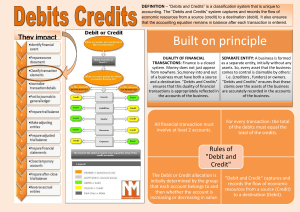

会 计 Work Report Accounting Analyzing and Recording Transactions 主讲人:马莺 汇报时间:2023.03 CONTENTS CONCEPTUAL C1 Explain the steps in processing transactions and the role of source documents. C2 Describe an account and its use in recording transactions. C3 Describe a ledger and a chart of accounts. C4 Define debits and credits and explain double-entry accounting. ANALYTICAL A1 Analyze the impact of transactions on accounts and financial statements. A2 Compute the debt ratio and describe its use in analyzing financial condition. PROCEDURAL P1 Record transactions in a journal and post entries to a ledger. P2 Prepare and explain the use of a trial balance. P3 Prepare financial statements from business transactions. 01 Explain the steps in processing transactions and the role of source documents. Explain thsteps in processing transactions and the role of source documents. 01 Business transactions and events are the starting points of financial statements. Process from transactions to financial statements is as follows: 1 Use source documents to identify accounts affected by an external transaction. 2 Analyze the impact of the transaction on the accounting equation. 3 Assess whether the transaction results in a debit or credit to account balances. 4 Record the transaction in a journal using debits and credits. 5 Post the transaction to the general ledger. 6 Prepare a trial balance. 7 Prepare the financial statements based on the trial balance. 01 Explain thsteps in processing transactions and the role of source documents. Source Documents identify and describe transactions and events entering the accounting system. They can be in either hard copy or electronic form. Tikets VAT invoice allowances for a business trip Reimbursement of travel expenses form Bank receipt 01 Explain thsteps in processing transactions and the role of source documents. Identify the items from the following list that are likely to serve as source documents. a. Sales ticket d.Telephone bill g.Income statement b.Trial balance e.Invoice from supplier h.Bank statement c.Balance sheet f.Company revenue account i. Prepaid insurance 02 Describe an account and its use in recording transactions 01 02 Describe an account and its use in recording transactions Account is a record of increases and decreases in a specific asset, liability, equity, revenue, or expense. provides a record of the business activities related to a particular item General ledger is a record of all accounts used by the company. provides, in a single collection, each account with its individual transactions and resulting account balance. 01 02 Describe an account and its use in recording transactions Asset accounts – Assets are resources owned or controlled by a company and that have expected future benefits. Most accounting systems include (at a minimum) separate accounts for the assets described Liability accounts – Liabilities are claims (by creditors) against assets, which means they are obligations to transfer assets or provide products or services to other entities. Equity Accounts – The owner’s claim on a company’s assets is called equity or owner’s equity. Equity is the owner’s residual interest in the assets of a business after deducting liabilities. 01 02 Describe an account and its use in recording transactions Buildings Cash reflects a company’s cash balances. It includes money and any funds that a bank accepts for deposit (coins, checks, money orders, and checking account balances). Supplies Land Cash Asset Accounts Accounts Receivable Accounts Receivable are held by a seller Prepaid accounts, and refer to promises of payment from customers to sellers. These transactions are often called credit sales or sales on account (or on credit). Prepaid Accounts Notes Receivable Equipment 01 02 Describe an account and its use in recording transactions Liabilities are claims by creditors against assets, which means they are obligations to transfer assets or provide products or services to others. Creditors are individuals and organizations that have rights to receive payments from a company. oral agreement written promise Accounts Payable Notes Payable Liability Accounts Accrued Liabilities Wages, taxes, interest and dividends Unearned Revenue 01 02 Describe an account and its use in recording transactions oral agreement written promise Notes Payable Accounts Payable Liability Accounts An unearned revenue is one in which the cash has been received but the product or service has not been delivered. Accrued Liabilities Unearned Revenue Wages, taxes, interest and dividends 01 02 Describe an account and its use in recording transactions Owner’s Withdrawals Revenues Equity Accounts Owner’s Capital Expenses The owner’s claim on a company’s assets is called equity. Equity is the owner’s residual interest in the assets of a business after deducting liabilities. Equity is impacted by four types of accounts: 1. Owner’s capital 2. Owner’s withdrawals 3. Revenues 4. Expenses 01 02 Describe an account and its use in recording transactions 03 Describe a ledger and chart of accounts 01 03 Describe a ledger and chart of accounts The ledger is a collection of all accounts for an accounting system. A company’s size and diversity of operations affect the number of accounts needed. The chart of accounts is a list of all accounts and includes an identifying number for each account. 01 03 Describe a ledger and chart of accounts Classify each of the following as assets (A), liabilities (L), or equity (EQ). 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) (A) Asset (EQ) Equity (A) Asset (L) Liability (A) Asset (A) Asset (L) Liability (L) Liability (A) Asset (A) Asset (L) Liability (L) Liability Prepaid Rent Owner, Capital Note Receivable Accounts Payable Accounts Receivable Equipment Interest Payable Unearned Revenue Land Prepaid Insurance Wages Payable Rent Payable Key words to look for in account titles: Prepaid Receivable Payable Unearned Always Always Always Always an asset an asset a liability a liability 04 Define debits and credits and explain double-entry accounting. 01 04 Define debits and credits and explain double-entry accounting. During the accounting period, transactions that result in exchanges between the company and external parties are analyzed to determine the accounts and effects. general journal general ledger These formal records are based on two very important tools used by accountants: journal entries and T-accounts. 01 04 Define debits and credits and explain double-entry accounting. Transactions have the effect of increasing or decreasing account balances. How can we know whether an transcation made the account balance increase or decrease??? Record transactions using debits and credits. 03 04 Define debits and credits and explain double-entry accounting. Debit and credit are derived A 点击在此录入上述图表的综合描述说明,在此录入上述 from Latin terms 礼仪 图表的综合描述说明。在此录入上述图表的综合描述说 明,在此录入上述图表的综合描述说明, 对象性 Debit Credit B C Their use dates back to 1494 and a Franciscan monk by the name of Luca Pacioli Debit simply means “left,” and credit means “right.” 03 04 Define debits and credits and explain double-entry accounting. 03 04 Define debits and credits and explain double-entry accounting. represents a ledger account and is used to depict the effects of one or more transactions. 礼仪 对象性 Account Title (left side ) (balance) (right side ) (balance) 03 04 Define debits and credits and explain double-entry accounting. 礼仪 对象性 Equtiy Asset : Debits means increase; Credits means decreases Liability and Equity : Debits mean decrease; credit means decreases 03 04 Define debits and credits and explain double-entry accounting. what are debit and credit rules for owner captial,withdrawl , revenue and expense ? 03 04 Define debits and credits and explain double-entry accounting. owner,capital owner,withdrawals debit credit debit credit Revenues debit Equtiy credit Expense debit credit 03 04 Define debits and credits and explain double-entry accounting. Do you remember the expanded accouting equation ? Define debits and credits and explain double-entry accounting. 03 04 = Asset debit Asset debit credit + liabilities debit Expense credit debit credit + credit + owner, capital debit owner, withdrawals debit credit - owner, withdrawals credit debit = + credit liabilities debit credit + Revenues debit - Expense credit debit credit Owner capital debit credit + Revenue debit credit 03 04 Define debits and credits and explain double-entry accounting. 2XXX.XX.1 Asset Beginning Balance Debit amount Crebit amount during a period changing amount Ending Balance during a period changing amount 2XXX.XX.30(31) Ending Balance=Beginning Balance +increased amount-decreased amount Ending Balance=Beginning Balance+Debit amoun-Crebit amount 30 03 04 Define debits and credits and explain double-entry accounting. libilities,owner equiry Beginning Balance Debit amount Crebit amount 2XXX.XX.1 during a period changing amount Ending Balance during a period changing amount 2XXX.XX.30(31) Ending Balance=Beginning Balance +increased amount-decreased amount Ending Balance=Beginning Balance+credit amount-Debit amount 31 03 04 Define debits and credits and explain double-entry accounting. Can you draw the T-account structure of assets, liabilities and owner's equity? 03 04 Define debits and credits and explain double-entry accounting. Asset Beginning Balance Debit amount Credit amount Ending Balance Ending Balance=Beginning Balance +increased amount-decreased amount Ending Balance=Beginning Balance +Debit amount-Credit amount 03 04 Define debits and credits and explain double-entry accounting. Liabilities/Equity Beginning Balance Debit amount Credit amount Ending Balance Ending Balance=Beginning Balance +increased amount-decreased amount Ending Balance=Beginning Balance +Credit amount-Debit amount 03 04 Define debits and credits and explain double-entry accounting. Cash 100 300 20 Bal. 310 50 60 Balance?????? 03 04 Define debits and credits and explain double-entry accounting. Accounts Payable 2,000 8,000 2,700 Balance?????? Bal. 3300 03 04 Define debits and credits and explain double-entry accounting. Accounts Receivable 600 150 150 150 100 Bal. 50 Balance?????? 03 04 Define debits and credits and explain double-entry accounting. expense Beginning Balance 1000 Balance?????? 11,000 800 100 1000+11000+800+1004500-6000-1300=1100 4,500 6,000 1,300 NEED-TO-KNOW 2-2 Identify the normal balance (debit [Dr] or credit [Cr]) for each of the following accounts. 1) 2) 3) 4) 5) 6) Dr. Debit Cr. Credit Dr. Debit Cr. Credit Dr. Debit Dr. Debit Assets Increase Decrease Debits Credits Normal Prepaid Rent Owner, Capital Note Receivable Accounts Payable Accounts Receivable Equipment = Liabilities Decrease Increase Debits Credits 7) 8) 9) 10) 11) 12) Cr. Credit Cr. Credit Dr. Debit Dr. Debit Dr. Debit Dr. Debit + Equity Decrease Increase Debits Credits Withdrawals Expenses Normal Interest Payable Unearned Revenue Land Prepaid Insurance Owner, Withdrawals Supplies Owner, Withdrawals ↓ Equity Investments Revenues Owner, Capital ↑ Equity Withdrawals Investments Normal Normal Expenses ↓ Equity Revenues ↑ Equity Expenses Revenues Normal Normal Learning Objective C4: Define debits and credits and explain double-entry accounting. 39 03 04 Define debits and credits and explain double-entry accounting. QS2-5 Indicate whether a debit or credit decreases the normal balance of each of the following accounts. a.Interest Payable e.Owner,Capital i.Owner,Withdrawals b. Service Revenue f. Prepaid Insurance j.Unearned Revenue c.Salaries Expense g.Buildings k. Accounts Payable dAccounts Receivable h.Interest Revenue l. Land 03 04 Define debits and credits and explain double-entry accounting. 1.Amalia Company received its utility bill for the current period of $700 and immediately paid it. Its journal entry to record this transaction includes a a.Credit to Utility Expense for $700. b.Debit to Utility Expense for $700. c.Debit to Accounts Payable for $700. d.Debit to Cash for $700. e.Credit to capital for $700. 03 04 Define debits and credits and explain double-entry accounting. a.Credit to Unearned Lawn Service Fees for $2,500. b.Debit to Lawn Service Fees Earned for $2,500. c.Credit to Cash for $2500. d.Debit to Unearned Lawn Service Fees for $2,500. e.Credit to capital for $2,500. Assets Increase Decrease Debits Credits Normal = Define debits and credits and explain double-entry accounting. 03 04 3. Debit cash 250,000 Land 500,000 credit owner capital 750 000 Asset=liability + owner equity 05 Record transactions in a journal and post entries to a ledger. 01 05 Record transactions in a journal and post entries to a ledger. 01 05 Record transactions in a journal and post entries to a ledger. a. Transaction Date b. Titles of Affected Accounts Formally record transactions using those same debits and credits in a journal. d. Transaction explanation c. Dollar amount of debits and credits 01 05 Record transactions in a journal and post entries to a ledger. 1. For example, if shareholders invest $10,000 in a firm on January 1 a. c. Transaction Date January 1 10,000 Cash Invested Capital 10,000 To record shareholders’ investment b. Titles of Affected Accounts d. Transaction explanation Dollar amount of debits and credits 01 05 Record transactions in a journal and post entries to a ledger. Format for Recording a Business Transaction, or Journal Entry For each journal entry, total debits total credits. It’s certainly possible to have or more than one credit in a journal entry as the result of a business transaction. These are known as compound entries. Feb 2 Cash 3,000 equipment 5,000 Invested Capital 8,000 To record shareholders’ investment 01 05 Record transactions in a journal and post entries to a ledger. T-accounts are useful illustrations, but balance column ledger accounts are used in practice. Two formal accounting records: the general ledger and subsidiary ledger Asubsidiary ledger is to provide detailed information regarding a particular general ledger account. 01 05 Record transactions in a journal and post entries to a ledger. Example of subsidiary ledger. assume that the Pine Company is owed a total of $700 from its three customers. Customer A owes $400, Customer B owes $200, and Customer C owes $100. 01 05 Record transactions in a journal and post entries to a ledger. Transcribing the amounts from journal entries into the general ledger is called posting. From a procedural standpoint, transactions, events, and so on, are never initially entered into the general ledger. 06 Analyze the impact of transactions on accounts (From to ). 01 06 Analyze the impact of transactions on accounts and financial statements. Double-entry accounting is useful in analyzing and processing transactions. Analysis of each transaction follows these four steps. 01 Identify the transaction and any source documents 03 Record the transaction in journal entry form applying double-entry accounting. 02 04 Analyze the transaction using the accounting equation. Post the entry (for simplicity, we use T-accounts to represent ledger accounts). 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 13.Pay Cash for Future Iusurance IdentIfy FastForward pays $2.400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. Analyze Assets Cash -2400 = liabilitites + Equity prepaid Insurance +2400 = + 0 0 Changes the composition of assets from cash toprepaid insurance. Expense is incurred as insur-ance coverage cxpires. Record Date (13) Account Titles and Explanation Prepaid Insurance Cash PR Debit 128 101 2,400 Credit 2,400 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. 01 06 Analyze the impact of transactions on accounts and financial statements. Assume Tata began operations on January 1 and completed the following transactions during its first month of operations. Jan. 1 Jamsetji invested $4,000 cash in the Tata company. Jan. 5 The company purchased $2,000 of equipment on credit. Jan. 14 The company provided $540 of services for a client on credit. For each transaction, (a) analyze the transaction using the accounting equation, (b) record the transaction in journal entry form, and c) post the entry using T-accounts to represent the general ledger accounts. 01 06 Analyze the impact of transactions on accounts and financial statements. Jan. 1 Jamsetji invested $4,000 cash in the Tata company. a) Analyze Assets = Liabilities + Equity + $4,000 + $4,000 b) Record c) Post Date Jan. 1 General Journal Cash J. Tata, Capital Normal Credit 4,000 Cash Jan. 1 4,000 J. Tata, Capital Jan. 1 Assets Increase Decrease Debits Credits Debit 4,000 = Liabilities Decrease Increase Debits Credits Normal 4,000 + Equity Decrease Increase Debits Credits Owner, Withdrawals Expenses Owner Investments Revenues 01 06 Analyze the impact of transactions on accounts and financial statements. Jan. 5 The company purchased $2,000 of equipment on credit. a) Analyze Assets = Liabilities + Equity + $2,000 + $2,000 b) Record c) Post Date Jan. 5 Jan. 5 General Journal Equipment Accounts Payable Normal = Credit 2,000 Equipment 2,000 Accounts Payable Jan. 5 Assets Increase Decrease Debits Credits Debit 2,000 Liabilities Decrease Increase Debits Credits Normal 2,000 + Equity Decrease Increase Debits Credits Owner, Withdrawals Expenses Owner Investments Revenues 01 06 Analyze the impact of transactions on accounts and financial statements. Jan. 14 The company provided $540 of services for a client on credit. a) Analyze Assets = Liabilities + Equity + $540 + $540 b) Record Date Jan. 14 c) Post Jan. 14 General Journal Accounts receivable Services revenue Normal = Credit 540 Accounts receivable 540 Services revenue Jan. 14 Assets Increase Decrease Debits Credits Debit 540 Liabilities Decrease Increase Debits Credits Normal 540 + Equity Decrease Increase Debits Credits Owner, Withdrawals Expenses Owner Investments Revenues 07 Prepare and explain the use of a trial balance. 01 07 Prepare and explain the use of a trial balance. A trial balance is simply a listing of general ledger accounts and their amounts List each account title and its amount (from ledger) in the trial balance. If an account has a A 点击在此录入上述图表的综合描述说明,在此录入上述 礼仪 zero balance, list it with a zero in the normal 图表的综合描述说明。在此录入上述图表的综合描述说 balance column (or omit it entirely). 明,在此录入上述图表的综合描述说明, 对象性 B C Compute the total of debit balances and the total of credit balances. Verify (prove) total debit balances equal total credit balances. 01 07 Analyze the impact of transactions on accounts and financial statements. Fast Forward Trial Balance December 31,2017 Order: Assets Liabilities Equity Revenues Expenses Debit Credit The trial balance lists all ledger accounts and their balances at a point in time. If the books are in balance, the total debits will equal the total credits. EAGLE SOCCER ACADEMY Trial Balance December 31, 2024 Once the trial balance is complete, we prepare financial statements. 01 07 Analyze the impact of transactions on accounts and financial statements. Prepare a trial balance for Apple using the following condensed data from its fiscal year-ended September 26, 2015. $111,547 Owner, Capital Owner, Withdrawals $45,586 35,490 Accounts payable Investments and other assets 230,039 135,634 Other liabilities Land and equipment 22,471 140,089 Cost of sales (expense) Selling and other expense 40,232 21,120 Cash Accounts receivable 16,849 233,715 Revenues APPLE Trial Balance September 26, 2015 Debit Assets Credit Normal Liabilities Normal Owner, Capital Normal Owner, Withdrawals Normal Revenues Expenses Totals Normal Normal Debits = Credits 01 07 Analyze the impact of transactions on accounts and financial statements. Prepare a trial balance for Apple using the following condensed data from its fiscal year-ended September 26, 2015. $111,547 Owner, Capital Owner, Withdrawals $45,586 35,490 Accounts payable Investments and other assets 230,039 135,634 Other liabilities Land and equipment 22,471 140,089 Cost of sales (expense) Selling and other expense 40,232 21,120 Cash Accounts receivable 16,849 233,715 Revenues APPLE Trial Balance September 26, 2015 Debit Credit Cash $21,120 Accounts receivable 16,849 Land and equipment 22,471 Investments and other assets 230,039 Accounts payable $35,490 Other liabilities 135,634 Owner, Capital 111,547 Owner, Withdrawals 45,586 Revenues 233,715 Cost of sales (expense) 140,089 Selling and other expense 40,232 Totals $516,386 $516,386 01 07 Analyze the of transactions on accounts and financial statements. If the trial balance does not balance, the error(s) must be found and corrected. Make sure the trial balance Re-compute each account columns are correctly added. balance in the ledger. Make sure account balances are correctly entered from the ledger. Verify that each journal entry is posted correctly. See if debit or credit accounts are mistakenly placed on the trial balance. Verify that each original journal entry has equal debits and credits. CONTENTS CONCEPTUAL C1 Explain the steps in processing transactions and the role of source documents. C2 Describe an account and its use in recording transactions. C3 Describe a ledger and a chart of accounts. C4 Define debits and credits and explain double-entry accounting. ANALYTICAL A1 Analyze the impact of transactions on accounts and financial statements. A2 Compute the debt ratio and describe its use in analyzing financial condition. PROCEDURAL P1 Record transactions in a journal and post entries to a ledger. P2 Prepare and explain the use of a trial balance. P3 Prepare financial statements from business transactions. THANK .YOU 谢谢观看 Your content to play here, or through paste in this box, and select only the text. Your content to play here or through your copy, paste