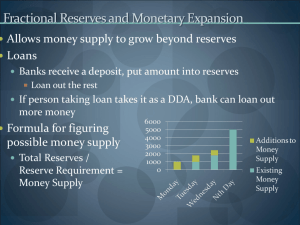

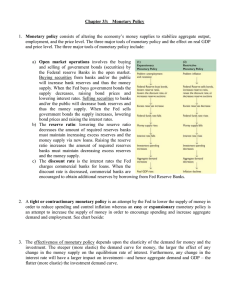

Review outline for Final Exam Fin360 1. Overview of financial system (Chapter 1+2) Chap 1 Chap 2 2. Interest rate and bond price, bond duration Discount bond When interest rates decrease, how might businesses and consumers change their economic behavior? When interest rates decrease, consumers are willing to spend more money on goods because they now receive fewer returns from their investments (for example, interest payments on money in savings accounts fall) Duration measures a bond's or fixed income portfolio's price sensitivity to interest rate changes. Macaulay duration estimates how many years it will take for an investor to be repaid the bond’s price by its total cash flows. Modified duration measures the price change in a bond given a 1% change in interest rates. A fixed income portfolio's duration is computed as the weighted average of individual bond durations held in the portfolio. In general, the higher the duration, the more a bond's price will drop as interest rates rise (and the greater the interest rate risk). For example, if rates were to rise 1%, a bond or bond fund with a five-year average duration would likely lose approximately 5% of its value. 3. Structure of interest rate, yield curve Stock valuation principle Concepts of derivative securities (W3) 4. Stock valuation principle 5. Concepts of derivative securities Web chapter 3 Chapter 9 Explain major sources and uses of fund by a bank Principles in bank management: reserves, credit risk and interest rate risk General Principles of Bank Management - Liquidity management - Asset management - Liability management: your lender money invested in good things - Capital Adequacy Management - Credit Risk - Interest-rate Risk: not risky, but high returns Liquidity management and the role reserves I want my 100 dollars back, but they only have 10 lefts, and the rest is put into loans. 4 options: - Borrowing from other banks or corporations but they have to pay an interest rate for that (The cost of this activity is the interest rate on these borrowings, such as the federal funds rate) - Selling securities: sell in secondary markets (The bank incurs some brokerage and other transaction costs when it sells these securities. The U.S. government securities that are classified as secondary reserves are very liquid, so the transaction costs of selling them are quite modest. However, the other securities the bank holds are less liquid, and the transaction costs can be appreciably higher.) - Borrowing from the Fed: lower interest rate than borrowing from other banks - Calling in or selling off loans: very desperate, scares of customers. (This process – calling in loans is the bank’s costliest way of acquiring reserves when a deposit outflow exists. The other is also very costly because other banks do not know how risky these loans are and so may not be willing to buy the loans at their full value.) A bank expects to attract most of its funds through short-term CDs and prefer to use most of its funds to provide long-term loans. A fixed-rate loan may be perceived as rate insensitive. Yet, if it is prepaid, the funds are loaned out to someone else at the prevailing rate. Therefore, this type of loan can be sensitive to interest rates. A bank could follow the strategy that the bank expects to attract most of its funds through short-term CDs and would prefer to use most of its funds to provide long-term loans and still reduce the interest rate risk by using the floating-rate loans even with long-term maturities. The floating rate is also known as variable or adjustable rate hence this strategy can be used to manage the interest rate risk. According to duration analysis, if interest rate falls, the market value of the long-term loans will rise and increase further than the liabilities of short-term CDs, thus increase the net worth of the bank and increases its profits. Chapter on the Web 2 Operation of insurance companies and how asymmetric information affects the operation of insurance companies; application: Insurance management In the case of an insurance policy, moral hazard arises when the existence of insurance encourages the insured party to take risks that increase the likelihood of an insurance payout. For example, a person covered by burglary insurance might not take as many precautions as possible to prevent a burglary because he or she knows the insurance company will pay for most of the losses if a theft occurs. Adverse selection holds that the people most likely to receive large insurance payouts are the ones who will most want to purchase insurance. For example, a person suffering from a terminal disease would want to take out the biggest life and medical insurance policies possible, thereby exposing the insurance company to potentially large losses. Both adverse selection and moral hazard can result in large losses to insurance companies because they lead to higher payouts on insurance claims. All insurers face moral hazard and adverse selection problems, which explain the use of insurance management tools, such as information collection and screening of potential policyholders, risk-based premiums, restrictive provisions, prevention of fraud, insurance cancellation provisions, deductibles, coinsurance, and limits on the amount of insurance. Describe and differentiate the operations of Finance companies, mutual fund, and securities markets operations Finance companies Finance companies raise funds by issuing commercial paper and stocks and bonds and then using the proceeds to make loans that are particularly suited to consumer and business needs. Virtually unregulated in comparison to commercial banks and thrift institutions, finance companies are able to quickly tailor their loans to customer needs securities markets operations Investment bankers assist in the initial sales of securities in primary markets, whereas securities brokers and dealers assist in the trading of securities in the secondary markets, some of which are organized into exchanges. The SEC regulates the financial institutions in the securities markets and ensures that adequate information reaches prospective investors. Mutual funds Mutual funds sell shares and use the proceeds to buy securities. Open-end funds issue shares that can be redeemed at any time at a price tied to the asset value of the firm. Closed-end funds issue nonredeemable shares, which are traded like common stock. They are less popular than open-end funds because their shares are not as liquid. Money market mutual funds hold only short-term, high-quality securities, allowing shares to be redeemed at a fixed value using checks. Shares in these funds effectively function as checkable deposits that earn market interest rates. All mutual funds are regulated by the Securities and Exchange Commission (SEC). Chapter 14 Explain the function and organization for central bank (the Fed) Function: Central banks carry out a nation's monetary policy and control its money supply, often mandated with maintaining low inflation and steady GDP growth. On a macro basis, central banks influence interest rates and participate in open market operations to control the cost of borrowing and lending throughout an economy. Central banks also operate on a micro-scale, setting the commercial banks' reserve ratio and acting as lender of last resort when necessary. Organization This initial diffusion of power resulted in the evolution of the Federal Reserve System to include the following entities: the Federal Reserve Banks, the Board of Governors of the Federal Reserve System, the Federal Open Market Committee (FOMC), the Federal Advisory Council, and around 2,000 member commercial banks. Federal reserve Banks Each of the twelve Federal Reserve districts defined by the Federal Reserve Act of 1913 has one main Federal Reserve Bank, which may have branches in other cities in the district. Each of the Federal Reserve Banks is a quasi-public (part private, part government) institution owned by the private commercial banks in its district that are members of the Federal Reserve System. member Banks All national banks (commercial banks chartered by the Office of the Comptroller of the Currency) are required to be members of the Federal Reserve System. Commercial banks chartered by the states are not required to be members, but they can choose to join Board of governors of the federal reserve system At the head of the Federal Reserve System is the seven-member Board of Governors, headquartered in Washington, DC. Each governor is appointed by the president of the United States and confirmed by the Senate. federal Open market committee (fOmc) The FOMC usually meets eight times a year (about every six weeks) and makes decisions regarding the conduct of open market operations and the setting of the policy interest rate, the federal funds rate, which is the interest rate on overnight loans from one bank to another. Indeed, the FOMC is often referred to as the “Fed” in the press When the Fed pays for a government bond, it pumps money into the banking system. However due to the reserve requirement, the entire money cannot be used by banks for lending purposes. Hence the actual increase in money supply is equal to the money paid for government bonds minus reserve requirement. This is equal to 120 m*(1-8%)= 110.4 million Chapter 15 Explain meaning of items in the Fed’s balance sheet 4 items Liabilities The two liabilities on the balance sheet, currency in circulation and reserves, are often referred to as the monetary liabilities of the Fed. They are an important part of the money supply story, because increases in either or both will lead to an increase in the money supply (everything else held constant). The sum of the Fed’s monetary liabilities (currency in circulation and reserves) and the U.S. Treasury’s monetary liabilities (Treasury currency in circulation, primarily coins) is called the monetary base (also called high-powered money). Assets The two assets on the Fed’s balance sheet are important for two reasons. First, changes in the asset items lead to changes in reserves and the monetary base, and consequently to changes in the money supply. Second, because these assets (government securities and Fed loans) earn higher interest rates than the liabilities (currency in circulation, which pays no interest, and reserves), the Fed makes billions of dollars every year—its assets earn income, and its liabilities cost practically nothing. Comment on the Fed’s ability to control MB and banks’ reserves Open market purchase Because the monetary base equals currency plus reserves, an open market purchase increases the monetary base by an amount equal to the amount of the purchase. FED ability to control bank reserves Banks loan funds to customers based on a fraction of the cash they have on hand. The government makes one requirement of them in exchange for this ability: keep a certain amount of deposits on hand to cover possible withdrawals. This amount is called the reserve requirement, and it is the rate that banks must keep in reserve and are not allowed to lend. In the United States, the Federal Reserve Board sets the reserve requirements. The Federal Reserve Board receives its authority to set reserve requirements from the Federal Reserve Act. The Board establishes reserve requirements as a way to carry out monetary policy on deposits and other liabilities of depository institutions. The reserve requirement is another tool that the Fed has at its disposal to control liquidity in the financial system. By reducing the reserve requirement, the Fed is executing an expansionary monetary policy, and conversely, when it raises the requirement, it's exercising a contractionary monetary policy. This latter action cuts liquidity and causes a cool down in the economy. Explain the simple and complete model of money supply process and determinants of money supply A single bank can make loans up to the amount of its excess reserves, thereby creating an equal amount of deposits. The banking system can create a multiple expansion of deposits, because as each bank makes a loan and creates deposits, the reserves find their way to another bank, which uses them to make loans and create additional deposits. In the simple model of multiple deposit creation, in which banks do not hold on to excess reserves and the public holds no currency, the multiple increase in checkable deposits (simple deposit multiplier) equals the reciprocal of the required reserve ratio. The simple model of multiple deposit creation has serious deficiencies. Decisions by depositors to increase their holdings of currency or by banks to hold excess reserves will result in a smaller expansion of deposits than is predicted by the simple model. All three players—the Fed, banks, and depositors—are important in the determination of the money supply. Determinants of money supply The money supply is positively related to the nonborrowed monetary base MBn, which is determined by open market operations, and the level of borrowed reserves (lending) from the Fed, BR. The money supply is negatively related to the required reserve ratio, rr, and excess reserves. The money supply is also negatively related to holdings of currency, but only if excess reserves do not vary much when there is a shift between deposits and currency. The model of the money supply process takes into account the behavior of all three players in the money supply process: the Fed through open market operations and setting of the required reserve ratio; banks through their decisions to borrow from the Federal Reserve and hold excess reserves; and depositors through their decisions about the holding of currency. Chapter 16,17 Explain the goals of monetary policy: dual and hierarchical mandates Describe the problem of time inconsistency and give real-life example for this problem Explain the role of a nominal anchor in conducting monetary policy Describe and differentiate tools of monetary policy and their advantage, disadvantage Conventional monetary policy tools include open market operations, discount policy, reserve requirements, and interest on reserves. Open market operations are the primary tool used by the Fed to implement monetary policy in normal times to change interest rates and monetary base, because they occur at the initiative of the Fed, are flexible, are easily reversed, and can be implemented quickly. However, even if implemented quickly, the macro effects of monetary policy generally occur after some time has passed. The effects on an economy may take months or even years to materialize. Interest rates can only be lowered nominally to 0%, which limits the bank's use of this policy tool when interest rates are already low. Keeping rates very low for prolonged periods of time can lead to a liquidity trap. Discount policy has the advantage of enabling the Fed to perform its role of lender of last resort, while raising interest rates on reserves to increase the federal funds rate eliminates the need to conduct massive open market operations to reduce reserves when banks have accumulated large amounts of excess reserves. Nevertheless, if a bank expects that the Fed will provide it with discount loans if it gets into trouble, then it will be willing to take on more risk, knowing that the Fed will come to the rescue if necessary. The Fed’s lender-of-last-resort role has thus created a moral hazard problem similar to the one created by deposit insurance: Banks take on more risk, thus exposing the deposit insurance agency, and hence taxpayers, to greater losses. when the zero-lower-bound problem occurs, central banks use nonconventional monetary policy tools, which involve liquidity provision, asset purchases, and commitment to future policy actions. Liquidity provision and asset purchases lead to an expansion of the central bank balance sheet, which is referred to as quantitative easing. Expansion of the central bank balance sheet by itself is unlikely to have a large impact on the economy, but changing the composition of the balance sheet, which is accomplished by liquidity provisions and asset purchases and is referred to as credit easing, can have a large impact by improving the functioning of credit markets. Explain how monetary policy tools can affect the Short-term interest rate in market for bank’s reserves, draw figures for illustration an open market purchase causes the federal funds rate to fall, whereas an open market sale causes the federal funds rate to rise. the interest rate paid on reserves, ior, sets a floor for the federal funds rate. Strategies in conducting monetary policies: monetary targeting, inflation targeting, interest rate/implicit nominal anchor Monetary targeting (MT) is a simple rule for monetary policy according to which the central bank manages monetary aggregates as operating and/or intermediate target to influence the ultimate objective, price stability. Under MT, the inflation target is not announced and the central bank intervention is concentrated only on the money market. Typically, the central bank sets the interest rates to control monetary aggregates, which are considered the main determinants of inflation in the long run. Thus, controlling monetary aggregates would be equivalent to stabilising the inflation rate around the target value. Implicit nominal anchor The Federal Reserve’s monetary policy has evolved over time. From the 1980s through 2006, the Federal Reserve set an implicit, not an explicit, nominal anchor. As with inflation targeting, the central bank used many sources of information to determine the best settings for monetary policy. The Fed’s forward-looking behavior and stress on price stability helped discourage overly expansionary monetary policy, thereby ameliorating the time-inconsistency problem. Despite its demonstrated success, this monetary policy lacked transparency and was inconsistent with democratic principles. Current framework of monetary policy of FED The Federal Reserve has a mandate from Congress to promote stable prices and maximum sustainable employment. The Federal Open Market Committee’s (FOMC’s) monetary policy framework spells out its strategy to achieve these goals over the medium and longer run. During 2019 and the first half of 2020, the Fed undertook a review of its monetary policy strategy, tools and communications. Following that review, the Fed introduced a new monetary policy framework in August 2020. The FOMC made several key changes to its statement on longer-run goals and monetary policy strategy, a few of which I will discuss here.3 Two of the main changes were related to the employment side of the Fed’s mandate. In the updated statement, the FOMC stressed that the employment goal is broad-based and inclusive, affecting all parts of the labor market and not just certain segments. The updated statement also suggests that monetary policy decisions will aim to reduce shortfalls—rather than deviations (as the prior statement said)—of employment from its maximum sustainable level. With this second change, the FOMC is stressing that it will react to high unemployment but not to particularly low unemployment unless inflation is threatening the economy. Another key change to the statement on longer-run goals is related to how the FOMC aims to achieve the price stability goal. Under the new framework, the FOMC will focus on hitting an inflation rate of 2% on average over time. To do so, the FOMC will aim for inflation to run moderately higher than the 2% target for some time to make up for past misses of inflation to the low side of the target. This new strategy is referred to as flexible average inflation targeting, and it should help center longer-term inflation expectations at 2% and reinforce the inflation target. Chapter 18 What is exchange rates and why are they important? The price of one currency in terms of another is called the exchange rate. There are two kinds of exchange rate transactions. The predominant ones, called spot transactions, involve the immediate (two-day) exchange of bank deposits. Forward transactions involve the exchange of bank deposits at some specified future date. The spot exchange rate is the exchange rate for the spot transaction, and the forward exchange rate is the exchange rate for the forward transaction. When a currency increases in value, it experiences appreciation; when it falls in value and is worth fewer U.S. dollars, it undergoes depreciation Foreign exchange rates (the price of one country’s currency in terms of another’s) are important because they affect the price of domestically produced goods sold abroad and the cost of foreign goods bought domestically. When a country’s currency appreciates (rises in value relative to other currencies), the country’s goods abroad become more expensive, and foreign goods in that country become cheaper (holding domestic prices constant in the two countries). Conversely, when a country’s currency depreciates, its goods abroad become cheaper, and foreign goods in that country become more expensive. Explain determinants of exchange rates in long-run and short-run Determinants of exchange rates in the long run Law of one Price The starting point for understanding how exchange rates are determined is a simple idea called the law of one price: If two countries produce an identical good, and transportation costs and trade barriers are very low, the price of the good should be the same throughout the world, no matter which country produces it. When certain conditions are taken into account, the law of one pricing stipulates that the price of an identical item or commodity will be the same around the world, regardless of location. Relative prices, which are defined by the relative supply of money across countries and the relative real demand for money across countries, govern the exchange rate in the long run. resulting in a corresponding devaluation of the national currency (through PPP). Exchange rates, like any other price in a local economy, are determined by supply and demand – in this case, supply and demand for each currency. The following factors influence a currency's supply in the foreign exchange market: Demand for that currency's goods, services, and investments. If a factor increases the demand for domestic goods relative to foreign goods, the domestic currency will appreciate; if a factor decreases the relative demand for domestic goods, the domestic currency will depreciate. Trade barriers, preferences for domestic versus foreign goods, productivity, inflation and interest rate are among the many factors that influence exchange rates. The purchasing power of a currency depreciates due to inflation. The demand for the currency will fall as long as inflation is high. The combination of supply and demand determines exchange rates, just as it does other prices. The supply and demand for a currency are both equal at the equilibrium exchange rate. Changes in the exchange rate occur when the supply or demand for a currency shift. Determinants of exchange rates in the short run In the short run, exchange rates are determined by changes in the relative expected return on domestic assets, which cause the demand curve to shift. Any factor that changes the relative expected return on domestic assets will lead to changes in the exchange rate. Such factors include changes in the interest rates on domestic and foreign assets, as well as changes in any of the factors that affect the long-run exchange rate and hence the expected future exchange rate. What is PPP and interest parity condition and applications of these theories. PPP One of the most prominent theories of how exchange rates are determined is the theory of purchasing power parity (PPP). It states that exchange rates between any two currencies will adjust to reflect changes in the price levels of the two countries. The theory of PPP is simply an application of the law of one price to national price levels rather than to individual prices. In reality, purchasing power parity is difficult to achieve, due to various costs in trading and the inability to access markets for some individuals. The formula for purchasing power parity is useful in that it can be applied to compare prices across markets that trade in different currencies. As exchange rates can shift frequently, the formula can be recalculated on a regular basis to identify mispricings across various international markets. interest parity condition Interest rate parity (IRP) is a theory according to which the interest rate differential between two countries is equal to the differential between the forward exchange rate and the spot exchange rate. interest parity condition is a commonly employed technique in making exchange rates forecasts. Forecast under this condition are made by inputting the spot exchange rates and the interest rates in the domestic and foreign countries respectively. IRP is the fundamental equation that governs the relationship between interest rates and currency exchange rates. The basic premise of IRP is that hedged returns from investing in different currencies should be the same, regardless of their interest rates. IRP is the concept of no-arbitrage in the foreign exchange markets (the simultaneous purchase and sale of an asset to profit from a difference in the price). Investors cannot lock in the current exchange rate in one currency for a lower price and then purchase another currency from a country offering a higher interest rate. Increasing domestic trade barriers (raising tariffs on foreign products) reduces demand for foreign products (imports) relative to domestic products, which reduces the demand for foreign currency, reduces the value of foreign currency, increases the value of domestic currency. The value of the indian rupee today will appreciate The current exchange rate is 0.75 euro per dollar, but you believe the dollar will decline to 0.67 euro per dollar. If a euro-denominated bond is yielding 2%, what return do you expect in U.S dollars? Calculation of the return you expect in US dollars: Formula we will use here: Forward rate = Spot rate x [(1+Return in Euro) / (1+Return in US)] 0.67 = 0.75 x [(1+0.02) / (1+ Return in US)] (1+ Return in US) = 0.75 x 1.02 / 0.67 Return in US = 1.1418 - 1 Return in US = 0.1418 or 14.18% So, the return you expect in US dollars is 14.18% Type of questions: short question/problems and answer (as much details as possible is better), give examples (with analysis and explanation), draw relevant figures (with explanations)