to decrease. D. The increase in sales increases contribution margin per unit causing the break-even point to decrease. Bobadilla Bobadilla 37. In planning product mix for maximum profit, CVP analysis would stimulate sales of the product by increasing the: A. sales price C. contribution margin B. variable cost per unit D. emphasis on customer priority Bobadilla 38. A relatively low margin of safety ratio for a product is usually an indication that the product: 99 Cost-Volume-Profit Analysis A. B. C. D. is losing money has a high contribution margin is riskier than higher margin of safety products is less risky than higher margin of safety products A. the break-even point. B. contribution margin. Bobadilla 39. Within the relevant range, total revenues and total costs A. increase, but at a decreasing rate. C. remain constant. B. decrease. D. can be graphed as straight lines. Bobadilla 40. An assumption in a CVP analysis is that a change in costs is caused by a change in A. unit direct material cost C. sales commission per unit Bobadilla B. the number of units D. efficiency due to learning curve effect 41. In CVP analysis, when the number of units changes, which one of the following will remain the same? A. Total sales revenues C. Total fixed costs B. Total variable costs D. Total contribution margin Bobadilla Bobadilla 47. The most likely strategy to reduce the breakeven point would be to A. Increase both the fixed costs and the contribution margin. B. Decrease both the fixed costs and the contribution margin. C. Decrease the fixed costs and increase the contribution margin. D. Increase the fixed costs and decrease the contribution margin. Bobadilla 48. The break-even point in total sales decreases when: A. variable cost increases and sales remain unchanged B. variable cost increases and sales increase C. fixed cost increases D. fixed cost decreases Bobadilla 49. Which of the following best describes the impact of an increase in fixed cost? A. The increase in fixed cost will result in an increase in selling more units. B. The increase in fixed cost will cause an increase in variable cost. C. The increase in fixed cost causes net income to decrease and the break-even point to decrease. D. The increase in fixed cost causes net income to decrease and the break-even point to increase. Bobadilla 42. As fixed costs for a firm rise, all other things held constant, the breakeven point will A. be unchanged C. increase B. not be affected by fixed costs D. decrease Bobadilla 43. Which of the following would not affect the breakeven point? A. Number of units sold. C. Total fixed costs. B. Variable cost per unit. D. Sales price per unit. C. total variable costs. D. unit selling price. 50. A company’s breakeven point in peso sales may be affected by equal percentage increases in both selling price and variable cost per unit (assume all other factors are equal within the relevant range). The equal percentage changes in selling price and variable cost per unit will cause the breakeven point in peso sales to A. Decrease by less than the percentage increase in selling price. B. Decrease by more than the percentage increase in the selling price. C. Increase by less than the percentage increase in selling price. D. Remain unchanged. Bobadilla Bobadilla 44. The margin of safety is a key concept of CVP analysis. The margin of safety is A. The contribution margin rate. B. The difference between budgeted contribution margin and actual contribution margin. C. The difference between budgeted contribution margin and breakeven contribution margin D. The difference between budgeted sales and breakeven sales. Bobadilla 45. A technique for determining what would happen in a decision analysis if a key prediction or assumption proves to be wrong is called: A. CVP analysis. C. Post-audit analysis. Bobadilla B. Sensitivity analysis. D. Contribution-margin variation analysis. 51. If the fixed costs attendant to a product increase while variable costs and sales price remains constant, what will happen to contribution margin (CM) and breakeven point (BEP)? Bobadilla A. B. C. D. CM Increase Decrease Unchanged Unchanged BEP Decrease Increase Increase Unchanged 46. An increase in the unit variable cost will generally cause an increase in all of the following except 52. Which of the following will decrease the breakeven point? 100 Bobadilla Cost-Volume-Profit Analysis A. B. C. D. Decrease in Selling Price YES YES NO NO Increase in Direct Labor YES NO NO NO 57. Which of the following decreases per-unit contribution margin the most for a company that is currently earning a profit? A. A 10% decrease in selling price. C. A 10% increase in fixed costs. Bobadilla B. A 10% increase in variable cost per unit. D. A 10% increase in fixed cost per unit. Increase in Fixed Cost YES YES YES NO 53. Which of the following is an incorrect statement? A. The contribution income statement that is prepared for internal users is better than the traditional income statement as a management tool to predict the results of increases or decreases in sales volume, variable costs, and fixed costs. B. The greater the proportion of fixed costs in a firm's cost structure, the smaller will be the impact on profit from a given percentage change in sales revenue. C. In an economic recession, the highly automated company with high fixed costs will be less able to adapt to lower consumer demand than will a firm with a more labor-intensive production process. D. A major difference between income statements prepared under the traditional format and those prepared under the contribution format is that expenses under the traditional format are shown by function, while the expenses shown under the contribution format are shown by function and cost behavior. Bobadilla 54. If a company is operating at a loss, A. fixed costs are greater than sales. B. selling price is lower than the variable cost per unit. C. selling price is less than the average total cost per unit. D. fixed cost per unit is greater than variable cost per unit. 55. As volume increases, average cost per unit A. increases. B. decreases. C. remains constant. D. increases in proportion to the change in volume. 56. If all goes according to plan except that unit variable cost falls, A. total contribution margin will be lower than expected. B. the contribution margin percentage will be lower than expected. C. profit will be higher than expected. D. per-unit contribution margin will be lower than expected. Bobadilla 58. If variable cost as a percentage of sales increases, the A. contribution margin percentage increases. B. selling price increases. C. break-even point in pesos increases. D. fixed costs decrease. Bobadilla 59. Introducing income taxes into cost-volume-profit analysis A. raises the break-even point. B. lowers the break-even point. C. increases unit sales needed to earn a particular target profit. D. decreases the contribution margin percentage. Bobadilla 60. If a company is earning a profit, its fixed costs A. are less than total contribution margin. B. are equal to total contribution margin. C. are greater than total variable costs. D. can be greater than or less than total contribution margin. Bobadilla 61. A cost-volume-profit graph reflects relationships A. that are expected to hold over the relevant range. B. of results over the past few years. C. that the company's managers would like to have happen. D. likely to prevail for the industry. Bobadilla 62. The following diagram is a cost-volume-profit graph for a manufacturing company. Bobadilla E P C D Bobadilla A 101 B Cost-Volume-Profit Analysis A. expected mix B. least desirable mix O Volume The difference between line AB and line AC (area BAC) is the A. contribution ratio. C. total variable cost. B. contribution margin per unit. D. total fixed cost. 64. In a cost-volume-profit graph A. the total revenue line crosses the horizontal axis at the breakeven point. Bobadilla B. beyond the breakeven sales volume, profits are maximized at the sales volume where total revenues equal total costs. C. an increase in unit variable costs would decrease the slope of the total cost line. D. an increase in the unit selling price would shift the breakeven point in units to the left. PROBLEMS: 1. Green Corporation expects to sell 3,000 plants a month. Its operations manager estimated the following monthly costs: Variable costs P 7,500 Fixed costs 15,000 What sales price per plant does she need to achieve to begin making a profit if she sells the estimated number of plants per month? A. P7.51 C. P5.00 B. P7.50 D. P2.50 Bobadilla Bobadilla 2. An organization's break-even point is 4,000 units at a sales price of P50 per unit, variable cost of P30 per unit, and total fixed costs of P80,000. If the company sells 500 additional units, by how much will its profit increase? A. P25,000 C. P10,000 B. P15,000 D. P12,000 Bobadilla 66. If the sales mix shifts toward higher contribution margin products, the break-even point A. decreases. B. increases. C. remains constant. D. it is impossible to tell without more information. Bobadilla 67. Target costing is A. a substitute for CVP analysis. B. used by companies that cannot classify their costs by behavior. C. inappropriate if a company has already established a target profit. D. used in decisions to offer a new product or enter a new market. Bobadilla 69. Which of the following is a true statement about sales mix? A. Profits may decline with an increase in total peso of sales if the sales mix shifts to sell more of the high contribution margin product. B. Profits may decline with an increase in total peso of sales if the sales mix shifts to sell more of the lower contribution margin product. C. Profits will remain constant with an increase in total peso of sales if the total sales in units remains constant. D. Profits will remain constant with a decrease in total peso of sales if the sales mix also remains constant. Bobadilla Bobadilla 63. Select the answer that best describes the labeled item on the diagram. A. Area CDE represents the area of net loss. B. Line AC graphs total fixed costs. C. Point D represents the point at which the contribution margin per unit increases. D. Line AC graphs total costs. Bobadilla 65. An increase in the income tax rate A. raises the break-even point. B. lowers the break-even point. C. decreases sales required to earn a particular after-tax profit. D. increases sales required to earn a particular after-tax profit. C. most desirable mix D. traditional mix 3. The Red Lions Brotherhood is planning its annual Riverboat Extravaganza. The Extravaganza committee has assembled the following expected costs for the event: Dinner per person P 70 Programs and souvenir per person 30 Orchestra 15,000 Tickets and advertising 7,000 Riverboat rental 48,000 Floor show and strolling entertainment 10,000 The committee members would like to charge P300 per person for the evening’s activities. Bobadilla 68. In order for the break-even computation to be meaningful to management, sales mix should be computed using the 102 Cost-Volume-Profit Analysis Assume that only 250 persons are expected to attend the extravaganza, what ticket price must be charged to breakeven? A. P420 C. P320 B. P350 D. P390 Bobadilla 4. Consider the following: Fixed expenses Unit contribution margin Target net profit How many unit sales are required to earn the target net profit? A. 15,000 units C. 12,800 units B. 10,000 units D. 20,000 units 9. The sales price per unit will increase from P32 to P40. The variable cost per unit will remain at P24, and the fixed costs will remain unchanged at P400,000. How many fewer units must be sold to break-even at the new sales price of P40 per unit? A. 25,000 C. 10,000 B. 2,500 D. 12,500 Bobadilla P78,000 12 42,000 10. The Hard Company sells widgets. The company breaks even at an annual sales volume of 80,000 units. At an annual sales volume of 100,000 units the company reports a profit of P220,000. The annual fixed costs for the Hard Company are: A. P 880,000 C. P 800,000 B. P1,100,000 D. P1,000,000 Bobadilla Bobadilla 11. Albatross Company has fixed costs of P90,300. At a sales volume of P360,000, return on sales is 10%; at a P600,000 volume, return on sales is 20%. What is the break-even volume? A. P225,000 C. P301,000 B. P258,000 D. P240,000 Bobadilla 5. Carribean Company produces a product that sells for P60. The variable manufacturing costs are P30 per unit. The fixed manufacturing cost is P10 per unit based on the current level of activity, and fixed selling and administrative costs are P8 per unit. A selling commission of 10% of the selling price is paid on each unit sold. The contribution margin per unit is: A. P24. C. P30. B. P36. D. P54. Bobadilla 12. An entity has fixed costs of P200,000 and variable costs per unit of P6. It plans on selling 40,000 units in the coming year. If the entity pays income taxes on its income at a rate of 40%, what sales price must the firm use to obtain an after-tax profit of P24,000 on the 40,000 units? A. P11.60 C. P12.00 B. P11.36 D. P12.50 Bobadilla 6. Seal Yard Ornaments sells lawn ornaments for P15 each. Seal's contribution margin ratio is 40%. Fixed costs are P32,000. Should fixed costs increase 30%, how many additional units will Seal have to produce and sell in order to generate the same net profit as under the current conditions? A. 1,600. C. 6,933. B. 5,333. D. 1,067. Bobadilla 13. The following is the Lux Corporation's contribution format income statement for last month: Sales P2,000,000 Less variable expenses 1,400,000 Contribution margin 600,000 Less fixed expenses 360,000 Net income P 240,000 The company has no beginning or ending inventories. A total of 40,000 units were produced and sold last month. What is the company's degree of operating leverage? A. 0.12 C. 2.50 B. 0.40 D. 3.30 Bobadilla 7. At a break-even point of 5,000 units sold, variable expenses were P10,000 and fixed expenses were P50,000. The profit from the 5,001st unit would be? A. P10 C. P15 B. P50 D. P12 Bobadilla 8. Galactica Company has fixed costs of P100,000 and breakeven sales of P800,000. Based on this relationship, what is its projected profit at P1,200,000 sales? A. P 50,000 C. P150,000 B. P200,000 D. P400,000 Bobadilla 14. Delmar Company has the opportunity to increase its annual sales by P125,000 by selling to a new, riskier group of customers. The uncollectible expense is expected to be 10%, and collection costs will be 10%. The company’s manufacturing and selling expenses are 70% of 103 Cost-Volume-Profit Analysis sales, and its effective tax rate is 40%. If Delmar were to accept this opportunity, the company’s after tax profits would increase by A. P 7,500 C. P12,500 B. P 6,000 D. P15,000 Bobadilla 20. The following economic data were provided by the corporate planning staff of Heaven, Inc.: Sales volume 30,000 units Sales price per unit P30 Unit variable costs: Variable manufacturing P13 Other variable costs 8 Unit variable costs P21 Unit contribution margin P 8 15. In 2006 Lucia Company had a net loss of P8,000. The company sells one product with a selling price of P80 and a variable cost per unit of P60. In 2007, the company would like to earn a before-tax profit of P40,000. How many additional units must the company sell in 2007 than it sold in 2006? Assume that the tax rate is 40 percent. A. 1,600 C. 2,000 B. 2,400 D. 5,400 Bobadilla Fixed costs: Manufacturing P150,000 Other fixed costs P 50,000 Total fixed costs P200,000 The management is considering installing a new, automated manufacturing process that will increase fixed costs by P50,000 and reduce variable manufacturing cost by P3 per unit. The management set a target a profit of P70,000 before and after the acquisition of the automated machine. After installation of the automated machine, what will be the change in the units required to achieve the target profit? A. 6,667 unit increase C. 3,333 unit decrease B. 5,667 unit decrease D. 4,333 unit decrease Bobadilla 16. Bulusan Company has sales of P400,000 with variable costs of P300,000, fixed costs of P120,000, and an operating loss of P20,000. How much increase in sales would Bulusan need to make in order to achieve a target operating income of 10% of sales? A. P400,000 C. P500,000 B. P462,000 D. P800,000 Bobadilla 17. The following data apply to Diva Corporation for the year 2006: Total variable cost per unit P3.50 Contribution margin/sales 30% Breakeven sales (present volume) P1,000,000 Diva wants to sell an additional 50,000 units at the same selling price and contribution margin per unit. By how much can fixed costs increase to generate a gross margin equal to 10% of the sales value of the additional 50,000 units to be sold? A. P 50,000 C. P 67,500 B. P 57,500 D. P125,000 Bobadilla 21. In planning its operations for next year based on a sales forecast of P6,000,000, Herran, Inc. prepared the following estimated costs and expenses: Variable Fixed Direct materials P1,600,000 Direct labor 1,400,000 Factory overhead 600,000 P 900,000 Selling expenses 240,000 360,000 Administrative expenses 60,000 140,000 P3,900,000 P1,400,000 What would be the amount of peso sales at the breakeven point? A. P2,250,000. C. P4,000,000. B. P3,500,000. D. P5,300,000. Bobadilla 18. Marsman Company had a margin of safety ratio of 20%, variable costs of 60% of sales, fixed costs of P240,000, a break-even point of P600,000, and an operating income of P60,000 for the current year. What are the current year's sales? A. P 500,000 C. P 750,000 B. P 600,000 D. P 900,000 Bobadilla 19. Regal, Inc. sells Product M for P5 per unit. The fixed costs are P210,000 and the variable costs are 60% of the selling price. What would be the amount of sales if Regal is to realize a profit of 10% of sales? A. P700,000 C. P525,000 B. P472,500 D. P420,000 Bobadilla 22. The Expressive Company currently has fixed cost of P770,500. This cost is expected to increase by P103,500 if the company expands its production facilities. Currently, it sells its product for P47. The product has a variable cost per unit of P24. How many more units must 104 Cost-Volume-Profit Analysis the company sell to break even, at the current sales price per unit, than it did to break even prior to the increase in fixed cost? A. 3,500 C. 4,500 B. 4,000 D. 6,000 Bobadilla 23. The Tanker Company estimated the following data for the coming year: Fixed manufacturing costs Variable production costs per peso of sales Materials Direct labor Variable overhead Variable selling costs per peso of sales Tanker estimates its sales for the coming year to be P2,000,000. The expected cost of goods sold for the coming year is A. P1,265,000 C. P1,565,000 B. P1,115,000 D. P 700,000 26. Mercado, Inc. had the following economic data for 2007: Net sales Contribution margin Margin of safety What is Mercado’s breakeven point in 2007? A. P360,000 C. P320,000 B. P288,000 D. P 80,000 P565,000 P 0.125 0.150 0.075 0.150 Bobadilla 27. Marquez Co. manufactures a single product. For 2006, the company had sales of P90,000, variable costs of P50,000, and fixed costs of P30,000. Marquez expects its cost structure and sales price per unit to remain the same in 2007; however total sales are expected to jump by 20%. If the 2007 projections are realized, net income in 2007 should exceed net income in 2006 by A. 100% C. 20% B. 80% D. 50% Bobadilla Bobadilla 28. Below is the income statement for Harpo Co. for 2006: Sales P400,000 Variable costs ( 125,000) Contribution margin P275,000 Fixed costs ( 200,000) Profit before tax P 75,000 Assuming that the fixed costs are expected to remain at P200,000 for 2007, and the sales price per unit and variable cost per unit are also expected to remain constant, how much profit before tax will be produced if the company anticipates 2007 sales rising to 130% of the 2006 level? A. P 97,500 C. P195,000 B. P157,500 D. P180,000 Bobadilla 24. At a sales volume level of 2,250 units, Baluarte Company’s contribution margin is one and one-half of the fixed costs of P36,000. Contribution margin is 30% How much peso sales should the Baluarte Company sell to earn 10 percent of sales? A. P270,000 C. P360,000 B. P180,000 D. P540,000 Bobadilla 25. The Alpine Company’s year-end income statement is as follows: Sales (20,000 units) P360,000 Variable costs 220,000 Contribution margin P140,000 Fixed costs 105,000 Net income P 35,000 Alpine’s management is unhappy with the results and plans to make some changes for next year. If management implements a new marketing program, fixed costs are expected to increase by P19,200 and variable costs to increase by P1 per unit. Unit sales are expected to increase by 15 percent. What is the effect on income if the foregoing changes are implemented? A. decrease of P21,200 C. increase of P 1,800 B. increase of P13,800 D. increase of P14,800 P400,000 160,000 40,000 29. Almos Corporation produces a product that sells for P10 per unit. The variable cost per unit is P6 and total fixed costs are P12,000. At this selling price, the company earns a profit equal to 10% of total peso sales. By reducing its selling price to P9 per unit, the manufacturer can increase its unit sales volume by 25%. Assume that there are no taxes and that total fixed costs and variable cost per unit remain unchanged. If the selling price were reduced to P9 per unit, the company’s profit would have been A. P3,000. C. P5,000. B. P4,000. D. P6,000. Bobadilla Bobadilla 30. Information concerning the 2007 financial projections of the Silver Company is as follows: 105 Cost-Volume-Profit Analysis Net sales of P3,000,000. Fixed costs of P800,000. P0.65 increase in cost of sales for each peso increase in net sales. What is the projected cost of sales for 2007? A. P 950,000 C. P1,050,000 B. P2,750,000 D. P1,850,000 35. A firm has fixed costs of P200,000 and variable cost per unit of P6. It plans to sell 40,000 units in the coming year. If the firm pays income taxes on its income at a rate of 40%, what sales price must the firm use to obtain an after-tax profit of P24,000? A. P11.60 C. P11.36 B. P12.00 D. P12.50 Bobadilla Bobadilla 31. The Childless Company sells widgets. The company breaks even at an annual sales volume of 75,000 units. 36. Below is the income statement for Blender Co. for 2007: Sales P400,000 Variable costs (125,000) Contribution margin P275,000 Fixed costs ( 200,000) Profit before tax P 75,000 What is the degree of operating leverage for Blender Company for 2007? A. 3.67 C. 5.33 B. 1.45 D. 1.67 Bobadilla Actual annual sales volume was 100,000 units, and the company reported a profit of P200,000. The annual fixed costs for the Childless Company are A. P800,000 C. P200,000 B. P600,000 D. P150,000 Bobadilla 32. The costs to produce 24,000 units at 70% capacity are: Direct materials P36,000 Direct labor 54,000 Factory overhead, all fixed 29,000 Selling expense (35% variable, 65% fixed) 24,000 What unit price would the company have to charge to make P2,250 on a sale of 1,500 additional units that would be shipped out of the normal market area? A. P5.10 C. P4.10 B. P5.60 D. P5.00 Bobadilla 37. Food Factory, Inc. sells loose biscuits for P5 per unit. The fixed costs are P210,000 and the variable costs are 45% of the selling price. What would be the amount of sales if Food Factory, Inc. were to realize a profit of 15% of sales? A. P700,000 C. P525,000 B. P472,500 D. P420,000 Bobadilla 38. The Opposition Sales Corporation is expecting an increase of fixed costs by P78,750 upon moving their place of business to the downtown area. The company anticipates that the selling price per unit and the variable expenses will not change. At present, the sales volume necessary to breakeven is P750,000 but with the expected increase in fixed costs, the sales volume necessary to breakeven would go up to P975,000. 33. The Mandarin Company's product mix includes P720,000 in sale of X and P640,000 in sale of Y. X's contribution margin is 60% and Y's is 40% of sales. Fixed costs amount to P505,881. Y's sale at breakeven point should amount to A. P640,000 C. P529,490 B. P720,000 D. P470,590 Bobadilla Based on these projections, what were the total fixed costs before the increase of P78,750? A. P341,250 C. P183,750 B. P262,500 D. P300,000 Bobadilla 34. Levi’s Company has revenues of P500,000, variable costs of P300,000, and pretax profit of P150,000. Had the company increased the sales price per unit by 10%, reduced fixed costs by 20%, and left variable cost per unit unchanged, what would the new breakeven point in pesos have been? A. P 88,000 C. P100,000 B. P 80,000 D. P125,000 Bobadilla 39. At 40,000 units of sales, Benevolent Corporation had an operating loss of P3.00 per unit. When sales were 70,000 units, the company had a profit of P1.20 per unit. The number of units to breakeven is A. 35,000 C. 45,000 B. 52,500 D. 57,647 Bobadilla 106 Cost-Volume-Profit Analysis 40. The following information pertains to Hennin Corporation for the year ending December 31, 2006: Budgeted sales P1,000,000 Breakeven sales 700,000 Budgeted contribution margin 600,000 Cashflow breakeven 200,000 The margin of safety for the Hennin Corporation is: A. P300,000 C. P500,000 B. P400,000 D. P800,000 Bobadilla 43. Menor Company sells two products with the following per unit data: Standard Deluxe Selling price/unit P75 P120 Variable costs/unit 45 60 Contribution margin/unit P30 P 60 Sales mix 3 2 If fixed costs are P630,000, the number of standard and deluxe units that Menor must sell to break even is Bobadilla A. 1,800 standard and 1,200 deluxe. C. 9,000 standard and 6,000 deluxe. B. 3,600 standard and 2,400 deluxe. D. 21,000 standard and 14,000 deluxe. 41. Balboa, Inc. had the following economic information for the year 2006: Sales (50,000 units @ P20) P1,000,000 Variable manufacturing costs 400,000 Fixed costs 250,000 Income tax rate 40 percent Balboa, Inc. budgets its 2007 sales at 60,000 units or P1,200,000. The company anticipates an increased competition; hence, an additional P75,000 advertising costs is budgeted in order to maintain its sales target for 2007. 44. The following are projections about the two products of Dorine Company, baubles and trinkets, for the coming year: Baubles Trinkets Units Amount Units Amount Total Sales 10,000 P10,000 7,500 P10,000 P20,000 Costs Fixed P 2,000 P 5,600 P 7,600 Variable 6,000 3,000 9,000 P 8,000 P 8,600 P16,600 Income before taxes P 2,000 P 1,400 P 3,400 Assuming that the customers purchase composite units of four baubles and three trinkets, the breakeven output for the two products would be Bobadilla A. B. C. D. Baubles 6,909 6,909 5,000 5,000 Trinkets 6,909 5,182 8,000 6,000 What is the amount of peso sales needed for 2007 in order to equal the after-tax income in 2006? A. P1,125,000 C. P1,325,000 B. P1,187,500 D. P1,387,500 Bobadilla 42. Mauresmo Company developed the following information for the year ended December 31, 2007: Product A Product B Total Units Sold 4,000 6,000 10,000 45. The sales mix for Dial Enterprise is as follows: Product A: 12 units @ P5.25 sales price; P4.85 variable cost per unit. Product B: 10 units @ P7.50 sales price; P6.95 variable cost per unit. Product C: 6 units @ P12.25 sales price; P10.35 variable cost per unit. Sales P12,000 P27,000 P39,000 Variable costs 6,000 15,000 21,000 Contribution margin P 6,000 P12,000 18,000 Fixed costs 12,600 Net income P 5,400 If the sales mix changes to 5,000 units of Product A and 5,000 units of Product B, the effect on the company’s break-even point would be A. to increase it by 200 units. C. to increase it by 1,200 units. B. to decrease it by 200 units. D. no change. Bobadilla Dial Enterprise's fixed costs are P75,950. What are the composite break-even point? A. 98,000 B. 2,000 107 C. D. 3,500 4,000 Bobadilla Cost-Volume-Profit Analysis 46. Alexandra Co. provides two products, Velvet and Cotton. Velvet accounts for 60 percent of total sales. The variable costs as a percentage of selling prices are 60% for Velvet and 85% for Cotton. Total fixed costs are P225,000. A. P 72,000 B. P288,000 47. Last month, Zamora Company had an income of P0.75 per unit with sales of 60,000 units. During the current month when the unit sales are expected to be only 45,000, there is a loss of P1.25 per unit. Both the variable cost per unit and total fixed costs remain constant. C. P360,000 D. P210,000 Bobadilla 48. Bytes Company is a retailer of video disks. The projected after-tax income for the current year is P120,000 based on a sales volume of 200,000 video disks. Bytes has been selling the disks at P16 each. The variable costs consist of the P10 per unit purchase price of the disks and a handling cost of P2 per disk. Bytes’ annual fixed costs are P600,000, and Bytes is subject to a 40% income tax rate. Management is planning for the coming year when it expects that the unit purchase price of the video disks will increase 30%. Bytes Company’s breakeven point for the current year in number of video disks is A. 100,000 units C. 50,000 units B. 150,000 units D. 60,000 units Bobadilla 51. Glareless Company manufactures and sells sunglasses. The price and cost data are as follows: Selling price per pair of Sunglasses P25.00 Variable costs per pair of sunglasses: Raw materials P11.00 Direct labor 5.00 Manufacturing overhead 2.50 Selling expenses 1.30 Total variable costs per unit P19.80 Annual fixed costs: Manufacturing overhead P192,000 Selling and administrative 276,000 Total fixed costs P468,000 Forecasted annual sales volume (120,000 pairs) P3,000,000 Income tax rate 40% Glareless Company estimates that its direct labor costs will increase 8 percent next year. How many units will Glareless have to sell next year to reach breakeven? A. 97,500 units C. 101,740 units B. 83,572 units D. 86,250 units Bobadilla If fixed costs will increase by 30 percent, what amount of peso sales would be necessary to generate an operating profit of P48,000? A. P1,350,000 C. P1,135,000 B. P 486,425 D. P 910,000 Bobadilla The fixed costs amounted to A. P 80,000 B. P247,500 C. P 80,000 D. P320,000 52. Santos Company is planning its advertising campaign for next year and has prepared the following budget data based on a zero advertising expenditure: Normal plant capacity 200,000 units Sales 150,000 units Selling price P25 per unit Variable manufacturing costs P15 per unit Fixed manufacturing costs P800,000 Fixed selling costs P700,000 An advertising agency claims that an aggressive advertising campaign would enable Santos to increase its unit sales by 20%. What is the maximum amount that Santos Company can pay for advertising and have an operating profit of P200,000 next year? A. P100,000 C. P300,000 B. P200,000 D. P550,000 Bobadilla Bobadilla 49. Alonzo Corporation had sales of P120,000 for the month of May. It has a margin of safety ratio of 25 percent, and an after-tax return on sales of 6 percent. The company assumes its sales being constant every month. If the tax rate is 40 percent, how much is the annual fixed cost? A. P 36,000 C. P 90,000 B. P432,000 D. P360,000 Bobadilla 50. Cultured Company is a manufacturer of its only one product line. It had sales of P400,000 for 2007 with a contribution margin ratio of 20 percent. Its margin of safety ratio was 10 percent. 53. Adventurous Co. is considering dropping a product. Variable costs are P60.00 per unit. Fixed overhead costs, exclusive of depreciation, have been allocated at a rate of P3.50 per unit and What are the company’s fixed costs? 108 Cost-Volume-Profit Analysis will continue whether or not production ceases. Depreciation on the equipment is P60,000 a year. If production is stopped, the equipment can be sold for P270,000, if production continues, however, it will be useless at the end of 1 year and will have no salvage value. The selling price is P100 a unit. Ignoring taxes, the minimum number of units to be sold in the current year to break even on a cash flow basis is A. 1,500 units. C. 8,250 units. B. 6,750 units. D. 9,750 units Bobadilla Plastic Frames Glass Frames Sales price P10.00 P15.00 Direct materials ( 2.00) ( 3.00) Direct labor ( 3.00) ( 5.00) Fixed overhead ( 3.00) ( 2.75) Net income per unit P 2.00 P 4.25 Budgeted unit sales 100,000 300,000 The budgeted unit sales equal the current unit demand, and total fixed overhead for the year is budgeted at P975,000. Assume that the company plans to maintain the same proportional mix. 54. Pansipit Company had a 25 percent margin of safety. Its after-tax return on sales is 6 percent. The company’s income is subject to tax rate of 40 percent. If fixed costs amount to P320,000, how much peso sales did Pansipit make for the year? A. P1,066,667 C. P1,280,000 B. P1,000,000 D. P 800,000 Bobadilla The total number of units that MultiFrame needs to produce and sell in order to break even is A. 150,000 units C. 153,947 units B. 100,000 units D. 300,000 units Bobadilla 55. The management of Mesa Company has performed cost studies and has projected the following annual costs based on 60,000 units of production and sales: Total Annual Costs Percent of Variable Portion of Total Annual Costs Direct material P600,000 100 Direct labor 720,000 80 Mfg. Overhead 400,000 50 Selling costs 192,500 25 What selling price will yield a 15 percent profit from sales of 60,000 units? A. P41.67 C. P27.30 B. P37.50 D. P35.42 Bobadilla 58. During 2006, St. Paul Lab supplied hospitals with a comprehensive diagnostic kit for P120. At a volume of 80,000 kits, St. Paul had fixed costs of P1,000,000 and operating income before income taxes of P200,000. Because of an adverse legal decision, St. Paul’s 2007 liability insurance increased by P1,200,000 over 2006. Assuming the volume and other costs are unchanged, what should the 2007 price be if St. Paul is to make the same P200,000 operating income before income taxes? A. P120 C. P150 B. P135 D. P240 Bobadilla 59. The following data relate to Herbert Company which sells a single product: Unit selling price P 20.00 Purchase cost per unit 11.00 Sales commission, 10% of selling price 2.00 Monthly fixed costs P80,000 The firm’s salespersons would like to change their compensation from a 10 percent commission to a 5 percent commission plus P20,000 per month in salary. Currently, they only receive commissions as their compensation. 56. The following data relate to Harvester Company which sells a single product: Unit selling price P 80.00 Purchase cost per unit 55.00 Sales commission 15 % of selling price 12.00 Monthly fixed costs P180,000 The firm’s two salespersons would like to change their compensation from a 15 percent commission to a 7.5 percent commission plus P15,000 each per month in fixed salary. Currently, they only receive commissions as their compensation. At what sales volume in units would the two cost structures be indifferent? A. 2,500 units C. 4,000 units B. 3,000 units D. 5,000 units The change in compensation plan should change the monthly breakeven point by A. 1,071 Increase C. 1,538 Increase B. 1,071 Decrease D. 1,538 Decrease Bobadilla Bobadilla 60. The manager of Naughty Food Company reviewed the following data: Fruits Meat Canned Products 57. MultiFrame Company has the following revenue and cost budgets for the two products it sells: 109 Cost-Volume-Profit Analysis Contribution margin ratio 40% Sales mix in pesos 20% Fixed costs, P1,290,000 per month. The breakeven sales for each month is A. P1,677,000 B. P3,000,000 50% 30% B. P 8.25 40% 50% C. P4,500,000 D. P6,000,000 Bobadilla 64. During the month of June, Armani Corporation produced 12,000 units and sold them for P20 per unit. Total fixed costs for the period were P154,000, and the operating profit was P26,000. The variable cost per unit for June was A. P4.50 C. P6.00 B. P5.00 D. P7.17 Bobadilla Bobadilla 61. The Oregano Watch Company manufactures a line of ladies’ watches which are sold through discount houses. Each watch is sold for P1,500; the fixed costs are P3,600,000 for 30,000 watches or less; variable cost is P900 per watch. What is Oregano’s degree of operating leverage at sales of 12,000 watches? A. 2.0X C. 0.5X B. 5.0X D. 0.2X D. P 9.75 65. Stone Company plans to sell 400,000 laundry hangers. The fixed costs are P600,000, and the variable cost is 60% of the selling price. If the company wants to realize a profit of P120,000, the selling price of each laundry hanger must be A. P2.50 C. P4.50 B. P3.75 D. P5.00 Bobadilla Bobadilla 66. The unit contribution margin of Product A is P20 and of Product B is P16. If six units of Product A and eight units of Product B can be produced per machine hour, the contribution margin of the products per machine hour is Bobadilla A. Product A, P160; Product B, P96 C. Product A, P3.33; Product B, P2.00 B. Product A, P120; Product B, P128 D. Product A, P32.00; Product B, P30.00 62. Duke, Inc. owns and operates a chain of food centers. The management is considering installing machines that will make popcorn on the premises. These machines are available in two different sizes with the following details: Economy Regular Annual capacity 20,000 50,000 Costs: Annual machine rental P60,000.00 P82,500.00 Popcorn cost per box 3.90 3.90 Cost of each box 0.80 0.80 Other variable cost per box 6.60 4.20 The level of output in boxes at which the Economy and the Regular would earn the same profit (loss) is A. 20,000 boxes C. 15,000 boxes B. 9,375 boxes D. 12,500 boxes Bobadilla 67. The Bittersweet Company is a wholesale distributor of candy. The company services various grocery, convenience, and drug stores in Metro Manila. Small, but steady growth in sales, has been achieved by the company over the past few years while candy prices have been increasing. The company is formulating its plans for the coming fiscal year. Presented below are the data used to project the current year’s after-tax net income of P110,400. Average selling price P4.00 per box Average variable costs Cost of candy P2.00 per box Selling expenses 0.40 per box Total P2.40 per box 63. The Harper Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year, the shirts sold for P7.50 each, and the variable cost to manufacture them was P2.25 per unit. The company needed to sell 20,000 shirts to break even. The net income last year was P5,040. Harper’s expectations for the coming year include the following: 1. The sales price of the T-shirts will be P9 2. Variable cost to manufacture will increase by one-third 3. Fixed costs will increase by 10% 4. The income tax rate of 40% will be unchanged The selling price that would maintain the same contribution margin rate as last year is A. P 9.00 C. P10.00 Annual fixed costs: Selling P 169,000 Administrative 280,000 Total P 440,000 Expected annual sales volume (390,000 boxes) P1,560,000 The manufacturers of candies have announced that they will increase prices of their products an average of 15% in the coming year due to increases in raw material (sugar, cocoa, 110 Cost-Volume-Profit Analysis peanuts, etc.) and labor costs. Bittersweet Company expects that all other costs will remain at the same rates or levels as the current year. Bittersweet is subject to 40 percent tax rate. Sunday openings are estimated at P31,200. Round’s gross margin on sales is 25 percent. Round estimates that 75 percent of its Sunday sales to customers would be made on other days if the store were not open on Sundays. If net income after taxes would remain the same after the cost of candy increases but no increase in the sales price is made, how many boxes of candy must Bittersweet sell? A. 480,000 C. 400,000 B. 27,600 D. 29,300 Bobadilla The one-day volume of Sunday sales that would be necessary for Round to attain the same weekly operating as the current six-day week is A. P2,400 C. P9,600 B. P3,200 D. P9,984 Bobadilla 68. Larz Company produces a single product. It sold 25,000 units last year with the following results: Sales P625,000 Variable costs P375,000 Fixed costs 150,000 525,000 Net income before taxes P100,000 Income taxes 40,000 Net income P 60,000 In an attempt to improve its product in the coming year, Larz is considering replacing a component part in its product that has a cost of P2.50 with a new and better quality costing P4.50 per unit. A new machine will also be needed to increase plant capacity. The machine would cost P18,000 with a useful life of 6 years and no salvage value. The company uses straight-line depreciation method on all plant assets. 71. Ailu Company has the following operating data for its manufacturing operations: Unit selling price P 250 Unit variable cost 100 Total fixed costs 840,000 The company’s decision to increase the wages of hourly workers will increase the unit variable cost by 10 percent. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4 percent. If sales price is held constant, the next breakeven point for Ailu Company will be A. Increased by 640 units. C. Decreased by 640 units. B. Increased by 400 units. D. Increased by 800 units. Bobadilla 72. Solar Company sells two products, Biggs and Boggs. Last year, Solar Company sold 12,000 units of Biggs and 24,000 units of Boggs. If Larz wishes to maintain the same contribution margin ratio after implementing the changes, what selling price per unit of product must it charge next year to cover the increased material costs? A. P27.00 C. P25.00 B. P32.50 D. P28.33 Bobadilla Related data for last year are: Product Unit Selling Price Unit Variable Cost Unit Contribution Margin Biggs P120 P80 P40 Boggs 80 60 20 Assuming that last year’s fixed costs totaled P910,000, what was Solar Company’s composite break-even point? A. 34,125 C. 11,375 B. 27,302 D. 9,101 Bobadilla 69. BM Motors, Inc. employs 40 sales personnel to market its line of economy automobiles. The average car sells for P1,200,000 and a 6% commission is paid to the salesperson. BM Motors is considering a change to a commission arrangement that would pay each salesperson a salary of P24,000 per month plus a commission of 2% of the sales made by that salesperson. 73. River and Co., maker of quality pipes, has experienced a steady growth in sales for the past five years. However, increase in competition has led River Co. to believe that an aggressive advertising campaign will be necessary next year to maintain the company’s present growth. The amount of total car sales at which the two expense structures would be indifferent is A. P22,500,000 C. P30,000,000 B. P24,000,000 D. P12,000,000 Bobadilla To prepare for next year’s advertising campaign, the company’s accountant has prepared and presented the management with data for the current year, 2006, as presented below: Cost Schedule 70. Round Company is a grocery store that is currently open only Monday through Saturday. Round Company is considering opening on Sundays. The annual incremental costs of 111 Cost-Volume-Profit Analysis Variable costs: Direct labor Direct materials Variable overhead Total variable costs Fixed costs: Manufacturing Selling Administrative Total fixed costs Other fixed costs 32,000 Total P396,000 The company is considering changing the compensation plan for sales personnel. If the organization increases the commission to 10% of revenues and reduces salaries by P80,000, what revenues must the organization have to raise in order to earn the same net income as last year? A. P1,600,000 C. P1,350,000 B. P1,150,000 D. P1,630,000 Bobadilla P 80.00/pipe 32.50/pipe 25.00/pipe P137.50/pipe P 250,000 400,000 700,000 P1,350,000 76. Tactless Manufacturing Company produces two products for which the following data have been tabulated. Fixed manufacturing cost is applied at a rate of P1.00 per machine hour. Per Unit XY-7 BD-4 Selling price P4.00 P3.00 Variable manufacturing cost P2.00 P1.50 Fixed manufacturing cost P0.75 P0.20 Variable selling cost P1.00 P1.00 The sales manager has had a P160,000 increase in the budget allotment for advertising and wants to apply the money to the most profitable product. The products are not substitutes for one another in the eyes of the company’s customers. Selling price, per pipe P 250.00 Expected sales, 2007 (20,000 units) P5,000,000 Tax rate: 40% The company has set the sales target for 2007 at a level of P5,500,000 (or 22,000 pipes). If an additional P112,500 have to be spent for advertising in 2007, what is the required sales level in pesos to equal 2006’s after-tax income? A. P4,750,000 C. P5,250,000 B. P5,750,000 D. P4,250,000 Bobadilla The manager may devote the entire P160,000 to increased advertising for either XY-7 or BD4. 74. Adobe Company sold 100,000 units of its product at P20 per unit. Variable costs were P14 per unit, consisting of manufacturing costs of P11 and selling costs of P3. Fixed costs, which were incurred uniformly throughout the year, amounted to P792,000 (manufacturing costs of P500,000 and selling expenses of P292,000). There had been no beginning or ending inventories. Suppose Tactless has only 100,000 machine hours that can be made available to produce additional units of XY-7 and BD-4. If the potential increase in sales units for either product resulting from advertising is far in excess of this production capacity, which product should be advertised and what is the estimated increase in contribution margin earned? Bobadilla A. Product XY-7 should be produced, yielding a contribution margin of P75,000. B. Product XY-7 should be produced, yielding a contribution margin of P133,333. C. Product BD-4 should be produced, yielding a contribution margin of P187,500. D. Product BD-4 should be produced, yielding a contribution margin of P250,000. If labor costs comprise of 50 percent variable costs and 20 percent f fixed costs, a 10 percent increase in wages and salaries would increase the number of units required to break even to A. 152,423 C. 143,875 B. 175,617 D. 129,938 Bobadilla 75. Mellow, Inc. sells its single product for P40 per unit. Mellow purchases the product for P20. The salespeople receive a salary plus a commission of 5% of sales. Last year the corporation’s net income was P100,800. The corporation is subject to 30% income tax rate. The fixed costs of the company are: Advertising P124,000 Rent 60,000 Salaries 180,000 77. Drape Corp. would like to market a new product at a selling price of P15 per unit. Fixed costs for this product are P1,000,000 for less than 500,000 units of output and P1,500,000 for 500,000 or more units of output. The contribution margin percentage is 35%. How many units of this product must be sold to earn a target operating income of P1 million? A. 366,667 C. 476,190 B. 380,952 D. 256,410 Bobadilla 112 Cost-Volume-Profit Analysis 78. Care Company sold 100,000 units of its product at P20 per unit. Variable costs are P14 per unit, consisting of manufacturing costs of P11 and selling costs of P3. Fixed costs, which are incurred uniformly throughout the year, amount to P792,000 (manufacturing costs of P500,000 and selling costs of P292,000). There were no beginning or ending inventories. 80. The total variable costs per unit for the large and small discs, respectively, are A. P10.20 and P8.60. C. P 9.10 and P5.30. B. P14.40 and P8.40. D. P11.80 and P6.60. 81. If the material costs for large and small discs are P8.50 and P5.10, respectively, and the normal production capacity is 100,000-unit level, what is the breakeven point? A. 91,611. C. 79,816. B. 87,216. D. 82,412. Bobadilla If labor costs are 50% of variable costs and 20% of fixed costs, a 10% increase in wages and salaries would increase the number of units required to breakeven (in fraction form) to A. 807,840/5.3. C. 807,840/14.7. B. 831,600/5.78. D. 831,600/14.28. Bobadilla Questions 82 through 86 are based on the Statement of Income of Davao, Inc. which represents the operating results for the current fiscal year ending December 31. Davao had sales of 1,800 tons of product during the current year. The manufacturing capacity of Davao’s facilities is 3,000 tons of product. Consider each question’s situation separately. Sales P900,000 Variable costs Manufacturing P315,000 Selling costs 180,000 Total variable costs P495,000 Contribution margin P405,000 Fixed costs Manufacturing P 90,000 Selling 112,500 Administration 45,000 Total fixed costs P247,500 Net income before income taxes P157,500 Income taxes (40%) (63,000) Net income after income taxes P 94,500 Question Nos. 79 through 81 are based on the following: Metal Industries, Inc. operates its production department only when orders are received for one or both of its two products, two sizes of metal discs. The manufacturing process begins with the cutting of doughnut-shaped rings from rectangular strips of sheet metal; these rings are then pressed into discs. The sheets of metal, each 4 feet long and weighing 32 ounces, are purchased P13.60 per running foot. The department has been operating at a loss for the past year as shown below. Sales for the year P1,720,000 Less: expenses 1,772,000 Net loss for the department P 52,000 The following information is available. Ten thousand 4-foot pieces of metal yielded 40,000 large discs, each weighing 4 ounces and selling for P29, and 40,000 small discs, each weighing 2.4 ounces and selling for P14. The corporation has been producing at less than “normal capacity” and has had no spoilage in the cutting step of the process. The skeletons remaining after the rings have been cut are sold for scrap at P8.00 per pound. 82. The breakeven volume in tons of product for the year is A. 420 C. 1,100 B. 495 D. 550 The variable conversion cost of each large disc is 80% of the disc’s direct material cost, and variable conversion cost of each small disc is 75% of the disc’s direct material cost. Variable conversion costs are the sum of direct labor and variable overhead. Fixed costs were P860,000. 79. The net cost per ounce of material is A. P2.00 B. P1.60 C. P1.70 D. P1.80 Bobadilla Bobadilla 83. If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the after-tax income that Davao can expect for next year is A. P135,000 C. P110,250 B. P283,500 D. P184,500 Bobadilla Bobadilla 113 Cost-Volume-Profit Analysis 84. Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? A. P297,500 C. P211,500 B. P252,000 D. P256,500 Bobadilla 88. The total sales revenue at which Anilao Ski Company would make the same profit or loss regardless of the ski model it decided to produce is A. P880,000 C. P924,000 B. P422,400 D. P686,400 Bobadilla 89. How much would the variable cost per unit of the touring model have to change before it had the same breakeven point in units as the mountaineering model? A. P2.68/unit increase C. P5.03/unit decrease B. P4.53/unit increase D. P2.97/unit decrease Bobadilla 85. Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? A. 307.5 C. 273.3 B. 1,095.0 D. 1,545.0 Bobadilla 90. If the variable cost per unit of touring skis decreases by 10%, and the total fixed cost of touring skis increases by 10%, the new breakeven point will be A. 10,730 pairs B. 13,007 pairs C. 12,812 pairs Bobadilla D. Unchanged from 11,648 pairs because the cost changes are equal and offsetting 86. Without prejudice to preceding questions, assume that Davao estimates that the per ton selling price will decline 10% next year. Variable costs will increase P40 per ton and the fixed costs will not change. What sales volume in pesos will be required to earn an after-tax income of P94,500 next year? A. P1,140,000 C. P1,500,000 B. P 825,000 D. P1,350,000 Bobadilla 91. If the Anilao Ski Company sales department could guarantee the annual sale of 12,000 skis of either model, Anilao would A. Produce touring skis because they have a lower fixed cost. B. Produce only mountaineering skis because they a lower breakeven point. C. Produce mountaineering skis because they are more profitable. D. Be indifferent as to which model is sold because each model has the same variable cost per unit. Bobadilla Question Nos. 87 through 91 are based on the following: Anilao Ski Company recently expanded its manufacturing capacity to allow it to product up to 15,000 pairs of cross-country skis of either the mountaineering model or the touring model. The sales department assures management that it can sell between 9,000 and 13,000 pairs (units) of either product this year. Because the models are very similar, Anilao Ski will produce only one of the two models. The following data were compiled by the accounting department. Mountaineering Touring Selling price per unit P88.00 80.00 Variable cost per unit 52.80 2.80 Fixed costs will total P369,600 if the mountaineering model is produced but will be only P316,800 if the touring model is produced. Anilao Ski Company is subject to a 40% income tax rate. Question Nos. 92 through 96 are based on the following: Pullman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its products. These agents are paid a commission of 15% of selling price for all items sold. Maui Soliman, Pullman’s controller, has just prepared the company’s budgeted income statement for next year. The statement follows: Pullman Company Budgeted Income Statement For the Year Ended December 31 Sales Manufacturing costs: 87. If Anilao Ski Company desires an after-tax net income of P24,000, how many pairs of touring model skis will the company have to sell? A. 13,118 C. 13,853 B. 12,529 D. 4,460 Bobadilla 114 P16,000,000 Cost-Volume-Profit Analysis Variable Fixed overhead Gross margin Selling and administrative costs: Commissions to agents Fixed marketing costs* Fixed administrative costs Net operating income Less fixed interest cost Income before income taxes Less income tax (30%) Net income *Primarily depreciation on storage facilities P7,200,000 2,340,000 2,400,000 120,000 1,800,000 Total 9,540,000 6,460,000 “Super,” replied Kim. “And I note that the P2,400,000 is just what we’re paying the agents under the old 15% commission rate.” “It’s even better than that,” explained Maui. “We can actually save P75,000 a year because that’s what we’re having to pay the auditing firm now to check out the agents’ reports. So our overall administrative costs would be less.” 4,320,000 2,140,000 540,000 1,600,000 480,000 P1,120,000 “Pull all of these number together and we’ll show them to the executive committee tomorrow,” said Kim. “With the approval of the committee, we can move on the matter immediately.” 92. What is the breakeven point in pesos for next year assuming that the agents’ commission rate remains unchanged at 15%? A. P10,650,000 C. P 9,000,000 B. P12,000,000 D. P10,750,000 Bobadilla As Maui handed the statement to Kim Viceroy, Pullman’s president, she commented, “I went ahead and used the agents’ 15% commission rate in completing these statements, but we’ve just learned that they refuse to handle our products next year unless we increase the commission rate to 20%.” 93. What is the breakeven point in pesos for next year assuming that the agents’ commission rate is increased to 20%? A. P13,171,000 C. P13,714,286 B. P15,000,000 D. P12,750,000 Bobadilla “That’s the last straw,” Kim replied angrily. “Those agents have been demanding more and more, and this time they’ve gone too far. How can they possibly defend a 20% commission rate?” “They claim that after paying for advertising, travel, and the other costs of promotion, there’s nothing left over for profit,” replied Maui. 94. What is the breakeven point in pesos for next if the company employs its own sales force? A. P15,000,000 C. P13,090,909 B. P12,954,545 D. P15,157,895 Bobadilla “I say it’s just plain robbery,” retorted Kim. “And I also say it’s time we dumped those guys and got our own sales force. Can you get your people to work up some cost figures for us to look at?” 95. Assume that Pullman Company decides to continue selling through agents and pays the 20% commission rate. The volume of sales that would be required to generate the same net income as contained in the budgeted income statement for next year would be: A. P18,285,714 C. P19,225,000 B. P18,368,421 D. P20,414,714 Bobadilla “We’ve already worked them up,” said Maui. “Several companies we know about pay a 7.5% commission to their own salespeople, along with a small salary. Of course, we would have to handle all promotion costs, too. We figure our fixed costs would increase by P2,400,000 per year, but that would be more than offset by the P3,200,000 (20% x P16,000,000) that we would avoid on agents’ commissions.” The breakdown of the P2,400,000 cost figure follows: Salaries: Sales manager Salespersons Travel and entertainment Advertising P2,400,000 96. The volume of sales at which net income would be equal regardless of whether Pullman Company sells through agents at a 20% commission rate or employs its own sales force: A. P11,625,000 C. P19,200,000 B. P12,000,000 D. P18,600,000 Bobadilla P 100,000 600,000 400,000 1,300,000 Question Nos. 97 through 102 are based on the following information: 115 Cost-Volume-Profit Analysis San Carlos operates a general hospital but rents space and beds to separate entities for specialized treatment such as pediatrics, maternity, psychiatric, etc. San Carlos charges each separate entity for common services to its patients like meals and laundry and for all administrative services such as billings, collections, etc. All uncollectible accounts are charged directly to the entity. Space and bed rentals are fixed for the year. The staffing levels above represent full-time equivalents, and it should be assumed that the Pediatrics Department always employs only the minimum number of required full-time equivalent personnel. Annual salaries for each class of employee follow: supervising nurses, P180,000; nurses, P130,000; and aides, P50,000. Salary expense for the year ended June 30 for supervising nurses, nurses, and aides was P720,000, P1,560,000, and P1,100,000, respectively. For the entire year ended June 30, the Pediatrics Department at San Carlos Hospital charged each patient an average of P650 per day, had a capacity of 60 beds, operated 24 hours per day for 365 days, and had revenue of P10,676,250. The Pediatrics Department operated at 100% capacity during 111 days of the past year. It is estimated that during 90 of these capacity days, the demand average 17 patients more than capacity and even went as high as 20 patients more on some days. The hospital has an additional 20 beds available for rent for the coming fiscal year. Expenses charged by the hospital to the Pediatrics Department for the year ended June 30 were: Basis of Allocation Patient Days Bed Capacity Dietary P 328,500 Janitorial P 118,400 Laundry 197,100 Lab, other than direct charges to patients 410,625 Pharmacy 410,625 Repairs and maintenance 65,700 66,045 General administrative services 1,218,780 Rent 2,546,710 Billings and collections 689,850 Bad debt expense 246,375 Others 114,975 240,315 Total P2,463,750 P4,190,250 The only personnel directly employed by the Pediatrics Department are supervising nurses, nurses, and aides. The hospital has minimum personnel requirements based on total annual patient days. Hospital requirements beginning at the minimum, expected level of operation follow: Annual Patient Days Aides Nurses Supervising Nurses 10,000 – 14,000 21 11 4 14,001 – 17,000 22 12 4 17,001 – 23,725 22 13 4 23,726 – 25,550 25 14 5 25,551 – 27,375 26 14 5 27,376 – 29,200 29 16 6 97. The contribution margin per patient day is A. P400.00 B. P450.00 C. P500.00 D. P525.00 Bobadilla 98. How many patient days are necessary to cover fixed costs for bed capacity and for supervisory nurses? A. 9,500 C. 10,250 B. 9,820 D. 12,000 Bobadilla 99. The number of patient days needed to cover total costs is A. 14,780 C. 15,820 B. 15,140 D. 16,080 Bobadilla 100. If the Pediatrics Department rented an additional 20 beds and all other factors remain the same as in the past year, what would be the increase in revenue? A. P 994,500 C. P1,054,500 B. P 877,500 D. P 897,500 Bobadilla 101.Continuing to consider the 20 additional rented beds, the increase in total variable cost applied per patient day is A. P229,350 C. P229,650 B. P229,500 D. P239,350 Bobadilla 102.What is the increase in fixed cost applied for bed capacity, given the increase in number of beds? A. P1,396,667 C. P1,470,000 116 Cost-Volume-Profit Analysis B. P1,187,238 D. P1,520,000 Bobadilla 105.What is the cash flow breakeven point in number of pizzas that must be sold? A. 19,529 C. 12,990 B. 21,284 D. 10,773 Question Nos. 103 – 105 are based on the following: Ms. Sharkey started a pizza restaurant in 2003. For this purpose a building was rented for P40,000 per month. Two women were hired to work full time at the restaurant and six college students were hired to work 30 hours per week delivering pizza. This level of employment has been consistent. An outside accountant was hired for tax and bookkeeping purposes, for which Ms. Sharkey pays P30,000 per month. The necessary restaurant equipment and delivery cars were purchased with cash. Ms. Sharkey has noticed that expenses for utilities and supplies have been rather constant. Ms. Sharkey increased her business between 2003 and 2006. Profits have more than doubled since 2003. Ms. Sharkey does not understand why profits have increased faster than volume. Question Nos. 106 through 109 are based on the following information: Timex Sporting Goods Company, a wholesale supply company, engages independent sales agents to market the company’s products throughout the country. These agents currently receive a commission of 20 percent of sales, but they are demanding an increase to 25 percent of sales made during the year ending December 31, 2007. The controller already prepared the 2007 budget before learning of the agents’ demand for an increase in commission. The budgeted 2007 income statement is shown below. Assume that cost of goods sold is 100 percent variable cost. Sales P10,000,000 Cost of goods sold 6,000,000 Gross margin P 4,000,000 Selling and administrative Commissions P2,000,000 Other expenses (fixed) 100,000 2,100,000 Income before taxes P 1,900,000 Income tax (30%) 570,000 Net income P 1,330,000 Timex’s management is considering the possibility of employing full-time sales personnel. Three individuals would be required, at an estimated annual salary of P30,000 each, plus commissions of 5 percent of sales. In addition, a sales manager would be employed at a fixed annual salary of P160,000. All other fixed costs, as well as the variable cost percentages, would remain the same as the estimates in the 2007 budgeted income statement. A projected income statement for the year ended December 31, 2007, prepared by the accountant, is shown below: Sales P9,500,000 Cost of food sold P2,850,000 Wages & fringe benefits: Restaurant help 815,000 Delivery help 1,730,000 Rent 480,000 Accounting services 360,000 Depreciation: Delivery equipment 500,000 Restaurant equipment 300,000 Utilities 232,500 Supplies 120,000 7,387,500 Net income before taxes P2,112,500 Income taxes (40%) 845,000 Net income P1,267,500 Note: The average pizza sells for P250. 103.What is the tax shield on the noncash fixed costs? A. P320,000 C. P149,500 B. P340,000 D. P540,000 Bobadilla 104.What is the breakeven point in number of pizzas that must be sold? A. 25,929 C. 23,569 B. 18,150 D. 42,114 Bobadilla Bobadilla 106.How much is the estimated break-even point in peso sales for the year ending December 31, 2007, based on the budgeted income statement prepared by the controller? A. P500,000 C. P250,000 B. P400,000 D. P125,000 Bobadilla 107.How much is the estimated break-even point in peso sales for the year ending December 31, 2007, if the company employs its own sales personnel? A. P 542,857 C. P 875,000 B. P 742,857 D. P1,000,000 Bobadilla 108.How much volume in peso sales would be required for the year ending December 31, 2007, to yield the same net income as projected in the budgeted income statement, if Timex continues 117 Cost-Volume-Profit Analysis to use the independent sales agents and agrees to their demand for a 25 percent sales commission? A. P 8,000,000 C. P10,000,000 B. P 9,533,333 D. P13,333,333 Bobadilla 113.Assuming that Step Company will just rent a manufacturing space for a month in order to produce special order for 8,000 toys. What is the acceptable minimum selling price to Step Company for the special sale? A. P14.00 C. P22.00 B. P15.25 D. P24.00 Bobadilla 109.How much is the estimated volume in peso sales that would generate an identical net income for the year ending December 31, 2007, regardless of whether Timex employs its own sales personnel or continues to use the independent sales agents and pays them a 25 percent commission? A. P1,000,000 C. P1,500,000 B. P1,250,000 D. P1,800,000 Bobadilla Question Nos. 114 through 118 are based on the following: Bolton Company’s income statement for last month is given below: Sales (15,000 units @ P30) P450,000 Less variable expenses 315,000 Contribution margin 135,000 Less fixed expenses 90,000 Net income P 45,000 The industry in which Bolton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Question Nos. 110 through 113 are based on the following data: Step Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. Enough capacity exists in the company’s plant to produce 16,000 units of the toy each month. Variable costs to manufacture and sell one unit would be P12.50, and fixed costs associated with the toy would total P350,000 per month. The company’s Marketing Department predicts that demand for the new toy will exceed the 16,000 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed cost of P10,000 per month. Variable costs in the rented facility would total P14 per unit, due to somewhat less efficient operations than in the main plant. The new toy will sell for P30 per unit. 110.The breakeven units for the new toy would be: A. 20,000 C. 21,000 B. 18,000 D. 22,500 A new equipment has come onto the market that would allow Bolton Company to automate a portion of its operations. Variable costs would be reduced by P9 per unit. However, fixed costs would increase to a total of P225,000 each month. 114.How much income for the month would the company earn if the new equipment is purchased? A. P45,000 C. P60,000 B. P30,000 D. P75,000 Bobadilla Bobadilla 115.How many units are required as increase or decrease in breakeven point if the new equipment is purchased? A. Zero C. 3,200 units B. 2,500 units D. 4,000 units Bobadilla 111.How many units should the company need to sell in order to earn a before-tax profit of P150,000? A. 9,143 C. 31,875 B. 30,375 D. 35,000 Bobadilla 116.The degree of operating leverage during the month where the new equipment is used is: A. 3.0 times C. 6.0 times B. 4.5 times D. 9.0 times Bobadilla 112.If the sales manager receives a bonus of P1.00 for each unit sold in excess of the break-even point, how many units must be sold each month to earn a return of 25% on the monthly investment in fixed costs? A. 23,344 C. 29,833 B. 27,000 D. 30,000 Bobadilla 117.Refer to the original data. Rather than purchase a new equipment, the president is thinking about changing the company’s marketing method. Under the new method, sales would increase by 20% each month and net income would increase by one-third. Fixed costs could 118 Cost-Volume-Profit Analysis be slashed to only P48,000 per month. Compute the break-even point for the company after the change in marketing method. A. 8,000 units C. 9,000 units B. 12,500 units D. 10,000 units Bobadilla B. P(600,000) 122.Instead of paying the manager a straight P75 per pair of shoes commission on all pairs of shoes sold, the company is considering paying the store manager P50 commission on each pair of shoes sold in excess of the breakeven point. If this change is made, what will be the sales outlet’s net income or loss if 25,000 pairs of shoes are sold? A. P 250,000 C. P1,500,000 B. P 900,000 D. P1,250,000 Bobadilla Bobadilla Question Nos. 119 through 124 are based on the following: Zapatero Corporation operates a chain of shoe stores around the country. The stores carry many styles of shoes that are all sold at the same price. To encourage sales personnel to be aggressive in their sales efforts, the company pays a substantial sales commission on each pair of shoes sold. Sales personnel also receive a small basic salary. 123.If the company would pay the manager P50 commission on each pair of shoes sold in excess of the breakeven point, how many pairs of shoes are required to earn P900,000 profit? A. 23,600 C. 25,000 B. 23,000 D. 27,500 Bobadilla The following cost and revenue data relate to Davao sales outlet and are typical of the company’s many sales outlets: Selling price P800 Variable expenses: Invoice costs P360 Sales commission 140 P500 Fixed expenses per year: Rent Advertising Salaries Total 124.The company is considering eliminating sales commissions entirely in its stores and increasing fixed salaries by P2,142,000 annually. If this change is made, what will be the number of pairs of shoes to be sold by Davao outlet to be indifferent to commission basis? A. 25,300 C. 21,000 B. 15,300 D. 18,505 Bobadilla P1,600,000 3,000,000 1,400,000 P6,000,000 119.How many units are required for the company’s Davao sales outlet to breakeven? A. 12,000 pairs C. 20,000 pairs B. 17,143 pairs D. 22,000 pairs Bobadilla 121.The company is considering paying the store manager of Davao sales outlet an incentive commission of P75 per pair of shoes (in addition to the salesperson’s commission). If this change is made, what will be the new breakeven in pairs of shoes? A. 26,667 C. 20,000 B. 16,000 D. 22,000 Bobadilla 118.Assuming that during the month following the month new equipment has been started in use, the unit sales increased by 4,500 units. The variable expenses per unit and the monthly fixed costs as affected by the acquisition of the new equipment are expected to remain constant. What is the expected profit of the company for that month? A. P 81,000 C. P 85,500 B. P126,000 D. P 45,000 D. P(500,000) The following information should be used to answer Question Nos. 125 through 131. Due to erratic sales of its sole product - a high-capacity battery for laptop computers, Salcedo Company has been experiencing difficulty for some time. The company’s income statement for the most recent month is given below: Sales (19,500 units @ P300) P5,850,000 Less variable expenses 4,095,000 Contribution margin 1,755,000 Less fixed expenses 1,800,000 Net loss P (45,000) Bobadilla 120.If 18,000 pairs of shoes are sold in a year, what would be Davao sales outlet’s net income? A. P 600,000 C. P 500,000 125.The break even in peso sales for Salcedo Company is: 119 Cost-Volume-Profit Analysis A. P6,000,000 B. P2,571,429 C. P5,852,756 D. P7,500,000 Question Nos. 132 – 134 are based on the following: Almo Company manufactures and sells adjustable canopies that attach to motor homes and trailers. The market covers new unit purchases as well as replacement canopies. Almo developed its 2007 business plan based on the assumption that canopies would sell at a price of P400 each. The variable costs for each canopy were projected at P200, and the annual fixed costs were budgeted at P100,000. Almo’s after–tax profit objective was P240,000; the company’s effective tax rate is 40 percent. Bobadilla 126.The president believes that a P160,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will result in an P800,000 increase in monthly sales. If the president is right, what will be the effect on the company’s monthly net income or loss? A. P120,000 increase C. P120,000 decrease B. P 80,000 increase D. P 80,000 decrease Bobadilla While Almo’s sales usually rise during the second quarter, the May financial statements reported that sales were not meeting expectations. For the first five months of the year, only 350 units had been sold at the established price, with variable costs as planned, and it was clear that the 2007 after-tax profit projection would not be reached unless some actions were taken. Almo’s president assigned a management committee to analyze the situation and develop several alternative courses of action. The following mutually exclusive alternatives, labeled A, B, and C, were presented to the president. 127.Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of P600,000 in the monthly advertising budget, will cause unit sales to double. What will the new profit or loss if these changes are adopted? A. P 60,000 C. P 45,000 B. P(60,000) D. P(45,000) Bobadilla 128.Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would help sales. The new package would increase packaging costs by P7.50 per unit. Assuming no other changes, how many units would have to be sold each month to earn a profit of P97,500? A. 21,818 C. 25,450 B. 23,000 D. 28,000 Bobadilla Reduce the sales price by P40. The sales organization forecast that with the significantly reduced sales price, 2,700 units can be sold during the remainder of the year. Total fixed and variable unit costs will stay as budgeted. Lower the variable costs per unit by P25 through the use of less expensive materials and slightly modified manufacturing techniques. The sales price will also be reduced by P30, and sales of 2,200 units for the remainder of the year are forecast. 129.Refer to the original data. By automating certain operations, the company could reduce variable costs by P3 per unit. However, fixed costs would increase by P72,000 each month. Cut fixed costs by P10,000, and lower the sales price by 5 percent. Variable costs per unit will be unchanged. Sales of 2,000 units are expected for the remainder of the year. How would the breakeven point in units change if the company automated the operations? A. 1,000 units increase C. 3,000 units increase B. 1,000 units decrease D. 3,000 units decrease Bobadilla 132.Assuming no changes were made to the selling price or cost structure, how many units must Almo sell to break even? A. 167 C. 500 B. 250 D. 1,700 Bobadilla 130.At what level of production would the automation of the production process be indifferent to the present process? A. 18,000 C. 24,000 B. 21,000 D. 28,000 Bobadilla 133.Assuming no changes were made to the selling price or cost structure, how many units must Almo sell to achieve its after-tax profit objective? A. 1,250 C. 2,000 B. 1,700 D. 2,500 Bobadilla 131.Which of the two methods (the present or the automated) has higher income at the level of sales of 26,000 units? A. Manual, P60,000 C. Manual, P240,000 B. Automated, P60,000 D. Automated, P240,000 Bobadilla 134.If management decides to reduce the selling price by P40, what will Almo's after-tax profit be? A. P157,200 C. P241,200 120 Cost-Volume-Profit Analysis B. P160,800 D. P301,200 Bobadilla After the break-even level, the amount of profit equals the unit contribution margin multiplied by the number of units sold in excess of break-even units. 135.If the management can reduce the variable cost per unit by P25 through the use of less expensive materials and slightly modified manufacturing techniques, with the sales price reduced by P30, and sales of 2,200 units for the remainder of the year are forecast, the amount of expected income for the year was: A. P239,400 C. P241,200 B. P204,000 D. P399,000 Bobadilla The candidates should remember that the profit increases by the amount of contribution margin brought by additional units sold. 3 . Answer: A Cost of dinner Favors and program Fixed costs (15,000 + 7,000 + 48,000 + 10,000)/250 Cost to be charged 136.How much would be the expected income for the year if the management cut fixed costs by P10,000, and lower the sales price by 5 percent, with variable costs per unit unchanged and sales of 2,000 units are expected for the remainder of the year? A. P239,400 C. P241,200 B. P204,000 D. P399,000 Bobadilla 1 . Answer: B Contribution Margin = Fixed costs = P15,000 5 . Answer: A Selling Price Less: Variable Manufacturing Cost 10% Commission P 60 ( 30) ( 6) Unit Contribution Margin P 24 6 . Answer: A Current break-even: Pesos: (P32,000 ÷ 0.40) Units: [P32,000 ÷ P6) Contribution margin per unit: P15 x 0.40 (Contribution Margin/Unit Sales) + Variable cost per unit = Desired Minimum Sales Price 2 . Answer: C Unit contribution margin (P50 - P30) Additional profit (500 x P20) 320.00 P420.00 4 . Answer: B The number of units required to earn the target profit is equal to the sum of fixed expenses and the target profit divided by the unit contribution margin. The number of units required to earn the target net profit is: (P78,000 + P42,000) ÷ P12 10,000 137.If the sales price is reduced by 6.25 percent starting June 1, an analysis indicates that 2,500 unit sales can be made if the company has to spent for additional advertising. What is the maximum amount of advertising cost that the company can spend and still the profit objective is achieved? A. P35,000 C. P15,000 B. P22,500 D. P 7,500 Bobadilla (P15,000 ÷ 3,000) + (P7,500 ÷ 3,000) P 70.00 30.00 7.50 P Additional units to cover additional fixed costs: (P32,000 x 0.3) P6 P 20.00 P10,000 Alternative solution: New breakeven units (P32,000 x 1.3) ÷ P6 Less current breakeven units 121 5,333 6.00 P80,000 1,600 6,933 5,333 Cost-Volume-Profit Analysis Increase in breakeven units 1,600 The contribution margin per unit is linear or constant per unit. Therefore: TCM Units = UCM 7 . Answer: A The amount of contribution margin per unit is constant within a relevant range. The amount of profit is increased by the amount of unit contribution margin. 11 . Answer: B TCM Sales = CMR Change in TCM: (600,000*0.2) – (360,000*0.1) CMR: Increase in TCM ÷ Increase in Sales 84,000 ÷ 240,000 Contribution margin per unit: fixed cost ÷ breakeven unit sales 50,000 ÷ 5,000 P10.00 At breakeven point, the profit is zero. Therefore, the profit at a level of 5,001 units will be P10 which is the amount of contribution provided by the unit (one unit) in excess of breakeven point. 8 Answer: A CMR = Fixed cost/Sales = 100,000/800,000 = 12.50% Profit = (1,200,000 – 800,000)0.125 P50,000 Alternative solution: Total contribution margin 1,200,000 x 0.125 Fixed costs Profit 9 . Answer: A Current unit contribution margin (P32 – P24) Current break-even units (P400,000 ÷ P8) New unit contribution margin (P40 - P24) New break-even units (400,000 ÷ 16) Net decrease in breakeven units (50,000 – 25,000) 10 . Answer: A CM per unit: 220,000 / (100,000 – 80,000) Fixed costs: 80,000 x 11 35% Breakeven sales 90,300 ÷ 0.35 258,000 12 . Answer: C Before-tax profit 24,000 ÷ 0.6 Add fixed cost Total contribution margin 40,000 200,000 240,000 Selling price = UVC + UCM Selling Price = 6 + (240,000 ÷ 40,000) The amount of sales that provides profit should be the sales revenues above the break even sales. 84,000 12.00 13 . Answer: C The company's degree of operating leverage is determined as follows: Degree of operating leverage = Contribution margin ÷ Net income Degree of operating leverage = P600,000 ÷ P240,000 = 2.50 P150,000 100,000 P 50,000 14 . Answer: A Increase in sales Less variable costs and expenses 0.90 x 125,000 Additional profit before tax Less additional tax 0.40 x 12,500 Additional profit P8 50,000 P16 25,000 25,000 15 . Answer: B Additional profit ÷ UCM = additional unit sales = (40,000 + 8,000) ÷ (80-60) = 2,400 units 11.00 P880,000 16 . Answer: A 122 125,000 112,500 12,500 5,000 7,500 Cost-Volume-Profit Analysis Total peso sales required 120,000 ÷ (0.25 – 0.1) Less prior sales Required increase in sales 800,000* 400,000 400,000 S = P210,000 + 0.10S 0.40 0.40S = P210,000 + 0.10S 0.40S - 0.10S = P210,000 S = P210,000/(0.40 – 0.10) S = P700,000 *Peso sales required to earn profit stated as percentage of sales (ROS): S = [FC + (ROSS)] CMR (CMR S) = [FC + (ROSS)] (CMR S) - (ROSS) = FC (CMR – ROS) S = FC 20 . Answer: C Current number of units required to earn the target net profit: [(P200,000 + P70,000) ÷ P9] S = FC (CMR – ROS) 17 . Answer: A Contribution margin 50,000 x (5-3.50) Less: additional profit (250,000 x 0.10) Additional fixed costs 75,000 25,000 50,000 Selling price = P3.50 ÷ 0.70 P5.00 After the automated machine is placed into service, the number of units required to earn the target net profit will be: ((P250,000 + P70,000) ÷ P12) 21 . Answer: C CMR= 100% - (3.9 ÷ 6.0) = 35% BES = 1,400,000 ÷ .35 22 . Answer: C New break-even point: P874,000 ÷ P23 Current break-even point in units: P770,500 ÷ P23 Increase in units: 38,000 - 33,500 Alternative solution: (P103,500 ÷ P23) An alternative solution to find sales is to compute the profit margin. Sales (60,000 ÷ 0.08) 19 . Answer: A Peso sales = FC/(CMR - ROS) = P210,000/(0.40 - 0.10) CMR = 40% 26,667 Change in units: 30,000 - 26,667 = 3,333 decrease in unit sales 18 . Answer: C A shorter calculation of finding the amount of sales is to divide breakeven sales by (1 – MSR) Sales = P600,000 (1 – 0.2) P750,000 Profit margin = Contribution margin ratio x margin of safety ratio. Profit margin = 20% x 40% Sales = Profit ÷ Profit margin 30,000 8% 23 . Answer: A The estimated cost of goods sold = P565,000 + 0.35S* *Sum of all percentages for variable production costs P750,000 P700,000 = P565,000 + (P2,000,000 x 0.35) = P1,265,000 A long computation of required sales uses the following equation: 24 . Answer: B 123 4,000,000 38,000 33,500 4,500 4,500 Cost-Volume-Profit Analysis Peso sales required to earn 10% of sales; FC/(CMR – ROS) = P36,000/(0.30-0.10) = 180,000 25 . Answer: A Revised contribution margin 20,000 x 1.15 x (7-1) Fixed cost (105,000 + 19,200) Revised profit Prior profit Decrease in profit 26 . Answer: A Margin of Safety = Budgeted sales – Breakeven sales Margin of Safety: P400,000 – P40,000 Increased units 4,000 x 1.25 Revised contribution margin 5,000 x (9 – 6) Less fixed cost Revised profit 30 . Answer: B Projected cost of sales: P800,000 + (P3,000,000 x 0.65) 138,000 124,200 13,800 35,000 21,200 90,000 50,000 40,000 30,000 10,000 DOL = TCM/OP = 40,000/10,000 4 times Fixed costs = Breakeven units x UCM 75,000 x 8 = 600,000 32 . Answer: B Unit cost: Materials (P36,000 ÷ 24,000) Labor (P54,000 ÷ 24,000) Variable selling expense Variable unit cost Required profit (2,250 ÷ 1,500) Required minimum selling price % increase in sales x DOL = % increase in profit 4 x 20% = 80% 28 . Answer: B 2006 DOL = 275,000/75,000 Percentage Increase in profit, 2007 = 3.67 x 30% 2007 Profit = 75,000 +(75,000 x 1.10) 29 . Answer: A Peso sales 12,000/(0.40 – 0.1) Unit sales P40,000/10 P2,750,000 31 . Answer: B Unit CM = Change in Profit ÷ Change in Sales = 200,000 ÷ (100,000 – 75,000) =8 P360,000 27 . Answer: B DOL at P90,000 sales: Sales Variable costs Total Contribution margin Fixed costs Profit 5,000 P15,000 12,000 P 3,000 3.67 110% P157,500 P40,000 4,000 124 P1.50 2.25 0.35 P4.10 1.50 P5.60 33 . Answer: D Composite ratio: X: 640,000 ÷ (720,000 + 640,000) Y: 720,000 ÷ (720,000 + 640,000) 47.059% 52.941% Weighted-Average Contribution Margin: (.52941 × .60) + (.47059 × .40) 0.505882 Breakeven sales in pesos: (505,881 ÷ 0.505882) P1,000,000 Y’s peso sales at breakeven P1M x 0.47059 P 470,590 Cost-Volume-Profit Analysis 34 . Answer: A Sales (500,000 x 1.10) Variable cost Contribution margin Fixed costs before an increase of 78,750: 750,000 x 0.35 550,000 300,000 250,000 The increase in fixed costs of P78,750 equals the increase in contribution margin in order to continue at breakeven sales. CMR = 250 ÷ 550 = 45.45% Original fixed costs: 500,000 – 300,000 – 150,000 = 50,000 New fixed cost = 50,000 x 0.80 = 40,000 Breakeven sales = 40,000/0.4545 = P88,000 35 . Answer: B Before-tax profit (24,000 ÷ 0.6) Add fixed costs Total contribution margin Contribution margin per unit (P240,000 ÷ 40,000) Variable cost per unit Selling price 262,500 39 . Answer: D UCM = (70,000 x 1.20)+(40,000 x 3) 70,000 – 40,000 = P6.80 FC = Units(UCM – profit per unit) = 70,000(6.80 – 1.20) = P392,000 P 40,000 200,000 P240,000 BEU = 392,000/6.80 = 57,647 P 6.00 6.00 P12.00 36 . Answer: A DOL = CM/OP = 275,000/75,000 = 3.67 times 37 . Answer: C Peso sales : FC ÷ (CMR - Profit Margin) = P210,000 ÷ (0.55 - 0.15) = P525,000 40 . Answer: A Margin of safety in peso sales = Budgeted sales – Breakeven sales Margin of safety = P1M – P.7M P300,000 41 . Answer: A 2006 Sales Advertising Cost (75000 ÷ .6) Required 2007 peso sales 1,000,000 125,000 1,125,000 42 . Answer: A Revised WACM (0.5 x 1.50) + (0.5 x 2) Original WACM (0.4 x 1.50) + (0.6 x 2) Revised Breakeven units 12,600/1.75 Original Breakeven units 12,600/1.80 Increase in breakeven units CMR = 100% - 45% = 55% 38 . Answer: B CMR: Change in Fixed Costs ÷ Change in Breakeven Sales 78,750 ÷ (975,000 – 750,000) 0.35 43 . Answer: C WACM = (30 x 0.6) + (60 x 0.4) Breakeven units: 630,000/42 125 1.75 1.80 7,200 7,000 200 P42 15,000 Cost-Volume-Profit Analysis Breakdown: Product Standard 15,000 x 0.6 Product Deluxe 15,000 x 0.4 49 . Answer: B CMR = Before Tax Profit Margin M/S Ratio = (0.06 ÷ 0.6) ÷ .25 = 40% 9,000 6,000 44 . Answer: B WACM = (4/7 x 0.40)+(3/7 x 0.93 = P0.62857 BE units = 7,600/0.62857 = 12,091 Baubles = 12,091 x 4/7 = 6,909 Trinkets = 12,091 x 3/7 = 5,182 45 . Answer: C Total sales revenue per composite sales: (12 x P5.25) + (10 x P7.50) + (6 x P12.25) Total variable cost per composite sales: (12 x P4.85) + (10 x P6.95) + (6 x P10.35) Total contribution margin per composite sales (P211.50 - P189.80) Composite breakeven point P75,950 ÷ P21.70 FC = (120,000 x .40) – (120,000 x .10) = P36,000 Annual FC = 36,000 x 12 P211.50 P189.80 P 21.70 3,500 30% P 292,500 P1,135,000 48 . Answer: B BEV = 600,000 16 – 12 P72,000 51 . Answer: A Revised UCM = 25 – 19.80 – (5 x 0.08) BEU = 468,000/4.80 P4.80 97,500 53 . Answer: B Cash-flow breakeven: 270,000 ÷ (100-60) 47 . Answer: C UCM = (60,000 x 0.75)+(45,000 x 1.25) 60,000 – 45,000 = 6.75 Fixed cost = (60,000 x 6.75)-(60,000 x 0.75) 50 . Answer: A Profit Margin = 20% x 10% = 2% Profit = 400,000 x 2% = 8,000 Fixed Costs = CM - Profit Fixed Costs = (400,000 x 20%) – 8,000 52 . Answer: A The Company projected zero profit based on zero advertising expenditure. Additional CM (30,000 units @ 10) P300,000 Less: Required profit 200,000 Maximum advertising cost P100,000 Note: Total breakeven units: 3,500 x 28 = 98,000 46 . Answer: C WACMR = (.6 x .4) + (.4 x .15) Fixed Costs = 225000 x 1.3 Sales (292500 + 48000) ÷ .3 P432,000 54 . Answer: A CMR = Before-tax return on sales/MSR = (0.06 0.60) 0.25 BES = 320,000 0.40 Sales = 800,000 0.75 P360,000 6,750 0.40 or 40% P 800,000 P1,066,667 55 . Answer: B The easier calculation of sales value of 60,000 units is to divide the total annual costs by total cost ratio of 85% (100% - 15%). Sales required = P1,912,500/0.85 P2,250,000 P150,000 126 Cost-Volume-Profit Analysis Unit selling price = 2,250,000/60,000 56 . Answer: D Indifference Point = Change in Fixed Cost ÷ Change in Variable Cost Increase in fixed cost: 2 @ 15,000 Decrease in variable cost (15% - 7.5%) 80 Indifference point: 30,000 ÷ 6 P37.50 62 . Answer: B The indifference point refers to the level of sales that would give equal profit or total costs for the two alternatives 11.30x + 60,000 = 8.90x + 82,500 2.40x = 22,500 x = 9,375 P30,000 P6 5,000 units 63 . Answer: C Variable cost ratio = 2.25/7.50 = 30% Variable cost next year = 2.25 x 1.3333 = 3 Selling price required = 3/0.30 = P10 57 . Answer: A WACM = (0.25 x 5)+(0.75 x 7) = 6.50 BEU = 975,000/6.50 = 150,000 64 . Answer: B Total Fixed Cost Operating Profit Total Contribution Margin 58 . Answer: B The additional fixed costs of P1,200,000 should be fully covered by the same amount as additional sales (also additional contribution margin) through an increase in selling price. Increased price Selling price Contribution margin per unit (180,000 ÷ 12,000) Unit variable cost P120 +(1.20M/80,000) P 135 59 . Answer: A Breakeven point: Old policy: P80,000/7 New policy: P100,000/8 Increase in Breakeven point 65 . Answer: C Fixed costs Operating profit Contribution margin 11,429 12,500 1,071 60 . Answer: B WACMR = (.4 x .2) + (.5 x.3) + (.4 x.5) = 0.43 BES = 1,290,000 ÷ .43 = P3,000,000 61 . Answer: A Contribution margin 12,000 x (1,500 – 900) Fixed costs Operating profit Unit contribution margin 720,000 ÷ 400,000 Selling price (1.80 ÷ 0.40) P154,000 26,000 P180,000 P 20 15 P 5 600,000 120,000 720,000 1.80 P4.50 66 . Answer: B Contribution margin per machine hour: Contribution margin per unit x No. of units produced per machine hours Product A P20 x 6 P120 Product B P16 x 8 P128 P7,200,000 3,600,000 P3,600,000 DOL: 7.2/3.6 = 2 times 127 Cost-Volume-Profit Analysis 67 . Answer: A 440,000 + (110,400/0.61) = 4 – 2.70 Increase in BEU = 6,240 – 5,600 = 640 480,000 Revised variable cost: P2.40 + (P2.00 x 0.15) 72 . Answer: C Composite CM = 40 + (2 x 20) = 80 P2.70 68 . Answer: D VC Ratio 375,00/625,000 = 60% VC / unit 375,000/25,000 = P15 New VC = 15 + (4.50 – 2.50)= P17 SP = 17/0.6 = P28.33 Composite BE = 910,000/80 = 11,375 73 . Answer: C Required new sales = 2005 sales + (P112,500/CMR) = P5M +(P112,500/0.45) P5.25M 69 . Answer: B The level of sales that would give equal costs: 0.06S = (40 x 24,000)+ 0.02S 0.04S = 960,000 S = 24M CMR = (250 – 137.50)/250 45% 74 . Answer: A Breakeven units = 807,840 ÷ 5.30 152,423 New CM/unit = 20 – 14.70 = 5.30 New variable cost: (14 + (14 x.5 x 0.10) = 14.70 New FC = 792,000 + (792,000 x.20x.10) = 807,840 70 . Answer: C Additional fixed cost/week: 31,200/52 = 600 Additional weekly sales to cover additional fixed cost: 600/0.25 = 2,400 Total Sunday’s sales (where 2,400 represents 25%): 2,400/0.25 = 9,600 75 . Answer: A Indifference point = Decrease in Fixed Cost Increase in Variable Cost = 80,000/0.05 = P1.60M Alternative solution: 600 = 0.25 x 0.25S 600 = 0.0625S S = 9,600 76 . Answer: D Processing hours per unit: XY – 7: 0.75/1 = 0.75 or 45 minutes BD – 4: 0.20/1 = 0.20 or 12 minutes 71 . Answer: A New BES = 873,600/140 = 6,240 New FC = 840,000 x 1.04 = 873,600 New CM = 250 – 100 –(100 x 0.10) = 140 Old BES = 840,000/150 = 5,600 Additional contribution margin using 100,000 hours: XY – 7: 100,000/0.75 x P1 = P133,333 BD – 4: 100,000/0.20 x P0.50 = P250,000 77 . Answer: B 128 Cost-Volume-Profit Analysis Units sold to earn P1M: (1,000,000 + 1,000,000) / 5.25 = 380,952 = 91,611 82 . Answer: C CM /unit 405,000 ÷ 1,800 BEV = 247,500 ÷ 225 The use of P1M fixed costs will require 380,952 units which are within the first range. 78 . Answer: A Fixed costs = 792,000 +(792,000 x 0.20 x 0.10) = 807,840 83 . Answer: A Operating Profit: (2,100 x 225) – 247,500 = P225,000 After–tax profit: 225,000 x 60% = 135,000 UCM = 20 – 14 –(14 x 0.50 x 0.10)= 5.30 Computation = 807,840/5.30 79 . Answer: A Cost of one 4–foot piece of metal 4 x 13.60 Less proceeds from sale of scrap 6.4 / 16 x 8 Net cost of one 4- foot piece of metal 54.40 3.20 51.20 Net cost per ounce P 51.20 ÷ 25.6 oz P2.00 Output per one 4-foot piece of metal Large 4 x 4oz Small 4 x 2.4oz Scrap Total oz 16.00 9.60 6.40 32.00 80 . Answer: B Material cost per unit Large: 4 x P2 x 1.8 Small 2.4 x P2 x 1.75 225 1,100 units 84 . Answer: C Contribution margin Regular sales 1,500 x 225 Special sale 1500 x 175 Total Contribution Fixed costs Taxable income Income tax Net income 337,500 262,500 600,000 247,500 352,500 141,000 211,500 85 . Answer: A Additional FC/ New Unit CM 61,500 ÷ 200 = 307.5 tons 86 . Answer: D New SP = 500 x .90 New VC 275 + 40 New CM P14.40 P 8.40 450 315 135 Sales required:] (Fixed costs + Before Tax profit) ÷ CMR 247,500 + (94,500 ÷ 60) P1,350,000 81 . Answer: A Unit CM Large: 29.00 – (8.5 x 1.8) = 13.70 Small: 14.00 – ( 5.1 x 1.75) = 5.075 87 . Answer: A Unit sales required: (316,800 + 40,000) ÷ 27.20 = 13,118 pairs Unit Contribution Margin, Touring: 80.00 – 52.80 P27.20 WACM = (13.70 + 5.075) ÷ 2 = 9.3875 Breakeven point = 860,000/9.3875 129 100% 70% 30% Cost-Volume-Profit Analysis Breakeven next year with no change in commission: 4,800,000 ÷ 0.4 = P12,000,000 88 . Answer: A Indifference point in peso sales: 0.4S – P369,600 = 0.34S – P316,800 0.06S = 52,800 S = P880,000 89 . Answer: D Breakeven sales, Mountaineering: 369,600 ÷ 35.20 = Required contribution margin – Touring 316,800 ÷ 10,500 = Present contribution margin – Touring Required decrease in variable cost per unit 90 . Answer: A New breakeven point: 348,480 ÷ 32.48 New UCM, Touring: 27.20 + (52.80 x 0.1) New Fixed costs: 316,800 x 1.1 93 . Answer: C If the commission rate is increased by 5%, the contribution margin is decreased by 5% or a new contribution margin ratio of 35% Breakeven sales next year. 4,800,000 / 0.35 = P13,714,286 10,500 94 . Answer: A Fixed cost under 15% commission plan Increase in Fixed cost Decrease in audit fee Increased fixed costs 30.17 27.20 2.97 10,730 The commission rate of 7.5%, instead of 15% will raise the contribution margin ratio to 47.5% (40% + 7.5%). = 32.48 = 348,480 Revised breakeven sales 7,125,000 / .475 = P 15M 91 . Answer: C The indifference point in number of pairs is 6,600. Inasmuch that the expected level is 12,000 units, it is better to sell Mountaineering because it has high leverage than the touring model. Once the indifference point is exceeded, the one with the higher contribution margin (leverage) has the advantage over the one with the lower contribution margin. 92 . Answer: B Fixed Costs: Overhead Marketing Administrative Interest Total 4,800,000 2,400,000 ( 75,000) 7,125,000 95 . Answer: A Required sales, with 20% commission and profit target of P1,120,000: (P4,800,000 + 1,600,000) ÷ .35 = 18,285,714 96 . Answer: D The question asked for is the indifference point. The peso sales required to produce equal income can be easily calculated by dividing the net increase in fixed costs by the increase in contribution margin ratio: 2,340,000 120,000 1,800,000 540,000 4,800,000 Difference in CMR = 35% - 47.5 = 12.5% Increase in fixed costs = 2,400,000 – 75,000 Indifference Point: 2,325,000 ÷ 0.125 Contribution margin ratio: 1 - [(7,200,000 + 2,400,000)/16M] = 40% Alternative Solution: .355 – 4,800,000 = .475S – 7,125,000 .125S = 2,325,000 130 P2,325,000 P18.6M Cost-Volume-Profit Analysis S = P18,6M The calculated breakeven point of 14,780 is invalid because the number falls under the second range wherein the amount of fixed costs that had been used are not relevant to that range. 97 . Answer: C Billing charge per patient day Variable cost per patient day Contribution margin P650 150 P500 Number of patient days for the year: P10,676,250/650 Second Range (Final calculation): Total fixed cost, lowest range Additional fixed cost: 1 aide 1 nurse Total Breakeven in patient days: 7,570,000 ÷ 500 16,425 Variable cost per patient day: P2,463,650÷16,425 P150 98 . Answer: B Fixed costs for bed capacity Salary, supervisory nurse Total 100 .Answer: A Additional revenues if 20 beds are rented: 90 days @ 17 patient days x 650 P4,190,000 720,000 P4,910,000 17 beds x 90 days x P150 99 . Answer: B In solving for the breakeven level where there are step fixed costs, the logical approach is to test the validity of the ranges of activities. Breakeven calculation: 7,390,000 ÷ 500 4,190,000 1,050,000 1,430,000 720,000 50,000 130,000 7,570,000 15,140 994,500 101 .Answer: B Increase in variable cost should be calculated based on additional patient days for 90 days at P150 per patient day. Number of patient days required to cover fixed costs for bed capacity and salaries of supervisory nurse 4,910,000 ÷ 500 9,820 First Range: Fixed costs based on capacity Salaries: Aides 21 x 50,000 Nurses 11 x 130,000 Supervisor 4 x 180,000 Total 7,390,000 102 .Answer: A The increase in fixed cost based on bed capacity: P4,190,250 ÷ 60 x 20 P1,396,750 103 .Answer: A Tax shield in non cash expenses 40% x 800,000 = P320,000 104 .Answer: A Breakeven in number of pizzas (traditional) 4,537,500/(250 – 75) 3,200,000 7,390,000 14,780 Units sold: P9,500,000/250 Unit variable cost (cost of food) 131 P229,500 = 25,929 = 38,000 Cost-Volume-Profit Analysis 2,850,000 ÷ 38,000 Fixed cost = 7,387,500 – 2,850,000 105 .Answer: A Cash Flow Breakeven: 3,417,500 ÷ 175 Total fixed cost: Less: Noncash fixed cost Tax shield on noncash Fixed costs Fixed cash flow = P75.00 2S = 250,000 S = P1,250,000 P4,537,500 110 .Answer: C The problem illustrates a calculation of breakeven point for a company with a step variable and step fixed cost. 19,529 P4,537,500 ( 800,000) Contribution Margin per Unit: 60,000 or less (P30 – P12.50) Units above 60,000 (P30 – P14.00) ( 320,000) P3,417,500 Total contribution margin from the first 60,000 (60,000 x P17.50) 106 .Answer: A Breakeven sales based on 20% commission: P100,000 ÷ 0.20 P500,000 The new contribution margin ratio is (20% + 15%) 0 = 280,000 + 16X -360,000 X = 80,000 ÷ 16 X = 5,000 units Breakeven units: 16,000 + 5,000 21,000 Alternative Solution: P1,000,000 Total fixed costs Less Contribution margin from 60,000 units Remaining fixed costs to be covered by additional units, each with CM of P16 35% Fixed costs are expected to be P350,000 (100,000 + 90,000 + 160,000) Breakeven units: 16,000 + (80,000 ÷ 16) 108 .Answer: D The required peso sales to earn net income of P1,330,000 if the commission is raised to 25%: (P100,000 + P1,900,000) ÷ 0.15 P280,000 Let X = Number of units above 16,000 Contribution margin ratio: (10M – 8M) ÷ 10M 20% 107 .Answer: D Breakeven sales if the company employs its own salesmen: (P350,000 ÷ 0.35) P17.50 P16.00 P360,000 280,000 P 80,000 21,000 111 .Answer: B The units that will generate the desired profit of P150,000 for the company, contributes P16 each. These units are the excess of 21,000 units to breakeven. P13,333,333 109 .Answer: B The indifference point, the level of sales where the alternatives will have equal profits: .15S- 100,000 = .35S – 350,000 Unit sales required: 21,000 + (150,000 ÷ P16) 132 30,375 Cost-Volume-Profit Analysis 112 .Answer: B The bonus plan of P1.00 per unit on sales made in excess of breakeven point (21,000 units) will necessarily decrease the contribution margin to P15. (Please see solution for No. 94) 117 .Answer: A Breakeven units if there is a change in marketing method: P48,000 ÷ 6 The desired profit based on fixed cost: 25% x P360,000 P90,000 Units required: 21,000 + (P90,000 ÷ 15) Contribution margin per unit: (Fixed cost + profit) ÷ Units sold 27,000 113 .Answer: B In determining the minimum selling price for the 8,000 units should consider the increased variable cost per unit and the additional fixed cost. Any cost and losses on the first 16,000 units are irrelevant: Variable cost per unit P14.00 Additional fixed cost per unit (10,000 ÷ 8,000) 1.25 Minimum selling price P15.25 114 .Answer: A The net income for the month if the new equipment is acquired: Contribution margin based on the present system Add increase in contribution margin due to decrease in variable cost (15,000 x 9) Increased contribution margin Less Increased fixed costs Net income (P48,000 + P60,000) ÷ 18,000 units P6.00 118 .Answer: B The percentage increase in profit can be calculated by multiplying the degree of operating leverage (DOL) by the percentage increase in sales during the second month. The sales increased by 30% (P4,500 ÷ P15,000) and therefore the profit percentage increased by 180% (6 x 30%). The expected profit during the next month would be: P135,000 P45,000 + (P45,000 x 1.8) 135,000 270,000 225,000 P 45,000 115 .Answer: B The increase in breakeven point would be: (12,500 – 10,000) Breakeven, present (P90,000 ÷ P9) Breakeven, proposed (P225,000 ÷ P18) 116 .Answer: C The degree of operating leverage (DOL) during the month that the new equipment would be used: (270,000 ÷ 45,000) 8,000 units 2,500 units 10,000 units 12,500 units P126,000 119 .Answer: C Breakeven Units: Fixed Costs ÷ Unit Contribution Margin P6,000,000 ÷ 300 20,000 pairs 120 .Answer: B Contribution margin (P18,000 x 300) Less Fixed costs Net loss P5,400,000 6,000,000 P( 600,000) 121 .Answer: A The breakeven level for the sales outlet is expected to rise because of additional commission, a variable cost item, and such a commission is being paid for all pairs of shoes sold. 6X Breakeven in pairs of shoes: 6,000,000 ÷ (300 – 75) 133 26,667 pairs Cost-Volume-Profit Analysis 127 .Answer: B Sales 39,000 x P270 Variable cost 39,000 x P210 Contribution margin Fixed cost Net loss 122 .Answer: D Though an additional commission is paid on pairs of shoes sold, the breakeven point is not affected and shall remain at 20,000 because the additional commission applies only to number of pairs of shoes sold in excess of breakeven level. The profit contribution by the 5,000 pairs is based on reduced contribution margin per pair. Profit: 5,000 x (300 – 50) Alternative Solution: Sales (25,000 x P800) Variable costs (24,000 x P500) Total contribution margin Fixed costs Profit 128 .Answer: B Original unit contribution margin (1,755,000 ÷ 19,500) Less increase in packaging cost New Unit contribution margin P1,250,000 P20,000,000 12,750,000 7,250,000 600,000 P 1,250,000 Unit sales required: (P1,800,000 + P97,500) ÷ P82.50 129 .Answer: A Breakeven units, Automated (P1,800,000 + P720,000) ÷ (P90 + P30) P2,520,000 ÷ 90 Breakeven units, Present (P1,800,000 ÷ 90) Increase in breakeven units 123 .Answer: A Because the breakeven level is unchanged, the calculation of the number of pairs to earn P900,000 is simple. The amount of the desired profit will be contributed by the number of pairs of shoes in excess of breakeven, each contributing P250. 20,000 +(P900,000 ÷ 250) 23,600 pairs 124 .Answer: B 300X – P6,000,000 = 440X – P8,142,000 140X = P2,142,000 X = 15,300 pairs 125 .Answer: A Breakeven peso sales: P1,800,000 ÷ 0.3 CMR = P1,755,000 ÷ P5,850,000 30% 126 .Answer: B Additional contribution margin P800,000 x 0.30 Additional fixed cost Increase in profit P10,530,000 8,190,000 2, 340,000 2,400,000 P( 60,000) P90.00 7.50 P82.50 23,000 21,000 20,000 1,000 130 .Answer: C The computation of the indifference point for the two processes can be determined by dividing the increase in fixed costs by the decrease in variable cost per unit because the selling price was unchanged. Indifference Point: P720,000 ÷ 30 P6,000,000 24,000 131 .Answer: B If the level of sales is higher than the indifference point, the one with higher leverage, i.e., higher fixed costs and lower unit variable cost, will provide higher income. The automated process has the higher leverage and therefore, it has higher income: P240,000 160,000 P 80,000 Difference in income: (26,000 – 24,000)30 134 P60,000 Cost-Volume-Profit Analysis 132 .Answer: C Breakeven units = Fixed costs Unit contribution margin P100,000 (P400 – P200) 500 units 133 .Answer: D Step 1: Compute before-tax profit: P240,000 (1.0 – 0.4) Units sales required to earn before-tax profit: (P100,000 + P400,0000) P200 Revenue (350 x P400) + (2,000 x P380) Variable costs (2,350 x P200) Contribution margin Fixed costs Operating profit Income tax Net income P400,000 137 .Answer: D Before tax profit objective (240,000 ÷ 0.6) Fixed costs Total contribution margin required Less contribution margin made on units sold January – May (350 x 200) Additional contribution margin still needed Additional contribution margin from 2,500 units (2,500 x P175) Less additional contribution margin required to meet profit objective Maximum advertising cost 2,500 units Alternative Solution: Profit = Sales – Variable costs – Fixed costs P400,000 = P400X – P200X – P100,000 P500,000 = P200X X = 2,500 units 134 .Answer: C Revenue (350 x P400) + (2,700 x P360) Variable costs (3,050 x P200) Contribution margin Fixed expenses Operating income Income tax Net income P1,112,000 610,000 502,000 100,000 P 402,000 160,800 P 241,200 135 .Answer: A Revenue (350 x P400) + (2,200 x P370) Variable costs (350 x P200) + (2,200 x P175) Contribution margin Fixed expenses Operating income Income tax Net income P 954,000 455,000 499,000 100,000 399,000 159,600 P 239,400 136 .Answer: B 135 P 900,000 470,000 P 430,000 90,000 340,000 136,000 P 204,000 P400,000 100,000 500,000 70,000 P430,000 P437,500 430,000 P 7,500