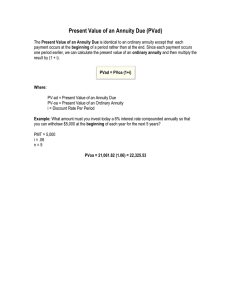

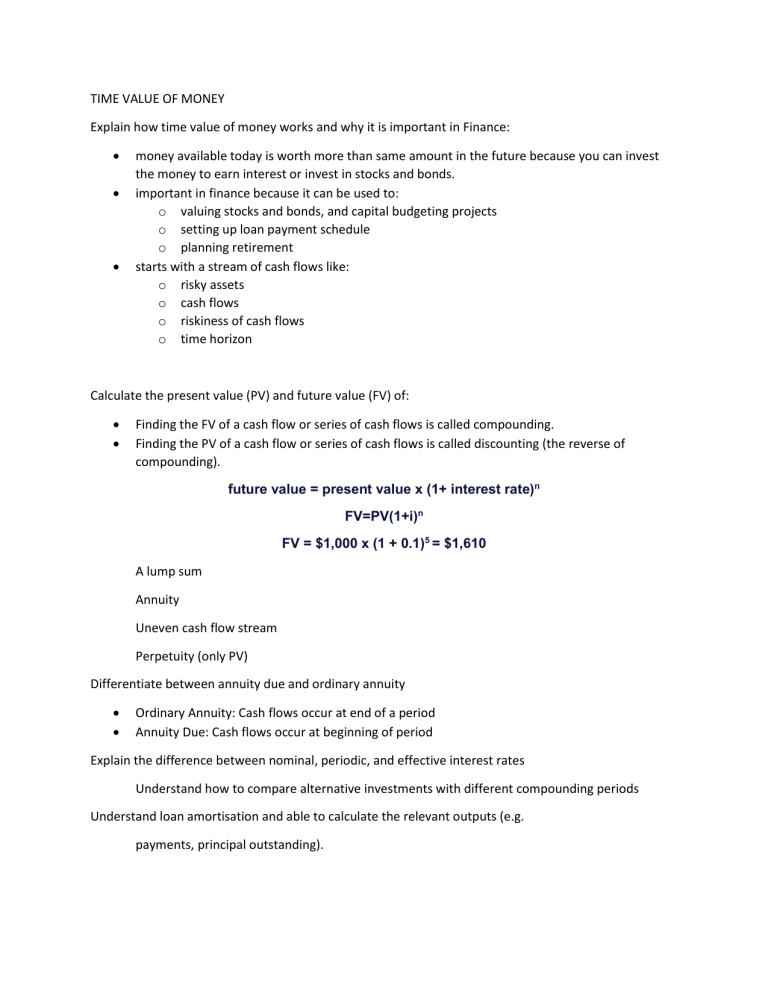

TIME VALUE OF MONEY Explain how time value of money works and why it is important in Finance: money available today is worth more than same amount in the future because you can invest the money to earn interest or invest in stocks and bonds. important in finance because it can be used to: o valuing stocks and bonds, and capital budgeting projects o setting up loan payment schedule o planning retirement starts with a stream of cash flows like: o risky assets o cash flows o riskiness of cash flows o time horizon Calculate the present value (PV) and future value (FV) of: Finding the FV of a cash flow or series of cash flows is called compounding. Finding the PV of a cash flow or series of cash flows is called discounting (the reverse of compounding). future value = present value x (1+ interest rate)n FV=PV(1+i)n FV = $1,000 x (1 + 0.1)5 = $1,610 A lump sum Annuity Uneven cash flow stream Perpetuity (only PV) Differentiate between annuity due and ordinary annuity Ordinary Annuity: Cash flows occur at end of a period Annuity Due: Cash flows occur at beginning of period Explain the difference between nominal, periodic, and effective interest rates Understand how to compare alternative investments with different compounding periods Understand loan amortisation and able to calculate the relevant outputs (e.g. payments, principal outstanding).